Choose Language

August 6, 2018

NewsQ2 earnings underline the strength of corporate America

Originally published I the Luxemburger Wort on 4/8/18.

Next week, earnings will continue to be a focal point for investors. At the time of print, over 60% of companies in the S&P 500 had reported their earnings results for the second quarter (Q2) of 2018. So far, this earnings season has been testament to the health of corporate America as Republican tax cuts continue to stoke the economy.

To date, the aggregate earnings growth for the S&P 500 is just shy of 25% with a +5.25% surprise (relative to analyst estimates). If this is the final growth rate, this will mark the second highest pace of growth since Q3 2010 (34.1%). Sales growth is sitting around 10% with a surprise of +1.2%.

In terms of sectors, Energy is the star of the show with earnings growth greater than 100% and sales growth above 20%. Success has derived from a +40% increase in the oil price - according to FactSet, the average price of oil in Q2 2018 was $67.91 vis-à-vis $48.15 in Q2 2017.

Contrary to what may be assumed given some of the headlines that big tech names have elicited as of late, the IT sector has also delivered robust Q2 results with aggregate earnings growth of over 40% and sales growth of around 17%. Some high profile stocks have, however, suffered nosediving share prices as investors became unnerved by company guidance that envisaged tighter margins moving forward.

Another thing which has become apparent during this earnings season is that corporate America, on the whole, has not yet felt significant pain from the US’ ongoing trade spat with various trading partners. FactSet scanned company earnings calls for any mention of the word ‘tariffs’. 70 companies discussed tariffs on their calls, but the majority of these (61%) saw little to no impact on their earnings in Q2 or anticipated little to no impact in future quarters from tariffs. The Industrials sector has witnessed the highest number of companies discussing “tariffs” on earnings calls.

From the onset we have resisted any urge to react to headlines and rather, we have stayed fixated upon hard data and fundamentals, managing risk based on known information rather than on threats (which at times did not materialise) and assumptions. This has proven to be beneficial for our portfolios.

Looking ahead

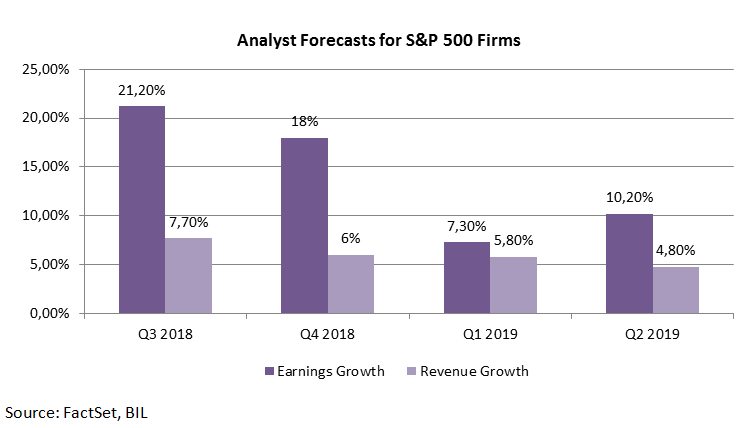

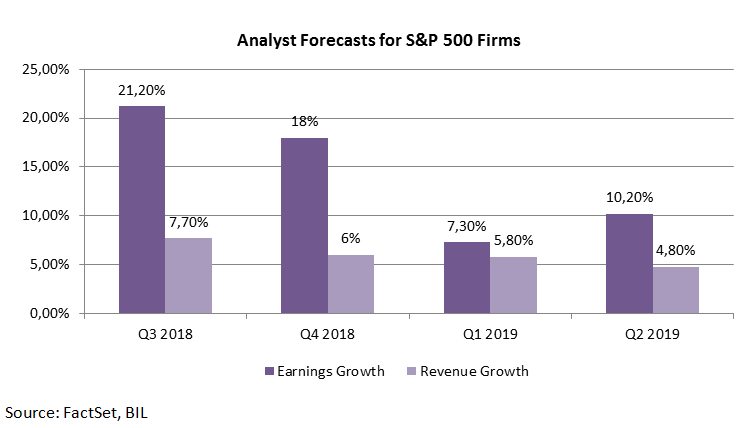

Analysts project that earnings growth will continue at a pace of around 20% through the remainder 2018, before slowing in the first half of 2019.

If their predictions are accurate, 2018 is poised to be a fine vintage in terms of earnings. Our portfolios are quite heavily skewed towards US equities at the moment in order to benefit from the burgeoning US economy and strong earnings whilst they persist. Not only are earnings themselves key, but also how the market reacts to them. Fortunately for our tactical bets, FactSet finds that the market is rewarding positive earnings surprises more than average and punishing negative earnings surprises less than average at the moment.

However, this is not to say that equity investors will have a smooth ride over the coming weeks. It’s prudent to note that the month of August has historically been choppy month in markets. Further still, in years when US midterm elections are scheduled for September (as they are this year) the S&P 500 has been 34% percent more volatile in the August. Albeit, our base case is for further upside in equities this year, though some setbacks can be expected along the way.

Data source: FactSet, Bloomberg

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...