Treasury bond yields have been rising for the past few weeks based on hopes for tax reform and expectations of Federal Reserve (Fed) policy normalization through higher interest rates and balance sheet reduction (i.e. Quantitative Tightening (QT)). Further information surrounding the Fed’s intentions should be revealed at next week’s FOMC meeting which will kick-off on October 31st.

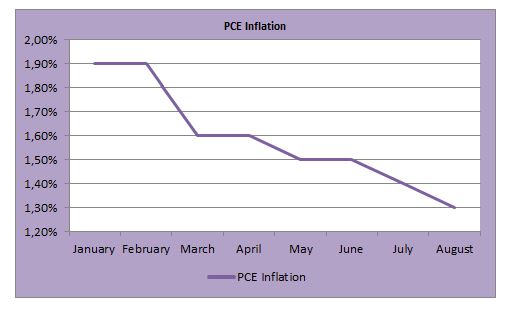

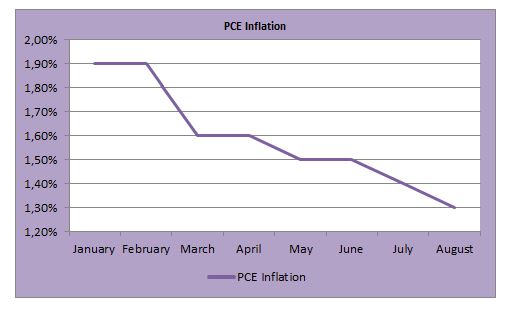

Whilst there are expectations of even higher yields to come and an end to the US bond bull market, one must consider that US economic activity has been slowing for some time. The Economic Cycle Research Institute leading indicator has been contracting in recent weeks and now stands at its lowest point of 2017. Yet the Fed has already raised rates four times and is on track for one more hike this year in addition to shrinking its balance sheet (QT). This is hardly a constructive backdrop for economic growth and higher inflation (i.e. rising yields). Moreover, inflation is elusive. In fact, (Personal Consumption Expenditure) PCE inflation, the Fed’s preferred measure, is decelerating:

Thus, it seems the recent rise in Treasury yields does not reflect fundamentals and has more to do with shifts in market positioning, tax reform hopes and expectations around the Fed’s balance sheet reduction which will supposedly begin in the next few months. There are fears that such QT will lead to higher long-term rates. However, a look at history reveals a slightly different picture.

During QE1 in 2008/09 the yield on 30-year Treasuries actually rose significantly. The same was true during QE2 (2010/11) and QE3 (2012/13). But, when the Fed paused (between various phases of QE) long-term rates declined by an average of 83 basis points.

Banks, pension funds, insurance companies and foreign sovereign wealth funds showed up as buyers as the Fed stopped buying bonds: the Fed is not the only major player in town.

According to conventional wisdom Fed balance sheet reduction (QT) will eventually result in higher long-term yields. However, there is a good case to be made for the opposite to happen in the shorter term.

Firstly, QT is going to free up high quality collateral. Today, there are a lot of high-yield (junk) bonds swirling around, but there is a global shortage of high quality long-duration bonds. This means, once the Fed starts to unwind its balance sheet (i.e. selling bonds) there will be high demand for the new AAA-rated debt hitting the market.

Capital rules will ensure that banks move more Treasuries onto their balance sheets, especially at a time when consumer loan quality is deteriorating and delinquency rates are rising. Bank holding companies specializing in credit cards home loans, auto loans have seen delinquency rates (at least 30 days past due) rise to the highest levels since February 2011.

The most important aspect is that banks will be moving simultaneously towards bolstering their liquid asset ratio and will be shifting to replenish their depleted holdings of safe bonds. This expected strong demand from banks for Treasuries will not only keep long bond yields from rising, but will help push yields lower.

Moreover, 40% of the Fed’s balance sheet unwind is in mortgage-backed securities. This comes at a time when housing statistics show signs of late cycle strains. This will add to uncertainty in the real estate market, aggravate the slowdown in the credit sensitive segments of the economy, and continue to drive investor demand for safe havens with yield.

Against this backdrop, it is not unreasonable to conclude that initially QT could benefit Treasuries in the short to medium term, which are a hedge against weaker growth when the policy of boosting “consumer wealth”, increasing “confidence” and spurring “spending” unwinds.

Since the middle of 2015 the 10-year Treasury yield has been in a trading range between 2.0% and 2.4%. Given the fact the 10-year bond yield is closer to upper end of the trading range, we think there is some upside potential for the price of the 10-year bond from current levels, thus long-term Treasury holders should not immediately panic if next week, the Fed decides to push ahead with QT.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...