Choose Language

June 29, 2021

NewsBIL Midyear Outlook 2021

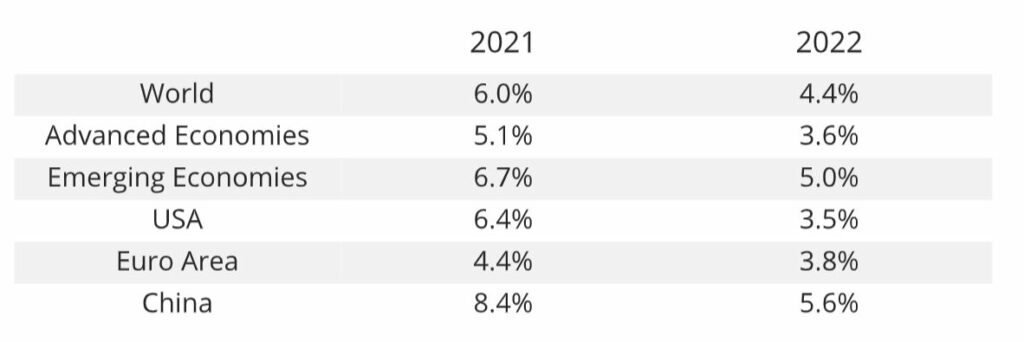

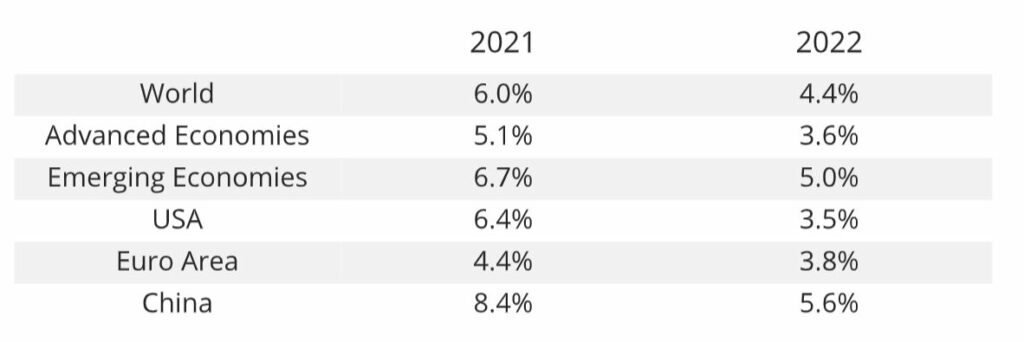

In terms of growth, this year looks set to be a fine vintage. The IMF now expects the global economy to expand 6.0% in 2021, up from the 5.5% it forecast in January. If this comes to fruition, it would be the fastest expansion on IMF records which date back to 1980.

This robust growth can partially be attributed to low base effects, but on top of that, a culmination of factors are supercharging the economic recovery. These include: unleashed pent-up demand as Covid-19 vaccines permit an economic reopening, a generous decanting of fiscal stimulus and ongoing monetary support from major central banks.

However, just as with a good wine, if you pour it too quickly, there is a risk that you “scare” the wine and ruin the flavour. With growth coming more rapidly than anticipated, an inflationary scare has rippled through markets, with investors afraid that it could induce premature monetary tightening. For a period, strong economic data releases were no longer perceived as “good news” by markets as they diluted the case for accommodative monetary policy. Through 2021, this fear has stirred significant volatility in markets, only for central bankers to step in and reassure that they deem price pressures as transitory and that they will not put the cork on their accommodative monetary policies all of a sudden. As of June, markets seem to have subscribed to this mantra, perfectly illustrated by the fact that the S&P 500 managed to scrape a new all-time high just after the red-hot US CPI print for May.

The overall expectation in markets is that inflation and interest rates will move up gradually as the reopening proceeds in the second half of the year.

In light of this context, this Midyear Outlook will examine, from a tactical perspective, the exit from the pandemic and the themes we believe will drive markets near-term:

- Reopening (highlighting the assets that still offer recovery potential)

- Reflation (looking at assets that typically benefit in an environment when growth, interest rates and inflation expectations are grinding upwards)

We also take a strategic angle, looking at longer-term themes that we believe will shape the future, namely sustainability and digitalisation.

Overview

The global economy is recovering more rapidly than expected, albeit in a de-synchronised manner. As the IMF Managing Director Kristalina Georgieva said in April, “Vaccine policy is economic policy". The recovery pace of individual countries is largely tied to success in containing the virus, as well as the extent of fiscal support.

IMF Growth Forecasts

Source: IMF, BIL

Where these two prerequisites are in place, the economic cycle is powering up, almost at full speed. However, the terroir is marred by supply-side constraints. After months of involuntary saving, consumers are now able to and willing to spend. Demand is snapping back, but on the supply side, the hangover from the pandemic lingers.

Businesses are facing supply chain bottlenecks leading to scarcity across an array of goods, raw materials and components - most notably semiconductors. This is temporarily seeping into inflation prints, but we expect that as the reopening broadens, the economic traffic jam will ease, alleviating price pressures.

With half of its adult population inoculated and vaccines available to every willing citizen of age, the US economy is exiting the health crisis. Growth is heating up, with output rising at a robust 6.4% (annualised) in the first quarter, a rate unseen since 2003, leaving GDP just shy of pre-Covid levels. The hasty recovery is largely thanks to ongoing supportive monetary policies from the Fed and unprecedented fiscal stimulus.

Monetary Policy

While we see price pressures building (US CPI came in at 5% in May), we do not believe the Fed will be trigger happy when it comes to policy tightening.

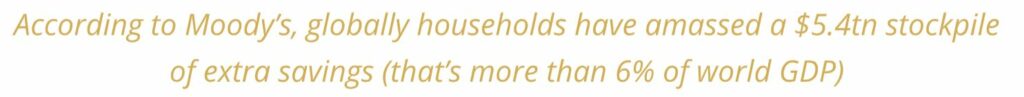

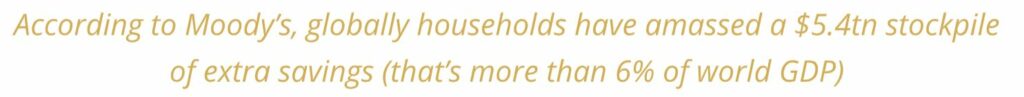

At its June meeting, the Fed kept its main policy rate on hold at a record low (0 to 0.25%) and left the pace of its bond buying program ($120bn per month) unchanged, while upgrading its growth outlook:

The Chair, Jerome Powell reiterated the Fed’s belief that higher prices are mainly temporary, being linked to the reopening, and that he doesn’t expect them to feed into expectations (i.e. to begin a self-fulfilling feedback loop). However, the refreshed dot-plot is slightly more hawkish, suggesting two rate hikes in 2023 and 7 out of 18 members already expect one in 2021. Given the Fed’s preferred normalisation sequence, we could expect tapering in Q1 2022.

However, time will tell as the Fed has shifted its reaction function associated with both its mandates—inflation and employment—from being “outlook” based to “outcome” based and is laser-focused on achieving its full-employment mandate, including a broader definition of employment across wage, racial and ethnic groups. So, even if the tapering conversation has begun

inside the FOMC, it is important to remember that slowly taking pressure off of the gas pedal is not the same as slamming the brakes. We believe that the Fed will continue to be pragmatic and transparent in its approach, so as not to derail markets and more communication may be provided at the August Jackson Hole Symposium.

Fiscal Stimulus

President Biden appears to have ushered in a new breed of “go big or go home” economics coined “Bidenomics”. In March this year, he pushed a $1.9 trillion coronavirus relief bill - The American Rescue Plan - through Congress, and more fiscal largesse looks to be in the pipeline. His key proposals on the table are:

- The American Families Plan ($1.8trn) – centred around federal investment into education, child care and paid family leave.

- The American Jobs Plan (originally worth $2.25trn) – this aims to create millions of jobs while “rebuilding America’s crumbling infrastructure” over a period of eight years. This involves upgrading roads, bridges and ports and modernizing the electricity grid, while emphasising sustainability and the energy transition.

Biden’s proposed and realised packages together carry a heavy price tag. With the US twin deficits already burgeoning and national debt at $28 trillion, the elephant in the room is how all of this will be paid for. His proposed American Tax Plan would see the bill divided between corporations (roughly 2/3 of the total) and high income individuals (roughly 1/3), through higher taxes. As part of a tax overhaul, among other measures, the Biden administration intends to:

- Raise the domestic corporate tax rate from 21% to 28%

- Apply a global minimum corporate tax rate of 21% on overseas income

- Return the highest income tax rate for individuals to 39.6% (where it stood from 2013 to 2017), up from the current 37%.

- Hike capital gains tax for those who earn over $1 million per year, to 39.6% from the current 20%.

However, we note that the American Jobs Plan, Families Plan and Tax Plan are only proposals which have not been legislated and may be subject to dilution. Discussions surrounding the American Jobs Plan have shown that the Republicans are keen to disburse a much more fiscally prudent package. This may have contributed to the recent easing in inflation fears.

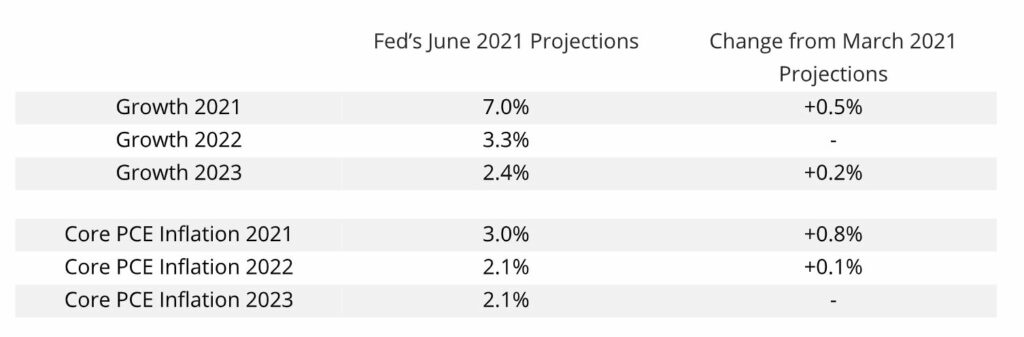

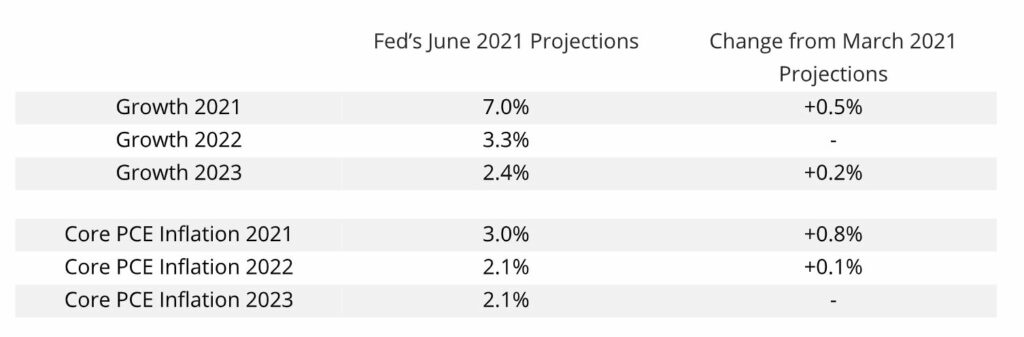

Even without a new dose of stimulus, the US economy is faring well. Business sentiment is strong and durable goods orders (a proxy for investment) are rising nicely. Consumers armed with an additional $2tn in savings are ready to loosen their purse strings: The University of Michigan's Consumer Sentiment index increased to 86.4 in June from 82.9 in May, beating forecasts, with the Expectations component soaring (83.8 from May’s 78.8) and the current conditions gauge also edging up (90.6 vs 89.4).

But the economy is not yet at its full potential with labour market dynamics lagging the broader recovery.

US Labour Market Dynamics

Unlike in Europe where government furlough schemes kept the majority of employees on company payrolls, 20 million Americans lost their jobs when the pandemic brought the economy to a virtual standstill. As such, it is taking a while to restart – something economists refer to as ‘reallocation friction’ - and labour dynamics remain fragile.

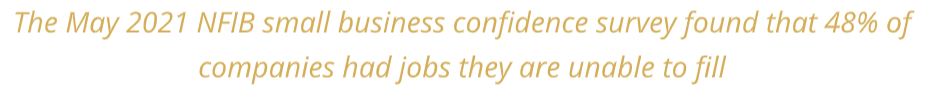

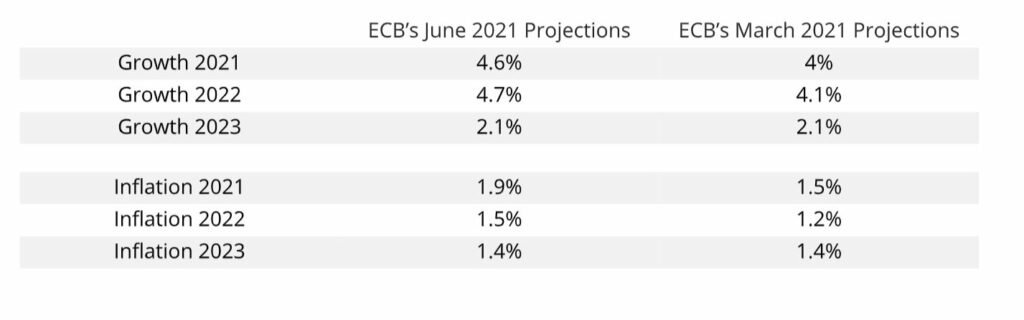

The unemployment rate sits at 5.8% (versus 3.5% in February 2020) and the key factor affecting hiring appears to be a shortage of workers. This is important because it could give more bargaining power to employees (a key ingredient for inflation).

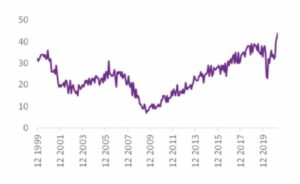

Small businesses declaring that jobs are “hard to fill”

Source: Bloomberg, BIL

Already, in a bid to attract workers, especially in the service sector, we are seeing companies increasing wages (which on the whole rose by 3.3% in the first quarter) and offering other perks such as cash bonuses to fill thousands of open roles.

One potential explanation for the worker shortage could be that government benefits served as a disincentive – some Americans found that pandemic era unemployment checks could pay more than minimum wage jobs. In response to this, several states have been withdrawing the $300 weekly federal unemployment bonus made available during the pandemic. This may catalyse a new influx of workers, alleviating some constraints on labour supply.

We are closely monitoring the evolution given that labour market slack holds the key to whether inflation becomes more persistent.

After initial hitches, the European vaccination campaign is well underway, allowing countries to begin easing restrictions just as Europe’s largest-ever stimulus plan is about to be deployed. As such, we believe that the Eurozone economy has room to run this year.

Business activity has bounced back and we look to be on the precipice of summer spending boom, especially as intra-EU travel restrictions loosen. Last year, across the Eurozone, the household savings rate almost doubled in response to the pandemic. Consumer spending is the biggest driver of Europe’s economy and we believe that much of these lockdown-induced excess savings could be deployed in the second half of 2021. Indeed, May’s Eurozone consumer confidence index reading came in well above its long-term average.

Fiscal Stimulus

Finally, the European Union Recovery fund will start flowing into the economy. While the bottle was uncorked almost a year ago, the package has been given more than enough time to breath as we waited for all 27 member states to ratify its contents, worth some €800 billion.

With consensus reached, in June, the EU issued its inaugural joint-issuance sovereign bond with a 10-year maturity, and two more syndicated transactions are planned for July. In total, the European Commission intends to issue €80bn of long-term bonds and short-term EU bills this year. The full €800bn package will be borrowed between mid-2021 and 2026 (roughly €150bn/year) and all borrowing will be repaid by 2058.

The 27 EU capitals will receive a first disbursement of 13% of the total amount that’s been allocated to them in the coming months, with Italy and Spain as key beneficiaries.

There is also talk on the grapevine of more stimulus packages at national level in select European countries. The EU Commission has extended a general waiver allowing member states to spend on fiscal stimulus into 2022. Budget deficits will increase in most EU member states in 2021 and remain above the nominal threshold of 3% of GDP prescribed under the bloc’s rules in all countries except Denmark and Luxembourg.

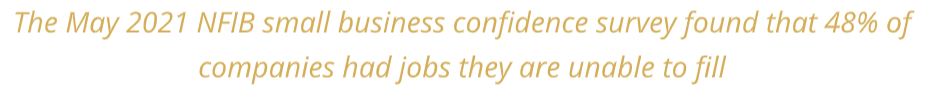

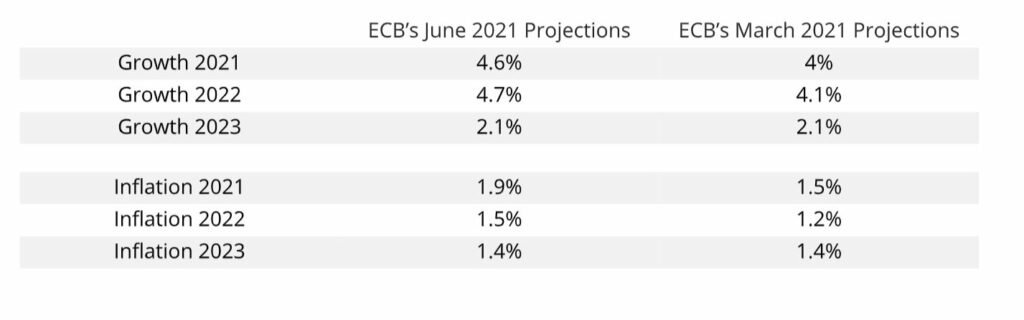

Monetary Policy

Headline inflation in the Eurozone hit 2% in May, topping the ECB’s target of close to, but below, 2%. Nonetheless, at its June meeting, the ECB renewed its pledge to maintain a faster bond buying pace under its €1.85tn pandemic emergency purchase program (PEPP), to support growth. This is despite significant upgrades to its future growth and inflation estimates. According to the Chair, Christine Lagarde, uncertainties remain and the near term economic progress is still very dependent on the course of the pandemic, citing “significant economic slack that will only be absorbed gradually.”

As the global economy heals from the coronavirus pandemic, one economy stands out as a trailblazer when it comes to virus containment, reopening and recovery: China. After being the only major economy to record positive growth in 2020 (+2.3%), its economy grew by 18.3% in the first quarter of 2021 (YoY); the biggest jump since China started keeping quarterly records in 1992. In achieving this, China has avoided broad-brushed pandemic relief, preferring a very targeted approach to stimulus.

A quick normalisation of activity meant that China has increased its share of global output substantially - imports and exports rose 28% and 49% YoY in the first quarter, respectively, highlighting China’s position as an unambiguous engine of growth and as a key player in the broader global recovery. Analysts are now surmising that China’s economy could become the biggest in the world by 2028 –two years earlier than expected before the pandemic.

Growth is supported by Beijing’s ambitious projects such as Made in China 2025 and its new dual circulation policy. The latter will see China cultivating its domestic cycle of production, distribution and consumption via upgrades to the economy, innovation and cutting edge advances in areas such as healthcare, new generation IT, biotechnology, AI and robotics.

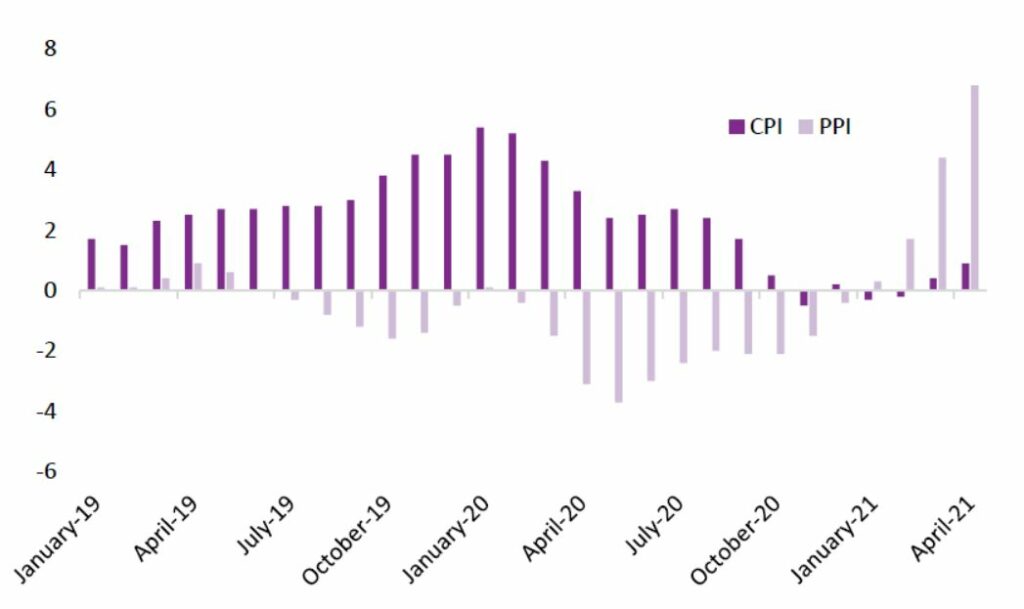

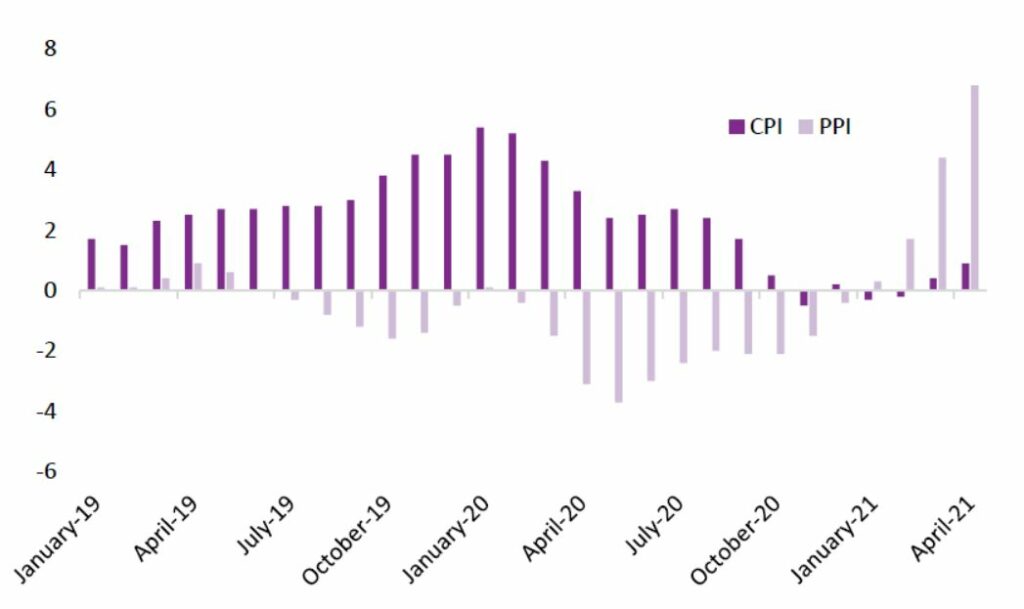

China CPI versus PPI

Source: Bloomberg, BIL

Lately, rising commodity prices brought headwinds for China. Its producer price index, a measure of factory gate costs, rose 9% in May from a year ago, the fastest since September 2008, threatening company profitability, especially given that CPI only rose by 1.3% in the same month. However, the government recently announced some intervention in commodity markets as well as additional support, including help for small businesses, particularly those affected by rising raw material prices.

With regard to the currency, we have seen the Chinese yuan appreciating strongly as of late. Our analysts believe that the government will act to cap further upside leading them to expect range-bound trading - not a significant depreciation.

Further reading: Our China series available on the BIL Investment Insights blog explores China’s compelling growth story and the drivers behind it.

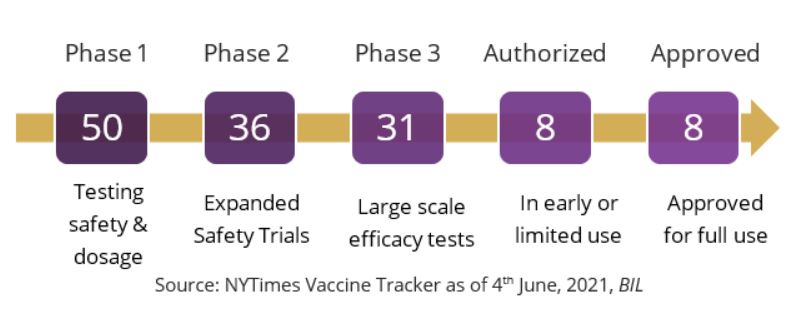

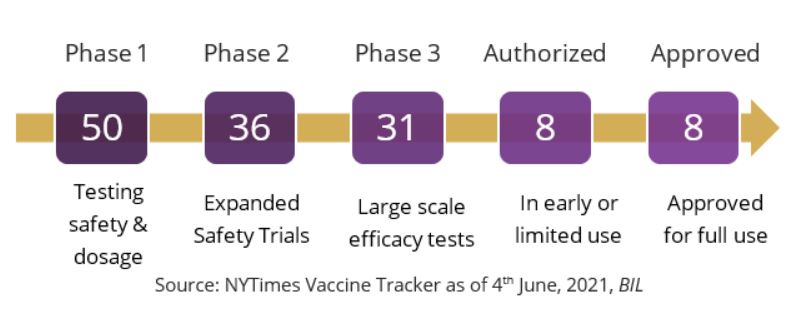

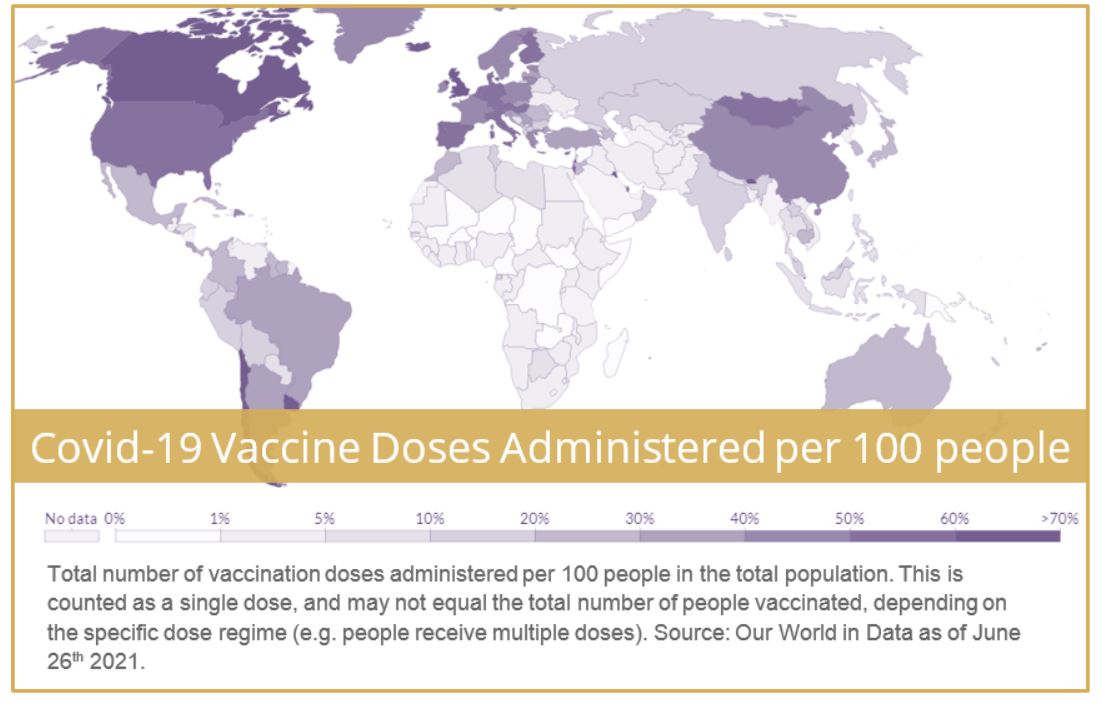

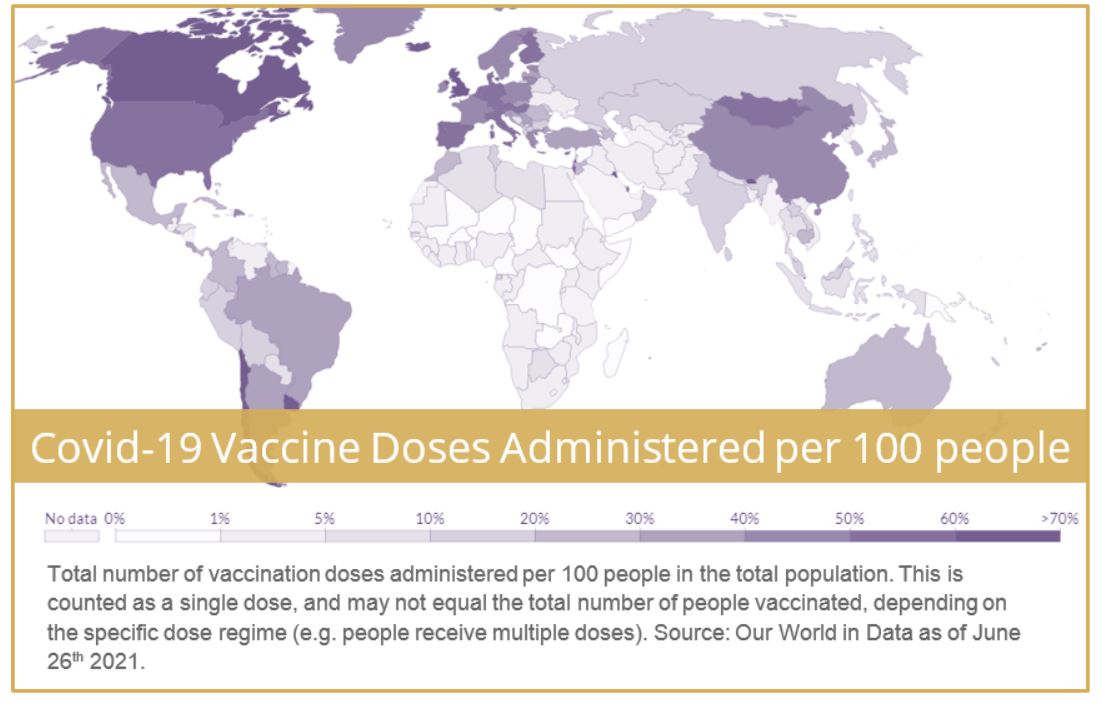

With the Covid-19 vaccine roll-out gaining traction (see Appendix 1.1), the tunnel towards the end of the pandemic looks shorter, and the light at the end a bit brighter. Until now, with international travel still quite restricted, vaccines are proving to be very effective against severe cases, reducing hospitalisations and the need for lockdowns. In the absence of vaccine-resistant variants, economies could face fewer economic disruptions, even in the face of another wave, with the virus ultimately being tamed into a treatable ailment like the seasonal flu.

Vaccine Development Progress

But we cannot be complacent. The pandemic, a human tragedy, still persists, especially in emerging markets, where vaccines are less readily available, which could allow new vaccine-resistant mutations to flourish. At their June summit in Cornwall, G7 leaders said they would work together to increase vaccine availability, pledging 1 billion doses to lower-income countries through Covax, the joint initiative of the WHO and the Gavi vaccine alliance. This gives a much needed boost of momentum to Covax which initially intended to provide 2 billion doses by year-end, but has thus far only distributed around 83 million: a drop in the ocean compared to the 11 billion doses that the WHO estimates are needed to vaccinate 70% of the global population.

In May, CPI climbed to 5% in the US (the largest jump since 2008) and 2% in the Eurozone (the highest level in almost 3 years). China’s CPI was more contained at 1.3% but the PPI rose to a red-hot 9%, on the back of rising commodity prices, suggesting that consumer goods and service CPI could accelerate in the second half of the year.

Central banks largely believe this burst of inflation will prove temporary in that it has been pushed up in the short-term by:

- Base effects - Numbers were likely to be sizable when compared with the lockdown period in 2020, when oil futures even traded below zero for a brief instance.

- Supply chain disruptions - This year has been punctuated by a number of ‘accidents’ that temporarily disturbed supply chains, for instance the Suez Canal blockage, Texas blizzards that jeopardized the chemical industry across the US, the cyberattack on the Colonial Pipeline,… At the same time, certain bottlenecks are yet to be resolved, including a global shortage of semiconductors and shipping containers.

- Pent-up demand (lost leisure) being addressed as restrictions ease, while businesses are still in the process of normalising operations.

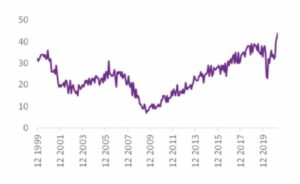

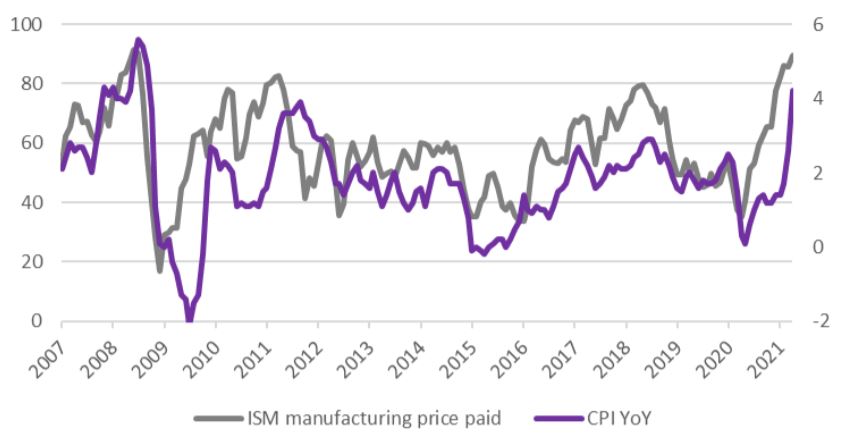

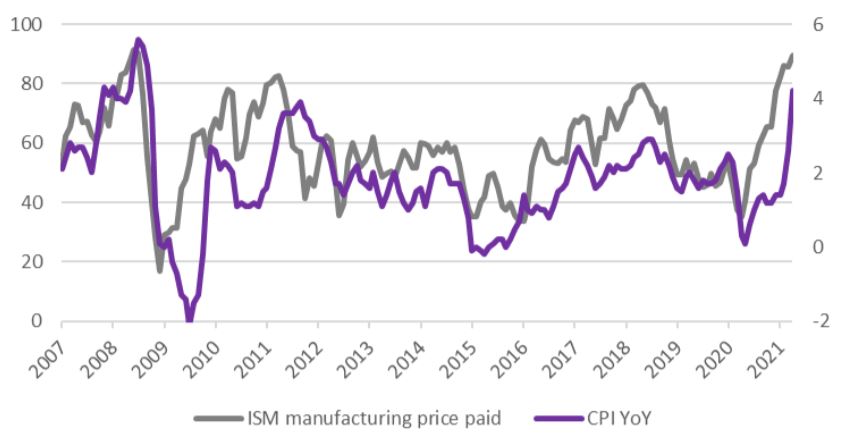

But we should not rest on our laurels - several indicators suggest that inflation’s uptick could persist further. For example, US CPI is yet to catch up with the ISM prices paid index, as history suggests it will.

ISM “prices paid” usually leads CPI by a few months

Source: Bloomberg, BIL

At the same time, an important component of US CPI is yet to rise: the cost of shelter. Due to the health crisis, and helped by low mortgage rates, higher cash than usual, and improving labour prospects, consumers rushed en masse to buy homes. As a result, the price of homes (not included in the CPI calculation) sky-rocketed, and the rental market (a heavy weight in the CPI) was depressed. But record-high prices are now deterring new home buyers. As this trend continues, the rental market will very likely be revived, pushing up inflation in what many may call the “second round”.

Thereafter, the key indicator on the stickiness of inflation will be the job market and wage dynamics. Typically for sustained, broad-based inflation to arise, workers need to have enough bargaining power to secure higher wages.

In contrast to previous experiences, the Fed is adamant that it will not tighten based on outlooks, but on actual data and the ECB appears to be singing from the same hymn sheet. We do not think inflation will spiral out of control compelling central banks to shift away from this stance and abruptly tighten policies. However, inflation could ultimately settle at a higher level than in the previous cycle spanning 2009-2019 (when it was historically low and stubbornly below central bank targets).

We have not yet seen a material impact from inflationary pressures on margins but expect this will become more apparent in Q2 earnings results. Companies with pricing power will be at an advantage as they should be more resilient to moderately higher inflation.

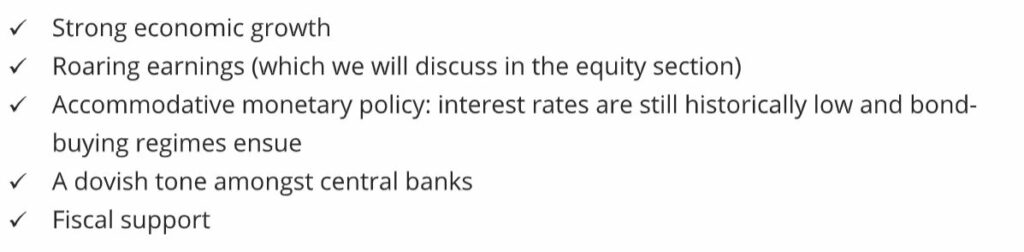

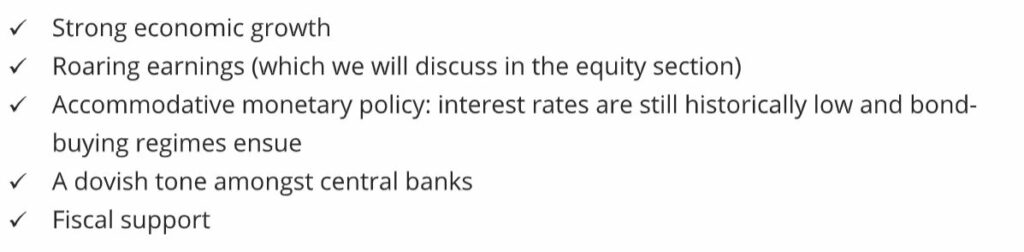

As is clear in the Macro section, the fundamental backdrop continues to check all the boxes for a durable bull market. We have:

In light of this, our strategy is overweight equities versus bonds, while being calibrated to take advantage of the reopening and reflation themes.

![]()

![]()

Equities

Supported by growth and stimulus, equities are currently the Grand Cru of the investment world. Where and when market dynamics prevent fixed income investors from generating positive returns after inflation, equities will play an even more important role in portfolio construction. However, the next leg of the cycle will be about rotation, not direction, meaning that investment returns will largely be dictated by style and sector decisions.

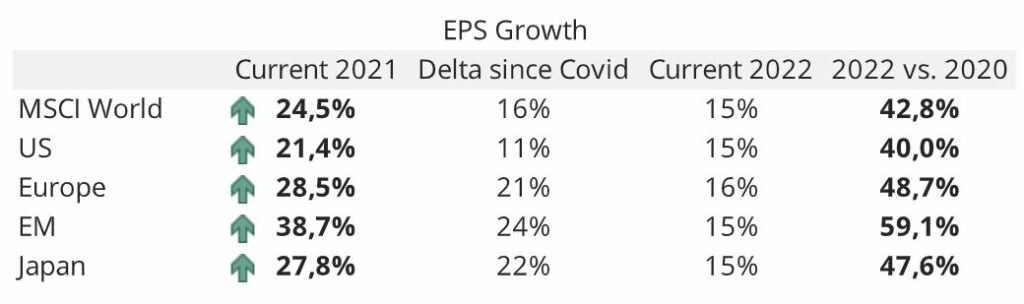

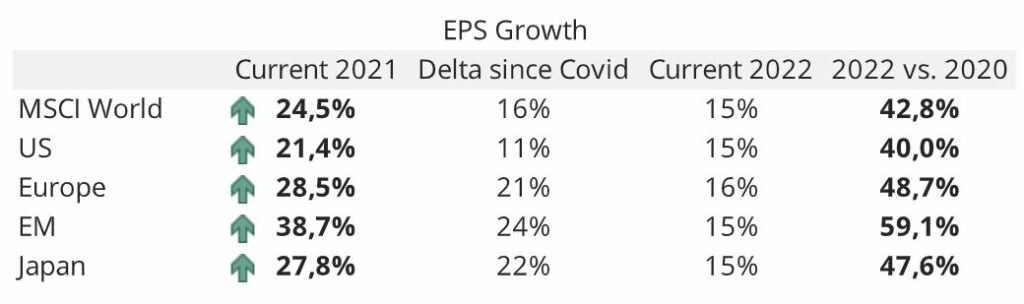

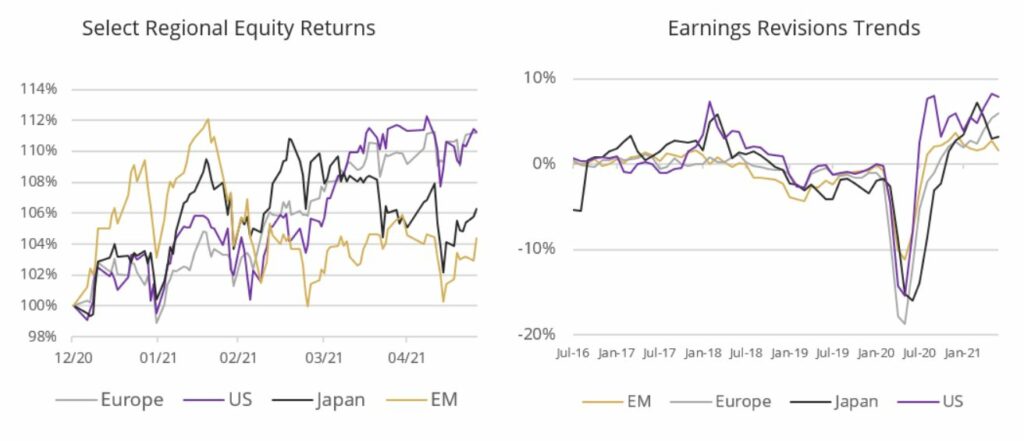

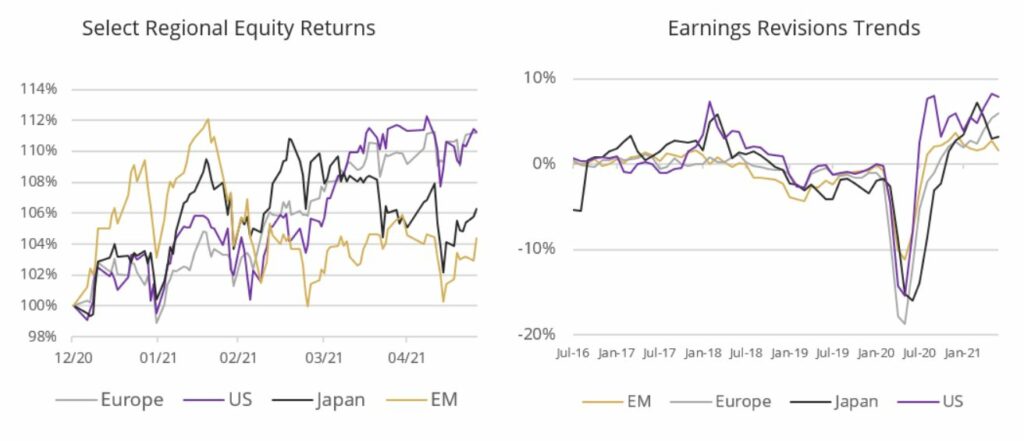

The Q1 earnings season was very positive and analyst revisions (relative and absolute) are moving up in all regions. Nonetheless, markets have traded range-bound with inflation fears tempering gains. As such, the E in the P/E is doing more of the heavy lifting (earnings growth expectations are near 30% for 2021), making valuations more manageable.

Source: Bloomberg, BIL

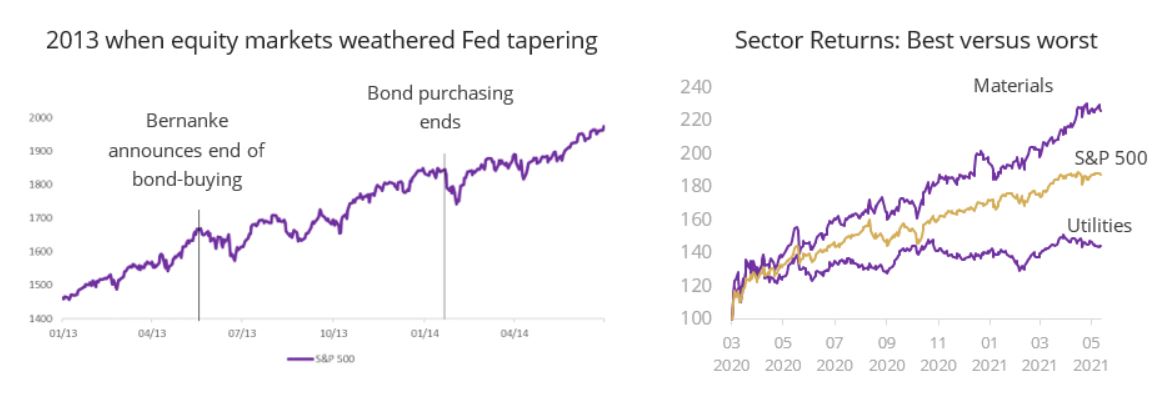

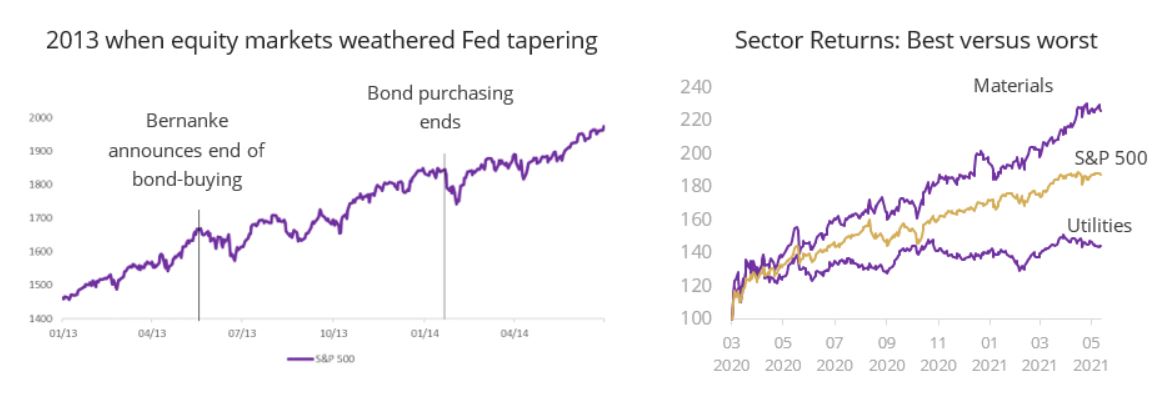

So long as rates move up gradually, in tandem with the economic recovery, we believe equities will be able to move higher from here. Some investors are concerned that talk of tapering from the Fed could derail equities, but we believe that the market can digest slow and measured adjustments to monetary policy, which in the end, are necessary to keep overheating fears in check. The last time we were in a similar situation with the Fed on the cusp of tapering its bond purchasing program was back in 2013 with interest rates at roughly the same level as they are at today. Although not all factors are constant between the two episodes, at that time, when the tapering announcement from former Chairman Bernanke was made in May 2013, equities took an initial hit of around 6% but quickly resumed their upward trend. At that point, cyclicals outperformed defensives and we expect the same this time around, also in keeping with the reopening narrative.

Source: Bloomberg, BIL

![]()

![]()

So far in this recovery, it is interesting to observe that developed markets have outperformed emerging markets ex-China. This links back to our observation in the macro section: economic expansion is now largely driven by the size of fiscal stimulus packages and the success of vaccination campaigns.

We remain bullish on US equities, where the economy is burgeoning and set to benefit from more stimulus. Given that the Fed is drawing closer to taper talk, our short-term outlook for the US dollar is less bearish and we have removed the currency hedging on our US equity overweight.

Source: Bloomberg, BIL

Already, first quarter earnings in Europe outpaced those in the US and looking ahead, European EPS growth estimates for 2021 have risen the most among developed countries since the end of Q1, up 16 percentage points to 43%. This growth is not accompanied by the lofty valuations of broad US large caps. Moreover, Europe typically becomes a lot more palatable at this stage in the cycle given that it has a high concentration of value stocks which tend to benefit from rising inflation and interest rate expectations.

We are overweight China, which is an unambiguous global growth driver, and we believe that in the aftermath of the pandemic, to achieve superior returns, investors will need to give greater consideration to international equities further afield. The medium-term correction in Chinese equities has levelled off and we are seeing the beginnings of a rebound. The market is supported by strong inflows, while valuations are compelling relative to global peers. Observing that Chinese authorities have made little use of monetary stimulus, especially compared with the west, investors in China will not have to sniff out when tapering might start.

Re-focusing on developed markets, typically at the stage of the cycle in which they are, we have seen a rotation from growth and defensive plays to value and cyclicals.

As such, we like financials, a key beneficiary of higher inflation and expectations for higher rates. Net interest margins for the sector are poised to benefit from higher long-term yields, while central banks keep the short-end of the curve anchored in the near-term. We also like cyclicals such as consumer discretionary and materials, which are well-positioned to benefit from the reopening theme and pent-up demand. Finally, we like energy, another key beneficiary of the reopening, where earnings revisions are good. The sector is supported by higher oil prices which render more fields profitable.

![]()

![]()

After the Fed adopted more hawkish undertones at its June meeting, as the market digested the news, the value trade came under pressure and growth stocks were once again in the front seat. However, despite short-term headwinds, we do not see any fundamental changes to the outlook and thus maintain our value tilt in our US equity exposure, believing that long-term yields will resume their slow march upwards. Growth stocks (which derive much of their value from expectations about future earnings) could become more vulnerable in a context of higher yields and inflation. Further reading: Value stocks, back in vogue?

For yields to change direction and start moving downwards in a sustained manner, the macro picture would have to change drastically, for example, as a result of a new virus variant, which is not our base case.

Sector Preferences

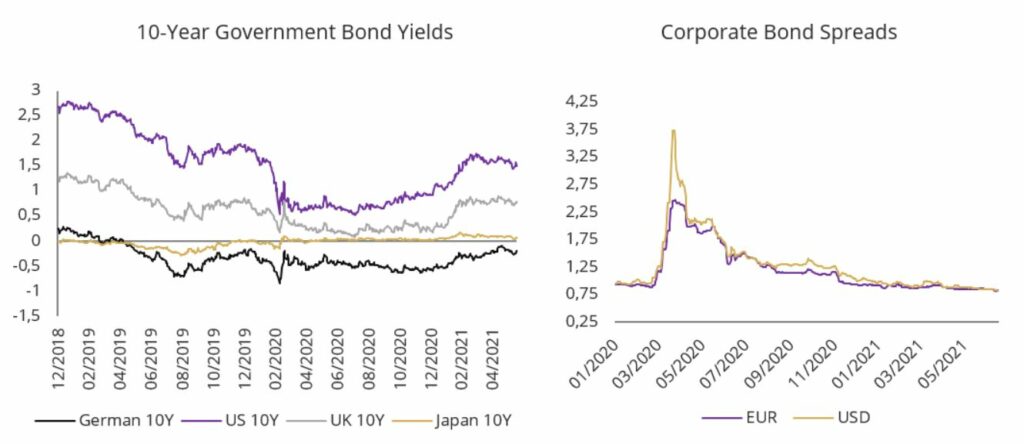

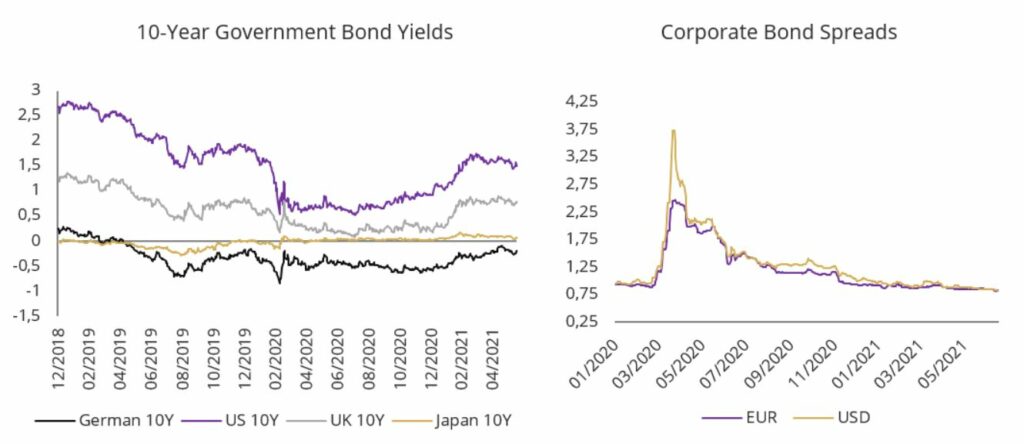

Fixed Income

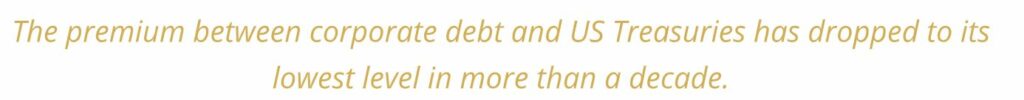

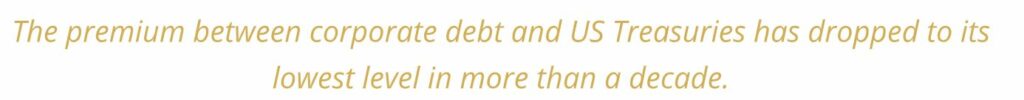

Even if we believe that central bank policies will continue to be helpful rather than hurtful in the short-term, the reflationary environment makes us broadly reluctant on fixed income. In credit, the reflation trade has been characterised by spread compression, leaving us mid-cycle with end-cycle valuations.

The terrain will become even more challenging for bond investors in the second half as nominal yields grind higher while robust economic activity keeps credit spreads tight, making active management essential in the pursuit of desirable risk-return dynamics.

As the recovery unfolds, Government bond yields are destined to rise, compelling us to carry an underweight on duration, European govies and virtually no exposure to US Treasuries.

Source: Bloomberg, BIL

We believe that investment grade corporates (both developed and emerging) still offer some opportunity for excess return, though this will be generated by being highly selective and from carry. The sector continues to be supported by central bank buying, economic momentum and strong demand. Given that the Fed is further ahead in contemplating tapering, we have a preference for European Corporates versus the US equivalent.

Further down the quality curve, select pockets of the developed market high-yield bond market are still interesting. Just as the reopening has signalled a return to tourism in the real world, in search of sunshine, reflation has signalled a return to tourism in the bond world: that is, investors are venturing out of their comfort zone in the IG space, into high-yield, in search of yield. These inflows are supportive of the segment, alongside positive rating trends: it is worth noting that in the US HY space, rating upgrades outnumber downgrades by the largest amount seen in a decade and the same trend is taking hold in Europe. For the same reasons as with IG, we now give preference to European high-yield corporates.

In the US, senior secured loans (SSL) may be preferable to HY as they carry less duration risk and a lower exposure to rising rates. SSLs are less interesting in Europe where coupons are calculated using the EURIBOR rate as a base (which is still negative).

Emerging market bonds have held up well recently, given the more hawkish undertones from the Fed and a stronger dollar, while default rates remain low. Within our EM bond exposure, we have a preference for corporates over sovereigns as they are more insulated against a rise in US yields (i.e. that have a lower beta to US Treasuries than EM sovereigns), while flows are more sticky. Further still, credit rating trends are stabilising, reflecting the economic recovery and improvement in credit fundamentals: The 12-month rolling number of net downgrades amongst EM corporates bottomed mid-2020.

Beyond our traditional allocation, we are intensifying our focus on long-term investment thematics triggered by the structural changes playing out across society. The pandemic has catalysed important changes to the global economy that will touch almost every industry. We believe these deserve consideration within portfolios.

Sustainability / ESG

The growth of sustainable investing and the inclusion of environmental, social and governance (ESG) factors in investment decision-making reached a new level of awareness during the pandemic. In retrospect, ESG-aligned companies did not disappoint their investors in terms of relative performance, demonstrating that their responsible business practices made them more resilient through the tough business environment posed by the crisis. From here, we believe sustainability will be the defining theme of the decade.

The most pressing issue at hand is climate change, which has risen to the top of government agendas. 196 countries have adopted the Paris Agreement - a legally binding international treaty on climate change – and coronavirus recovery packages have been aligned with the carbon-reduction ambitions therein. The EU, China and the US are poised to spend heavily on green infrastructure.

The effects of climate change are increasingly obvious and are coming closer to home, sparking concern amongst corporates and consumers alike. For example, wine connoisseurs will know that unseasonably warm weather, followed by April frosts, adversely affected about 80% of French wine regions and up to one-third of crops may have been lost. The French government pledged €1bn in aid to frost-hit vignerons while the agriculture minister Julien Denormandie called the event 'the greatest agricultural catastrophe of the beginning of the century'. [1] This incident is anecdotical and less tragic than bushfires in Australia or droughts in California, but provides more evidence on the impact of climate change on food availability and quality. It also gives a clear demonstration that global warming is affecting all regions, in the Northern and Southern Hemispheres alike.

Such events perfectly demonstrate why central banks, led by the Bank of England, are now weaving climate related risks into their definitions of financial stability.

Such climate-related events, which are growing in frequency, make it clear why climate change has arrived at the top of corporate agendas, in realising their own vulnerability to external shocks and the need to think strategically about the impending emergency. More than one in five of the world’s largest companies have made some form of commitment to reaching net zero emissions. [2]

In terms of ensuring progress on such pledges, Europe is set to lead, with new regulation embedding sustainability concerns into the law. The Commission has created an EU-wide “taxonomy”, which will provide businesses and investors with a common language to identify economic activities which are considered sustainable and under what conditions. At the same time, the proposed “Corporate Sustainability Reporting Directive” (amending the “Non- Financial Disclosure Regulations” (NFDR)) lays down the rules, requiring 50,000 companies to disclose information on the way they operate and manage social and environmental challenges.

In the asset management world, we now have “Sustainable Finance Disclosure Regulation” (SFDR), under which financial market participants are subject to product classification and disclosure requirements based on the double materiality framework, reducing the opportunity for greenwashing.

Amid intensifying regulatory scrutiny, government spending and incentives, societal shifts and growing investor demand, we believe the sustainability theme is here to stay, bringing myriad opportunities for investors. The State of Finance for Nature Report [3], has said that in nature-based solutions must triple to $350bn by 2030 and quadruple by 2050, warning of irreversible damage to economies, the planet and humanity if the status quo remains unchanged.

We reiterate the case for long-term exposure to the unstoppable trend of “greening the world”, but believe investors should look beyond the obvious and urgent climate risks associated with carbon emissions, to encompass biodiversity and inclusive growth perspectives. Social and governance factors should also be given consideration, because sustainable growth entails progress on all three of these inter-connected categories: E,S and G.

Digitalisation

Even after the virus fades, digitalisation will not retreat from its leap forward.

Societies have discovered new efficiencies by embracing technology through necessity during the pandemic and we believe this is only the tip of the iceberg. The age of hyper-connectivity, ushered in by technologies such as 5G networks, blockchain, big data, the internet of things and robust cloud-based infrastructures, will create growth drivers and disruptions in almost every sector, whether it be retail, healthcare, finance, entertainment, leisure, mobility, education, and the list goes on…

As such, gaining exposure to this theme no longer means being overweight IT. Rather it means hand-picking companies that are actively pursuing digitalisation, from insurance companies through to high-street retailers. Failure to do so could mean their business model is increasingly obsolete.

One recent example of a non-tech firm embracing digitalisation is the behemoth bank JP Morgan. The company has acquired Nutmeg, a British robo-advice platform for an undisclosed sum after CEO Jamie Dimon discussed girding his firm against fintech players like PayPal as well as Big Tech firms such as Google’s parent, Alphabet. Sanoke Viswanathan, CEO of international consumer business at the bank said “We are building Chase in the UK from scratch using the very latest technology and putting the customer’s experience at the heart of our offering.” [4]

However, as digitalisation takes hold, the importance of cyber security will heighten in order to protect businesses, governments and the general public. Already, this year has been marked by a number of high-profile cyber-attacks, for example on the US Colonial pipeline and on Ireland’s health service. Recognising the potential threat of such attacks to critical national infrastructure, NATO leaders are seeking to modernise their alliance and toughen their response to new high-tech threats. We believe this is an important area worth monitoring for investment opportunities moving forward.

The vaccine rollout is making the tunnel towards the end of the pandemic shorter, and the light at the end, brighter.

Already, the global economy is recovering strongly, led by China and the US, with Europe catching up. We believe the positive momentum will continue throughout the second half of the year due to effective monetary and fiscal stimulus and a consumer comeback.

Despite the benign macro landscape, the investment terroir will continue to be complex and challenging through the latter half of 2021. Given the velocity of the recovery, investors must be prepared for shifts in cyclical positioning across regions and should brace themselves for potentially higher volatility than we have witnessed recently. While bull market pullbacks are unavoidable, they should not be considered as a reason to stay on the side lines.

As of now, our portfolios are positioned in order to take sap from the reopening and reflation trade. We like equities, with a preference for value and cyclical sectors such as consumer discretionary, financials, energy and materials, which are best poised to benefit from either reopening or increasing long-term yields. Regionally speaking, we are broadly diversified, with an overweight in Europe, the US and China. In the fixed income world, managing duration risk is key in a rising rate environment and active management is essential in order to benefit from carry opportunities, particularly in the investment grade and high-yield segments.

Appendix

1.1 Vaccination Rates

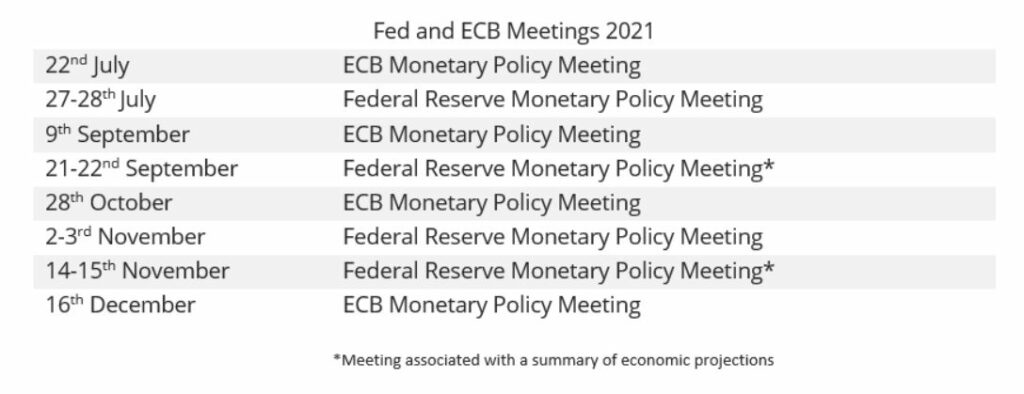

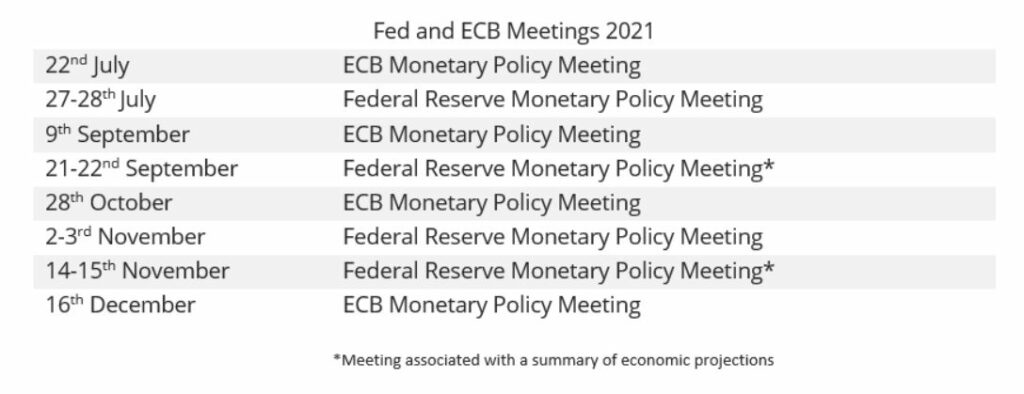

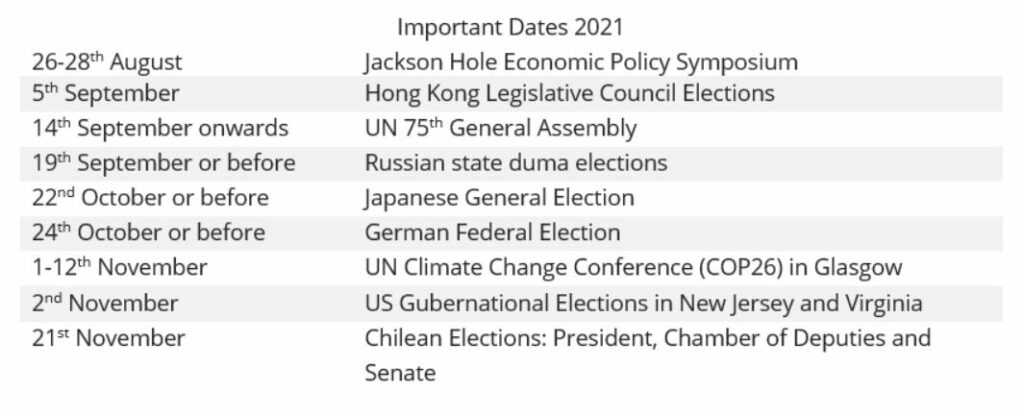

1.2 Important Dates

References

[1] According to CNIV, the French National wine union

[2] https://www.ft.com/content/6c59ed7a-170b-4898-81a2-7420f0c28888

[3] The State of Finance for Nature Report is produced by the United Nations Environment Programme (UNEP), World Economic Forum (WEF), Economics of Land Degradation Initiative and Vivid Economics and is co-funded by the governments of Germany and Luxembourg.

[4] https://www.ft.com/content/f76ed493-6611-4308-8c06-30dff37715d0

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...