Choose Language

January 30, 2018

NewsGICS Reclassifications: Telecommunications, the new ‘it’ sector in the US?

- Shake-up of GICS system will see the Telecommunications Sector expanded and rebranded as ‘Communication Services’

- The revamped sector will inherit several tech behemoths from the IT Sector and big media names from the Consumer Discretionary Sector

- Investors should begin to re-evaluate sector-centric strategies and ETF holdings

What is GICS?

The Global Industry Classification Standard (GICS) is a standardized classification system for equities developed jointly by MSCI and Standard & Poor's in 1999. The GICS methodology is used by the MSCI indexes, which include domestic and international stocks, and has become the de facto analysis framework across the professional investment management community for investment research, portfolio management and asset allocation. Approximately 95% of the world’s equity market capitalization is classified under GICS.

As of 28th September 2018, the GICS classification system which guides index compositions and asset allocation strategies globally, will be re-shuffled. Preliminary notifications[1] reveal that the most radical changes will pertain to the Telecommunications sector which will be broadened and re-named Communication Services.

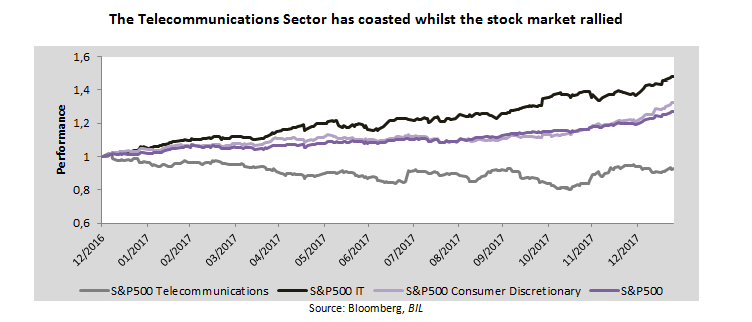

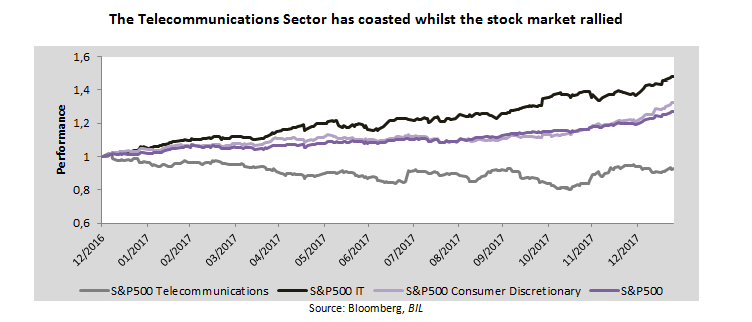

At present, the Telecommunications sector has become a home of humdrum investments, drawing mainly risk-averse investors seeking bond-proxy stocks that offer a reliable dividend as an alternative to paltry yields in the fixed income world. Returns have been unexciting as a result of anemic growth and intense competition within the sector which has squeezed profit margins. A wave of consolidations has left only a handful of companies, representing only around 2% of the S&P500 index. Subsequently, the sector’s overall performance is vulnerable to swings in any one of its constituent’s prices.

Plot twist. The sector is soon to be given a new lease of life, inheriting glittering names from the IT sector, like Facebook and Alphabet (Google’s parent company) as well as big media names like Netflix and Comcast which previously belonged to the Consumer Discretionary sector.

As a result of the Sector’s metamorphosis, it will contain two main industry groups: Telecommunication Services (made up of existing telecommunication names like AT&T) and a newly-minted Media & Entertainment group which will be divided into three sub-groups: Media, Entertainment and Interactive Media & Services (Appendix 1.1).

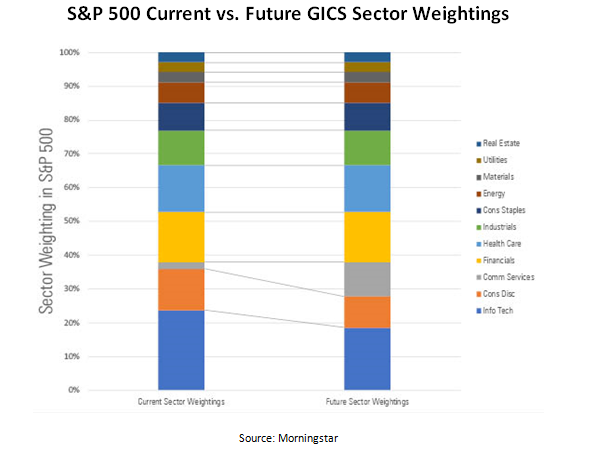

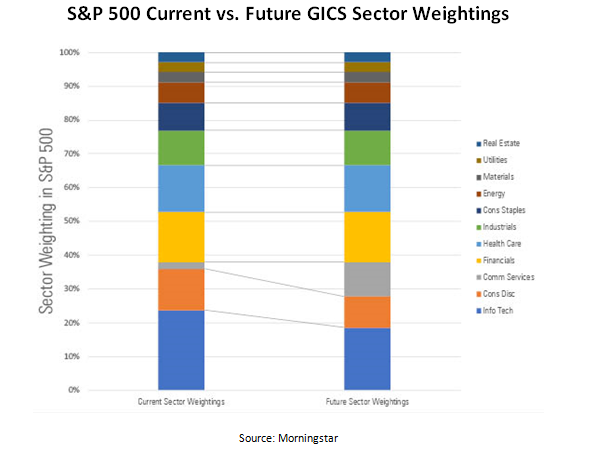

The new GICS structure will still consist of 11 Sectors, but as the below diagram depicts, the IT and Consumer Discretionary sectors will lose muscle which will mainly be re-distributed to the rejuvenated Communication Services sector. As a result it will come to represent roughly 10.2% of the S&P 500 index.

Investment implications

In light of the changes, there are several important considerations for investors.

In terms of sector allocation, investors will need to re-evaluate their preferred sectors and curate their portfolios accordingly. (Tele)communications is about to become a lot more relevant, housing a number of ‘stock market darlings’ from the IT sector; notably, three out of the four ‘FANG’ stocks – Facebook, Netflix and Google.[2]

In turn, the IT sector could lose its dominance (by the end of 2017, it accounted for 24% of the S&P 500) and some of its most prominent names that helped drive the laudable returns the sector has become known to produce. Likewise, stocks such as Comcast, TripAdvisor, Netflix (and potentially Walt Disney) that have boosted the performance of the Consumer Discretionary sector will switch into Communications services.

Investors in the bourgeoning exchange traded fund (ETF) industry will have to pay particular attention. The vast majority of ETFs are passively managed, meaning that the underlying indices guide trillions of dollars of investments worldwide, dictating what funds buy and sell. Thus, ETF investors should be aware that the basket of stocks which they currently invest in is subject to major changes, especially if their ETF tracks either the IT, Consumer Discretionary or Telecommunications sector. Rearrangements in the underlying holdings could drastically alter the risk, growth potential and income generation characteristics of the funds. So now, more than ever, it is essential that investors know exactly what is inside the funds they hold in order to have a grasp on future prospects.

Investors should also consider that track records for the sectors most heavily affected by the GICS re-classifications will become meaningless. Investors who place importance on past performance will miss the big picture and fail to understand what will drive performance moving forward.

Mutual fund investors in funds following a specific thematic may also wish to inquire as to whether this will alter the fund’s investment strategy.

Perhaps the most important conclusion is that Telecommunications should no longer be disregarded as bland. With a new injection of ‘cool’, this may be an up-and-coming sector to consider being in.

Media – comprised of companies engaged in Advertising, Broadcasting, Cable & Satellite, and Publishing.

Entertainment – comprised of companies engaged in producing and selling entertainment products and services as well as those producing interactive home entertainment content such as games and mobile gaming applications.

Interactive Media & Services – comprised of companies engaged in content and information creation or distribution through proprietary platforms, search engines, social media and networking platforms, online classifieds, and online review companies such as TripAdvisor (which was previously under the Consumer Discretionary umbrella).

[1] Amazon’s new categorization is still to be announced

[2] The full list of companies affected will be released on July 2nd

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...