Choose Language

February 15, 2021

NewsReopening, recovery, reflation and rates

The strong “reopening and recovery” narrative has lathered up a reflation trade on markets. While setbacks could present themselves along the way, the vaccine rollout, expectations around a new fiscal stimulus package and continued monetary support have investors looking beyond the current reality towards a bright, post-pandemic future and a return to a positive growth environment. However, with growth back on the menu, the accompagnement could well be higher inflation (something we have grown unaccustomed to in recent years). As we wrote in our 2021 Outlook, inflation is the most important long-term issue facing investors. Recent developments could mean that portfolio adjustments become increasingly necessary.

Across the dashboard, all indicators point to reflation: The dollar has lost muscle, while commodities (which have been out of vogue for the best part of a decade) have risen in unison. Their ascent is fuelled by expectations about an economic reopening, fiscal measures which will see billions of euros, dollars and yuan funnelled into infrastructure projects (especially around the energy transition), and demand from China - the world’s biggest buyer of natural resources. Copper, for example, a key component in electric wiring, has risen around 40% year-to-date. Even oil – the beleaguered commodity that saw its price temporarily turn negative last year - has risen back towards pre-corona levels. Equities (based on the MSCI World) have scaled new all-time highs, yields have set off on a northbound journey (the US 10-year Treasury yield has moved up towards the 1.2% level, while the 30-year yield brushed the 2% mark for the first time since February 2020) and market-based inflation expectations all point to an economic upswing.

The key question is whether inflation will actually follow and to what extent. As the Ketchup Theory cautions, inflation can appear stuck for while until suddenly, it all comes out at once.

In Europe, it seems the ECB will have a harder task in coaxing inflation upwards, but in the US, the Fed (who has said it will tolerate a temporary overshoot above its 2% target as it strives to pull the labour market out of its convalescence) may indeed have some tomato sauce on its hands in the coming years.

While adding a disclaimer that inflation is notoriously difficult to predict – even for central banks – it is notable that certain stars are aligning for higher inflation in the US.

Firstly, inflation expectations are rising - the 10-year break-even rate in the US has reached 2.20%, its highest level in 5 years. Rising expectations alone can kickstart a self-fulfilling prophecy whereby expectations of higher inflation provoke behaviours that actually push up inflation.

Secondly, we are living in an era of unprecedented monetary support. In the US, the Fed and Treasury have injected massive amounts of liquidity into the system (visible in the M2 money supply); the Fed is buying at least $120 billion worth of bonds per month and its balance sheet has swollen to a staggering $7.5 trillion. Though the correlation between sharp rises in money supply and future inflation appears to have broken down since 2008 (because of the decline in money velocity), “this time is different” theories are gaining credibility. With the Fed holding rates on the floor, real rates are deeply negative. In turn, negative real rates are a blessing for most assets and the economy.

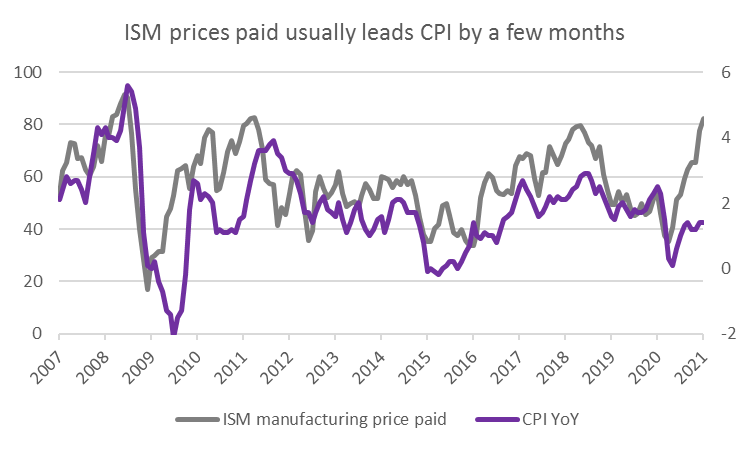

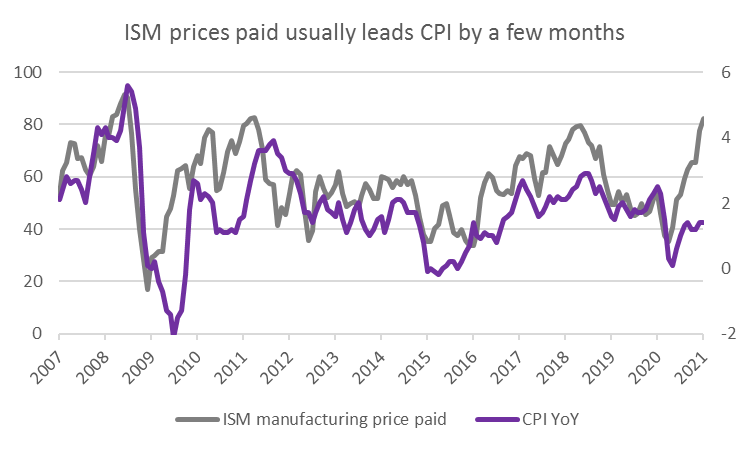

Thirdly, recent data from the survey of purchasing managers at manufacturing firms confirms that prices paid in the production process are rising. This is a leading inflation indicator because producers will most likely pass along the price increases to consumers.

Source: Bloomberg, BIL

Moreover, there will naturally be higher inflation in the next months due to base effects. Just remember that oil price quoted below zero in April 2020. Everything above this will mechanically drive higher energy costs for the world economy.

Lastly, the supply shock that was catalysed by the pandemic has not fully reversed. Due to a shortage of containers, shipping costs are elevated, and we are seeing a shortage in the supply of certain goods – for example, semi-conductors (so acute that US factory activity has drawn to a halt in some sectors). As people replace services (which they cannot currently consume as normal) with the purchase of physical goods, demand is ticking up, while supply is still reduced. Further, some expect that when services can operate again, the resurgence in demand could compel establishments such as restaurants, airlines and hotels to hike prices. Reduced competition (given that certain names did not weather the storm) gives them additional leeway to do so while households could be poised to pay and in position to afford. US savings rates shot up during the crisis and government stimulus checks left many Americans better off financially than they were before Corona struck.

Ultimately, reflation is a reasonable expectation in the US, but this does not necessarily mean we have to position for a 1970s-style inflationary spike. Despite all the reasons for higher consumer prices over the next couple of years, a scenario of persistently higher inflation is not a foregone conclusion. Inflation has been much lower and more stable since the mid-1990s than in earlier times. Identified deflationary forces in recent years, like the “Amazon effect” and demographics are still at play, what is clearly changing now is the “sticky effect” with inflation expectations starting to oscillate towards the awakening of "sleeping beauty". It is also worth noting that the path of inflation will largely be determined by labour market dynamics. If the economy sees rapid jobs growth and wages start to rise (Biden has mentioned a $15 minimum wage), this is when inflation could indeed become too hot to handle. But for now, there are still 10 million less Americans in the work force.

The risk of runaway inflation appears small, but we expect inflation to move (modestly) higher as the economic recovery gains traction. Because inflation erodes the future value of bond coupons, faster price rises make these investments less attractive. For some time, we have anticipated an uptick in US rates, compelling us to cut our Treasury exposure by half mid-December, and to reduce duration. We kept a thin layer for the purpose of diversification, but now, as the reopening and recovery narrative takes hold, the case is less compelling.

At a recent ad hoc Asset Allocation committee, we decided to close all positions in US Treasuries (with the exception of TIPS), switching instead to European government bonds. Already, the yield differential between the US and Europe is increasing and this trend has the potential to continue. We do not believe that European rates will be immune to rising US rates, but we do not think that they will move to the same extent.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...