Choose Language

August 29, 2022

NewsMarket sentiment turns after hawkish Jackson Hole speech

- Federal Reserve Chair warns that monetary policy will probably have to remain tight for quite some time as the US central bank acts to control 4-decade high inflation

- The speech pushed back on hopes for a dovish pivot while delivering a cautionary note about the risks of inflation becoming entrenched

- “Reducing inflation is likely to require a sustained period of below-trend growth, some softening of labour market conditions and some pain to households and businesses

On Friday at the annual central banking forum in Jackson Hole, Wyoming, Federal Reserve Chair Jerome Powell delivered a highly-anticipated speech on US monetary policy.

A year ago at the same event, Powell posited that inflation pressures would only be “transitory”, largely driven by supply-side forces. This did not prove to be the case and soon the Fed had the most acute inflation problem in forty years on its hands, forcing aggressive action to try and force it back down towards its 2% target. In just four months, it has raised the benchmark policy rate from near-zero to a target range of 2.25-2.50% and more hikes are expected.

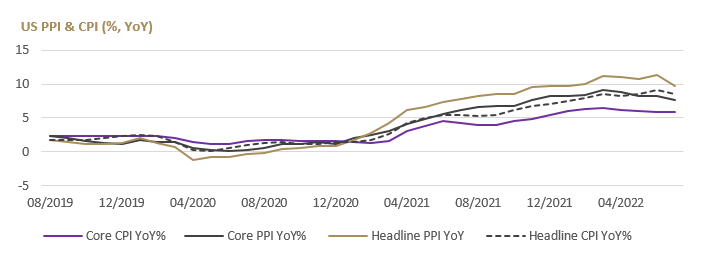

While both the producer price index (PPI) and the consumer price index (CPI) have edged downwards, owing largely to a fall in US energy costs, the Fed cannot yet declare victory over inflation which is still well-above target. Nonetheless, with inflation seemingly peaking and signs that economic data is softening, some market participants had expected that the Fed would soon adopt a more dovish stance and rate cuts were priced in for 2023. Powell pushed back on this idea saying that the Fed “must keep at it until the job is done” and that policy will have to be restrictive for “some time”.

Source: Bloomberg, BIL

He added that history cautions strongly against prematurely loosening policy, warning that “the longer the current bout of high inflation continues, the greater the chance that expectations of higher inflation will become entrenched.” The bad news for markets was the suggestion that the Fed is willing to forgo growth to control prices, with Powell commenting that while “higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses,” but that “a failure to restore price stability would mean far greater pain.”

Recently, President of the St Louis Fed, James Bullard, said he supported the Fed funds rate reaching 3.75-4% by the end of the year, noting that inflation could be more persistent than many on Wall Street expect.

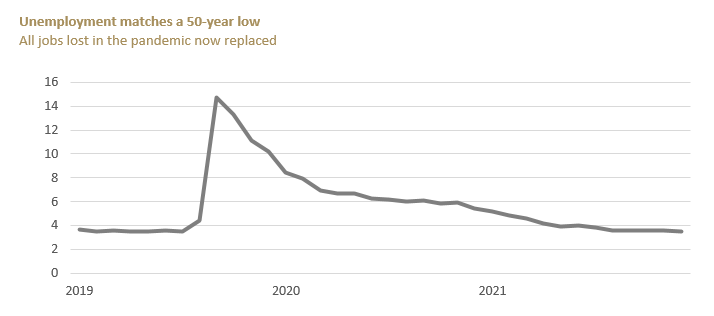

Source: Bloomberg, BIL

For now, labour market strength pushes back on notions of recession, with 528k jobs added in July and an unemployment rate of just 3.5%, matching a 50-year low. July also saw 10.9 million job openings (not much less than the record figure recorded in March of 11.9m) and companies continue to note shortages of workers (49% of small business owners reported job openings they could not fill in July, according the NFIB survey). However, as the Fed proceeds with its tightening campaign we could see dynamics soften and already, hairline cracks are beginning to appear; the ISM employment indices have fallen into contractionary territory while various household names such as Microsoft, Google and Netflix have announced plans to reduce staff or hiring freezes.

Market Implications

Throughout 2022, market sentiment has been driven by two competing narratives: One focused on durably higher inflation and rising rates, and the other on the growing risk of recession, ultimately compelling central banks to become more dovish. During the summer, the latter was dominant, benefitting equity markets and capping the rise in yields. Powell’s speech has once again swung the pendulum back towards a mood of “higher for longer” and the market has started to reverse bets that we will see rate cuts in 2023.

Following the speech, US stocks suffered their worst day in two months, with only five S&P 500 companies closing in the green. So long as markets are gripped by this mood, it will be difficult for equities to rebound.

Investor attention will now focus on incoming data on the labour market and inflation in order to gauge whether we can expect a third consecutive 75bp hike at the September 21 FOMC meeting, or a smaller one of 50bp.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...