Choose Language

March 29, 2019

NewsBrexit: Last Chance Saloon

Today was supposed to be the day when the UK officially left the EU. But with the UK still unable to decide on how to proceed, the EU has delayed the departure – but not by much...

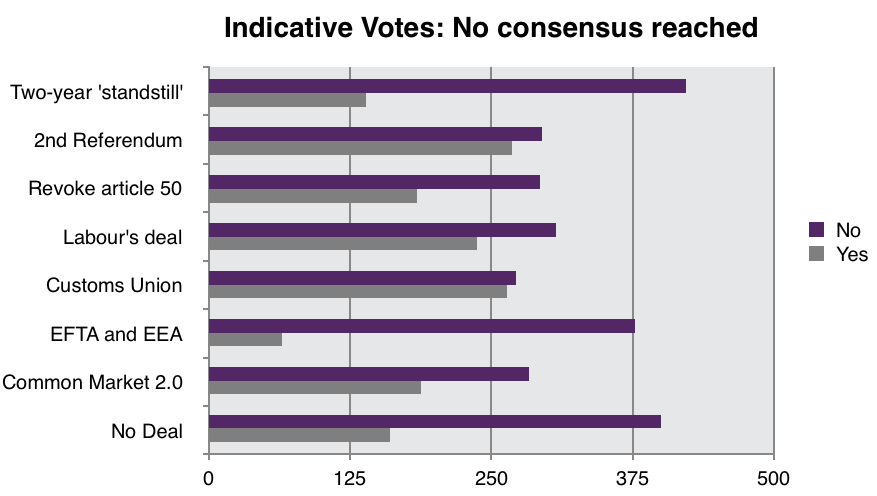

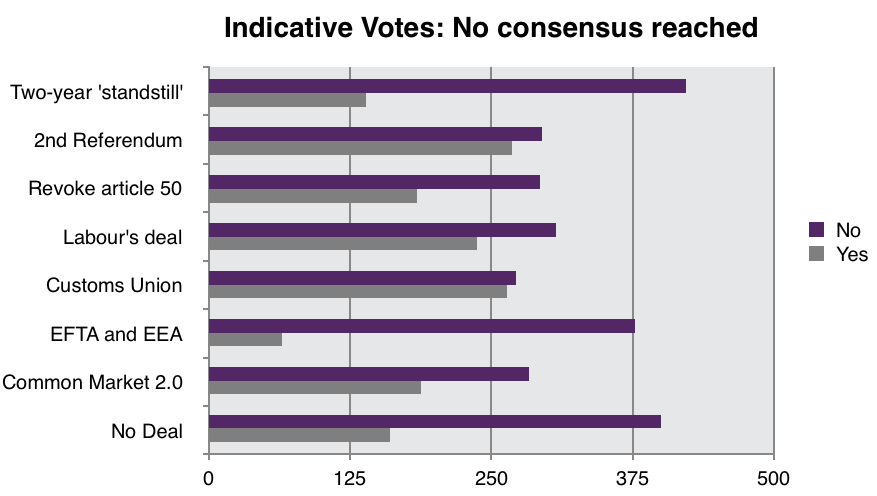

Late Wednesday, it came to fruition that not one of the eight Brexit options which were subject to an indicative vote in the British Parliament was accepted.

After the stalemate, Theresa May will today between 9.30am and 2.30pm hold a critical vote on the ‘withdrawal agreement’ section of her broader Brexit deal. If MPs do not vote for the agreement, Britain will have only until April 12th — the country’s deadline for triggering elections to the European Parliament — to choose between the remaining courses of action. Failure to choose a course of action could result in a no-deal Brexit on this day. If MPs do vote for the agreement, the EU will offer an extension until May 22nd in order for May to pass the implementing legislation in the UK.

May’s Brexit deal consists of two parts – the legally binding ‘withdrawal agreement’ (covering items such as citizens’ rights, Northern Ireland and the £39bn exit bill) and a ‘political declaration’ on the framework for future relations. May has already put her blueprint to a meaningful vote twice, suffering a heavy defeat both times. The House Speaker, Mr Bercrow said he would not permit a third MV on May’s deal, unless substantial changes are made. By excluding any decision on Britain’s future relations with the EU in Friday's vote - focusing solely on the withdrawal agreement, May has ‘made the substantial changes’.

Theresa May has gone as far as gambling her position on this vote saying she will resign in Summer, if MPs vote in support. This was effective in winning the hearts and minds of some hardcore Brexiteers in her own party. Indeed, Boris Johnson and Jacob Rees-Mogg were amongst 14 other Eurosceptic ‘switchers’. However, hopes have been dashed by the Democratic Unionist party (which props up May’s majority) who said it would continue to vote against her plan, regardless.

We continue to steer clear of the UK market, which is becoming somewhat of a casino. Sterling, a barometer of investor hopes and fears about the Brexit outcome has remained range bound over the past weeks, but at any point, with such a wide spectrum of outcomes, it could shoot in either direction. As the Financial Times put it: even seasoned market professionals are reluctant to predict which way it will jump. FX uncertainty is weighing on firms based in and operating in the UK who are struggling to model future cash flows and assess hedging needs. Renowned emerging markets fund manage Mark Mobius yesterday said the UK was becoming akin to an emerging market amidst the Brexit chaos.

Beside Brexit, the other major risk we face is the ongoing trade spat between the US and China. Yesterday, a new round of trade talks began in Beijing, attended by Trade Representative Robert Lighthizer and Treasury Secretary Steve Mnuchin. The chief Chinese envoy, Vice Premier Liu He, is due to visit Washington in early April for more talks. A “signing ceremony” summit between the two presidents is unlikely until the end of April at the earlies according to analysts. Trump delayed the March 1st deadline for imposing more tariffs, citing “substantial progress”. It seems this has removed some of the urgency to strike a deal.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...