April 11, 2023

BILBoardBILBoard April 2023: Following the fundamentals

Source: Bloomberg, BIL

Recently, equity markets have had a spring in their step. The S&P 500 has eked out fresh multi-week highs, and is up 7.4% year-to-date. The Nasdaq is in a bull market having risen by over 20% in the first quarter. The EuroStoxx 600 was up by about 8% over the same period. All this is in spite of an environment of rising interest rates and the biggest banking failures since the financial crisis. From a fundamental perspective, this is somewhat perplexing.

Macro Outlook

The macro landscape is a challenging one. Much ink has been spilled as to whether the US economy will have a soft or a hard landing as the Fed attempts to stamp out inflation; it seems we will soon find out. Because monetary policy kicks in with a lag, only now are we starting to see the impact of a culmination of interest rate hikes and quantitative tightening. Inflation is coming down, albeit slowly (current pace is 6% YoY). The labour market has adjusted at a snail’s pace, but is now weakening (the most layoffs in any given February since 2008, average hourly earnings growth has come down from recent peaks, the unemployment rate rose from 3.4% to 3.6%). Moreover, consumers are starting to pull back on discretionary spending amid a cloudier outlook and tighter financial conditions. The Michigan Consumer Sentiment Index dropped for the first time in four months in March, with households increasingly expecting a recession ahead.

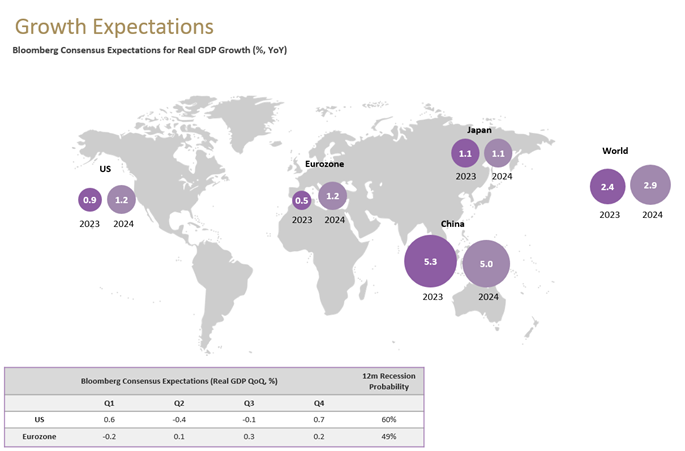

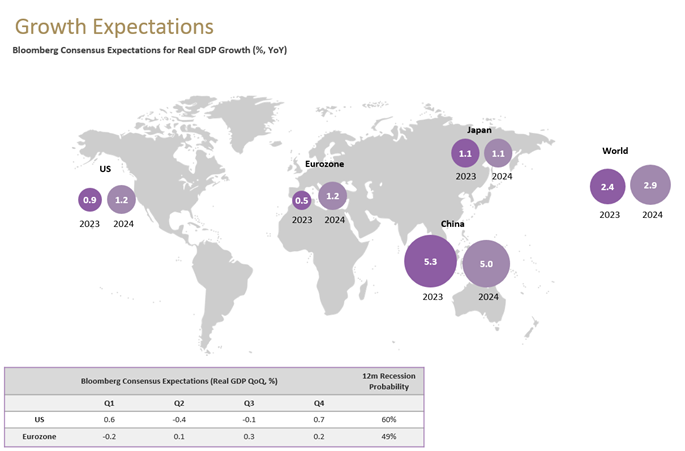

According to Bloomberg consensus estimates, economists expect a very mild US recession over Q2 and Q3. Marginally negative growth and no spike in unemployment might still be considered a soft landing. However, nothing its guaranteed.

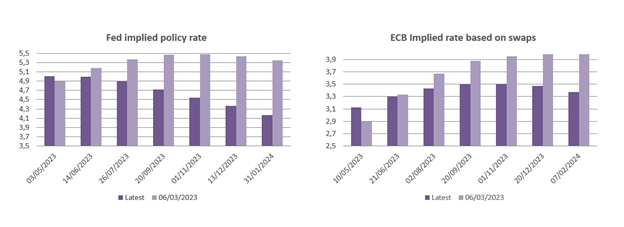

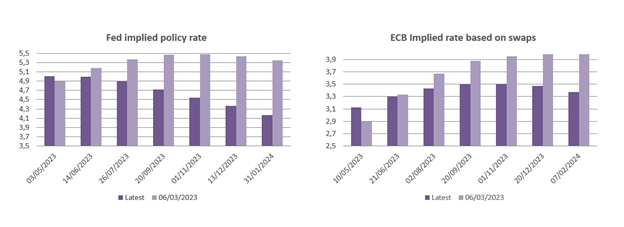

Much depends on how restrictive monetary policy has to become. The Fed delivered another 25bp rate hike in March, accompanied by softer forward guidance (“some additional policy firming may be appropriate”). Being less hawkish doesn’t necessarily mean the Fed will become dovish, yet recent banking turmoil has led investors to heavily revise their rate expectations, betting that the Fed will already begin to cut rates this year. In the grid below, the lilac bars show the market’s current expectations for the Fed Funds Rate, markedly lower than what was expected just a few weeks ago on 6 March (represented by the dark purple bar). We believe that the market has overshot – absent a major crisis, the Fed will likely be apprehensive to cut rates until it can be sure that the inflation genie is safely back in the bottle.

Markets have strongly repriced rate expectations on both sides of the Atlantic

Source: Bloomberg, BIL

In Europe, generous fiscal stimulus, a pick-up in sentiment, and the avoidance of an energy crisis could mean that a recession is averted this year. While the US might soon have its landing, Europe seems destined for a slow-burning period of lethargic growth and still-high inflation. While headline inflation has begun to recede (now running at 6.9% YoY, down from a peak of 10.6%), this is largely due to a decrease in energy prices (which could always resurge if Chinese demand picks up). Core inflation, which removes volatile components like food and energy, continues to scale new highs (currently running at a clip of 5.7% YoY). Quite worryingly, second-round effects are starting to kick in – a tight labour market (unemployment at an all-time low of 6.6% with a high participation rate) is emboldening workers to ask for pay increases (e.g. in a rare occurrence, German unions Verdi and EVG joined forces and called a major transport strike to demand higher pay for millions of workers). As such, it is safe to say that the ECB still has “more ground to cover”, as Lagarde has stated. With the latest projections from the central bank estimating that inflation will still be above target by 2025, clearly market expectations for rate cuts already this year are wishful thinking (again, in the absence of a major crisis).

China is an outlier in the global tightening cycle. So far, its reopening has been slow to materialise with consumers “stunned” coming out of the zero-Covid era that disrupted many businesses. As seen after the Sars outbreak in 2003, when consumers in the hardest hit areas took time to recover their confidence, it is expected that it will take some time for normal habits to resume and for households to start spending their pent-up savings. At the same time, China’s policy-driven infrastructure investment is expected to be largely preserved throughout 2023 to support economic development and create jobs. Ultimately, despite a conservative GDP growth target (5%), we do believe that China will be an important driver of global economic growth over the course of the year as other regions slow.

Investment strategy

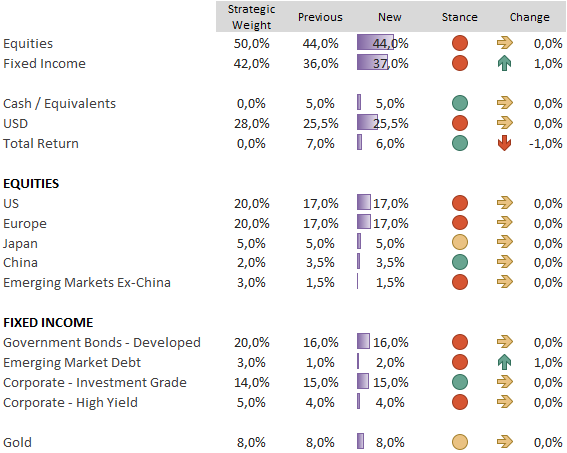

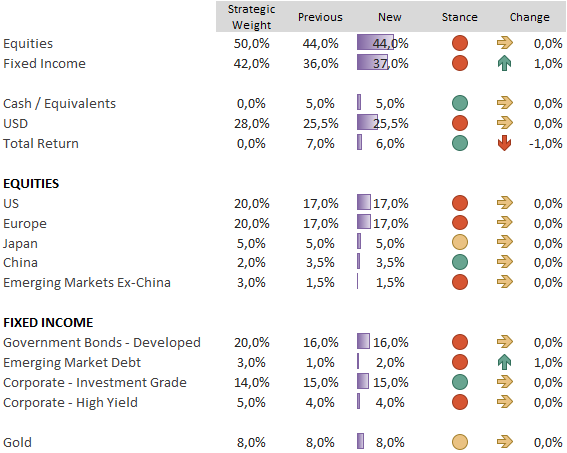

Key highlights

- Broadly, we remain underweight equities and fixed income

- Switched approximately 10% of European government bonds into US Treasuries

- Equity regions: underweight the US, Europe and EM. Overweight China

- Sectors: favour European healthcare, US utilities, energy & selected IT names

- Style: emphasise quality – cash (on the balance sheet) is king

- Begin to build exposure to emerging market debt

- Neutral on gold, constructive on oil

In our investment decision-making process, we remain focused on the fundamentals. Not only is the macroeconomic landscape challenging, but micro fundamentals are also deteriorating. Earnings growth expectations have been revised sharply downwards. At best, this could mean prices move in a horizontal fashion from here; at worst, it could mean a correction is forthcoming.

As such, we maintain a cautious portfolio make-up, with underweight positioning on both equities and fixed income. To add, we also keep gold (despite the recent rally), believing that now is not the right moment to throw away our proverbial safety net.

Equities

Within our equity allocation, we are underweight on both the US and Europe. The US still exhibits the most expensive valuations (leaving ample room for disappointment), while profit margins are deteriorating. Europe is about 30% cheaper than the US, yet that discount comes with an increasingly worrying macro outlook. Where we do hold equities, we emphasise quality companies, those that are cash rich and those that have the ability to pass on costs to consumers. We side-step cyclicals, with the exception of energy given that scarcity is set to be a theme for the coming months (recent OPEC+ cuts of 100m barrels per day, US building strategic reserves, ban on Russian crude, etc.). As the Fed nears its terminal rate, we have become more fond of Tech, especially large-cap names that have ample cash piles on their balance sheets. With the fasten seatbelt sign illuminated in markets, it also makes sense to have exposure to more defensive sectors like healthcare (predominantly in Europe due to drug price reforms in the US) and utilities (US-centric due to the forthcoming Inflation Reduction Act that will see the largest ever US investment into clean energy). We also have an overweight exposure to China, which we believe will be fruitful over the longer-term while offering the added benefit of diversification.

Fixed Income

We are still reluctant on fixed income given that the battle with inflation is not yet won. Should no major crisis materialise, rates look poised to drift upwards throughout the year and we think the market is over-optimistic regarding the prospect of rate cuts by central banks. For now, we keep our duration below benchmark.

After the rally in bond prices stemming from banking sector woes, we took profit by selling some of our Core European Sovereigns at an ad-hoc Asset Allocation Committee in mid-March. Believing that the Fed is closer to the end of its hiking cycle than the ECB, at our most recent Committee, we continued to adjust our Sovereign exposure, switching approximately 10% of our remaining allocation in European govies into US Treasuries (currency hedged).

In addition, we reduced exposure to total return (held as an alternative to cash), in favour of adding some Emerging Market (EM) Debt denominated in Hard Currency. The Fed’s softer forward guidance bodes well for the asset class and inflows have picked up while supply is limited. We give preference to EM Sovereigns which held up better during recent turmoil than EM corporates. On top of that, EMD Sovereign debt still gives a historically high pick-up over US Treasuries and we feel adequately compensated for the additional risk we take.

Conclusion

The market is priced for something close to perfection believing that central banks will soon step away from their tightening campaigns, refocusing on the other component of their mandates: economic growth. In reality, central banks have been clear that recent stress in the financial sector does not eclipse the risk of not containing price pressures. While bringing inflation back to target will cause pain, not doing so is “non-negotiable”, as Lagarde put it. As rates continue to drift upwards, economies falter and profit margins decline, few asset classes look highly appealing. Cash is indeed king and that doesn’t necessarily mean moving money into a savings account. Focusing on cash can mean seeking out attractive short-term cash alternatives, or more broadly, pinpointing companies that are more equipped to deal with any incoming storm, due to large cash balances.

Asset Allocation Matrix

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...