March 11, 2024

NewsAre we watching an AI bubble inflate?

After hitting a new all-time high at the beginning of March, the S&P 500 might be on track for one of its best first quarters in decades. However, the gains are almost exclusively powered by a handful of large technology firms that are benefitting from an explosion of interest in artificial intelligence (AI). This begs the question: is AI in a bubble, reminiscent of that which encapsulated tech firms in the late nineties?

First, let’s clarify our definition of a stock market bubble. We consider this a significant run-up in stock prices without a corresponding increase in the value of the businesses they represent. A company's valuation should be determined by its business fundamentals - its profits, growth rate, and similar factors. In a bubble speculation and ultimately euphoria take over.

There are indeed some parallels between the dot-com boom and the ascendancy of AI.

Firstly, both concern transformative technologies. As was the case with the internet back in the nineties, hopes are high about AI and its capacity to alter the very fabric of society – how we work, interact, communicate and so on... According to Forbes, 64% of business expect AI to increase productivity. The risk is that expectations about AI’s potential become inflated, at least in the short-term. History has demonstrated that it is notoriously difficult to predict the amount of time it will take to capture value from technological innovations. The internet did usher in profound changes, but much more gradually than people expected, leading to disappointment along the way.

There is another similarity – a frothy investment landscape. During the dotcom bubble, investors poured capital into internet-based companies indiscriminately, resulting in a sector peak value of USD 2.95 trillion before the bubble burst. Some signs of exuberance are emerging in AI; one of the most glaring examples of this might be OpenAI CEO Sam Altman’s quest to raise up to USD 7 trillion for a new AI chip project. That's more than the entire US federal budget, roughly ninety times the size of Luxembourg’s GDP, and 13 times the value of global chip sales in 2023!

As investors rush to get onto the AI bandwagon, a handful of US tech stocks are seeing their prices rise substantially – especially those perceived as “early winners”, like those who manufacture the chips needed to build AI technology and cloud service providers with the computing infrastructure to commercialise it. Consequently, the concentration of performance on the S&P 500 is now at levels unseen since the dot-com bubble era, with only 28% of constituents outperforming the benchmark itself. In turn, that means 72% of firms on the index are currently detracting from its performance!

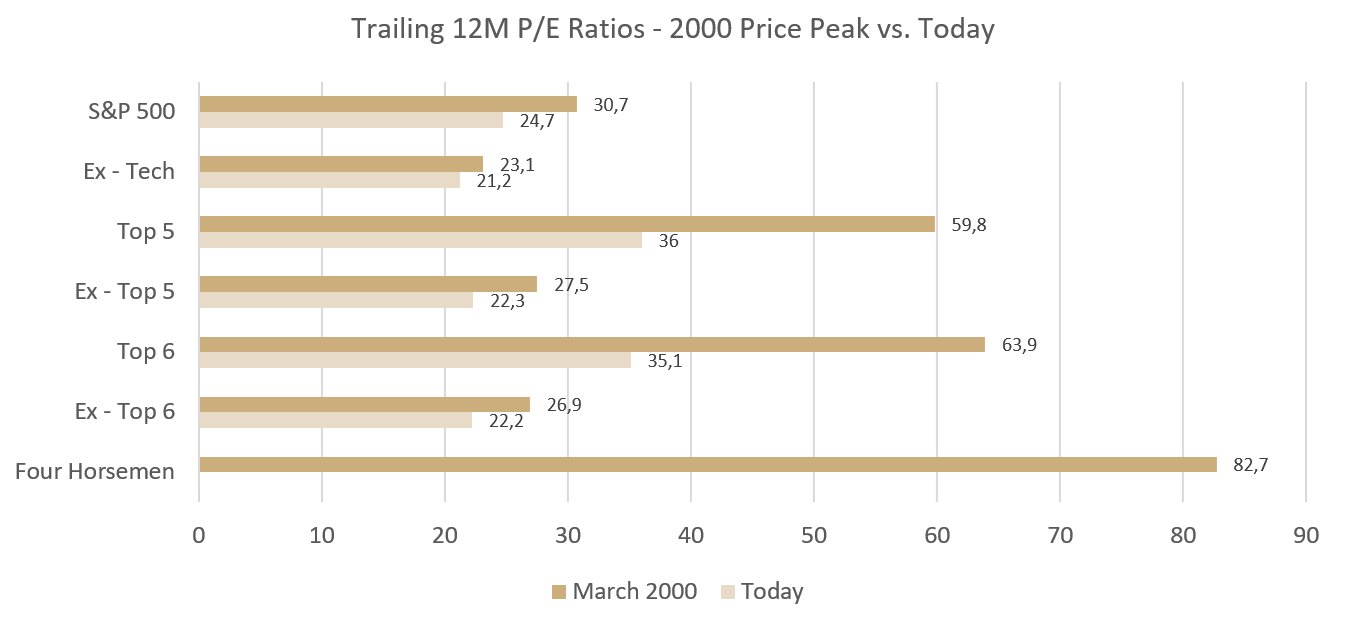

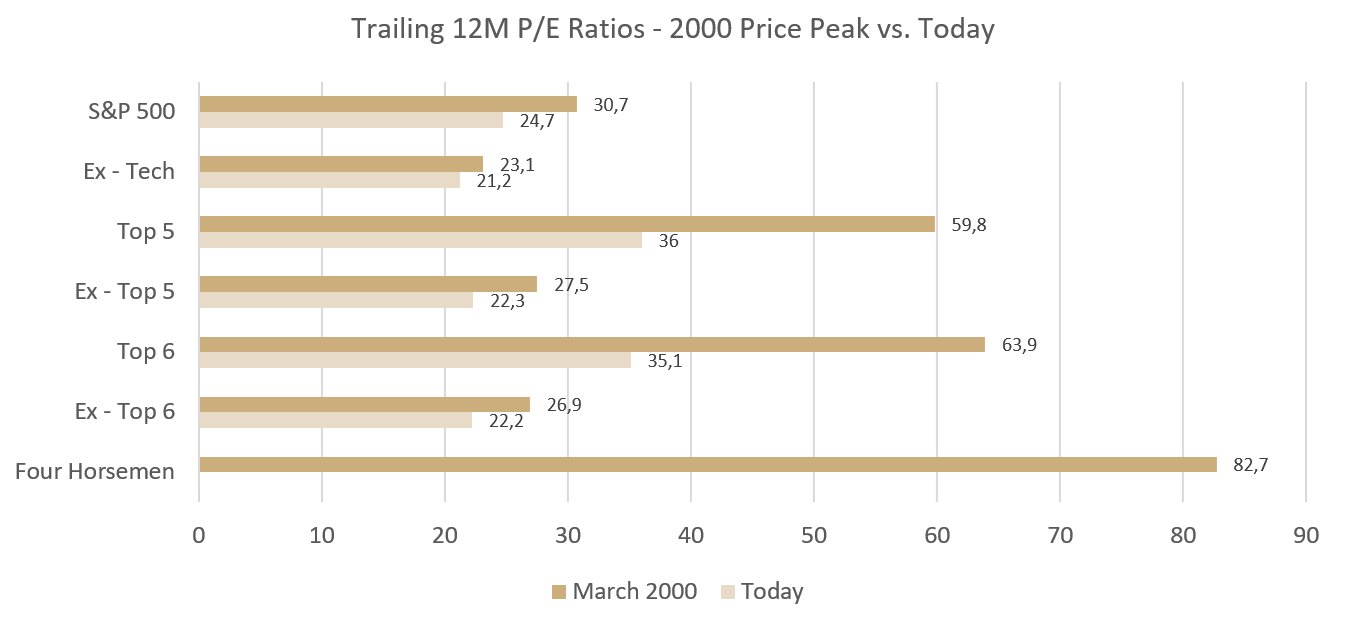

However, there is also a key differentiating point between now and the nineties: Valuations are not stretched like they were back then. Insofar as now, the multiples of some of the leading names in AI are accompanied by decent fundamentals. At the turn of the millennium, valuations were very much momentum-driven.

Source: Bloomberg Intelligence

(Four Horsemen: Microsoft, Intel, Cisco, Dell)

Even though valuations today are slightly expensive relative to earnings, they are still far off the levels evidenced during the dotcom bubble. When you exclude the technology sector, the price-to-earnings (P/E) ratio of the S&P 500 is more aligned with the historical average (19.4x), meaning the broader optimism that spilled over into equity valuations in the late 1990s is not [yet] prevalent.

Beyond this, on aggregate, the current market leaders have strong balance sheets; leverage doesn’t appear excessive, and their cash as a percentage of market capitalisation is double what companies had during the internet bubble. Their return on equity and average margins are also nearly double what was seen during the 1990s runup.

Another feature of the dotcom bubble that is not apparent today is a frenzy of IPO activity.

For these reasons, we can say the current AI boom is not perfectly analogous with the dotcom era. Nonetheless, there is still the possibility that this buoyant theme balloons into a bubble eventually.

How can investors protect their portfolios?

The key piece of advice we can give, is to be diversified and discerning. It is crucial not to assume that today’s the dominant players will retain their position in the future. AOL is a good example of this. In the late nineties, it reigned supreme as the dominant internet company of its time. By 2008, AOL's revenue was declining at a rate of 25% each year, and in 2015, it was acquired for USD 4.4 billion - 98% lower than its peak valuation.

New disrupters come along and disrupt the old disrupters and many companies created during hype periods fail. Those who sustain are those who best understand customer needs and adapt accordingly, not necessarily those who built the underlying technology. When it comes to AI, what will be key for firms is mastering distribution, the roll out of practical applications and using proprietary data to boost user experience and demand.

A theme for the long haul

Investors should bear in mind the old adage that people tend to overestimate the effect of innovation in the short run but underestimate it in the long run. We believe that AI will bring profound changes, just like the internet did 25 years ago, but this will happen gradually. As such, it should be treated as a long-term structural theme in an investment portfolio. There will be winners and losers, and as always, it is unlikely that there is a straight line to profitability. A correction is wholly possible if signs emerge that AI is not living up to the priced-in expectations.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...