Choose Language

July 25, 2019

FocusThe Future of the European Automotive Industry: Part II

The Future of the European Automotive Industry

Trends, challenges, risks and opportunities from an equity market perspective

Interview with Lars Mogeltoft and Arman Arshakyan

In an extensive interview, we spoke to Lars Mogeltoft, Head of Equity, and Arman Arshakyan, Equity Associate, in order to gauge what is happening inside of the European car industry.

The first in the three part series set the scene, detailing the current state of the industry and the key trends shaping the landscape. It also outlined the vital role that this sector plays within the European economy. This second part delves deeper into the challenges faced by automakers.

Part II: Challenges for European Car Manufacturers

Incoming data has been ominous - is a perfect storm brewing inside Europe automobile industry? Should we fear a “carmaggedon” ?

The automobile industry is currently facing multiple

structural changes. Four major developments could catch automakers and

suppliers in a vice-grip:

- The shift toward electric vehicles (EV): This trend has not only been spurred on by challengers like Tesla and Chinese manufacturers, but also by increasing regulations on carbon dioxide emissions and increasing awareness of environmental issues. The EU and China are considering phasing out traditional fuel vehicles over the coming decades. According to the German Times (3),10 years from now 25% of cars sold will have an electric engine. Today, depending on the country, that share is in between 0% and a maximum of 2% (Norway being a notable exception with EV accounting for around 40% of market share). However, it’s getting reasonable to assume that EV sales growth will not reach the stratospheric levels expected 2-3 years ago, as the industry now faces its own host of obstacles.

- Technological revolution - trends from connectivity to autonomous vehicles (AV) are disrupting traditional business models. With cars being now able to park themselves, the next reality should be cars able to find open parking spaces before assuming the task of driving, not to mention the digitalization of the automotive sales industry. According to analysis by Accenture, modern cars collect around 25GB of data per hour from various inbuilt sensors and cameras. This data allows for real-time insights to be drawn about performance, speed, condition of components and much more. In the case of breakdown or an accident, for example, the data gives insights on cause and effect and contributes to our understanding of how similar events can be prevented in the future. However, we think it will be a long time before autonomous vehicles become a reality. At the moment, companies involved in developing AV don’t yet have enough data to develop algorithms. This will take time to accumulate and then more time to structure the data into a usable format. This is a process which cannot be rushed because accuracy is paramount, we have to consider that errors in the development of this technology could lead to fatalities. There is also the question of insurance and regulation. Who will ensure these vehicles? And can they go on the road before regulation catches up with the technology? We do not believe that autonomous beyond level 3, initially announced by manufacturers for 2020, will materialize for now. We should expect a delay to allow regulation to catch-up part of the gap with technology.

- The changing needs of consumers. A shift in values is taking place, especially amongst younger generations. Not only are driving licenses being acquired later in life, the emotional connection that younger generations have to cars is decreasing. The focus of mobility lies in the rational point of view of getting from A to B, rather than on the emotional decision of owning a car. According to Astute Solution, the number of cars purchased by people aged 18 to 34 fell almost 30% between 2007 and 2011, and since then the percentage of Millennials without cars continues to grow (4).A clear new mindset appears to be forming with regard to mobility needs and the perception of undue burdens and expenses that cars bring. Car ownership is becoming optional in the age of Uber and co. Though it was clearly biased, the Lyft IPO filing was intriguing, in that its founders claimed that car ownership is in permanent decline and they want to help it die. The cultural value shift is visible in the trend towards the car sharing model from short-term rental (Uber model) to peer-to-peer sharing (Blablacar or SnappCar), the on-demand model (Flexdrive) to an Airbnb-equivalent model (Turo). For car manufacturers the challenge is to be prepared on a B2B channel rather than a traditional B2C. On this topic, Tesla’s business model is another disruption as it sells its vehicles directly to buyers via its own website, as opposed to using dealerships. Spurned middlemen proclaim that this is a violation of US industry ‘norms’. According to Dr. Herbert Diess, the Chairman of VW board, German carmakers have a 50:50 chance of pioneering the mobility of the future given the immense structural changes that are in motion. Diess argued that this uncomfortable fact was based on realism, not pessimism.

Anecdotal but informative is the fact that The Economist

calculates that the average car is parked 95% of the time and therefore is only

in use for the remaining 5% (5). Eventually a company will find an efficient

way to exploit this inefficiency, but when that day will be, is impossible to

predict.

- Heavier European regulation

While car manufactures say regulatory uncertainty acted as a

drag on demand, controversies like the VW emissions scandal and the C. Ghosn

indictment also weighed on credibility. This demonstrates the of potential

added value that governance (or more broadly ESG) integration could deliver.

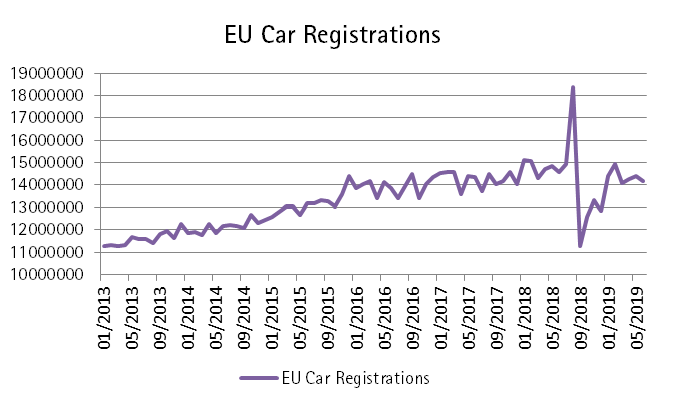

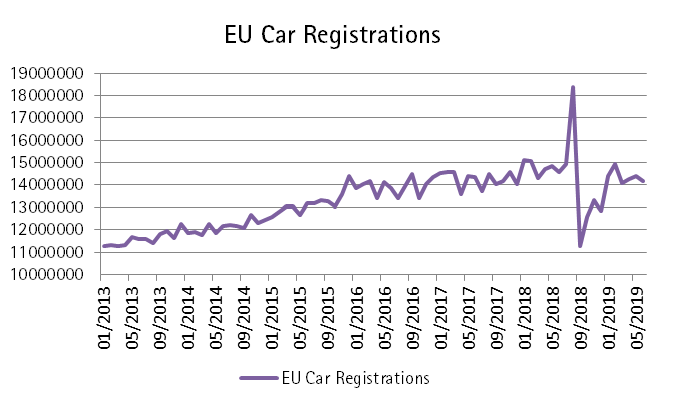

2018 was a key year for the roll-out of WLTP (Worldwide Harmonized

Light Vehicle Test), the new testing and approval cycle for motor vehicles

introduced in response to the 'dieselgate' scandal.

Vehicle manufacturers were discontinuing models that no longer meet the standards or because the investments were too high. There was also a sharp rise in vehicle sales just before the introduction of WLTP in September 2018, followed by an immediate drop afterwards.

In 2017, all but 3

car manufacturers (Lamborghini, Mazda and Société des Automobiles Alpine) met

their specific emission targets (130g CO2/km), based on European vehicle test

rules. While its fair to add that certain

other manufacturers, if considered individually, would have exceeded their

specific emission target, they met their obligations as members of pools or

thanks to derogations.

In 2021, the volume-weighted average CO2 emissions will be calculated by manufacturers with a maximum target level of 95g CO2/km.

Will electro mobility capture the road, after having captured the rails ?

In

its ‘BLUE Map scenario’, which has the goal of cutting greenhouse gas emissions

in half by 2050, the International Energy Agency (IEA) estimates that by 2050

nearly 80% of passenger cars being sold will be plug-in hybrid, electric or

fuel cell vehicles.

In

order for new ideas for electro mobility to have a chance, they must be

affordable for customers. Yet, electric vehicles are still more expensive than

conventional ones. However, experience shows that some users - the so-called

early adopters - are willing to pay higher prices initially, if the framework

conditions are right. We have to get away from the idea that a single type of

drive will dominate the entire market. Although the share of fossil fuels will

continue to decline, it is premature to say that diesel, for example, will

disappear entirely.

But the fact is that consumers are still holding back on

electric vehicles due to price, range and battery capacity concerns and

ultimately it is consumer preference that will dictate the growth of this

market. Furthermore, it’s worth considering that if environmental considerations

are driving the change for the electro-mobility, battery production (energy

intensity, e.g. CO2 generation + controversies on Cobalt extraction), weight (a

Renault Zoe battery weights 300kg (6)), standardization and recycling (or even

better resuscitated) are still open challenges.

Hydrogen-powered cars may be commonplace in the future. In 1999, Iceland announced its plan to become the first hydrogen-based economy over the next 40 years. Since then, disillusion is real in that the only material evidence today, is 3 hydrogen-powered buses on the street of Reykjavik. Hydrogen can still make a comeback, but it’s dependent on innovations to make it affordable and clean to produce (as of now, the electrolyze process to produce hydrogen uses either fossil fuels or electricity).

What about the shrinking Chinese market?

The immediate cause of the dip in global car sales last year was probably US tariffs on Chinese goods, hurting the Chinese economy, bringing sales

there to, at best, a standstill. LMC Automotive analysts are now predicting

that China’s vehicle sales will shrink by 5% this year after falling 3% in

2018. What’s going on? Can Chinese sales see a revival without stimulus?

2018 will be marked as the first year in almost three decades that

negative growth has been recorded in China’s auto industry. For the full year

2018, China sold 28 million cars, down nearly 3% from 2017. According to the

Chinese association of automobile manufacturers, the Chinese market saw a

pattern of rising premium car sales and a slump in sales at the lower-end of

the price spectrum, with Chinese brands losing market share.

There are three factors behind the decline in Chinese car sales:

- Buyers are hoping for government incentives - Analysts place roughly a 20% chance on the fact that Beijing will incentivize car ownership in 2020 (even after the April 2019 VAT cut from 16 to 13%), so consumers are waiting to see if this comes to fruition before buying.

- The trade war - Consumers are postponing big ticket purchases until the economic future is more certain.

- The accelerated introduction of China’s new emissions standards - State VI emission standards are already in effect in some parts of the country, ahead of the 2020 deadline. This is disrupting car sales in a similar fashion to the way new emissions standards disrupted European auto sales in 2018.

China now has more than 300 million registered vehicles – almost the same

number as people in the United States – on its increasingly jammed roads, even

though on a per capita basis, China’s car density is much lower than that of

the US. China, with 1.3 billion people, is quickly becoming a society on

wheels, providing a vast market for carmakers and cultivating a fan base for

movies like the Fast and Furious series (7). According to the latest

Traffic index, 10 of the 25 most congested cities in the world are in mainland

China.

According to KPMG China, the long multi-decade golden age of high automobile sales is ending, the next decade will be the one of transformation. What’s reassuring for foreign car makers selling cars in China is an alteration in tastes. Chinese consumers are exhibiting a preference to own foreign SUVs.

What about the trade war and tariffs?

The current paradox in the US trade war rhetoric is the fact that up to

now, the US administration’s concrete actions have been focused on China. From

a country perspective, the biggest part of the US trade deficit is indeed

mostly coming from China. But when looking at goods behind the deficit, auto

imports (primarily from Europe and Japan) are the main contributor.

As such car tariffs, are a serious likelihood, even if the US recently

announced a delay in decision to impose tariffs on imported European and

Japanese automobiles for at least six months.

And guess who’s the main region exporting Joe Sixpack’s preferred cars:

Europe.

Tariffs have the potential to shift the playing field for automakers. Consumers will get higher prices, companies lower earnings, and investors will face a bumpy road ahead. In the automotive industry, tariffs matter a lot because the supply chain is global. Parts are sourced from all around the globe and move across borders repeatedly. If the US was to apply tariffs universally, every major automaker would take a hit, including US companies that policy aims to support. This is visible in the numbers. European car companies such as VW that have more domestic operations have fared well this year (the stock is up about 14%). The hardest hit have been companies such as BMW and Daimler that produce in the US and then import the vehicles to China from there and which are now facing retaliatory tariffs from China (performance has been flat). This is the clear differentiating factor that has driven differences in earnings expectations and revisions.

Now that we have presented a breakdown of the challenges which the European auto industry faces, we will go on to explore whether there are still investment opportunities. The third part of our interview takes a look at the industry through the lens of an equity investor.

Sources

- https://www.acea.be/uploads/publications/ACEA_Pocket_Guide_2018-2019.pdf

- https://home.kpmg/be/en/home/insights/2019/01/the-future-of-the-automobile-industry.html

- http://www.german-times.com/the-automotive-industry-is-facing-major-challenges-around-the-world-german-carmakers-have-more-to-lose-than-most-and-are-thus-investing-a-great-deal-in-securing-its-future/

- https://www.astutesolutions.com/industry-insights/automotive-industry

- https://www.economist.com/leaders/2017/04/06/the-perilous-politics-of-parking

- https://www.candriam.lu/en/professional/market-insights/topics/sri/long-live-our-batteries/

- https://www.scmp.com/news/china/economy/article/2088876/chinas-more-300-million-vehicles-drive-pollution-congestion

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...