Choose Language

April 28, 2023

NewsUS GDP Growth: Q1 2023

The US economy slowed sharply in the first quarter of 2023 as the Federal Reserve pushed ahead with its historic monetary tightening campaign.

Preliminary data released today, showed that the world’s largest economy grew by 1.1% on an annualised basis in the first quarter. This marks a pronounced deceleration from the 2.6% growth registered in Q4 2022. It is also well below economists’ expectations for a 2% increase.

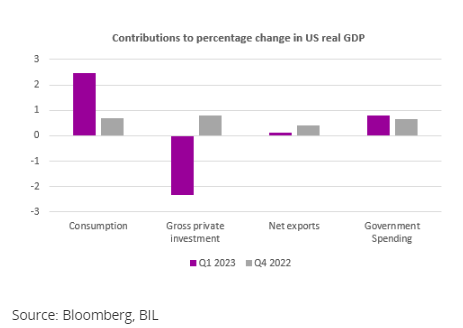

The key detractor was gross private domestic investment, with inventories shaving off 2.26 percentage points from the growth rate as the stockpile of unsold goods grew at a much slower pace. Also within this category, residential investment weighed on growth for the eighth month in a row. However, with the housing sector being one of the first victims of higher rates, it might now be bottoming out and the drag on growth is becoming less pronounced. It is also worth noting that businesses cut back on equipment spending as pressure starts to build on corporate profit margins.

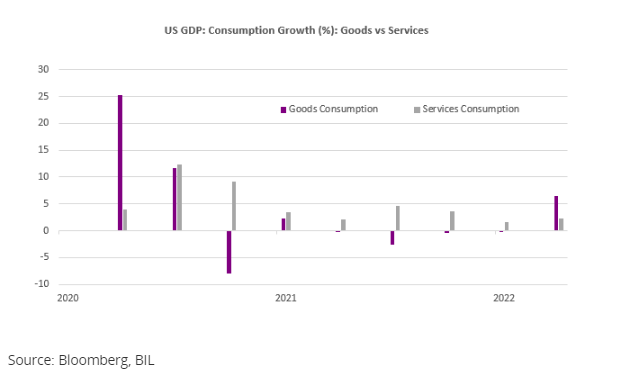

Consumption, the growth engine of the United States economy, showed enduring strength, adding 2.5 ppts to GDP, its biggest contribution since the second quarter of 2021. Interestingly, Americans returned to purchasing goods (especially motor vehicles and parts – perhaps a last burst of pent-up demand as chip shortages and other supply constraints eased, allowing new car production to resume pace, and ultimately prices for new and used cars to retreat). Service consumption also remained strong, especially on healthcare. Moving forward, sentiment indicators suggest that consumer demand is set to soften.

Government spending brought its biggest contribution to GDP in two years -- more than half of that came at the federal level. Defense spending in particular provided a notable bump, making up 0.21pp of the annualised growth rate.

While growth turned lower, inflation pushed higher with the first look at Core PCE prices rising to 4.9% compared to a forecast of 4.7% and 4.4% in the prior quarter.

With the inflation battle not yet over, the Fed is expected to announce another 25bp rate hike next week, which would bring the federal funds rate to a new target range of 5 to 5.25%, before considering a pause in its hiking cycle (especially given that the red-hot labour market is finally shows signs of cooling). A hiatus from June would allow policymakers to assess the impact of their actions over the past year as well as take the pulse on liquidity following the recent turmoil affecting small-to-mid-sized banks.

While allowing inflation to become entrenched is clearly the biggest risk, policymakers also have to take care not to overtighten, an eventuality that would likely lead to a "hard landing" for the economy (a sharp contraction and a spike in unemployment).

Authors

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...