Choose Language

November 21, 2023

NewsWhat’s taking the wind from the renewable sector’s sails?

The Copernicus Climate Change service reports that October 2023 was the warmest October on record. The same can be said for July, August, and September of this year; a year punctuated by a series of adverse weather events. With carbon emissions considered a key culprit in global warming, one might assume that the need for renewable energy has never been so great.

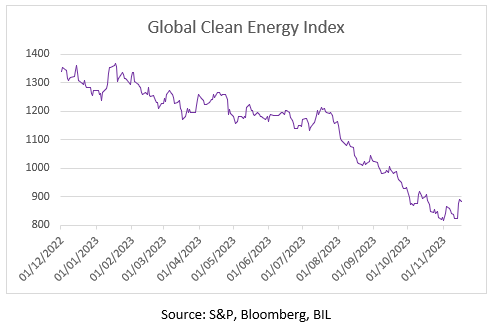

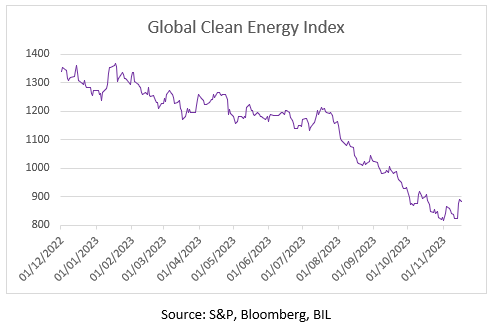

Yet, the sector that holds one of the keys to a greener future has found itself under intense pressure this year, with firms therein underperforming the broader market, as well as their fossil fuel peers. Year-to-date, the Global Clean Energy index is down by over 30%. The fall is even more surprising when one considers the multi-million-euro green stimulus packages disbursed by governments on both sides of the Atlantic.

The industry-wide downturn, which has affected all manner of players, from solar power companies to offshore wind developers, boils down to three major factors:

- Higher interest rates

- Inflation across the supply chain

- Barriers to price increases to allow firms to cover ballooning costs

Interest rates are a key area of sensitivity for the renewable energy sector because the projects usually require developers to borrow huge sums of capital up front to fund projects that span decades into the future. Expensive financing costs resulting from the “higher for longer” stance of major central banks, has rendered some projects altogether unviable. Ørsted, the largest offshore wind developer in the world, cited rising interest rates as a key reason why it recently decided to halt two offshore wind projects in New Jersey, resulting in impairments that could be as high as USD 5.6 billion.

While the cost of generating electricity from fossil fuels is largely driven by the price of the underlying commodity, the IEA estimates that a 5% rise in interest rates increases the levelized cost of producing electricity from wind and solar by a third.

And it isn’t only financing that has become more expensive. Prices across the supply chain were pushed up by pandemic-era bottlenecks and shortages and have yet to meaningfully subside. Swedish wind turbine developer Vattenfall this year said that its costs had climbed 40%.

For renewable power providers, the problem is that while costs have ballooned, the prices locked in for the power they generate have not. Owners typically sign long-term contracts to sell their electricity or secure subsidies before construction begins, so investors have a clear picture of future revenues and are less exposed to spot price gyrations. Many renewable projects were won back in 2019/20. Since then, the world has become very a different place.

Until now, we have seen pushback from authorities on requests to re-negotiate those contracts, sometimes compelling companies to cancel plans at a huge cost. BP noted the reluctance of state authorities to renegotiate terms as it wrote down USD 540 million on planned wind projects off New York. Also in the US, Spanish energy giant Iberdrola, cancelled an offshore wind project off the coast of Martha’s Vineyard, saying it was no longer possible at 2019 contract prices. Closer to home, Vattenfall halted work on its Norfolk Boreas project in the UK North Sea in July, again saying it was no longer viable at the electricity price it agreed with the government.

In sectors where companies are free to raise prices, they have their hands tied as consumers become more cost-conscious.

As an example, Enphase Energy, a maker of solar inverters, warned of below-estimate earnings on weak demand in the US, noting consumers are reining in spending due to high interest rates. This is akin to what we are seeing in the Electric Vehicle (EV) sector. Industry analysts say that the people who have held off buying an EV are likely price-sensitive shoppers, skeptical of making major adjustments to accommodate an entirely new technology. Convincing late adopters at this particular moment in time is a hard feat. As Elon Musk, Tesla CEO stated on the company’s Q3 earnings call, “A large number of people are living paycheck to paycheck, and with a lot of debt, they have got credit card debt, mortgage debt… We have to make our cars more affordable.”

Increasing competition from Chinese firms is another factor limiting strong price increases.

Looking Ahead

While it could take some time, we believe that the smog hanging over the renewable energy sector will clear. A lot of investors piled into green energy stocks, perhaps expecting immediate upside. However, as with all structural investment thematics, the idea is to benefit from a long-term societal shift. Rome was not built in a day and hiccups along the way are to be expected.

Already, the winds appear to be changing. The newest power projects are being struck at much better terms, which should allow companies in the sector to generate a profit moving forward, while supply chain disruptions are easing. At the same time, governments remain supportive – note the European Commission’s Wind Power Action program announced in October, which aims to significantly increase wind installed capacity and improve access to financing for companies. Moreover, we appear to have reached peak interest rates in both the US and Europe, with markets expecting cuts to begin in 2024.

The biggest support underpinning the renewable sector over the longer-term, however, is that fact that the need to decarbonise hasn’t gone away, even if it has been eclipsed by more immediate issues in the headlines. The COP28 in Dubai which kicks off on November 30th will probably give the topic more impetus.

Ultimately, we are reaching the beginning of the end for fossil fuels. The IEA predicts that demand for oil, natural gas and coal will all peak before 2030, creating huge growth potential for renewables. Just look at wind power – a key alternative favoured by governments. In 2022, it only accounted for 0.8% of global electricity output…

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...