Choose Language

December 1, 2017

NewsWhat US tax reform could mean for markets

"We're going to give the American people a huge tax cut for Christmas," - President Trump

The Trump administration is attempting to have its widely-anticipated tax reform bill written into law at breakneck speed. One of the key features of the proposals is a reduction in the corporate tax rate to 20% in order to further stimulate the domestic economy. Given that this was a central tenet of Trump’s election campaign, the President is eager to deliver before the mid-term elections in 2018; especially given the Republicans’ weak legislative record to date.

In only fourteen days, Republicans in the House of Congress were able to write their version of the tax bill and pass it through the chamber. Also in the fast lane, the Senate has moved its version of the Tax Cuts and Jobs Act out of the Finance Committee in just seven days. By comparison, the last time the tax code was overhauled under the Reagan administration, the proceedings lasted two years. Now, the Republicans must have the companion legislation passed in the Senate; this will be a tough feat given that here they have a diluted majority of 52-48. Even if the Senate votes in favour of its version of the bill, the finished piece would then have to be reconciled with the House version and be approved again in both chambers.

At present, JP Morgan (JPM), the investment bank, calculates that markets are placing a 20-30% probability of the tax reform package being passed in the near-term, whilst their analysis attributes higher probability, given the velocity thus far. Should the reforms materialise, there could be several market implications which investors should consider…

From a macroeconomic perspective, the roll-out of the ~$1.5 trillion tax plan (provided it is not watered down by the Senate), should translate to stronger economic growth in 2018 than otherwise would have prevailed. The Federal Reserve (Fed) is already anticipating such outcomes and the minutes of its most recent monetary policy meeting revealed that “appreciable” increases in business investment to support growth were expected and that tax reform could boost capital expenditures. A few participants said the prospects for “significant” tax cuts had improved.

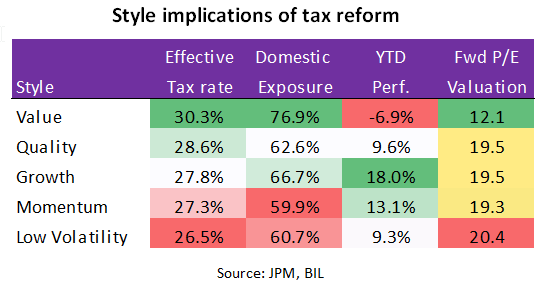

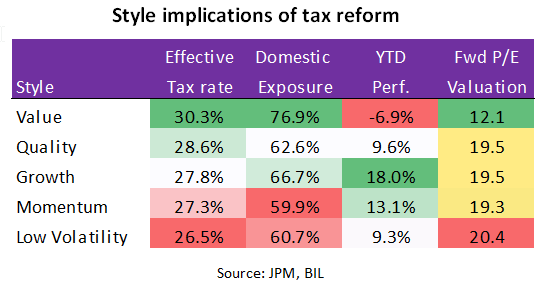

In the equity space, corporate tax cuts could trigger a rotation across style, sector, and size. Generally, tax reform should benefit domestic companies with a high effective tax rate (ETR) compared to US multinationals with significant overseas profits such as technology firms, pharmaceutical companies and consumer staples which generally already have a lower ETR.

Because of this, tax cuts may act as a catalyst for a rotation from Growth into Value stocks (such as financial firms, especially regional banks) which currently carry the highest domestic revenues as well as the highest ETR: 30.3%. (For more information on this theme refer to a previous publication ‘Value: Back in Vogue’.)

Owing to a higher domestic exposure, it is also expected that US Small-Caps would see more of a silver lining than Large-Caps and already we have seen outperformance in anticipation of this – this week the Small-Caps Russell 2000 closed at a record high.

Contrarily, the stock of highly leveraged companies may take a hit under the proposals which intend to cap the interest deduction firms can make from tax returns at 30% of EBITDA1. If a company has a poor year, this cap would essentially come as further salt on its wounds; the decline in EBITDA would also decrease the amount of interest expense that the company could deduct. This is something that is also likely to have negative implications in the high-yield bond space where about one-third of companies would see their interest deductibility capped. For the most highly-leveraged companies, this could have a knock-on impact on earnings, financial metrics and could even potentially accelerate defaults

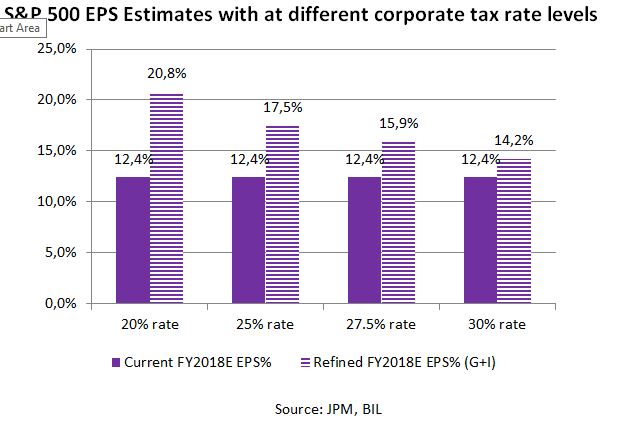

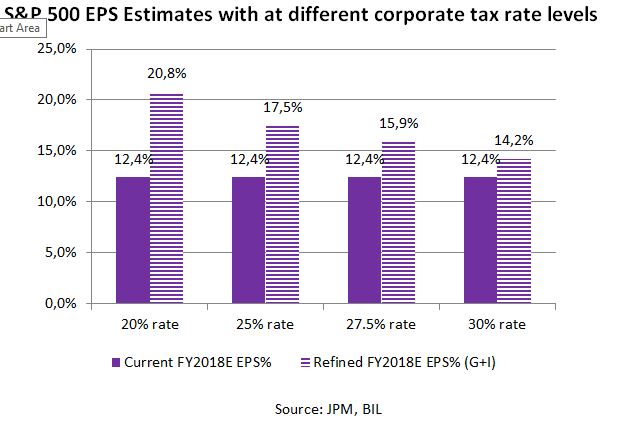

However, on aggregate, the reforms which have been proposed by the House should be a net positive for equities. Already, discussions are creating bouts of sentiment in prices, though the positive effects that reforms could bring are not yet baked into earnings forecasts. From the end of 2016 until present, the expected 2018 EPS growth for the S&P500 has only lifted by 2.7%, to its current level of 12.4%. JPM foresees that a corporate tax rate of 20% could add over 8% to this figure. If this comes to fruition, equity markets would see a huge boost.

In the fixed income space, expectations around the tax reform package are already thought to be influencing the long-end of the yield curve. This is because companies are recognising that it is more economically efficient to front-load tax-deductible expenses now, rather than later, at a lower tax rate and in light of deduction caps. Pension contributions are one such deductible item and therefore, companies with under-funded pensions are taking the opportunity to act, and are loading up on 30-year Treasuries, keeping yields suppressed.

However, the devil is in the details and all of the above is subject to change if Trump cannot garner enough support within the Senate to have the plan passed in its intended state. In the short-term, hopes and expectations around tax reform are keeping stock market sentiment alive. Should the plans falter, a lot of momentum could fizzle away and the market is likely to be disappointed. For those brave enough to bet on the bill’s passage, against the market consensus, only time will tell is this is a case of ‘fortune favours the brave’.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...