Choose Language

November 26, 2021

BilboardBILBoard December 2021 – With winter, a new wave

As winter sets in in the northern hemisphere, cases of COVID-19 are resurging, compelling governments to reinstate restrictive measures. Austria has reimposed a full lockdown, while the German Health Minster said that COVID infections are developing in a way that means a new lockdown in Europe’s largest economy cannot be ruled out. Markets are now mulling over the consequences for growth and monetary policy, while inflation still looms large.

Macro Outlook

After some volatility in macro data in the autumn, economic surprises have begun to tick upwards again in western economies.

The US: positive all the way – The US is undoubtedly the place where the most macro strength lies. Manufacturing activity is running faster than it did prior to the COVID-19 pandemic, companies are hastily building their inventories, and retail sales are 21% above February 2020 levels. But industrial production is still struggling to satiate demand. Inflation pressures have not yet hampered consumption, but are starting to weigh on sentiment.

Europe: skating on thinner ice – Some eurozone economic readings have also taken a brighter turn; the most recent PMIs beat consensus estimates, both for the headline manufacturing index (58.6) and the services measure (56.6), and Q3 GDP also surprised on the upside, coming in at +2.2%. However, beneath the surface, European companies are much harder hit by ongoing supply chain dislocations, rising input costs and shortages and a renewed COVID wave only adds salt to the wound.

China: an uphill struggle – China was at the helm of the recent dip in economic data and, in the short term, its economy is struggling to make a comeback. The manufacturing PMI fell to 49.2 in October, while the non-manufacturing PMI edged down to 52.4. Fixed asset investment is generally stable but weak real estate investment presents uncertainty in the near future. In 2022, we expect expansionary fiscal policy that should (together with a gradual pick-up in consumption) reboot growth and set China back on its normal growth trend.

Inflation

Price pressures are broadening out and becoming stickier, driven by both supply and demand dynamics. In October, the US inflation rate was the highest it has been since the early 90s (headline +6.2%, core +4.6%), while in the eurozone, it hit a 13-year high (headline +4.1%, core 2.0%). Central banks have started to acknowledge that price pressures may be longer-lasting than initially thought but they have not yet expressed an urgency to act – especially ahead of winter, which will be the real litmus test for the success of vaccination campaigns.

The Fed has altered its wording on inflation, from “largely reflecting transitory factors,” to “reflecting factors that are expected to be transitory.”

Our base case is that inflation will moderate at more manageable levels after Q1 2022 as volatile energy prices retreat and more kinks in supply chains are ironed out. However, inflation drivers are starting to broaden out and there is a risk that what might have been a temporary burst of inflation could become more ingrained. In this scenario, central banks would probably be forced to tighten quicker than expected, putting growth in jeopardy.

Investment Strategy

Equities

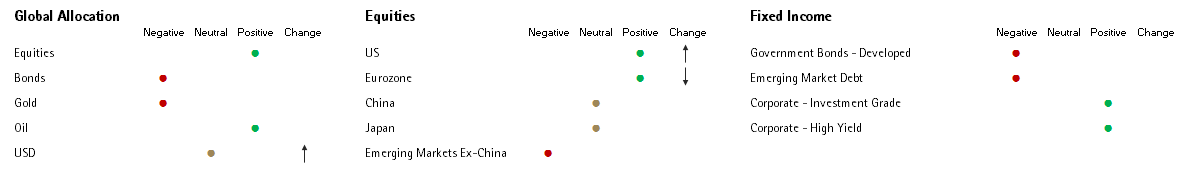

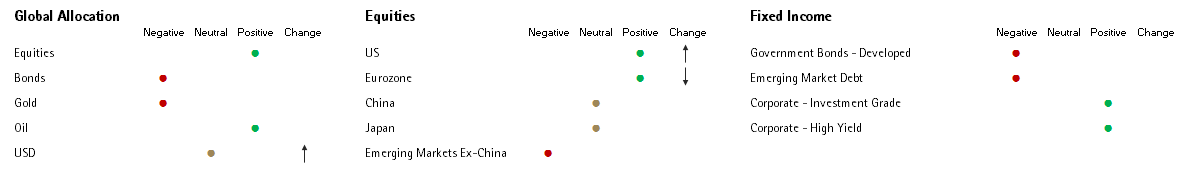

We remain overweight on equities, which are still supported by above-trend growth and a lack of attractive alternatives, given that negative real rates render other asset classes (e.g. cash and fixed income) uninteresting.

At our most recent Asset Allocation committee, we increased our overweight to US equities, based on the fact that this is the region where we see the most economic muscle. Profit growth is strong, with higher input costs yet to have any significant impact on margins, and revisions are still positive. Additionally, fiscal policy is still supportive; the recently passed infrastructure bill is worth some USD 1 trillion, while discussions around a new social safety net spending plan are ongoing. The US is also attractive from a flight-to-safety perspective on any potential risk-off sentiment (there are more quality stocks in the US that tend to perform better in a risk-off environment).

The trades were not currency hedged and, as such, our USD exposure increased proportionately. This is in line with our improving outlook for the dollar. The trajectory of monetary policy is likely to be the dominant driver of the USD going into next year, and tighter Fed policies (while the ECB remains relatively dovish), coupled with elevated inflation levels, should offer support.

Simultaneously, we trimmed our exposure to European equities, though we remain overweight on this asset class overall. Q3 earnings were very strong on the continent, albeit with fewer positive surprises than in the US, and the region offers a hedge against higher inflation expectations and rates as more of a Value play. However, the Delta variant has become a larger risk factor in Europe as cases surge again, while companies are still weighed down by supply chain issues (particularly in the auto sector). Dampened sentiment in the manufacturing sector is gradually seeping into services too.

In terms of style, we have diluted the relative weight that we allocate to Value inside of US equities. We still believe the Value style has further to go in this environment of higher inflation but feel a more balanced approach is prudent given that style rotations can happen all of a sudden and it can be painful to be on the wrong side of the trade when this occurs. We maintain a balanced allocation across cyclical and defensive sectors preferring healthcare, industrials, energy and financials.

Fixed Income

In the fixed income world, rates are expected to remain rangebound in the short term, given uncertainties around COVID, but we believe they will slowly succumb to the magnetic pull of the North Pole through 2022. As such, we are broadly reluctant regarding this asset class, particularly developed market sovereigns and duration. With a fine-tooth comb, investors can still find opportunities in the investment grade space. With most of the market priced for perfection, spreads seem to have found a floor; however, they might widen slightly for issuers/sectors which are rate-sensitive or companies at the risk of M&A activity (take for example, KKR’s recent bid for Telecom Italia). Returns must therefore be generated through carry and selectivity – we particularly like financials. High yield also offers some opportunities, but we advise our clients not to over-stretch when it comes to credit risk. Of particular interest is the BB space where a large pipeline of companies is set to join the investment grade universe – these “rising stars” are usually rewarded with spread tightening.

Commodities

Oil prices have dipped recently, largely driven by renewed restrictions in Europe, with some investors fearing that demand for fuel could dry up if the situation deteriorates. Additionally, President Biden has announced the release of emergency oil reserves – 50 million barrels worth – to combat high fuel prices. The impact of such measures are rarely long-lasting (the US burns through this amount in roughly 2.5 days) and OPEC+ could hold back a planned output boost, which would offset the single shot of new supply. Overall, the oil market is still very tight driven by a lack of investment and increasing demand, compelling our overweight stance.

An environment of policy normalisation, higher rates and a stronger US dollar makes us reluctant towards gold.

Conclusion

This will be the last BILBoard published in 2021, a year that has delivered double-digit returns on equity indices and exceptionally strong earnings growth. As we move into the new year, we maintain our equity overweight, believing that earnings should remain the key driver of returns, enabling equities to deliver sound, though perhaps not spectacular performance.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...