Choose Language

November 13, 2023

NewsUS consumer sentiment slips amid Middle East tensions and inflation worries

The usual weekly newsletter had already “gone to print” last Friday before the release of the University of Michigan’s US consumer sentiment index, so a short update...

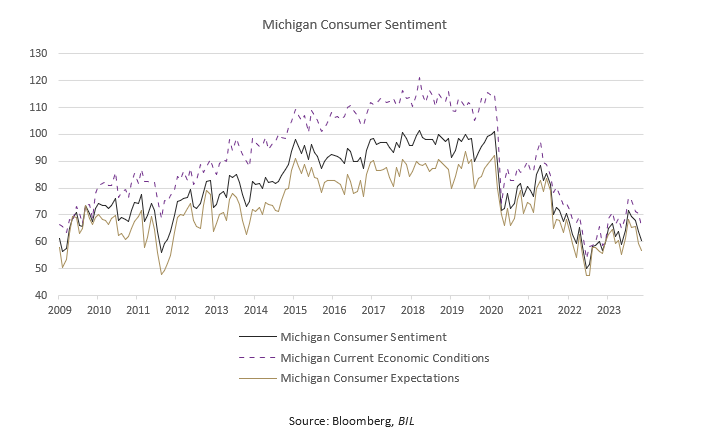

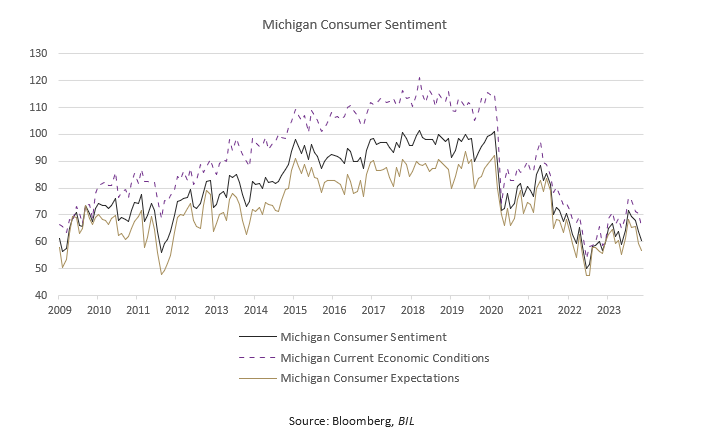

The Michigan Consumer Sentiment survey showed Americans becoming more pessimistic through November, with the headline (represented by the black line) falling to its lowest level in 6 months (60.4, versus estimates of 63.7). As illustrated below, it was dragged down by both perceptions of current economic conditions (65.7 from 70.6), and future expectations (56.9 from 59.3), with geopolitics and inflation playing on consumers’ minds.

However, the devil is in the details and there are two attention points worth highlighting:

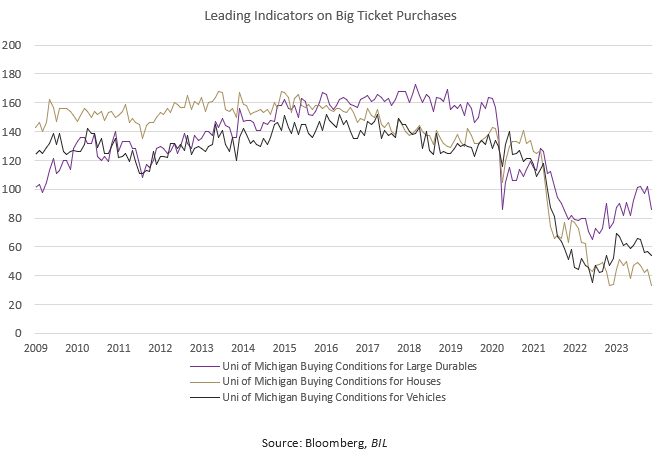

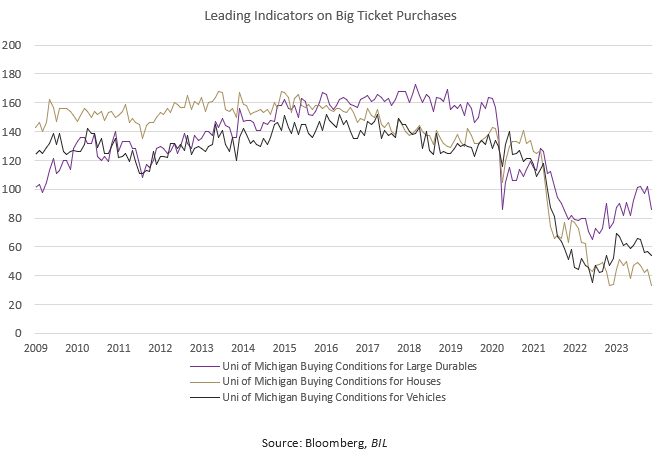

- A subindex showed the propensity to spend on large durable goods (purple line) declined amid higher borrowing costs and tighter lending conditions.

Until now, strong consumption has been the primary rebuttal against recession concerns. However, back in June of this year, Bloomberg Economics conducted a study of household consumption patterns during the recessions that began in 1969, 1973, 1980, 1990, 2001 and 2007. They found that broadly, consumption contains no signalling value for predicting recessions — rather, spending slows moderately only when a recession is already underway. Services spending (about 65% of the consumption basket) is often insensitive to recessions: In all six recessions studied, services spending grew robustly ahead of the recession and in half of the cases, continued to grow even during the recession.

Interestingly, the same study also found that one category had some signalling value – spending on durable goods (which accounts for about 12-13% of the consumption basket). In three of the recessions studied, real purchases of durable goods began to drop in the two or three quarters before recession.

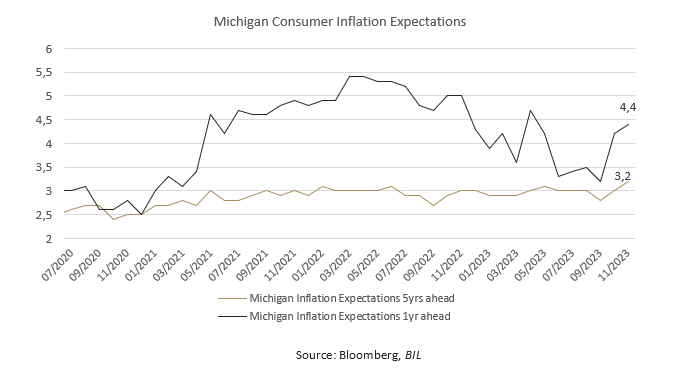

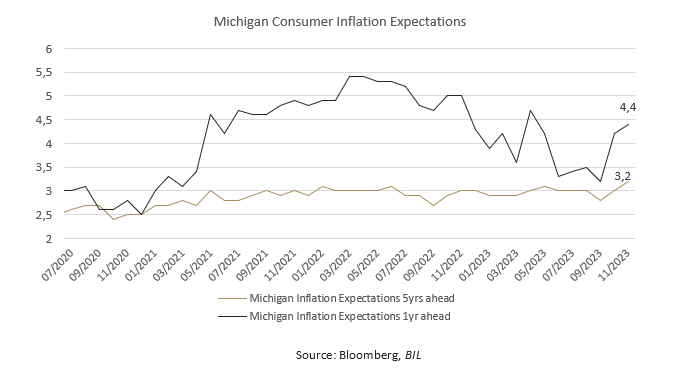

2. Inflation expectations came in above expectations, adding weight to the Fed’s recent communication that inflation has "a long way to go" to reach the Fed's long-term goal of 2%

- 1-year ahead inflation expectations rose to 4.4%, the highest level since April.

- 5-year ahead expectations rose to 3.2%, the highest level since March 2011.

This no doubt adds another worry line to already-crowded foreheads at the Fed, suggesting vigilance is required in that inflation expectations could still become de-anchored.

But with that said, it should be read as a “to note” rather than a crimson red flag. The price perceptions were no doubt influenced by the current geopolitical situation in the Middle East and the potential impact on oil prices. Often, the flash Michigan reading is subsequently revised, and we might see inflation expectations come down in response to the softer energy prices we have seen in recent days in the final print for November (due Wednesday 22nd).

Overall, the weak Michigan reading does not bode well for the prospect of continued strength in consumer spending and economic growth.

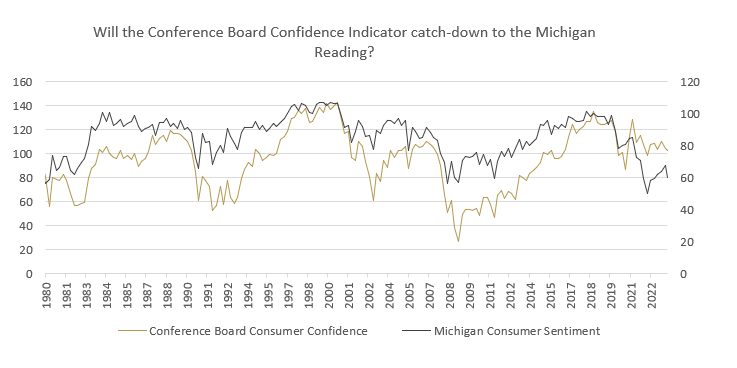

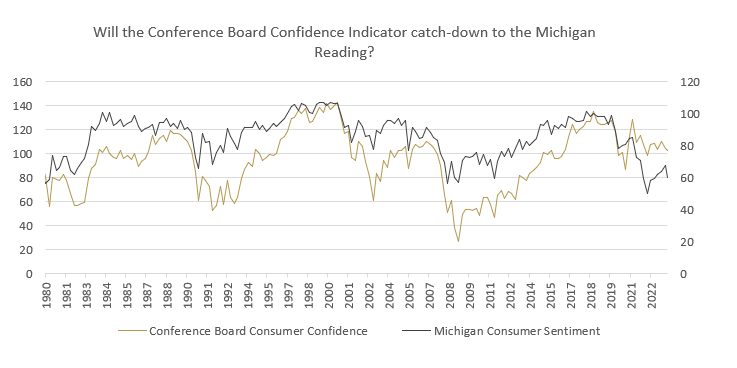

However, it is true that the survey, which is designed to gauge US consumers’ attitudes towards their immediate personal circumstances can be subject to noise (for example, it can be influenced by political attitudes towards the current administration or equity market returns).

Therefore, it helps to take the data in hand with the results of the Conference Board (CB) Consumer Confidence survey, which reflects consumers’ attitudes towards the overall economy more generally (due 28th November).

Until now, the CB index has held up a bit better than its counterpart. If it starts to really “catch-down”, then this would be another red flag for recession.

Source: Bloomberg, BIL

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...