Choose Language

June 30, 2017

NewsPortugal: Out of the red and into the green?

Until recently, Portugal was commonly viewed as one of the weak links in the EU – a peripheral nation more likely to hamper economic progress, rather contribute to it. The country’s ‘Great Recession’ from 2010-14 left it unable to refinance its government debt without the assistance of the IMF and the EU who provided a bailout of €79 billion (Bn) to keep the economy afloat. However, six years down the line, though there are challenges ahead, the nation’s prospects are firming.

In the first quarter of 2017, Portugal’s gross domestic product (GDP) expanded at an annual rate of 2.8% - twice as fast as the eurozone average. This was fuelled by recovering investment and increased exports (which hit an all-time high of €5.26Bn in March). The Portuguese tourism industry is booming, as is the real estate market.

But the success story goes further... Portugal has emerged from the ECB’s mechanism for fiscal discipline after reducing its budget deficit to 2.1% of GDP; comfortably below the EU’s 3% threshold. This was a big success for the Socialist Prime Minister António Costa - the deficit was 7.2% in 2015 when he came to power.

Between 2011 and 2014, 485,000 Portuguese workers (roughly 9% of the labour force) left the country. To address the country’s ‘demographic time-bomb’ and dilute the effects of emigration on the future labour force, the parliament is debating changes to Nationality Laws to grant all children born in Portugal the right to jus soli (citizenship). Portugal needs 75,000 new adult immigrants per year, while trying to stop the departure of working age Portuguese, especially the young.

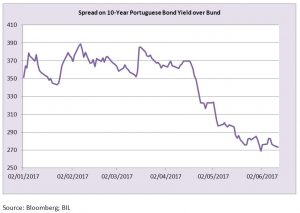

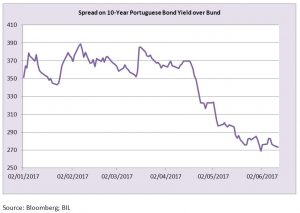

In light of recent successes and fading political risk across Europe, Portugal’s bond yields are falling. The spread on 10-year Portuguese Government bonds over the German Bund has narrowed to just above 270 basis points (bp). Our analysts believe a 200bp spread would be adequate, demonstrating a return to pre-2011 levels.

At present, only one small Canadian agency, DBRS, rates Portuguese Government bonds as ‘investment grade’. The best case scenario would be if Portugal’s credit rating was upgraded from ‘junk’ status by other agencies in Autumn at the next set of reviews, which should lower yields further.

However, ratings agencies may be reluctant as the Government debt to GDP ratio is 130% - the second highest in the eurozone after Greece. Moody’s believes this will start declining to reach 125% of GDP in 2020. Portugal is demonstrating progress and recently requested permission from the EU to re-pay an extra €10Bn which it owes to the IMF in advance.

Nonetheless, there are also concerns around weaknesses in Portugal’s banking sector which saw profits fall 7% in 2016, with non-performing loans (NPL) comprising 1.6% of banks’ total assets.

For now, we believe that Portugal’s progress galvanises the case for European equities in general, demonstrating a more broad-based recovery across the region, and further diminishing the risk of a fallout within the EU. There are several key events this year which will be instrumental in determining whether the country’s recovery can persist and give investors the green light to invest directly in Portugal; the Novo Banco/ Lone Star deal being finalised before the deadline, and for rating agencies to upgrade Portugal’s sovereign rating. The main agencies will now assess whether enough has been done to strengthen the banking sector and whether a falling debt trajectory (slowly though it may be) builds a convincing case for Portugal to wear its coveted investment grade hologram once more.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...