Choose Language

May 21, 2019

BILBoardBILBoard May 2019 – It’s not game over for growth but there are more snakes than ladders

In

the classic board game Snakes and Ladders, players must navigate from the

bottom of the board to the top, and the first to do so is declared the winner.

Successful players avoid snakes, which send you sliding back down the board, and

try to land on ladders which offer a shortcut up towards the finish line. Right

now, if the market were a game of snakes and ladders, the board would feature a

lot more snakes than ladders for risk assets. On top of that, the ladders would

be disproportionately shorter – meaning that the potential upside for risk

assets looks contained, whereas the downside could be very steep indeed. For

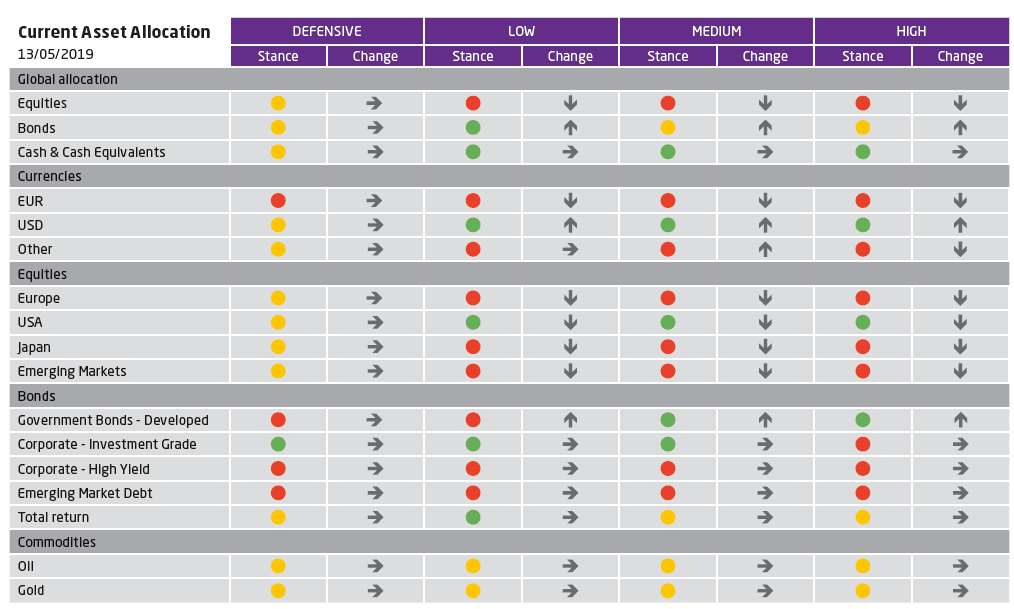

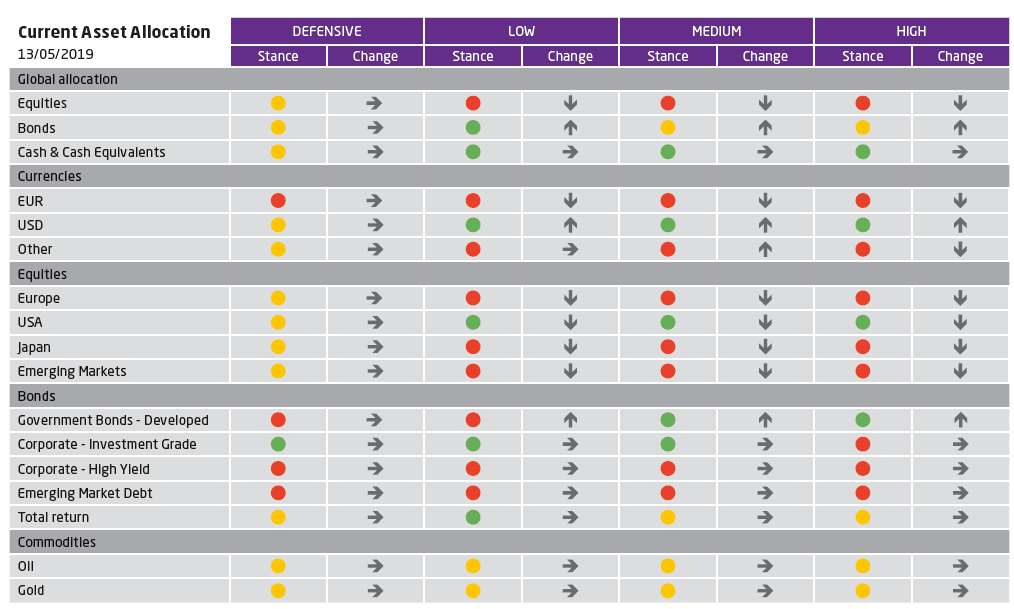

this reason, we have taken more risk off the table and reduced our equity

exposure from ‘neutral’ down to ‘underweight’. The proceeds were parked in safe

assets, namely US Treasuries and euro amounts in high-quality vehicles with

high liquidity.

This move was taken after the most recent ‘snake’ which sent major indices into the red (the S&P 500 by as much as 2.5%), namely the decision by the US administration to impose further tariffs on Chinese imports ($200bn of goods had their import levy raised from 10% to 25%). China countered by upping tariffs from 5% to 15% on $60bn of US goods. What this shows is that a truce is off the cards, and that the game of trade between the US and China is not a quick game of checkers. Rather, it seems that it will be more akin to a calculated, drawn-out, strategic game of chess, with the opponents trying and testing each other at every move. In the absence of a short-term solution, markets will keep yo-yoing. Over the longer term, higher tariffs will have implications for economic growth. A joint study by the Federal Reserve, Princeton and Columbia Universities found that the existing levies have raised costs for US consumers by $1.4bn a month. Higher prices could dampen the propensity to spend, and private consumption is the backbone of the US economy. At the same time, this could coax inflation upwards, potentially becoming a game changer for monetary policy. For now, the Fed has been locked in a ‘wait-and-see’ modus, especially with inflation tepid below its 2% target and global uncertainties prevalent. We don’t expect a rate move this year, whereas the market is currently pricing a cut. There is a danger that it could be caught off-guard here because – trade war aside – the US economy still looks to be in good shape, having registered growth of 3.2% in Q1. Investment and consumption still serve as pillars of growth and the labour market is ultra-tight: unemployment is at 3.6% - the lowest level since 1969.

The eurozone looks more precarious,

with its manufacturing sector (especially in Germany) in deep trouble. Factory

orders remain depressed from fluctuating demand (both domestic and foreign). With

the various risks dotted across the region, it’s a bit of an Indiana Jones-style

snake pit.

China churned out decent enough Q1

growth of 6.4%, and the

consensus expects the pace to stabilise at around 6.3% this year. Industrial

production and domestic consumption are both holding up well, rising 8.5% and

8.7%, respectively, whille the PMI is back in expansionary territory above 50.

The government is taking a hands-on approach in keeping the economy buoyant –

most recently Beijing even bought up Chinese equities following new tariff

impositions to limit the damage.

Equities

On

the whole, growth is, and is expected to remain at, comfortable levels,

supporting equities. However, that being said, there are not many catalysts

that could give stocks a further leg up, and for the next ‘ladder’ we may have

to sit tight until the Q1 earnings season. On the other hand, it seems there is no shortage of risks

– whether it be Brexit, the European elections where populists on the

fringes may gain more clout, or the US pursuit of protectionism with both

allies and adversaries. This asymmetric risk environment pushed our hand in underweighting

equities. Within our downsized universe, we still prefer the US where recession

is not considered an imminent risk, where earnings expectations have descended

to more realistic levels (consensus sees 4% EPS growth for the S&P 500) and

where prices should be supported by a wave of buybacks. Our least-preferred

region is Europe. Next to political risks, there is also the prospect that the

US section 232 investigation into automotive security could result in tariffs

on automotive imports. This could be the final block that topples the shaky Jenga

tower that Europe’s manufacturing sector is resembling. Furthermore, financials – which make up a significant

proportion of the European market – are facing a plethora of problems: money laundering

scandals, low rates, low loan demand, and so on.

We are underweight Japan due to its

sensitivity to the micro cycle and lacklustre earnings expectations. Further

tarnishing the region’s allure is the consumption tax hike penned in for

October, which will likely put a dent in consumer confidence. We are also underweight

emerging markets, which have lost momentum after a good run. The region’s fortunes

will be heavily influenced by the outcome of trade talks.

In terms of sectors, we are remaining overweight

in technology, which drives earnings growth. We are underweight utilities and

neutral elsewhere.

Fixed income

After investing the proceeds of our

equity sales in high-quality liquid bonds, our fixed income exposure is now

neutral. In this segment of our portfolios, we are still underweight high yield,

govies and emerging market bonds, while harbouring an overweight in investment

grade corporates. Quality is the leitmotif here, and we further minimised our risk

exposure by shifting into instruments with a higher credit rating and trimming

exposure to corporate hybrids and subordinated financials. The broader market seems to share this risk

aversion, and even during the recent rally investors have not wholeheartedly

jumped back into riskier bonds (as seen in the wide spread between A and

BBB-rated bonds). Overall, in investment grade, spreads are sitting around

historical averages, and demand is strong. Even without the invisible hand of

central banks, new issues have been well absorbed. That being said, no asset

class is immune to trade talks, and tensions could cause spreads to widen again,

as could an influx of new issues.

All in all, it’s not yet ‘Game Over’ for the global economic growth story. However, the slowdown is real and in motion and with risks abound, we felt it was time to play it safe and bring our exposure to risk assets below neutral.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...

June 11, 2025

News2025 Midyear Outlook: Going Deeper

A choppy start to 2025 When we published our 2025 Outlook, Tides of Change, we anticipated a year defined by turbulence—and indeed, the first half...

June 5, 2025

Weekly InsightsWeekly Investment Insights

Published early, on 5 June 2025, in light of the public holiday weekend As ash and gas billowed from Sicily’s Mount Etna, some steam also...