May 4, 2023

NewsWhat does the advent of Generative AI mean for investors?

Generative AI chatbots are just the tip of the iceberg. We are on the brink of an explosion of creative and innovative uses of AI which will allow for broader application for this type of technology across a variety of industries. Investors should be aware of the opportunities, but there are also some considerations that must be taken into account…

Generative AI has been propelled into mainstream discourse thanks to the roll-out of OpenAI’s ChatGPT. For those who haven’t dabbled with it yet, ChatGPT is a chatbot, built on a large-language model (LLM). It can converse, answer questions, give opinions and summarise large amounts of information. While previous AI models were effective in discerning patterns and relationships in data, LLMs – trained on billions of parameters – can mimic human intelligence and understand language, meaning, nuance and context.

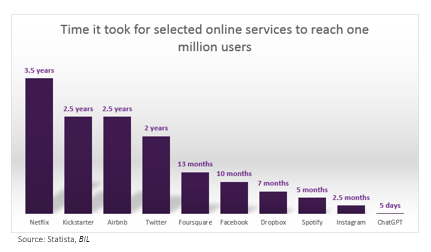

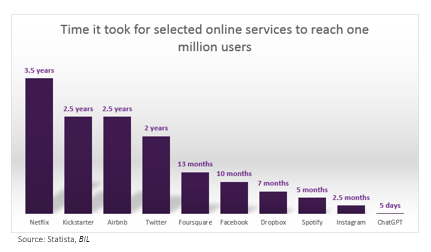

Taken aback by its capabilities of understanding and its human-like responses, people around the world raced to try out the tool for themselves and ChatGPT garnered users at a record pace. It reached 1 million users in just five days; a milestone that Netflix took 3.5 years to arrive at!

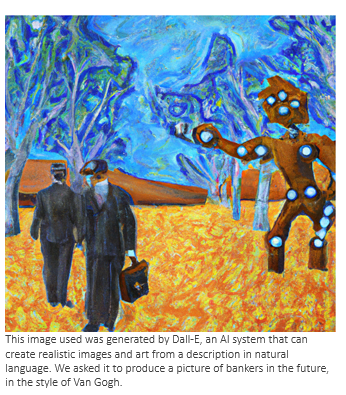

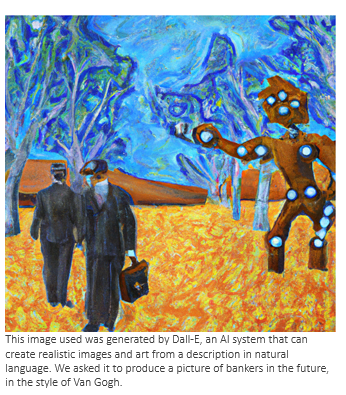

ChatGPT and other LLMs, which have been under development for a few years already, represent a breakthrough in unsupervised learning, in which the model makes its own predictions and calculations based on the massive amounts of data fed into it (note that we are all training ChatGPT every time we use it). But the potential output goes beyond words. Generative AI is capable of producing videos, art, logos, music and more… Already, it has been used to win a Cannes short film award, for example.

LLMs can become smarter over time. The more they are used and the more they learn, the more accurate they become and the more business use cases arise. In the finance sector, for example, a bank might use AI to assist it in making better investment decisions by using it to squeeze as much usable information as possible out of data. Even the best fund managers can only access a tiny fraction of available information relevant to security selection and then they can be subject to behavioral biases, which machines are free from. In education, LLMs might be deployed to create learning content, write textbooks or give explanations. In the world of law, they could be used to write legal texts and summarise cases – already ChatGPT has written articles that passed law exams. Customer service firms could train and use generative AI to answer the bulk of client queries…

These are just a few cherry-picked examples. The use cases are innumerate and could usher in advances and efficiencies in almost every sector. While the darker side of that is potential job losses, others counter that it will create new jobs and allow humans to engage in higher-value-added and more creative roles.

It seems that the genie is already out of the bottle and for investors, the future of generative AI will likely evolve rapidly.

According to PwC research, AI could contribute up to $15.7tn to the global economy by 2030. In Q1 2023 alone, roughly $1.7 billion was generated across 46 deals pertaining to AI and beyond that, an additional $10.68 billion worth of deals were announced but not yet completed (according to PitchBook data).

For investors seeking exposure to this fast-growing, disruptive technology, there are however a few key points to consider.

The first point to consider is that there will be winners and losers. Because of the huge amount of capital and computing resources required, recent leaps in generative AI might be compared to landing on the moon: an impressive achievement, only replicable by those with nation-state level wealth. It is increasingly apparent that big tech behemoths have already planted their flags in the key underlying technology, whether it be through years of internal development or through acquisitions. This could make it difficult for others to break into a market where operating at huge scale with the lowest unit costs will be essential.

As such, there may be more, less obvious, opportunities for investors in areas outside of the core business of generative AI. For example, in vertical applications, where generative AI is integrated into enterprise and commercial services. There is an entire ecosystem of existing technology (and businesses) that stand to benefit from the swift adoption of generative AI (across IT, industry, healthcare and beyond…).

The second consideration is that the lawmakers are scrambling to introduce laws that will govern the evolving technology. There are hundreds of active policy initiatives globally trying to regulate AI and the ground is continually shifting under businesses’ feet. With high-profile figures from the AI sector now publicly airing concerns about the technology, this is only set to intensify.

Often, people overestimate the effect of innovation in the short run, but underestimate it in the long run. Beyond the hype surrounding new AI chatbots, generative AI has the potential to be revolutionary, touching almost every industry – albeit this will take time. Long-term investors seeking exposure are advised to adopt a broad approach, not only looking at generative AI infrastructure, but also its applications and at AI-enabled industries.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...