Choose Language

June 16, 2022

NewsThe Fed’s first 75bp hike since 1994

- The Fed hiked the federal funds rate by 75bps to the 1.5% to 1.75% range – the largest single increase since 1994 - and announced a continuation of its balance sheet runoff

- Powell: “either a 50 or 75 basis point increase seems most likely at our next meeting", leaving the door open for another 75-basis-point rate hike

- Newly released quarterly economic projections showed a median projection of personal consumption expenditures (PCE) inflation is 5.2% in the fourth quarter of this year, up from 4.3% in March projection. Median projection of PCE inflation falls to 2.6% by 2023, and to 2.2% by 2024.

- Fed officials' median projection of GDP growth in the fourth quarter of 2022 is 1.7%, lower than the 2.8% projected in March.

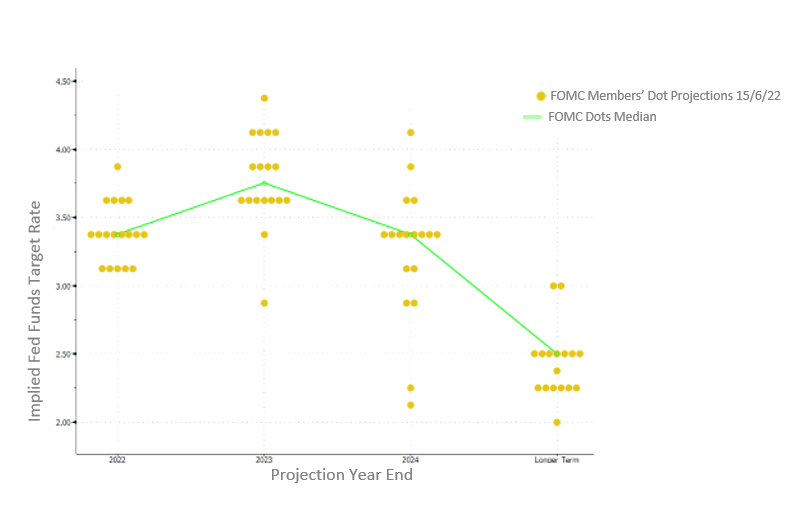

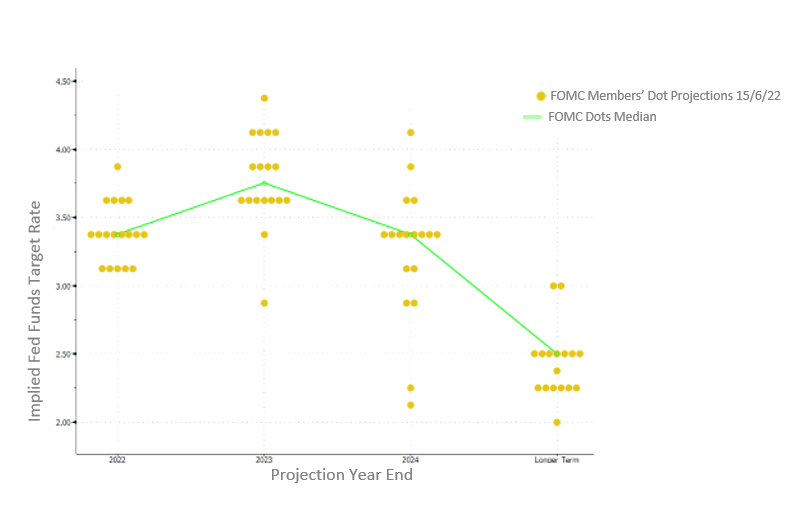

- Dot plot (chart below): the median FOMC projection for federal funds rate at the end of this year is now 3.4%, much higher than the 1.9% projected in March. Median projection for 2023 year-end federal funds rate is 3.8%.

Two weeks ago, almost no one was expecting a hike of 0.75%. But the inflation numbers (8.6% yoy) reported last Friday sent shudders through markets, with inflation at the consumer level unexpectedly accelerating last month. It dashed hopes on Wall Street that inflation may have already peaked, and the data seemingly compelled the Federal Reserve to adopt a more aggressive stance. The Fed has been criticized for moving too slowly to rein in inflation. Other central banks around the world are also raising interest rates, adding to the pressure.

Following the announcement, stocks climbed - halting a five-day rout - and Treasury yields went lower. Powell’s press conference came across much less hawkish than the initial message from the 75 basis-point increase and upgraded rate projections for 2023. A “flexible hawkish FED” came across as what markets were hoping for.

Still, the move on Wednesday was more hawkish than the 50-basis-point shift previously signaled by the Chair but markets were expecting a 75bps hike so the Fed could proceed without sending shockwaves through the market. In 1994, following the 75bp hike, the Fed managed to avoid a recession. Can the Fed achieve the same kind of soft landing in 2022? The difference this time is that the Fed is further behind the curve. Back then, the Fed was tightening ahead of inflation.

Powell will testify before Congress over two days next week, where he can expect to be challenged over his central bank’s performance.

The Fed’s Dot Plot

Source: Bloomberg, BIL

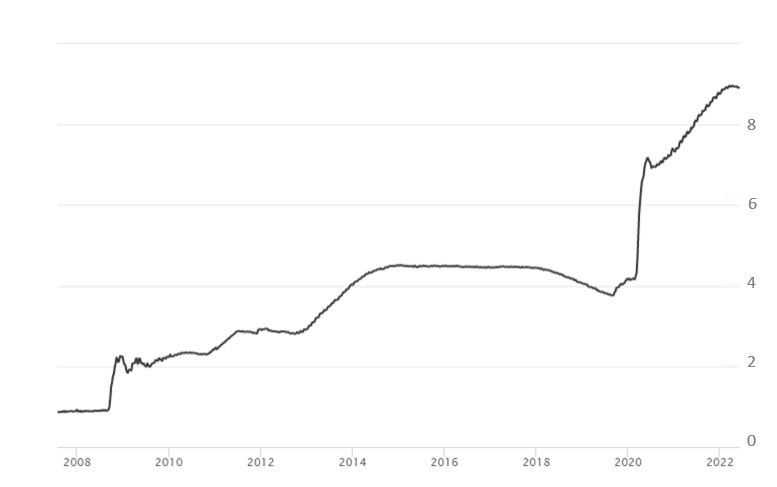

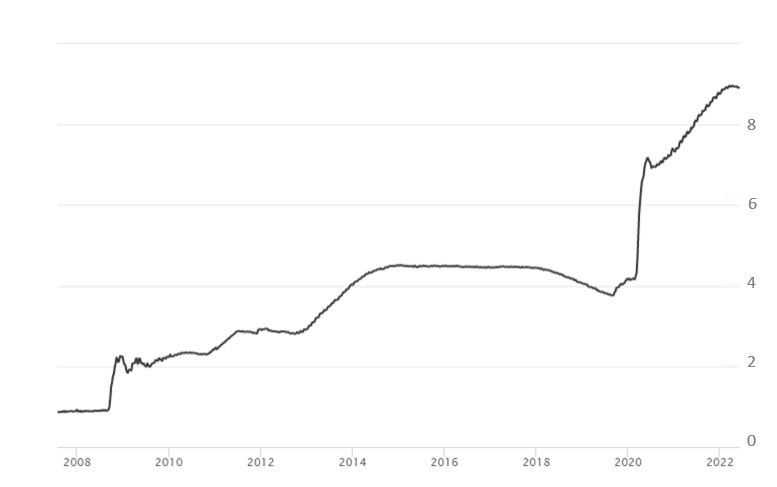

The task of shrinking the Federal Reserve’s $9tn balance sheet has also begun. The Fed will cap the run-off at an initial pace of $30bn a month for Treasuries and $17.5bn for agency mortgage-backed securities, before ramping up over three months to a maximum pace of $60bn and $35bn, respectively, amounting to as much as $95bn per month. While quantitative tightening has been well communicated, investors are not clear what the impact will be of a process that has never been attempted at such scale before.

The Fed’s Balance Sheet ($ trillions)

Source: Fed, BIL

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...