Choose Language

February 22, 2019

NewsThe Fed’s January Minutes: Patience and Pragmatism

Late on Wednesday evening, the Federal Reserve (Fed) published the minutes from its January meeting. The text affirmed the central bank’s new "patient" approach to policy due to "various [downside] risks and uncertainties in the outlook." In the aftermath of the government shutdown, faced with muted inflation and uncertainties with regards to the government budget, members decided that holding the federal funds rate steady "posed few risks at this point." Previously, officials have worried that keeping rates low for too long would allow inflation and the economy to overheat. Patience was advocated in nine separate instances in the document, with the Fed emphasising its need for a clearer picture on developments related to international trade and economic conditions. However, the minutes did also remind observers that interest rate hikes could resume if the US economy remains on track.

With recent economic data being mixed at best, markets are ruling out the prospect of a further rate hike this year. However, over the longer term, we still believe in the strength of the US economy and our fixed income team’s view is that a rate hike in the second half of the year is not completely off the table.

Perhaps the most important message was concerned the normalisation of the Fed’s balance sheet. Market participants had high expectations, given the tone struck recently by Fed Members (e.g. Governor Lael Brainard’s interview with CNBC and earlier press releases mentioning “extensive deliberations”) that it would switch out of ‘auto-pilot’ mode with regards to quantitative tightening (QT). Policymakers seemed to favour leaving their balance sheet permanently bigger than is was in the past, but also seemed eager to announce normalisation end date rapidly and formerly.

"Almost all participants thought that it would be desirable to announce before too long a plan to stop reducing the Federal Reserve's asset holdings later this year. Such an announcement would provide more certainty about the process for completing the normalization of the size of the Federal Reserve's balance sheet."

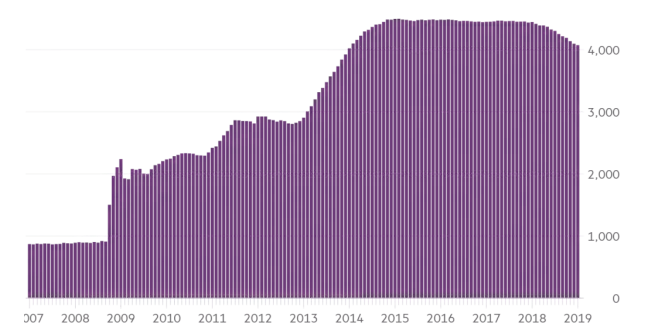

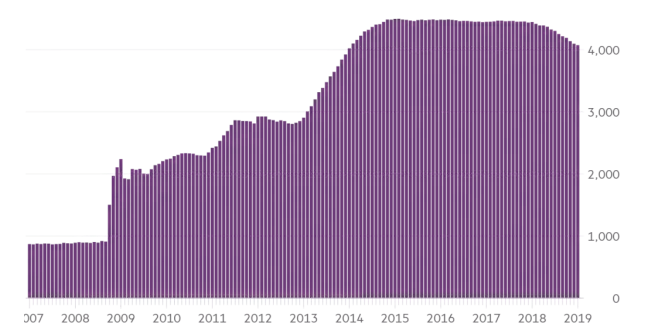

Under quantitative easing, the Fed’s balance sheet rose from $900bn in 2008 to $4.3tn by the end of 2014. It remained around this level until 2018 when the Fed embarked on quantitative tightening. Today, the Fed currently holds around $4 trillion in bonds. Following the Fed’s actions, our opinion is still that US rates should go higher from current levels but the risk of them going too high too fast has decreased.

Federal Reserve Balance Sheet

Total assets ($bn)

Source: FT, BIL

The minutes revealed extensive discussion about market conditions, particularly with regard to the impact that Fed actions have on the prices of risky assets such equities and corporate bonds. This can be taken as further evidence of the Fed’s pragmatism. A more dovish Fed bodes well for emerging markets, should reduce anxiety about tighter global liquidity, and should act as a support for equities.

Following the release, the market reaction was somewhat more muddled than usual with the S&P 500 closing 0.2% higher. A snowstorm in Washington prevented the usual proceedings whereby the Fed allows accredited press representatives to access the minutes ahead of the public release time, giving journalists time to prepare articles. This time, the Fed simply posted the minutes on his website and investors were initially left to their own devices to analyse the text.

For more on how the Fed’s and other central banks’ newfound dovishness affects our investment strategy, see our latest BILBoard ‘Central Banks change their tune’.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...