Choose Language

June 30, 2022

NewsGreenflation, the ‘new’ Green Goblin

Since the start of the year, financial markets have been navigating shockwaves with most central banks around the world fighting the big elephant in the room, namely inflation. And, indeed, inflation has been more persistent than expected by most, spreading fast and affecting everything from commodities to food, wages, electricity bills, rent, .. etc. As they try to bring inflation back to target, the hawkishness of monetary authorities has caused a sharp increase in bond yields, a significant sell-off in equities and a severe widening of credit spreads.

In economic theory, inflation has multiple facets, ranging from deflation (when prices decrease over time), disinflation (the slowing of price inflation), stagflation (a mix of stagnating economic growth and inflation), reflation (a classical case-study of economic recovery that usually results from a combination of expansive fiscal and monetary policy) and finally, hyper-inflation (generalised and significant price increases).

Some of those facets have frightening and ugly faces. Souvenirs of the oil price shocks of the ‘70s (which led US inflation to almost 15% in 1980) and the German Weimar Republic (with inflation reaching more than 20% on a daily basis in 1923) are probably amongst the worst nightmares of central bankers.

While inflation is the word on everyone’s lips today, there is also a new buzzword gaining traction: “GREENFLATION”, a hybrid type of price pressure stemming from cost-push inflation and the green transition. Ironically, it seems that the battle to cool down the planet is heating up the economy. Costs associated with the green transition are supercharging inflation, and we should also note that these are sticky in nature.

In the current context of inflation linked to both energy and food [1], pundits and economists were quick to establish a potential causation link between inflation and the way societies address climate change.

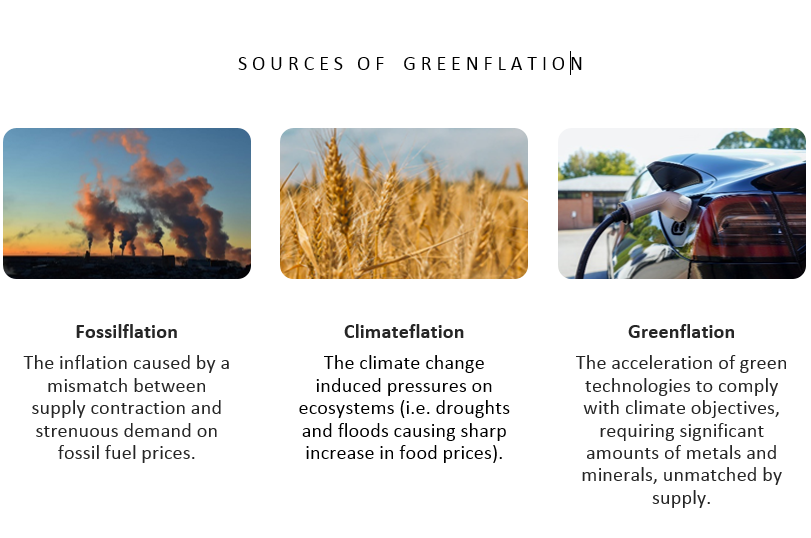

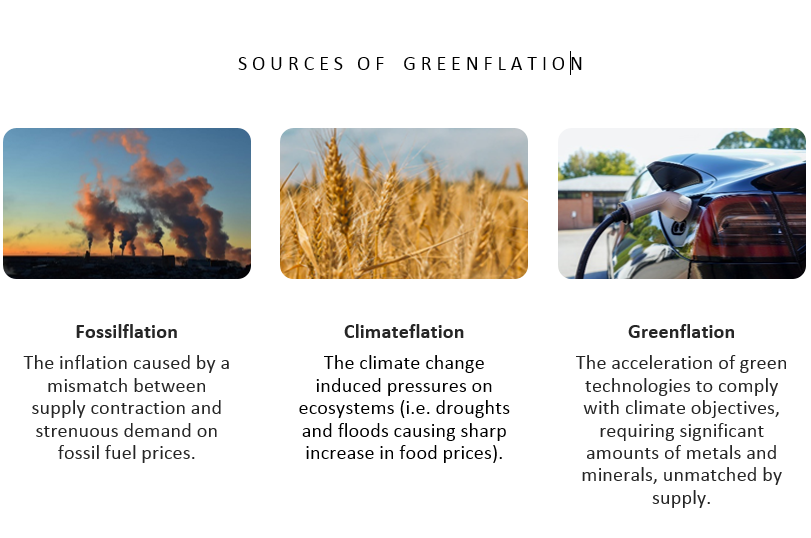

Fortunately, in March this year, Isabel Schnabel, member of the ECB’s Executive Board, proposed a new structure that distinguishes between three entangled sources of climate-related inflation:

Fossilflation, and the fact that the fossil fuel market faces multiple constraints, was reinforced by Covid and the conflict in Ukraine, but mostly originated from a significant decrease of investment in oil & gas activities. Some sort of “chicken or egg” questions are abound on the underinvestment. Some experts simply believe that peak oil production already passed long ago, others are blaming investors and society for bashing fossil energy as they adopt new climate objectives. Here, the Green Goblin is definitely inspiring some sort of mudslinging aimed at the energy transition. While the complaints may be rational, they also omit the fact that oil majors (as well as more broadly commodity suppliers) have, for the most part, been obsessed with demonstrating to their shareholders that oil (and commodities) could be a good investment by returning cash to shareholders, performing buybacks and paying down debt, deliberately limiting their capital expenditures and avoiding new projects.

The robust recovery post Covid, the conflict in Ukraine and higher fertiliser/fuel prices all contribute to higher food prices. But “climateflation” is also at play and if not yet putting upward pressure on prices it is, at least, increasing price volatility. The same logic is also applicable to both energy and metals. According to the IEA [2], over 50% of today’s lithium and copper production is concentrated in areas with high water stress levels, while both industry and extraction have high water requirements: “Several major producing regions are also subject to extreme heat or flooding, which pose greater challenges in ensuring reliable and sustainable supply”.

The energy transition has increasingly become one of the significant drivers of demand for industrial metals as global efforts to meet net-zero commitments and the Paris Agreement ramp up. And indeed, the push for a transition to a green economy has caused “greenflation”, a surge in the price of metals and minerals, such as copper, nickel, aluminium, lithium and cobalt, which are vital components of electric vehicles, solar panels, wind turbines, ..etc. For illustration, the IEA estimated that manufacturing an electric vehicle requires six times more minerals than a combustion engine equivalent. Likewise, an onshore wind farm needs nine times more minerals than a gas-fired power plant. In the end, while demand is booming, mining capacities are not ready to absorb such demand, creating upward pressure on prices. Worth mentioning is that the IEA estimated that it takes 16 years for mining projects to move from discovery to production, making the scaling up of supply unlikely in the short term. There is indeed a price to be paid for going green and the energy transition is costly considering the vast amount of commodities required to scale clean energy up. Building solar panels, wind farms and batteries, all require a host of minerals, while most of those minerals, including copper, lithium, cobalt and nickel, are in short supply.

In identifying Fossilflation, Climateflation and Greenflation as key climate-related inflation drivers, policymakers are better placed to formulate potential solutions. Broadly speaking, greenflation is real but we should not oversimplify the ongoing reality by using the green transition as a scapegoat for all the pains associated with a broad acceleration of inflation: we should not let perfect be the enemy of good.

Broadly speaking, greenflation is real but we should not oversimplify the ongoing reality by using the green transition as a scapegoat for all the pains associated with a broad acceleration of inflation: we should not let perfect be the enemy of good.

Claims that “going green could save the world, but we’re all going to have to pay up for it” are loudening. The comeback of inflation has rekindled the debate around the costs and the benefits of addressing climate change. Paying more today for a sustainable future is out of sync for many citizens, companies, investors and governments which often have a short-term way of looking at things and exploding prices are likely to reduce acceptance among the population for the energy turnaround. The Yellow Vest movement, the “end of the world vs. the end of the month” perspective highlighted in 2018, and resistance to the sustainable transition agenda, all illustrate constraints in providing justice in the age of climate change.

Definitely not something to minimize, but objectively, change has been, and will always be, a contested process. Anyone that feels concerned and is involved in the fight against climate change, should understand that in fostering broad societal acceptance for the sustainable transition, we cannot rely on economic considerations alone, but also cultural factors, experiences and perceptions.

To conclude, trying to answer the question if the green transition could cause persistent inflation globally, the answer is that there is no free lunch, as greening our economy has a price and we will all have to chip in to pay for it. The combination of insufficient production capacity for renewable energies in the short run, subdued investments in multiple commodities and rising carbon prices means that we could be facing a protracted transition period during which energy bills will increase.

There is no escape from the fact that if we try to avoid the costs of action, inaction will come with much greater costs, human as well as financial. Obviously, a disorderly climate transition pathway would create even more upward pressure on prices and commodity demand.

Fighting climate change and protecting living standards are both essential and prioritising one appears to set back the other. As such, it is becoming clear that it’s not only the supply that needs to be decarbonized - consumption habits also need to change.

As commented by Isabel Schabel, “while in the past energy prices often fell as quickly as they rose, the need to step up the fight against climate change may imply that fossil fuel prices will now not only have to stay elevated but even have to keep rising if we are to meet the goals of the Paris climate agreement.”

As consumers, with too much demand chasing too little supply of commodities, there is always the option to make smarter decisions centred around efficiency and sufficiency.

As investors, carbon has a price and it’s time for our financial and economic frameworks to integrate physical constraints into our traditional accounting system. As bankers, we have been spending most of our time calculating the present value of future cash flows. It’s high time that the present value of carbon emissions is also included in our spreadsheets. Inspired by the wisdom of crowd, if something costs more, people buy less of it.

But we should not forget that we are in desperate need of faster changes to prevent or to limit catastrophic and irreversible damage to our planet. And we should take it for granted, our journey will not be a comfortable one, though it is unquestionably necessary.

References

- Inside the 8.1% YoY growth of the EU harmonised Index of consumer price in May, energy has, by far, the highest annual rate (+39.2%), followed by food, alcohol and tobacco (+7.5%).

- International Energy Agency – The role of critical minerals in clean energy transitions

Sources

- IEA – The role of critical minerals in clean energy transitions

- E&E news – “Greenflation”: could climate action overheat the economy ?

- Societe Generale - Greenflation: the costs of the energy transition start to hit home

- Natixis – Greenflation, the new normal?

- Candriam – Greenflation, a fair cost or an obstacle?

- ECB : A new age of energy inflation: climateflation, fossilflation and greenflation. Speech by Isabel Schnabel

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...