Choose Language

September 7, 2021

BILBoardBILBoard September 2021 – Slower, steadier growth

One of Aesop’s Fables tells of a race between a fast hare and a slow but relentless tortoise. Readers are supposed to be surprised when the tortoise manages to defeat the hare, coining the phrase ‘slow and steady wins the race’. After an economic recovery that took forecasters by surprise for its sheer velocity, growth rates are normalizing, and positive economic surprises are occurring less frequently. This is not something we perceive negatively, rather, we believe that the economy is adopting a more sustainable pace and we remain upbeat about the macroeconomic outlook for the latter half of the year.

In the short-term, supply chain bottlenecks are preventing economies from reaching their full potential, but we believe this will only serve to push demand into Q4 of this year and 2022, thereby prolonging the cycle. Bottlenecks aside, key growth drivers are still in place:

- Vaccination rates continue to rise. 5.3 billion doses have now been administered globally, while one jab (Pfizer-BioNTech) has graduated from being authorized for emergency use to having full FDA approval. The proliferation of vaccines seems to have been effective in reducing hospitalization rates and fatalities.

- The fiscal stimulus train remains on track. In the US, a $1 trillion infrastructure package has been approved by the Senate and will be subject to a vote in the House before September 27th. In Europe, August saw initial disbursements of the pan-European recovery fund. Eligible countries have received pre-financing representing somewhere around 10-13% of their entitlement and this should soon start percolating through to the real economy. Looking east, China has said it will cut the reserve requirement ratio for banks and accelerate fiscal spending.

- Monetary policy remains supportive for now, but investors and central bankers alike are aware that current measures cannot go on indefinitely or inflation could spiral out of control. Eurozone CPI rose 3% in August, while the latest US reading came in at 5.4% (for July).

Given this situation, tapering is now trending. The Bank of Korea became the first major Asian central bank to raise its key rate (by 25 basis points to 0.75%), while the central scenario laid out in the Federal Reserve minutes is now a slower taper beginning this year. After hawkish comments from select ECB governors, the European sovereign yield curve bear steepened and investors now look to the next policy meeting on September 9th for more clues.

A taper without a tantrum?

At the height of the 2020 crisis, central banks adopted a ‘whatever it takes’ stance, resulting in a topsy-turvy world where there are negative yields on over $15 trillion worth of global debt. Some worry that central banks are so far down the rabbit hole that it will be difficult to get back out. However, we do believe that the Fed is capable of executing a tantrum-less taper. Firstly, the Fed has been very transparent, priming markets for a gradual reduction in asset purchases. Secondly, at the Jackson Hole symposium, the Fed calmed markets by confirming the absence of a mechanical link between the timing of tapering and that of an eventual increase in the target range for the federal funds rate. Thirdly, US GDP is almost back to its 10-year pre-Covid average on the back of unprecedented monetary and fiscal stimulus: it took at least 5 years for the economy to get back to its pre-2008 trend in 2013 when the last taper tantrum occurred. And lastly, the Fed’s Reverse Repo Facility (RRP) and Standing Repo Facility (SRF) facilities should also help dampen any liquidity impact.

Equities

Risk assets continue to flourish, even if growth is coming off the boil, and in August, the S&P 500 tied a bow on its seventh straight month in the green—its longest winning streak since 2017. Some are prophesizing about peaks (earnings, growth, etc.), but we believe that equities remain supported by ample liquidity, a still-strong macro backdrop and fiscal and monetary stimulus. Further, another stellar earnings season in Q2 bodes well for revisions moving forward. Sector-wise, we continue to favour cyclicals such as Consumer Discretionary, Materials, Energy and Financials, the latter providing a hedge against rising rates.

From a regional perspective, we are overweight the US, Europe and China. US firms eked out a record number of positive surprises in the Q2 earnings season, while forthcoming fiscal stimulus will be supportive for employment, growth and equities. Even if consumer confidence has taken a hit recently, an acceleration in shipments (1% in July after 0.6% in June) suggests that business investment in equipment could offset an anticipated slowdown in consumer spending and keep the economy on a solid growth path in the third quarter. In the US, we maintain a value tilt, believing that as the Fed begins to taper, rates may grind upwards lending support to value stocks.

Europe’s Q2 earnings season was also better than expected and so far the Delta variant has had a limited impact on sentiment. Europe is typically a key beneficiary of rising inflation and interest rate expectations given its value characteristics.

Current valuation levels render China even more interesting, especially when weighed against the longer-term growth opportunities presented by the region, which also offers a stable earnings environment. While recent PMIs disappointed, we believe this was largely due to temporary factors such as flooding and new restrictions on movement to curb the Delta variant. Of course, the current regulatory overhang presents some risk and we cannot rule out further policy action. Regulating big tech and ‘the new economy’ is a global theme that is also being pursued in the US and Europe. The difference is that Beijing’s communication style has deviated from what international investors are accustomed to but we believe that the ensuing pockets of volatility offer opportunities.

Fixed Income

We are reluctant on this asset class, anticipating a gradual rise in yields, hand in hand with continued macro strength. We expect the US 10Y yield to rise further, albeit modestly in comparison with its journey thus far, and European rates are likely to move in sympathy.

We give preference to investment grade corporates (though spreads are tight and excess returns must be generated through selectivity and carry) and high-yield paper (the universe of choice for investors hunting for yield, where distressed debt levels are low and where upgrades now outnumber downgrades by the most in the last 10 years (3x) in both Europe and the US.)

In the emerging market debt sphere, we continue to prefer corporates as they offer a more effective buffer against rising real yields while flows are stickier.

Commodities

An environment of policy normalization and higher rates makes us cautious on gold. We remain positive on oil. Despite the anticipated OPEC+ decision to increase its daily output by 400k barrels per day, oil futures are nudging higher. The recovery in oil demand is expected to continue over the coming months and investors are closely watching oil prices after Storm Ida knocked out at least 94% of offshore oil and gas production in the Gulf of Mexico.

Summary

In light of our base case scenario that sees a combination of slower but continued growth, the commencement of Fed tapering, and stickier inflation, longer-term rates should gradually move higher. However, we do not believe that higher borrowing costs risk choking off growth. With the Fed unlikely to hike rates for some time, we think the yield curve can steepen from here, which is in line with our recommended overweight on cyclical asset classes and value.

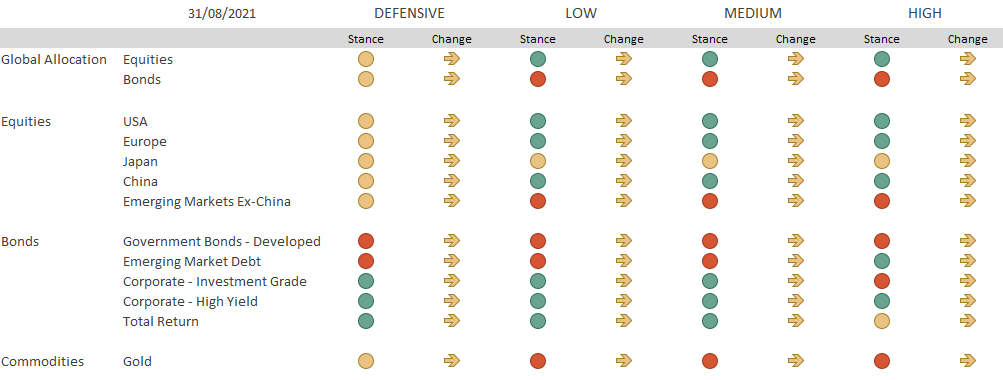

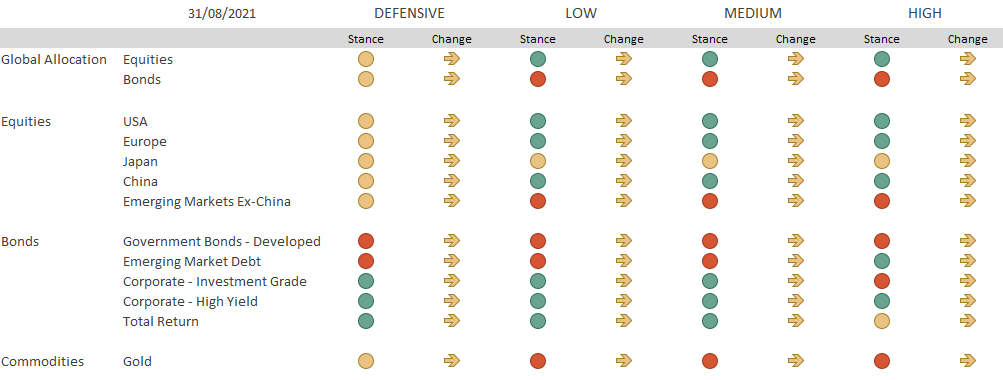

Asset Allocation Matrix

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...