Choose Language

January 23, 2019

NewsInterim Asset Allocation Committee – January 22nd 2019

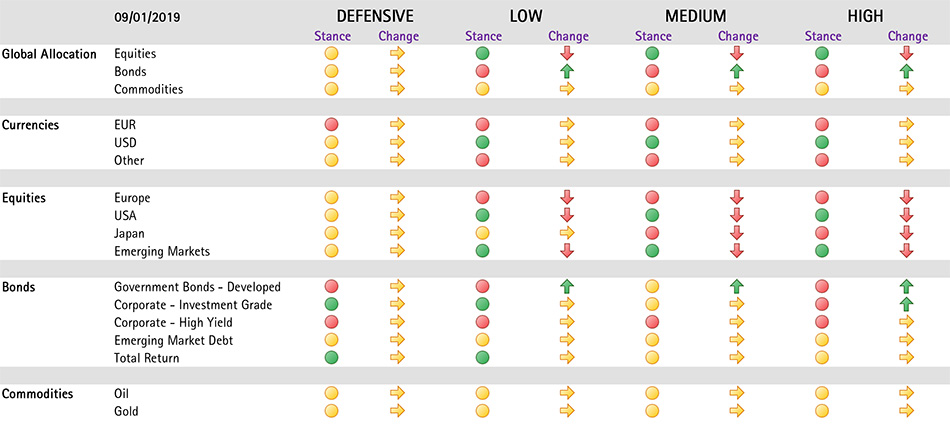

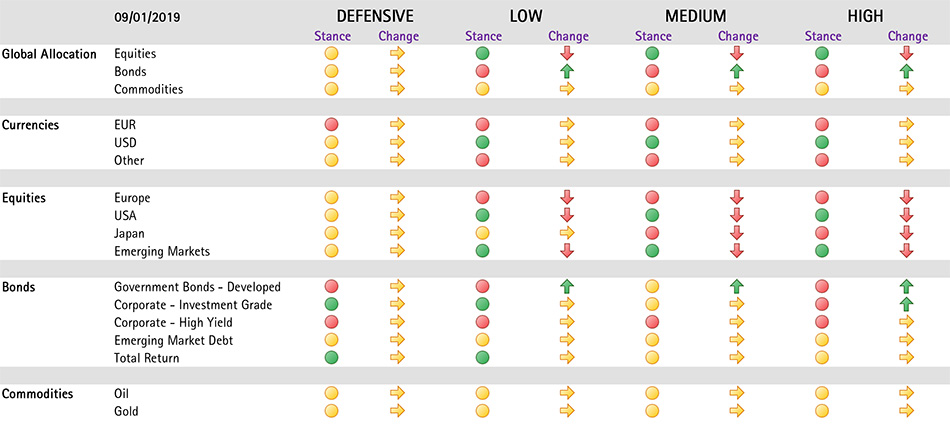

The Investment Committee met today to assess our positioning in light of current market dynamics.

We find ourselves in a benign market context, with positive sentiment having made a come-back. In January, investors have demonstrated a renewed appetite for risk and are once again seeing the glass as half full. As a result, equities have made a firm recovery - since the S&P 500’s nadir on Christmas Eve, it has clocked four consecutive weeks of gains, led by Financials, Technology and Industrials.

Now that we are out of the trough, we take this as an opportune moment to rebalance the risk across our portfolios and lock-in part of the profits realized on the equity exposure since December’s lows. To do so, we will reduce our equity overweight in each risk profile – but we remain positive (i.e. overweight) on equities since our fundamental view is unchanged.

We keep the cash in high quality liquid bonds, because we did not want to engage it in another type of risk in the midst of the earnings season, and we wish to be able to deploy it again rapidly should the circumstances justify. But of course, we stand ready as well to cut risk further if we see a clear deterioration in fundamentals, making our equity overweight irrelevant.

Strategic Asset Allocation

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...