Choose Language

June 17, 2021

NewsWhat is China’s Belt and Road Initiative?

The Belt and Road Initiative (BRI) has been appearing more frequently in the press lately, with G7 nations expressing a desire to pursue their own international infrastructure projects, akin to China’s. While these are at the early stages of discussion, Beijing’s BRI ambitions are already well underway. Proponents believe that the BRI has the potential to help solve a global infrastructure gap, catalyze growth in developing nations and increase trade, whilst generating investor returns.

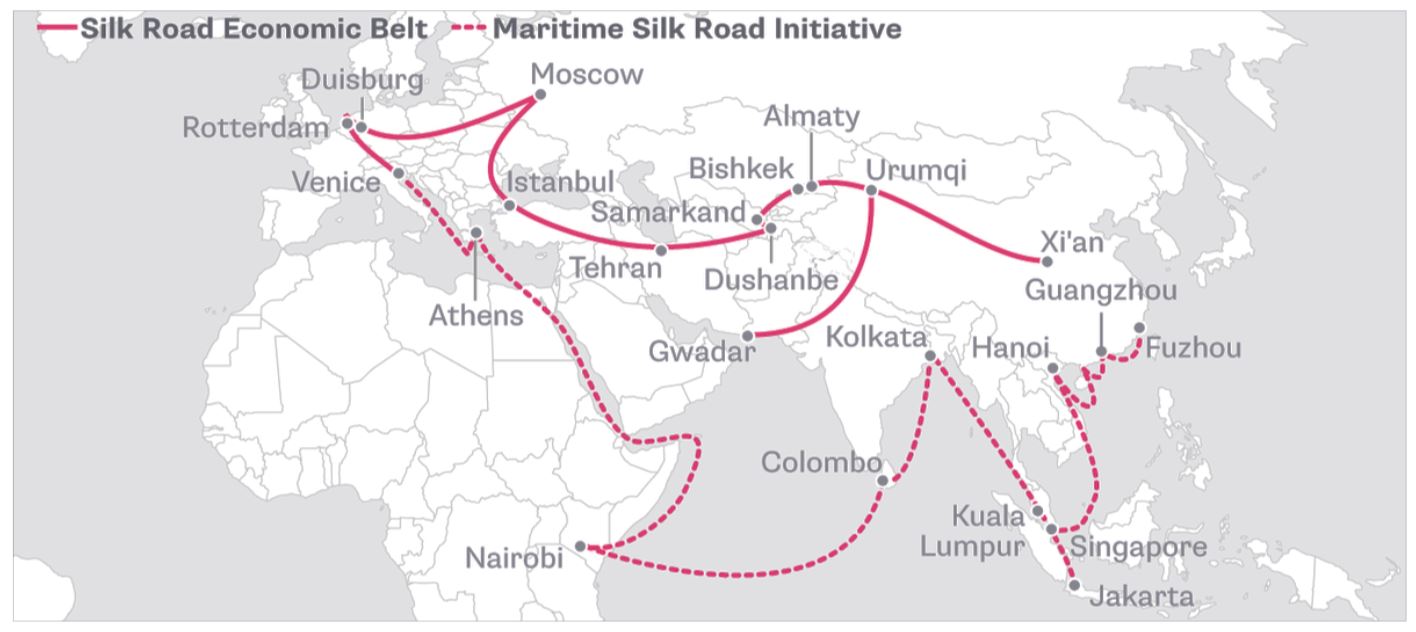

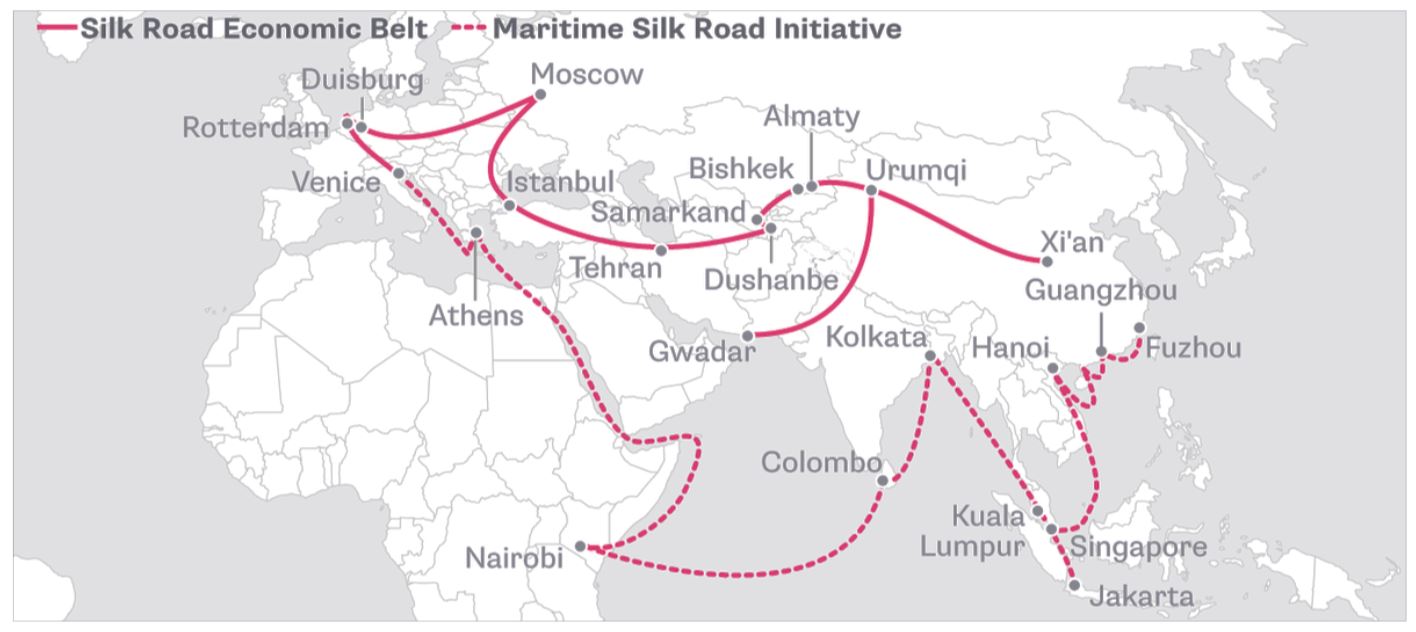

China’s BRI

Source: Bloomberg

The project, which was first unveiled by President Xi Jinping in the fall of 2013, is a loosely-defined set of interconnected bi-lateral trade agreements and infrastructure mega-projects that seek to link China with Central Asia, the Middle East, Europe and Africa. It is often described as the 21st Century Silk Road, made up of a “belt” of overland corridors and a maritime “road” of shipping lanes. In 2017, the BRI was enshrined in China’s constitution and thereafter, activity flourished, with an additional 61 countries joining BRI in 2018 alone. In all, 139 countries have joined the trillion-dollar initiative [1].

The BRI, which is infused with government financing and political clout, coincides with the economic rise of China which is forecasted to become the world’s largest economy by 2028. The project will serve as an important platform for supporting “dual circulation”, China's new development model consisting of the domestic economy as the main thrust of growth, complemented by the global economy [2].

The Digital Silk Road

Complimentary to the BRI, Beijing has launched the Digital Silk Road (DSR). Announced in 2015, with a loose mandate, the DSR has become a significant part of Beijing’s overall BRI strategy, with the aim of improving digital connectivity in participating countries. The DSR provides support to Chinese exporters, to many well-known Chinese technology companies, as well as to recipient countries to improve telecommunications networks, AI capabilities, cloud computing, e-commerce, mobile payment systems, smart cities, and other high-tech initiatives.

The Silk Road in the post-Corona context

More recently, the BRI has adapted the a pandemic-era world. We saw the emergence of a “Health Silk Road”, with China extending its outreach by offering Covid vaccines to other countries and by sending protective equipment along the New Silk Road by rail.

Freight trains in Harbin, China

China’s rapid containment of Covid-19 meant that it dominated global trade over the second half of 2020, with lockdowns increasing foreign demand for its manufactured goods from electronics to home appliances. As shipping containers went into short supply, Chinese manufacturers were able to instead move their goods via BRI rail routes. Over 2,000 freight trains travelled from China to Europe in the first two months of 2021, double the rate from a year earlier, and over the whole of 2020, the total number of train journeys increased sevenfold relative to 2016 levels.[3] In part thanks to the increased connectivity offered by the BRI, last year China overtook the US to become the EU’s largest trading partner in terms of goods, with total imports from China rising 6% to €384bn, according to Eurostat data.

On the whole, the BRI has allowed China and participating nations to greatly expand cooperation in trade, investment and industrial capacity.

Freight train crossing the Badain Jaran Desert, China

Sustainability

As we mentioned in a previous article, China is weaving its green ambitions into its policymaking and priorities. This is also true for the BRI and last year, for the first time, renewable power made up the bulk of BRI energy investments. The share of wind, solar and hydropower accounted for 57% (c. $11bn), of China’s total investment in energy infrastructure, up from 38% in 2019.[4] At the same time, it seems projects linked to pollution are falling out of favour; China has already informed Bangladesh that it will no longer consider projects with high pollution and high energy consumption, such as coal mining and coal-fired power stations [5].

Investment Opportunities

The BRI cements our view of China as a locomotive of global growth. The constellation of ventures and projects brings advantages for Chinese firms (those directly involved as well as domestic producers through greater and more efficient connectivity to various target markets) as well as international firms, regardless of their home base. We have seen various household names from the western world participate in BRI-affiliated projects, whether it be through service and equipment provision or through joint ventures and ample room remains for private sector input, innovation and solutions.

This scope of the BRI as an investment theme is long-term, structural, multi-sector and multi-geography. Because it is spearheaded by governments and big international development banks, some believe that it could potentially offer an improved risk-return ratio. As such, BRI-themed ETFs have emerged which aim to track the equity market performance of listed companies with high revenue exposure to Chinese infrastructure development in a specified set of industries relevant to the BRI.

However, in our view, investors and companies must be selective as to which specific programs they get involved in. Considerations may include geopolitics in concerned countries (this could create roadblocks, especially given that over the long life-span of the project, governments will likely change, bringing with them new foreign policy) or credit worthiness (many of the participating nations have low or no credit ratings). A more nuanced selection process, as opposed to a broad-brushed approach, could allow investors to take advantage of the lucrative opportunities attached to the BRI, while keeping downside risk in check.

References

- https://www.cfr.org/blog/countries-chinas-belt-and-road-initiative-whos-and-whos-out

- http://www.china.org.cn/opinion/2021-02/25/content_77249027.htm

- https://www.ft.com/content/8bcd9ded-b094-4562-8766-d7250ac4851b

- According to research from the International Institute of Green Finance at the Central University of Finance and Economics in Beijing, quoted by the Financial Times https://www.ft.com/content/8ec30baf-69e9-4d73-aa25-13668dcb659f

- https://green-bri.org/chinas-coal-investments-phase-out-in-bri-countries-bangladesh-case/

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...