Choose Language

April 29, 2021

BILBoardBILBoard April/ May 2021 – Brighter light, shorter tunnel

The implicit message in April’s better-than-expected macro data was that an economic rebound is well underway – more so in some regions than others. The upturn is supported by accommodative fiscal and monetary stimulus, while the hastening of the vaccine rollout (over 1 billion doses have been administered globally) is shortening the tunnel between the present and a bright, post-pandemic future.

But as they say, “there’s no show without Punch” and inflation is attempting to steal the show. Supply chain bottlenecks, a global chip shortage, pent-up demand and rising commodity prices are converging to present a convincing case for higher inflation. However, we believe price pressures will be temporary and that they will not provoke premature monetary tightening. The communiqué of major central banks and inflation break-evens suggest that policymakers and markets share this conclusion.

Then comes the question of interest rates. Earlier in the year, led by the US rate market - the biggest in the world and a foundation for global asset prices - bonds went into decline, as the prospect of higher inflation drove investors to flush them out of their portfolios. Consequently, the yield on the US 10-year tore above 1.7%. Since then, central banks appear to have quelled fears, insisting that they will not pull the rug from under the markets until the recovery is confirmed as sustainable. From here on out, we believe that the potential for further steepening on the US curve is limited and see the 10-year yield gradually moving higher – the key word being gradually.

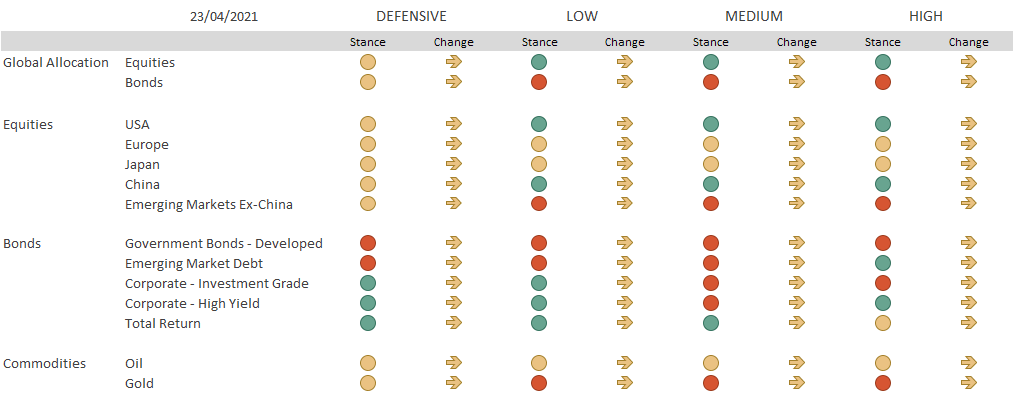

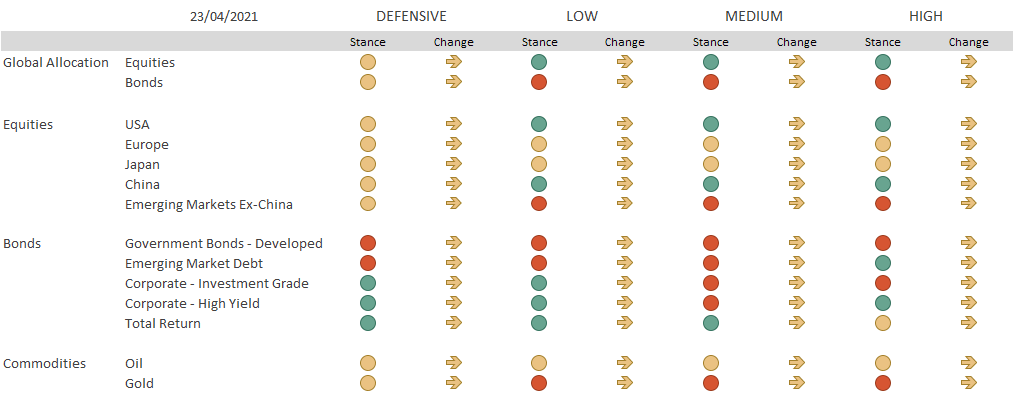

This scenario – a gentle rise in rates, in tandem with brightening eco data – is consistent with a pro-risk stance. As such, we are overweight equities and credits while being underweight core government bonds and duration.

Equities

Equities are still moving up while exhibiting relatively low volatility, supported by positive earnings revisions, liquidity and optimism around the reopening. A modest rise in interest rates, as is our base case, should not derail the general uptrend, but it means that sector and style decisions will be crucial determinants of returns.

Regionally speaking, we continue to favour the US and China. These regions can be considered MVPs in ushering in a broader global recovery. In the US, consumers are joining corporates as growth drivers (retail sales rose 9.8% in March), and President Biden is going “all guns blazing” when it comes to fiscal stimulus. To help fund this, the Democrats propose corporate tax hikes and increased capital gains tax for high-net worth individuals (from 20% to 39.6%). The US economy, in our view, should be able to more-than-adequately absorb the scale of the proposed tax increases and markets did not react strongly to the announcements. Republican resistance could spell a watering-down of the proposed measures. It is also worth mentioning that, if passed, much of the money will be redistributed into the economy, for example amongst lower income households, boosting their spending power, which is a positive for the macro outlook and ultimately corporates.

Style-wise, we have a Value tilt in our US exposure, where macro momentum is more robust. Sector-wise, we prefer cyclicals that can benefit from a strengthening economy and infrastructure spending (i.e. Materials and Industrials). According to Moody’s, globally households have amassed a $5.4tn stockpile of extra savings (more than 6% of GDP), with $2tn of this attributable to US households (largely due to voluntary precautionary savings and because many businesses were shut or restricted). The Consumer Discretionary sector is expected to receive a boost after the reopening allows this money to percolate back into the economy. We also like Utilities, selecting names that will benefit from the energy transition (including Biden’s commitment to half 2005 levels of US net greenhouse gas emissions by 2030).

China is an economic trailblazer, having expanded 18.3% (annualized) in the first quarter. After the recent sell-off, valuations are relatively cheap compared to global peers and onshore equity markets are supported by strong foreign inflows and rejuvenating IPO activity.

Europe’s growth story has been held back by delays in the vaccine rollout and the fact all EU member states have yet to approve the EUR 750 billion recovery fund, leaving the ECB to do the heavy-lifting until at least July at the very earliest. The good news is that the German constitutional court finally gave the green light for Germany’s ratification. Consumer sentiment is still fragile, which is unsurprising given labour market dynamics and Covid-19 restrictions. While Europe is traditionally a Value play that benefits from rising rates and a steepening curve, we are reluctant to switch to an overweight with the outlook still studded with uncertainty.

Emerging Markets outside of China are still in the grip of the pandemic, especially India, while central banks (Russia, Brazil, Turkey…) have begun hiking rates in the face of higher inflation. We are therefore underweight emerging market equities.

Fixed Income

The rise in yields momentarily paused, but ultimately we think they will continue their gradual move higher as the economic recovery ensues. As such, we are underweight govies and duration.

In an environment where central banks are expected to continue to provide support, where the macro picture is improving and where investors seem to be looking beyond the pandemic, investment grade corporate bonds should continue to perform. Strong demand for new bonds, slower issuance and high inflows create a favourable balance and credit spreads have shown very little volatility. Limiting duration risk, while stepping down in credit quality is still what works best.

For investors who can stomach additional risk, the high yield bond space is the go-to destination. Investor flows, ample liquidity and government stimulus programs are supportive (as well as rising oil prices if we focus on the US market). Rating migration trends continue to improve, approaching 2 in the US and Europe, meaning that the number of upgrades is twice that of downgrades.

The environment remains supportive for emerging market debt, so long as US real rates remain negative and yields rise at a gradual pace. Within our EMD exposure, we prefer Hard Currency corporates which have a better risk-adjusted profile. Corporates are more resilient against a rise in real yields vs. government related entities.

Currencies and Commodities

Our long-term outlook for the US dollar remains negative: In the absence of hawkish signals from the Fed and facing the twin deficit, we believe the greenback will be under pressure, even if virus flare-ups, geopolitical risks and prolonged lockdowns in Europe could provide some temporary tailwinds.

We are neutral on gold, which holds a place in our portfolios as a diversifier. However, if prices were to test the upper resistance level ($1825), we would consider taking some chips off the table. We are also neutral on oil. Prices are subject to opposing forces – on the upside a weaker dollar, OPEC supply constraints and the fact that demand is edging higher (especially as airlines take to the skies again): On the downside, extended lockdowns and Iran’s intentions to resume production.

Conclusion

As with almost every economic upturn, the current recovery is not perfectly synchronized and disparities between nations are quite clear. However, as investors, we can focus on the opportunities, rather than placing too much focus on the blemishes of this boom. For now, we are well-positioned for the upwards leg of the cycle in regions where macro indicators are flashing green. As mentioned previously, style and sector decisions will be critical for investment returns. These largely hinge on movements in rates markets and as such, this is an area that must be monitored diligently.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...