Choose Language

January 30, 2021

NewsThe K-Shaped Recovery

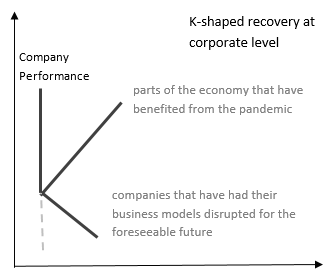

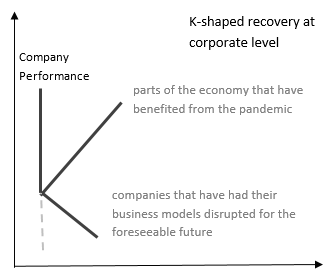

At her confirmation hearing as US Treasury Secretary, Janet Yellen discussed a K-shaped economy, one where existing wealth allows people to build more wealth, while others fall further and further behind. Ms. Yellen was referring to American households, but the same idea can be applied to the corporate world, where a K-shaped recovery is in motion.

The upward slope of the “K” represents the clear winners during the pandemic; big tech, delivery services and logistics firms, online retailing and entertainment names, AI and robo developers… The downward slope of the “K” symbolizes those businesses directly affected by Covid-19, such as hospitality and airlines. As long as preventative measures ensue, the service sector (which often constitutes face-to-face interaction), will continue to lag behind.

But even once the health crisis subsides, it is not a given that the two legs of the “K” will converge. Covid-19 has permanently altered the landscape and future success will largely depend on the extent to which a firm embraces the digital revolution and its ability to operate with agility.

When it comes to digitalisation, the genie is out the bottle. Digital-first business models were already on an upward trajectory when the pandemic hit and now, the structural shift towards a more digitalized society has been fast-forwarded. Trends such online shopping, teleworking and eLearning, will stick, even when “stay at home” orders are lifted.

Firms with a strong foothold in digitalisation will continue to have the odds twisted in their favour. This does not refer to high-flying tech names per se, in fact, almost every business today is (or should be striving to be) a tech business – this may entail robotic process automation, AI fed on big data that can anticipate future needs, or pursuing sales on unconventional channels such as Instagram shop... In recognizing this, even some of the most conservative industries had to break with the past, shifting themselves online last year. For example, the luxury watchmaker Patek Philippe finally allowed its distributors to sell over the internet and Geneva’s Watches & Wonders show was hosted online.

The dominance of digital model was highlighted recently with the announcement that pure online retailers plan to buy what were once flagship chains of the British high street: Topshop (alongside other brands in the Arcadia group) and Debenhams.

Traversing the upwards slope of the “K” will be difficult for firms who are unwilling to adapt to the new reality ushered in by the health crisis, while those who have already done so are well-poised for the incoming impetus the roll-out of 5G will give to the trend of digitalisation.

In order to ride the upwards slope of the “K” firms also have to be agile. This means using big data and analytics to identify opportunities in real time. A good example of this is the disruptive cab service -Uber. Amidst mass lockdowns, demand for taxis was naturally thin on the ground. However, the company quickly refocused on its Uber Eats food delivery business which of course was in high demand. Chameleon companies who can shift their strengths to meet the altered needs and demands of consumers also have a better chance of making it up the “K”.

In school, the letter “K” was called a “Kicking K” to differentiate it from its phonetic cousin – the “Curly C”. To avoid getting kicked by the “K”, companies must apply an agile, tech-led strategy. To identify the potential winners that are doing so, entails a highly selective investment process, whereby we look past sectors, down into each firms cogs to judge how it is poised on these parameters. Further, this does not automatically point to an IT overweight; every sector can reap the benefits of digitalisation.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...