Choose Language

November 16, 2020

NewsEurope: Growth expectations fall in the Autumn Economic Forecast, but help is on the way

The eurozone recorded its fastest rate

of expansion since records began in 1995 in the third quarter, but the European

Commission took the gilt off the gingerbread by revising down its growth

forecasts shortly after, pointing to the pandemic’s resurgence. Nonetheless,

more fiscal and monetary support is forthcoming.

Quarter-on-quarter, the eurozone economy

expanded 12.7% in Q3, versus 9.4% expected, but a new series of lockdowns,

curfews and restrictive measures threatens to put a spanner in the works. As

Maarten Verwey, European Director General Economic and Financial Affairs

comments, ‘The combination of renewed fear about the spread of the disease and

lockdown measures is weighing on economic activity in the short run and putting

the nascent recovery on hold.’ While, the EU commissioner, Paolo Gentiloni

said: ‘Growth will stall in the fourth quarter and pick up in the first part of

2021.’

A recovery on ice is much better than a

recovery falling into reverse. For now, a double-dip recession is not our base

case, however, it cannot be ruled out if new restrictions fail to contain the

virus swiftly.

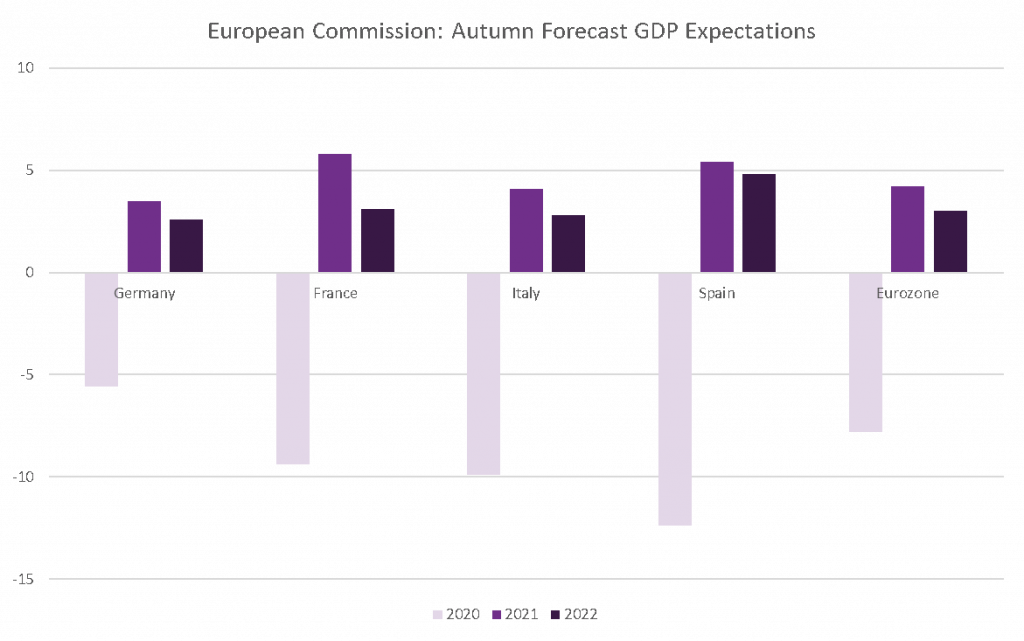

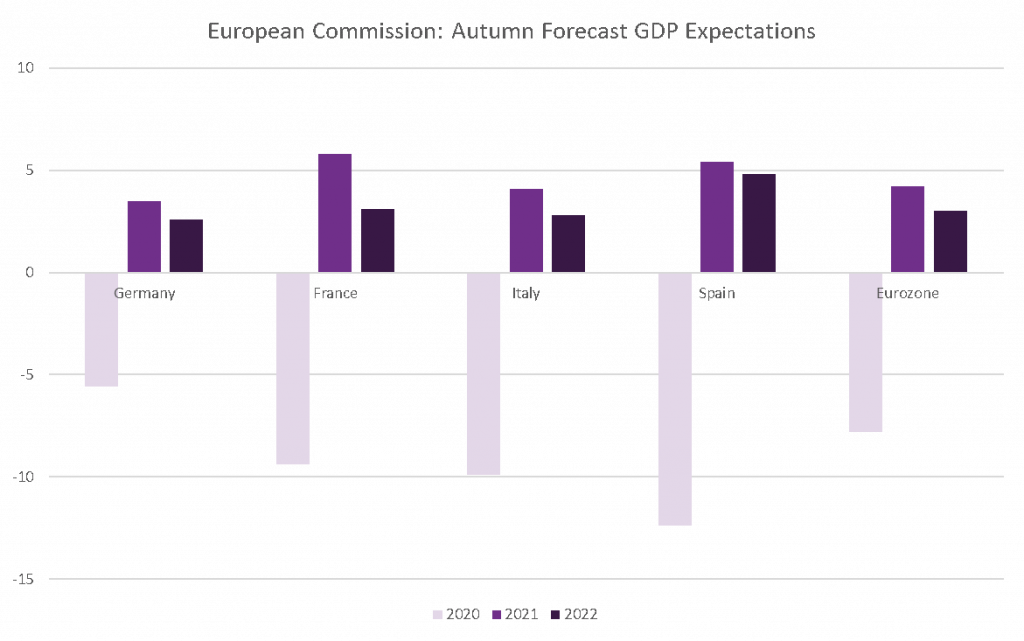

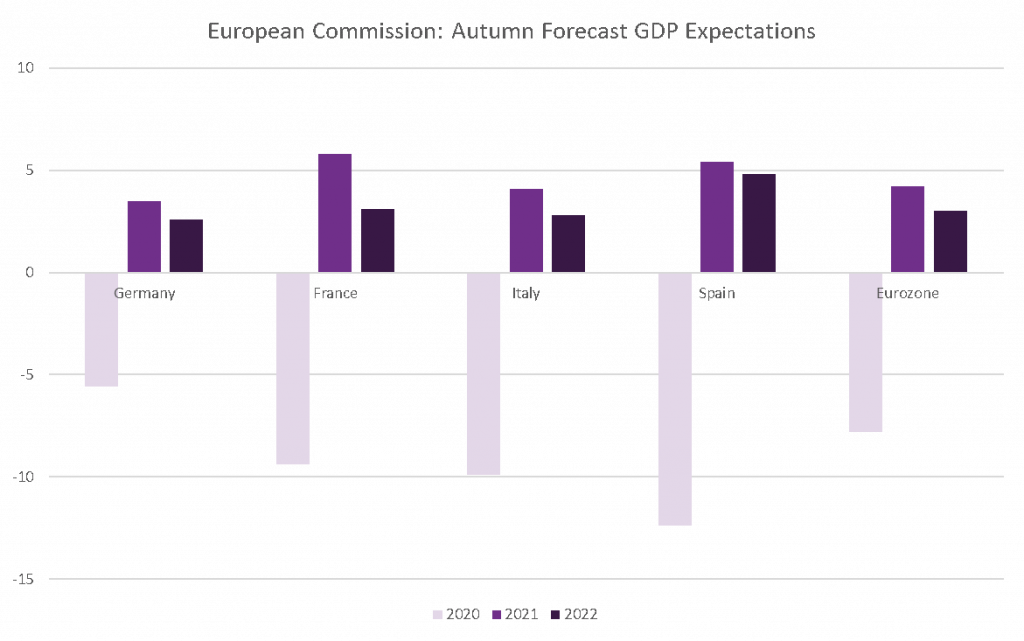

After factoring new government-imposed restrictions into its forecasts, the European Commission’s Autumn Economic Forecasts predicted the EU economy to shrink 7.4% this year, unchanged from its previous forecast, but expectations for 2021 were cut by 2% from +6.1% to +4.1%. The broad figures, however, mask the very uneven recovery that is playing out, as seen below.

The economic trajectory of individual

countries has largely depended upon their ability to keep a lid on the pandemic

while, at the same time, countries with manufacturing at the heart of their

economy have managed to make a gradual comeback with supply chains mended and

export demand picking up. Those countries with service based economies,

especially those reliant on tourism, are still in the doldrums: The IHS Markit

Manufacturing PMI rose to 54.8 in October, while the Service equivalent came in

at 46.9. 50 is the level that separates contraction from expansion.

New mentions of the “R” word, the

unevenness of the recovery and the fact that inflation has been in negative

territory for three months in a row (most recently -0.3% in October), should

spur policymakers into further action.

On the fiscal front, now that the EU

Parliament has reached an agreement on the “rule of law conditionality”[1],

it is hoped that the EUR 750bn recovery package can start being disbursed

before the end of the year.

On

the monetary policy side, the ECB has primed us for even more stimulus at its

December meeting. The shape and size of the ECB’s Christmas present is subject

to speculation but consensus expects that the EUR 1.35 trillion pandemic

emergency purchase program will be expanded by six months until the end of

2021. Since the bond-buying plan was announced in March, the ECB has only used

half of the available money. Other predictions include an expansion of the

bank’s other asset purchase program which is running parallel to the PEPP,

buying EUR 20 billion worth of bonds per month, plus a “temporary envelope” of EUR 120 billion.

It’s currently scheduled to run until the end of this year. Cognizant of the

weight of negative interest rates on bank balance sheets, it may be expected

that the ECB expands its long-term lending scheme to banks rather than taking

the scissors to rates. The last thing the eurozone needs is for credit flows to

thin.

Then there is the chance that Ms. Lagarde chooses to add her own signature to the policy mix, bringing something entirely new to the table – after all, she did use the word “recalibration” some 20 times at her last press conference. The parcel will be unwrapped on December 10th and the contents had better not be a tangerine or a lump of coal, or else markets could get stroppy.

[1] A clause which states that EU countries

must uphold the European rule of law (i.e. judicial independence) or risk

losing access to the funds. The specification faced strong opposition from

countries such as Hungary and Poland.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...