March 22, 2024

BILBoardBILBoard April 2024 – Shifting sands in the investment landscape

The sands in the investment landscape have shifted in that it appears major central banks have tamed inflation without triggering a deep economic downturn. At the same time, market rate cut expectations have moderated, without disrupting markets. These developments, coupled with better-than-expected earnings results and AI enthusiasm, have pushed global equity indices to new all-time highs over the past month. The S&P 500, the Nasdaq, Japan’s Nikkei 225, Germany’s Dax and France’s Cac 40, have all reached new peaks. While valuations are more expensive, momentum could continue in the near-term. In order to capture further potential upside, we increased our equity exposure mid-March. However, such a move requires a high risk tolerance and a willingness to accept volatility and as such, was only enacted in our high risk portfolios.

Macroeconomic Outlook

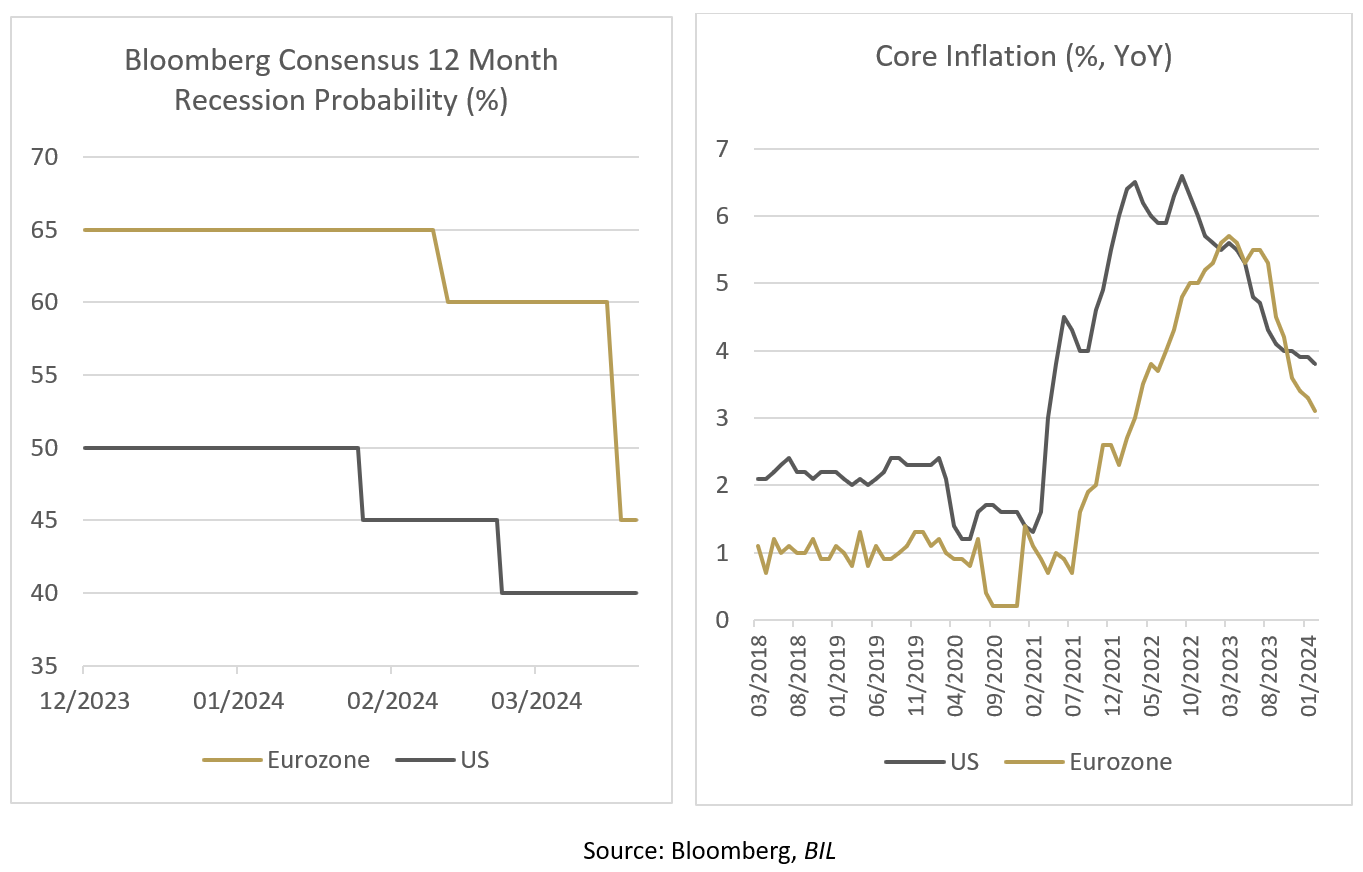

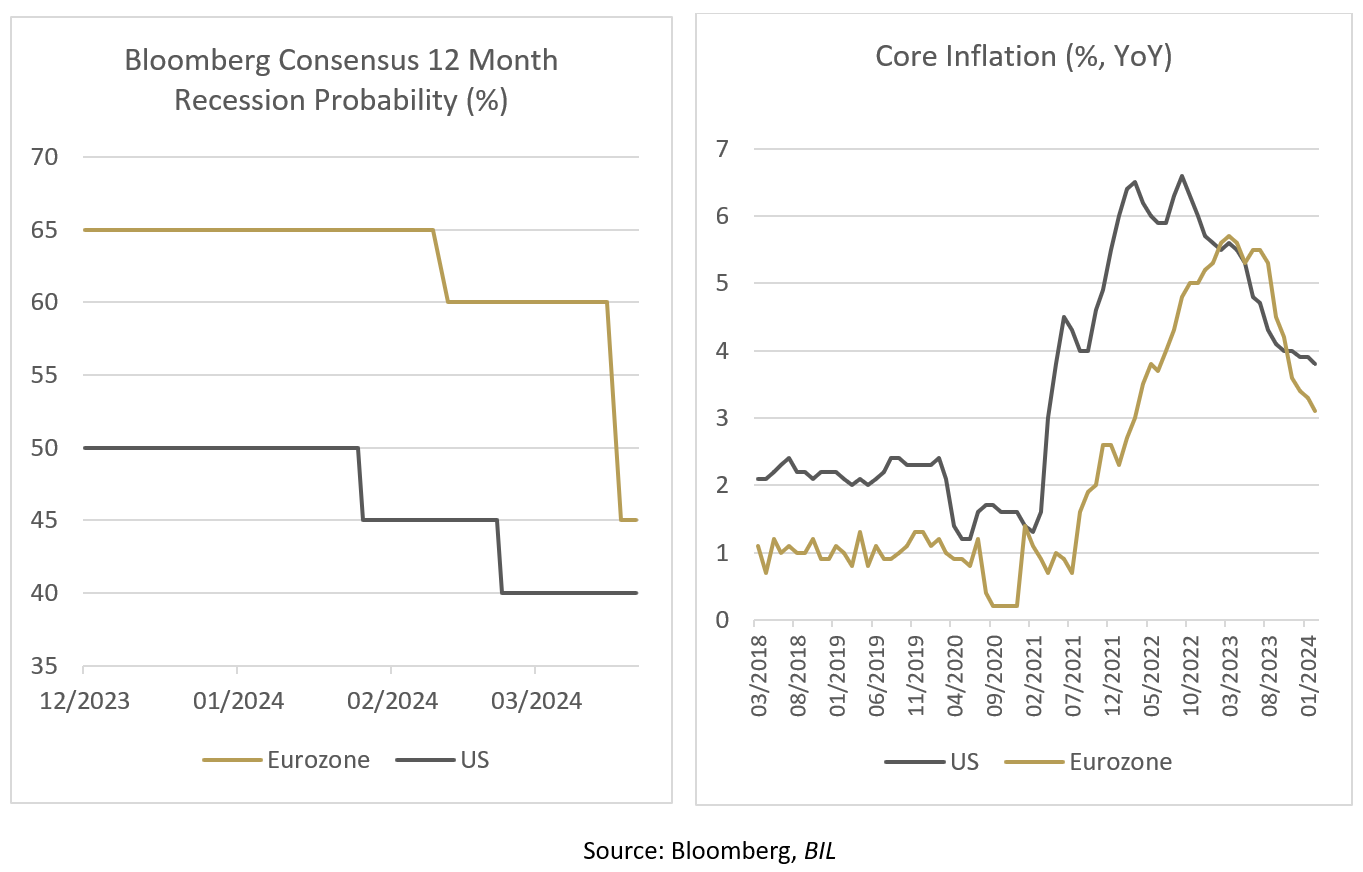

Incoming data points to a resilient macroeconomic backdrop and in turn, economists have watered down their recession expectations on both sides of the Atlantic.

In the US, growth is expected to slow from high levels this year (3.2% growth in Q4), with a “no landing” scenario becoming the reality. Core inflation continues its gradual downward trend and there are signs that the labour market is beginning to loosen up, making a June rate cut possible. While equities rallied late 2023 on the back of hopes that the Fed would cut interest rates as many as six times this year, the rally has continued even though investors have scaled back their expectations to only three or four cuts (the Fed’s dot-plot suggests three). This rests on the fact that rate cuts are being priced out not because investors are overly worried about inflation, but because they are becoming more optimistic about the economy. Stronger-than-expected corporate earnings corroborate this idea, with S&P 500 companies beating estimates by 8% on aggregate.

In the Eurozone, not much is expected in the way of growth this year. However, it might be enough that a deeper recession has been avoided, with growth only very briefly dipping below zero in what might be considered a soft landing. The labour market is a key pillar of strength, with the unemployment rate falling to a new all-time low of 6.4%. Meanwhile, PMIs appear to be bottoming out, driven by services, and the European economic surprise index has turned positive for the first time since May. While Germany is still grappling with structural issues, some glints of improvement are appearing. For example, the IFO edged up in February as companies became less negative about future prospects, and German industrial production rose for the first time in nine months. In terms of monetary policy, the ECB has signalled that it could begin cutting rates in June. It is awaiting more data on wage settlements, as well as price re-setting by firms, which normally takes place at the beginning of the calendar year.

In Japan, the return of inflation and the subsequent exit from negative interest rate policy is a game changer. Macro data, which is weighed down by consumption, could start to brighten: in the annual spring wage negotiations (Shuntō), Japanese workers secured their biggest pay rise in three decades (an average of 4% after 3.6% last year).

The macroeconomic situation in China remains challenging. Investors had been hoping that the annual “two sessions” conference would deliver a concrete, big-ticket government stimulus package, but this didn’t come to fruition.

Investment Strategy

Growing optimism about the world economy and decent earnings have helped drive equity markets higher. Market breadth is improving, and we believe momentum could continue in the near-term as investors look beyond just a handful of AI winners to consider opportunities in other sectors and regions outside of the US.

Given that rate cuts which are not quickly followed by a recession tend to push equity markets higher, it makes sense to start adding exposure to developed market equities, where risk appetite permits.

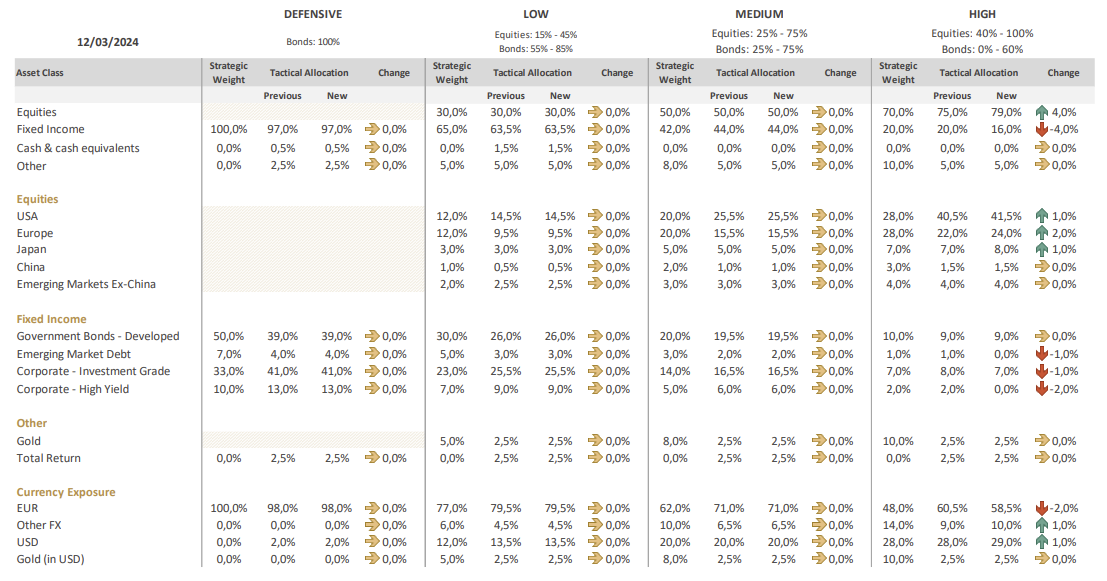

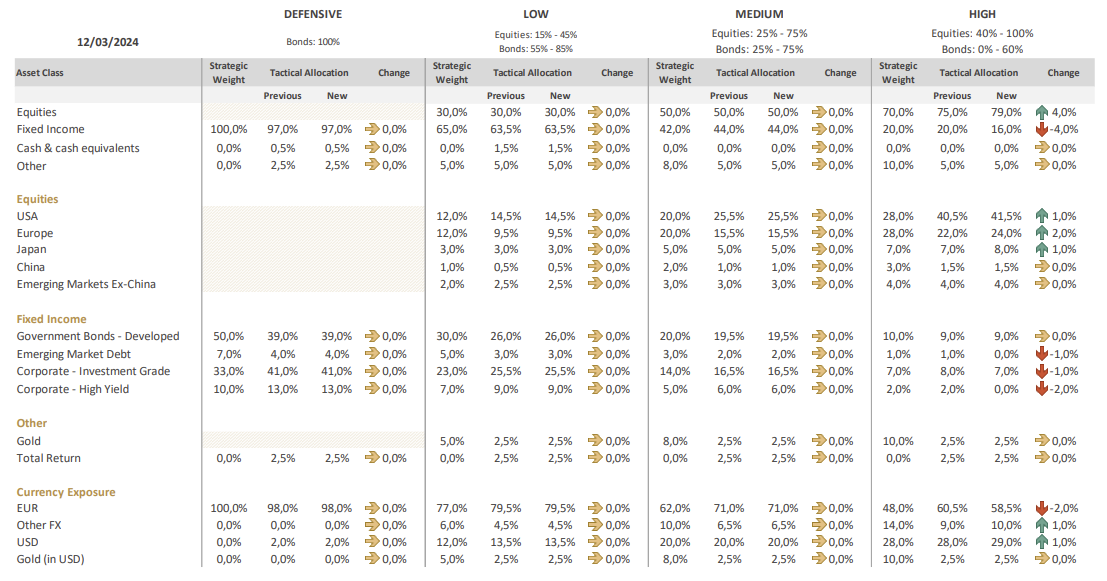

To this end, in high risk profiles we increased our overall equity overweight by:

- Topping up exposure to the US – the region offers unique exposure to structural themes such as AI and digitalisation, while earnings could continue to surprise positively in 2024 on economic resilience, falling rates and a softer USD.

- Decreasing our underweight to European equities – valuations are low and bright spots are emerging in certain sectors. For example, a handful of luxury companies are doing well despite weakness in China, and some companies have a near-monopoly along parts of the semiconductor supply chain. Note that we focus on core-Europe, avoiding the UK and Swiss stocks for the time being.

- Bringing Japan from neutral to overweight – while macro data is coming in better than feared, corporate governance reforms are promoting shareholder value and driving return on equity

To fund these purchases, we cut exposure to credit markets, thereby increasing the overall duration of the high-risk portfolio.

In low- and medium-risk portfolios, we believe we have adequate equity exposure with a neutral stance overall. Therein, lower equity weights are compensated with an overweight stance on European investment grade corporate bonds and on US high-yield.

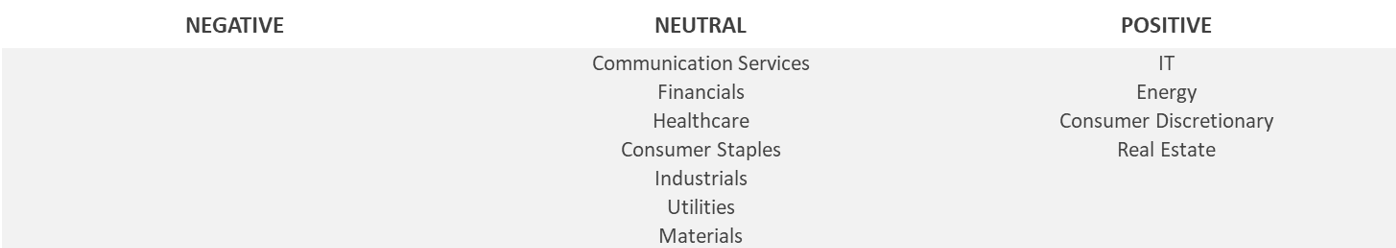

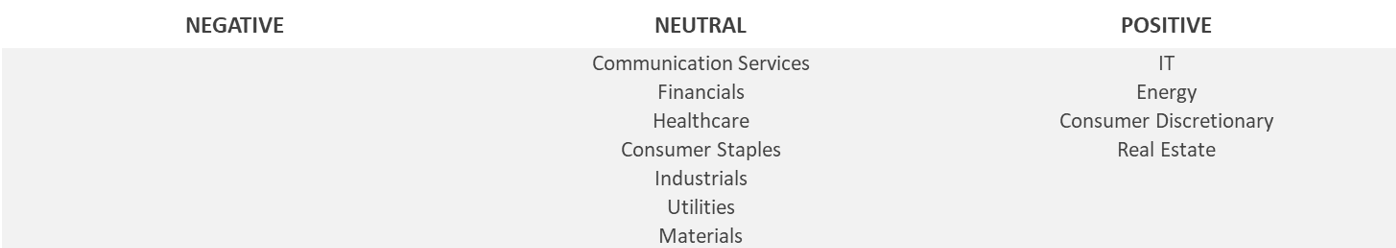

Sector Preferences

We also used our March meeting to reshuffle our sector preferences to reflect ongoing developments.

Real estate was moved from neutral to positive, with lower rates set to offer the sector breathing room. Note that we avoid commercial real estate and focus on logistics and residential real estate.

European consumer discretionary was also upgraded from neutral to positive, with the sector benefitting from renewed confidence in luxury and autos. Moreover, lower inflation and unspent excess savings should help foster a recovery in European consumption throughout the latter half of 2024.

Simultaneously, the consumer staples sector was downgraded to neutral. In the US, a chasm between the prosperous economy and lower-income households is evident; companies that cater to the low-end consumer are feeling the pressure. There is also the risk that the market over-extrapolates the impact of weight-loss drugs on food and snack consumption. Even if the market shifts to a risk-off mood, we might not see this defensive sector strengthen as much as in the past, given the threat to earnings from the limited volume recovery and the perceived crimping of food and alcohol consumption.

The Materials sector was moved from negative to neutral. We particularly like the building materials sub-sector as producers are managing to raise prices, while their input costs fall: energy (electricity, natural gas and coal), steel and other costs are all down compared to 2023 levels. We might still see flat-ish volume trends in the coming months, but rate cuts should improve the level of building permits and housing starts, and hence help boost volumes. Note that the mining category remains under pressure due to the continued weakness of Chinese real estate. Iron ore is nearing a seven-month low, negatively impacting firms in the sub-sector.

Conclusion

Movie fans might have sensed that some inspiration for this month’s BILBoard was drawn from the blockbuster, Dune: Part Two. As is the case on planet Arrakis with its shifting sands, there are still risks lurking under the surface, and like the toothed sandworms from the movie, you never know when they will rear their head. While the macro outlook is benign for now, we cannot rule out an unexpected shock as financial conditions tighten, with commercial real estate looking particularly vulnerable. At the same time, the geopolitical landscape is unstable. Perhaps the biggest risk, however, is that sentiment is fickle and can turn quite quickly.

For this reason, we only attempt to capture further upside in profiles with a high risk tolerance. We take comfort in the fact that the lion’s share of our equity overweight is in the US, a region where we have purchased substantial downside protection via options which do not expire until after the June FOMC.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...