Choose Language

July 18, 2019

FocusThe Future of the European Automotive Industry

The Future of the European Automotive Industry

Trends, challenges, risks and opportunities from an equity market perspective

Interview with Lars Mogeltoft and Arman Arshakyan

One of our key strengths lies in the fact that our

investment department is comprised of experts from various backgrounds and

disciplines, allowing us to pool their knowledge to build a robust,

well-rounded investment strategy. In our

focus series, we will hone in on these teams, harnessing their expertise in

order to present their angle on different market themes and trending topics.

In our first extensive interview, we spoke to Lars

Mogeltoft, Head of Equity, and Arman Arshakyan, Equity Associate, in order to

gauge what is happening inside of the European car industry. The content of the

interview will be rolled out in three parts.

The first sets the scene, detailing the current state of the industry, the key trends shaping the landscape. It also outlines the vital role that this sector plays within the European economy. The second part delves deeper into the challenges faced by automakers. The third will give a more market-based view, discussing margins, profitability and future prospects.

Part 1: Growth in the European Car Industry – Neither fast, nor furious

Context: Why is the automobile sector key for European industry and more broadly the European economy?

Europe is the cradle of the car

industry. When the first automobile was invented in Europe around 130 years ago,

very few understood the broader implications. As Germany’s last Kaiser Wilhelm

II infamously said, ‘The automobile is only a temporary phenomenon. I believe

in the horse’.

Since then, a lot of things have

changed. Europe’s automotive industry has grown and flourished to become an

essential part of our continent’s industrial fabric. It is inextricably linked

to other sectors, exerting an important multiplier effect in the economy,

directly influencing upstream industries such as steel, chemicals, and

textiles, as well as downstream industries such as Information &

Communication technology, repair, and mobility services.

According

to the European Automobile Manufacturers Association (ACEA), the sector (1):

- represents nearly 7% of EU GDP

- indirectly employs (incl. auto manufacturing,

services and construction) 13.3 million people (6.1% of the EU workforce) - directly employs 3.4 million people (11% of EU

manufacturing employment) - is the largest private investor in R&D within

Europe (almost €54Bn annually) - was granted over 8700 patents in 2017 alone.

In

terms of production, Europe churned out 23% of the 99 million motor vehicles

produced globally in 2017. This puts the continent in second place after Greater

China (30%), but well ahead of North America (18%).

The

European auto industry delivers a €90.3 billion trade surplus for the continent

with the main destination for European cars being North America, which represents

22.5% of total sales volumes, and 32.1% of market share value.

In

2017 alone, the EU exported more than 5.3 million passenger cars globally (5.9

million motor vehicles). While the value of those exports has been growing

mostly continuously, volumes are on a clear downtrend.

To

sum-up, the automobile industry is a key ingredient for European growth, but domestic markets are highly mature (in

Germany 85% of households own at least one car). On top of this, the market

share of European manufacturers is shrinking with Chinese firms looking poised to

edge in on the territory. In a 2019 industry survey by KPMG, two-thirds of

respondents said they expect the Western European share of production to drop

to 5% by 2030, on a global scale (2).

How would you summarize the current state of demand for vehicles?

Last year global car sales declined for the first time since

2009. Though small, the decrease may represent the first cracks in the

macro-backdrop, given that the auto industry is such an important catalyst for

global economic activity.

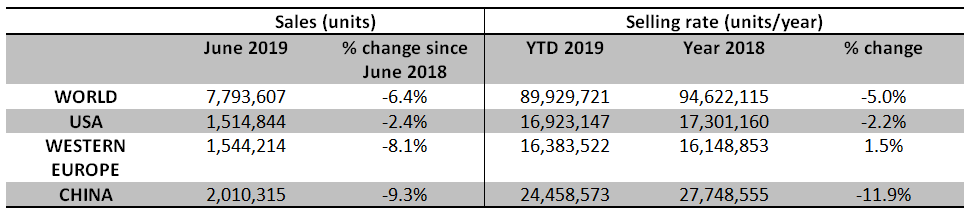

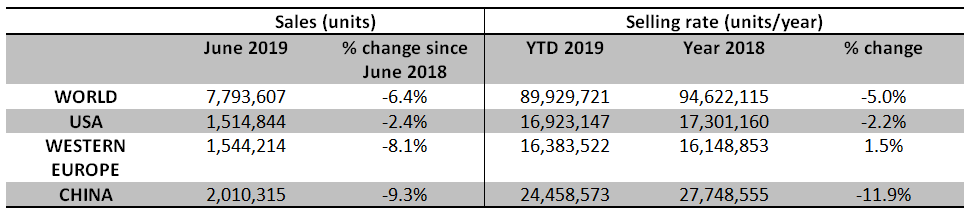

In terms

of sales, light vehicle registration was estimated at around 94.6 million units

in 2018 worldwide. China was in the lead

with around 28 million

registrations, followed by the USA with around 17 million and then Western

Europe with around 16 million.

The

factors which weighed on sales last year still linger, and only last week was

it announced that European car sales in June had declined by a substantial

7.8%.

What are the key trends inside of the European automobile industry?

There

are significant differences between the automotive markets of the various

European countries, but all have faced similar developments in recent years. It

was only in 2015 that production went back above pre-financial crisis levels.

Registrations are, nevertheless, still below the peak observed in 2007.

Bigger is better?

By

market segment, 2017 was the year when SUVs achieved the same sales penetration

as small and medium cars inside the EU. It was also in 2017 that petrol fell

back into favour as the preferred fuel type, ahead of

diesel and other alternatives (electricity, hydrogen and so on…).

Rising C02 levels

According

to figures published by the European Environment Agency (EEA), average carbon

dioxide (CO2) emissions from new cars went up (by 0.4%) to 118.5g/km in 2017.

This is significant as it is the first annual rise in CO2 emissions since

records began in 2010. The ‘demonisation of diesel’ and the subsequent shift to

petrol anlongside the rising SUV count seem to be the key drivers behind this.

Clearly, If this trend continues and the adoption of alternative fueled

vehicles doesn’t accelerate, the industry will need to take more drastic

measures in order to comply with new legislation.

The rise of the gadgetmobile?

As

cars have become equipped with ever more features to make them safer, (supposedly)

cleaner and smarter, the complexity of vehicle production has increased. This

increase in complexity affects energy demand. Nevertheless, manufacturers have

been working continuously to improve the energy efficiency of production. As a

result, the energy consumption per car produced has decreased by 15.7% over the

last decade. (1)

As

an interesting side note, with 89 passenger car registrations per 1,000

inhabitants in 2017, Luxembourg stands out as the European Union champion, in

terms of the most registrations per person. The EU average was 30 new cars per

1,000 habitants. Luxembourg’s cars are also newer: the average age of

passengers cars in Luxembourg was 6.3 years vs. the EU average of 11 years.

This bird’s eye view of the European auto industry depicts an industry that is at best coasting in the slow lane. In the next piece we look at the various challenges faced by Europe’s automakers at a more granular level.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...