Choose Language

December 15, 2022

NewsDecember FOMC: shifting down a gear

- Fed fund rate increased by 50bp to 4.25% - 4.50%

- Decision taken unanimously

- New dot plot released

Yesterday, at its final FOMC of the year, the US Federal Reserve raised its benchmark policy rate by half a percentage point, to its highest level since 2007, and signalled its intention to keep tightening next year.

The committee voted unanimously to increase the federal funds rate to a target range of 4.25-4.5%, ending a string of bumper 75bp hikes.

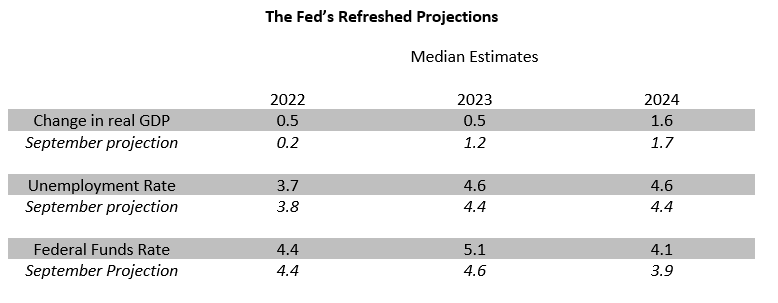

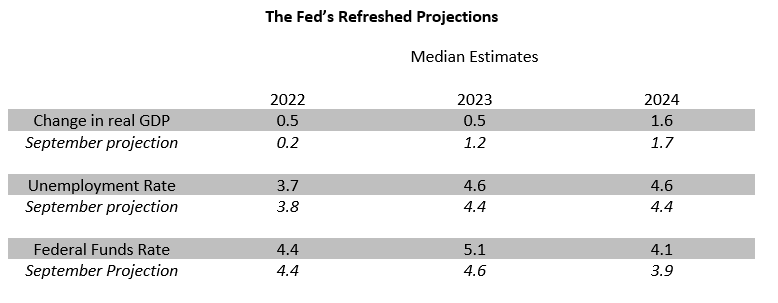

Alongside the rate decision, the Fed published a revised “dot plot” of officials’ individual interest rate projections. The median estimate for the fed funds rate by the end of 2023 rose to 5.1%, up from 4.6% in September and quite a bit higher than the 4.8% terminal rate the market had priced ahead of the meeting. Powell added that he couldn’t say, “confidently that we won’t move up our estimate . . . again.” This will depend on incoming data.

No recession was mentioned but the refreshed economic projections envisage growth of just 0.5% in 2023 before a 1.6% expansion in 2024 as the unemployment rate tops out at 4.6%. The labour market continues to show resilience and Powell highlighted the “extremely tight” dynamics and the pressure higher wages would put on companies’ labour costs and ultimately inflation. Wages are currently growing at a pace of 5.1% YoY – about 2 percentage points quicker than Powell believes is consistent with bringing inflation back down towards 2%.

Bond markets initially declined on what was perceived as “tough love” from the Fed but then appeared to grow sceptical that the Fed will stick to its guns. In futures markets, bets are on that the Fed will cut rates next year as the economy slows, essentially disputing the dot-plot which did not show any cuts in 2023.

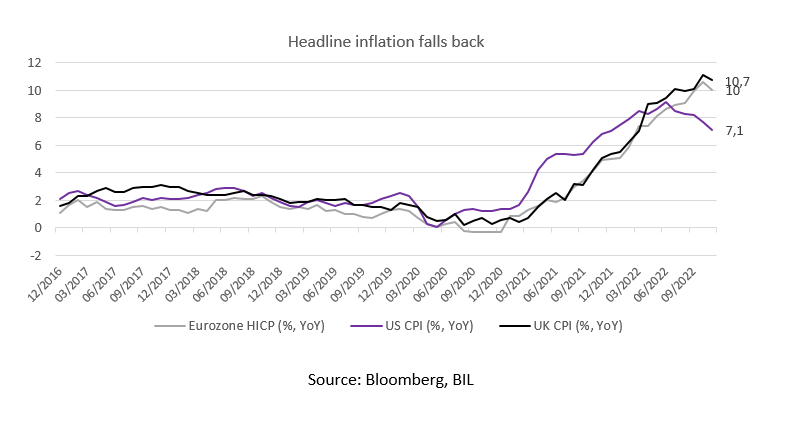

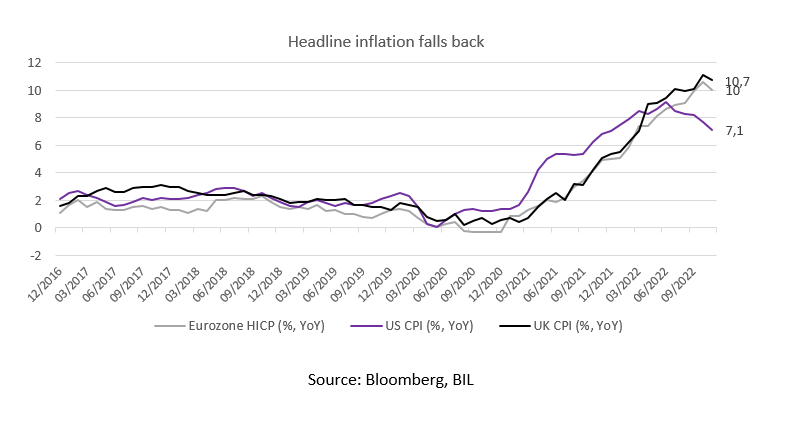

The Fed’s de-acceleration in the pace of hikes was followed across the Atlantic with both the BoE and ECB delivering 50bp hikes. Headline inflation appears to have peaked in all three regions, but concerns remain about how long it will take for it to come back towards their 2% targets, having seeped into stickier categories like rents and wages.

Conclusion:

- More Fed hikes to be expected at following meetings

- Economic data will determine the pace of further hikes

- Economic slowdown expected in the US that could lead to higher unemployment (no word on recession)

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...