Choose Language

April 17, 2019

NewsA new frontier of trade tensions as US turns attention to Europe

As

a trade deal between the US and China comes within striking distance, it

doesn’t look like the Trump administration is about to hang up its hat and call

it a day with regard to its protectionist push. Rather, it seems to be saddling

up to go into a fresh tussle, this time with the EU.

Tensions

flared up after a series of accidents spurred European aviation authorities to

ground Boeing 737 Max aircrafts – which belong to the US firm’s best-selling

family of models. This breathed new life into dispute that’s dragged on for

more than a decade under WTO adjudication: Both sides accuse each other of offering

domestic aircraft manufacturers (Airbus in Europe and Boeing in the US) illegal

aid.

Following

a WTO ruling that found EU subsidies to Airbus have had an adverse impact on

the US, the US has threatened tariffs on some $11Bn worth of EU goods. The

product list (which will be finalized after the WTO arbiter evaluates the

claims) covers mainly agricultural products:

salmon, lemons, an array of cheeses from Pecorino to Stilton, olive oil,

Marsala wine… For now, the market reaction has been minimal and our equity

analysts believe this is because such goods are mainly produced by private firms

that don’t trade on the stock exchange – farms, fisheries, dairies… There is

also some reassurance in the fact that the US is going through the correct

channels (the WTO). Last year, it attracted severe criticism following the way

it rolled out steel tariffs – the EU Trade Commissioner Pascal Lamy was quoted as saying:

‘The world steel market is not the wild

west, where people do as they like. There are rules to guarantee the

multilateral system.’

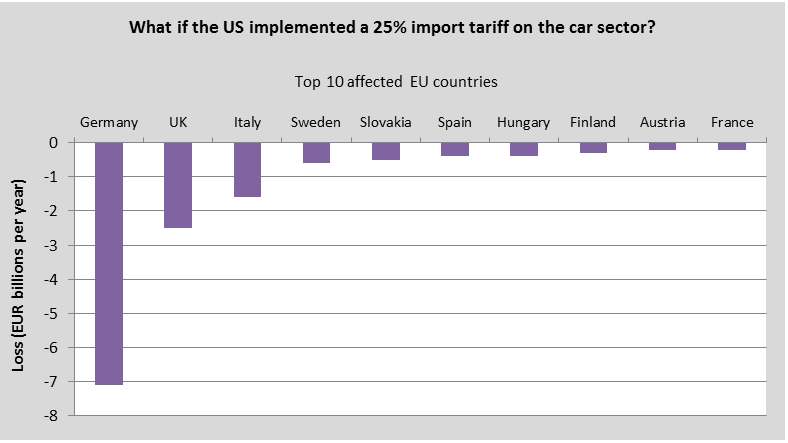

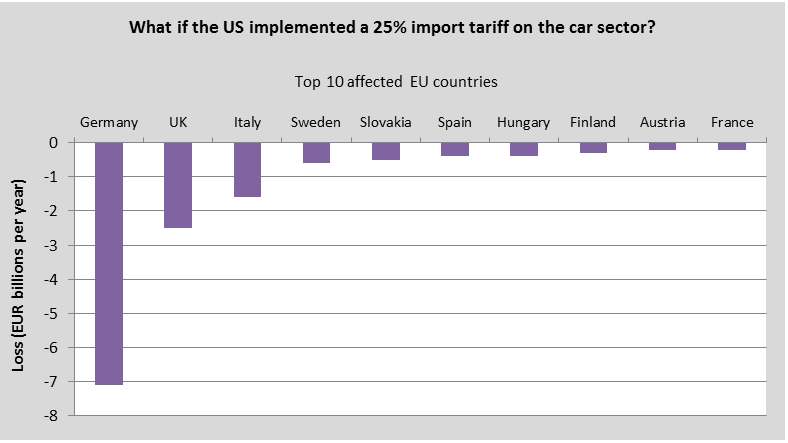

The EU has come out with retaliatory tariffs totaling over $22 billion on items such as plums, mangoes, planes, beeswax, tractors and car parts. Now, the danger is further escalation. The US-China spat began with trivial items like washing machines, but before long, the value of goods caught in the US’ lasso was worth $250 billion, with $267 billion more threatened. The US is currently considering tariffs on auto imports - a move that could really imperil the EU economy, hitting Germany the hardest as the below chart shows. Germany’s export-oriented economy is already feeling the fall-out from the US-China dispute which weighed on global trade.

Source: Chelem, World Bank, Euler Hermes, BIL

Over the longer term, the result

may be that the US pushes the EU to forge stronger ties in the east. Already,

Europe has formed the world’s largest trading pact with Japan, covering roughly

one-third of global GDP. As it stands, the EU is China’s largest trading

partner, and on April 9th, the two agreed to furthers strengthen

their trade relationship and widen market access. Italy has become the first G7

nation to sign on to China’s Belt and Road Initiative and last week Germany’s telecoms

regulator gave its clearest signal yet that Huawei will not be excluded from

the buildout of 5G networks, despite pressure from the US.

In

the shorter-term, a tariff standoff risks putting a dent in both business and

investor confidence. And the problem with confidence is that all too often, it leaves on horseback and returns on foot…

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...