Choose Language

September 23, 2022

NewsEurozone inflation broadens out in August

Eurozone headline inflation hit 9.1% in August, up from 8.9% and the highest level since the creation of the single currency. While energy is still the driving force behind this elevated figure, it is not the only one. Inflation is broadening out, compelling the ECB to act with greater haste.

Data released last week confirmed that while energy inflation in the Eurozone is still elevated, it actually softened last month, falling from 39.6 to 38.6% year-on-year. Whether it will continue to fall is a wild card. On one hand, oil prices are back below $100/barrel, and even gas prices have come off of their summer peaks, helped by proposed government intervention. On the other hand, if gas shortages materialise this winter, we could see renewed upward pressure on prices and not just for gas and electricity but also for oil which could be considered as a substitute in certain scenarios.

But what happens in the energy sector doesn’t stay in the energy sector. Elevated energy costs have led to second-round effects in other industries. Take for example, food alcohol and tobacco, for which prices rose 10.6% year-on-year in August. Not only have costs to transport produce risen, but also to heat greenhouses, to run machinery, to buy fertiliser and so on… With some fertiliser producers scaling back output due to higher costs of gas, carbon dioxide (a by-product in the process of making fertiliser) prices have risen to almost €3,500 per tonne from €100 per tonne a year ago. This leaves fizzy drink producers and beer brewers facing astronomical costs to put bubbles in our beverages.

The core inflation reading, which strips out volatile categories like food and energy, also hit a new all-time high of 4.3% in August, up from 4.0%. Non-energy industrial goods, such as clothing, cars and household appliances were up 5.1% versus 4.5% in July.

If this broadening out of inflation would continue, it could be more difficult for central banks to put the genie back in the proverbial bottle.

Inflation ultimately boils down to psychology. High inflation, if left unchecked or if people doubt central banks’ ability to contain it, can fuel fears about even higher future inflation, potentially creating a self-fulfilling feedback loop. The latest release of ECB consumer inflation expectations showed those were unchanged over a 1-year period at 5%, but expectations for inflation over 3-years inched up to 3.0%, from 2.8%.

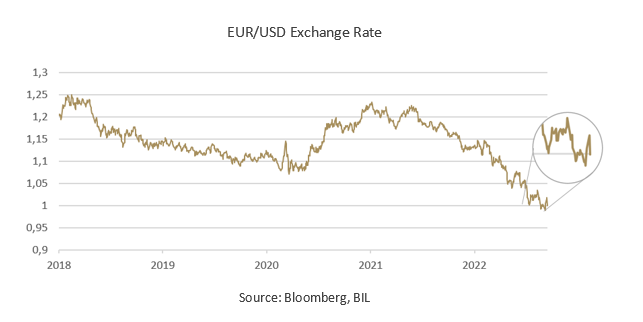

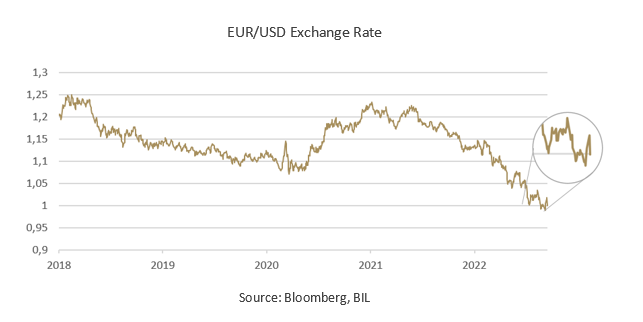

There is an additional factor complicating the ECB’s challenge to curb inflation: a weak euro. In summer, the euro hit parity with the dollar and the exchange rate has hovered around these levels. This is problematic because energy imports are typically invoiced in US dollars and indeed, the Eurozone just reported a trade deficit of EUR 34bn, the second-largest on record, as higher energy costs pushed up the overall figure for imports.

With all this in mind, it isn’t surprising that the ECB revised up its inflation projections this September. The governing council now expects it to average 8.1% in 2022 (up from 6.8% forecast in June), 5.5% in 2023 (from 3.5%) and 2.3% in 2024 (from 2.1%). Essentially that means that the ECB doesn’t believe that inflation will fall back to its 2% target before 2025.

In order to try and force it downwards, the ECB has been “front-loading” its interest rate hikes, raising rates by 50 basis points to zero in July – its first rate hike in 11 years – and then by 75bp in September. But August inflation data implies there is still some ground to cover.

Last week, ECB Vice President De Guindos said determined action is needed to anchor price expectations even as growth slows. While some might have thought that an economic slowdown would naturally depress demand and bring down inflation, he begged to differ, noting “the slowdown of the economy is not going to ‘take care’ of inflation on its own” and that the central bank will have to keep raising rates, prioritising the fight against inflation over growth concerns. But the ECB probably cannot fight this battle alone and bringing down inflation will also require coordinated fiscal action, particularly with regard to the energy sector. On this front, let’s see how European Commission energy talks go on September 27-29.

As policymakers wrestle with inflation, investors should acquaint or reacquaint themselves with the potential impacts that it could have on their portfolios – for several years up until the post-pandemic inflationary burst, this is something that many didn’t really have to consider. While investing at such a moment can be challenging, it is also important not to close ourselves to potential opportunities that might arise when it comes to building a well-diversified, long-term investment portfolio. The best move would be to talk to your bank/financial advisor to discuss the best options for you with regard to your own individual situation and risk tolerance.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...