Choose Language

January 16, 2019

BILBoardBILBoard January 2019 – 2019: Out of sync

Our expectation for the 2019 global macro landscape in a nutshell? Divergence. The previous theme of ‘synchronised global growth’, one that has been repeated to the point of seeming like a broken record, has played out. Now a gulf is forming between the growth prospects of the major economies, presenting an ever-more complex investment landscape.

The consensus estimates growth of 2% for the G10 collective this year, with China expected to register 6%, the US 2.6 % and Europe 1.6%. Our economists think 6% for China is fair, but believe that the US has the potential to surprise on the upside, whilst Europe will be hard pressed to live up to these expectations.

Though it has switched out of the fast lane, the US economy is still moving forward at a decent pace. Underlying its strength is a sturdy labour market (the latest jobs report showed that 312k jobs were added in December, while previous months were revised upwards too) and ebullient consumer sentiment. Headwinds exist, especially in the manufacturing sector, due to trade tensions as well as higher borrowing and wage costs: we have seen investment cool after a string of strong quarters as fiscal stimulus fades. However, current conditions should allow for stabilisation from here on out. Dedicated to prolonging the cycle, the Federal Reserve (Fed) has adopted a more dovish tone with regards to its tightening campaign, saying that it will ‘continue to monitor global economic and financial development and assess their implications for the economic outlook’ along the way. For now, the market doesn’t expect the Fed to go ahead with either of the two rate hikes that are inked on the dot-plot for 2019. It is too early to surmise about how the US-Sino negotiations will conclude on 2 March 2019, but initial press coverage has had an optimistic tinge to it. Fear of a full-blown trade war has lathered up anxiety amongst investors, seducing them towards the safety of the US dollar. An agreement on trade could therefore be a catalyst for a weaker dollar.

The EU’s saving grace is the fact that the economy is still generating jobs – unemployment fell to a ten-year low in November of 7.9%, which should keep consumption from collapsing. Aside from this, data has been disappointing, with even Germany exhibiting a more prolonged slowdown than anticipated. In view of the data, the likelihood of an ECB rate hike in 2019 is becoming increasingly remote.

Japan can only be described as ‘muddling along’, and we expect this to continue, with the consensus foreseeing just 1% growth for the year. Emerging markets have a lot of pent up potential, but ultimately, their future path will be defined by trade developments and the strength of the greenback. Whilst China’s economy is indeed slowing, we must bear in mind that the government is intervening to prop up the economy (with measures such as cutting reserve requirement ratios for banks). It should also be remembered that consumer confidence is holding up, and that if an economy worth $12 trillion in terms of GDP grows at a pace of 6%, this is still quite substantial.

So, on the whole, whilst we acknowledge that downside risks are increasing, we still believe that on aggregate, growth is still strong enough to merit an equity overweight, with a US tilt. As noted in our previous BILBoard, equity markets seem to have been over-pessimistic, and we expect that in 2019 they will become more calibrated against the still-benign macroeconomic backdrop. In fact, empirically speaking, in the late stages of the cycle – which we have entered – equities typically have a good run. It is also worth highlighting that global liquidity is still intact, and though the availability of credit is becoming more vulnerable to swings in sentiment, we don’t anticipate any liquidity crunch for the time being.

Equities

Equities have attempted a resurgence in the new year. At first, it was unclear if this was the result of bottom-feeding, or indeed a renewed appetite for risk. The outperformance of cyclicals suggests that the latter may have been driving markets.

US equities are still the best-in-class, boasting attractive earnings growth without the risk factors faced by Europe and Emerging Markets (EM). Q4 2018 earnings season is about to kick off, and analysts currently predict EPS growth of 11.4% on the S&P 500. It is true that this is a far cry from the ≈25% achieved in the past three quarters, but lower expectations leave less room for disappointment, while also bringing US equities into a more affordable price range.

We also give preference to Emerging Markets (EM). After underperforming throughout most of 2018, EMs are now beginning to outperform. Trade war worries are baked into prices, making for compelling valuations. At the same time, we see promising earnings prospects. Latin America is becoming particularly interesting, and has performed in line with the broad EM index as of late. This region benefits from having a more US-oriented economy, whilst other EMs that are inextricably linked to China are more at the mercy of any tariff truce that might be reached.

The macro picture in Europe is unappealing; on top of that you have Brexit, trade tensions (which will have an enlarged impact on a bloc so heavily dependent on exports), as well as the uncertainty surrounding Italy. Italian credit spreads affect the financial sector, which makes up 25% of the European equity market. For this reason we are content to maintain an underweight on the continent.

In terms of sectors, we favour Energy and Materials, as they usually have a good run at this stage of the cycle, when the economy is slowing; furthermore, they currently exhibit compelling valuations. Technology is also eye-catching given that valuations have come down at a time when the sector is outperforming the broad index in terms of earnings growth. With regard to style, we favour Growth, Quality and Momentum stocks, with a preference for Large Cap and low risk. These style biases will be embedded in individual stock selection.

Fixed income

Taking a bird’s eye view of the fixed income market, we do not feel compelled to increase our underweight on bonds. Yields are still expected to tick upwards – our fixed income specialists see the US 10-Year Treasury yield at 3.5% over the next 12 months, and their target for the Bund is 0.75% over the same time horizon. When yields go up, prices go down.

That said, in our lower risk profiles which have little to no equity exposure, we opt to overweight corporate investment grade (IG) bonds, preferring higher quality paper with a shorter duration. In the European market, fundamentals are still strong and interest coverage is still quite good, whilst at the same time, valuations (spreads) have approached attractive levels, above their own historical average. That said, caution is warranted due to the headwinds from the end of the ECB’s QE purchasing programme and the outflows that this is causing. With regard to sectors, we give preference to industrials over financials. Any future swivel into financials would be largely dependent on whether the ECB clarifies its tone with regard to fresh TLTRO.

Given the current level of short-term risk-free rates in dollars, we are less optimistic about US IG, where the curve pick-up is unappealing. Unfortunately for European investors, hedging costs above 3% tarnish the attractiveness of this option. European sovereigns are less tempting but we do maintain an exposure to core and semi-core government bonds inside of the bloc, as they are still the best cushion against market volatility in times of uncertainty.

All in all, growth is slowing – more markedly in some places than in others. It is important to bear in mind that a slowdown is not synonymous with a recession, and that in today’s macroeconomic environment, we can still expect equity investments to bear some fruit. We believe that equity investors jumped the gun towards the tail-end of 2018, resulting in asset prices that implied we were in the clutches of an economic downturn. In 2019, we expect equity investors to re-focus on the fundamentals, which are still sturdy in select regions. Of course, as the major economies fall out of sync with one another, a nuanced allocation becomes more relevant that ever.

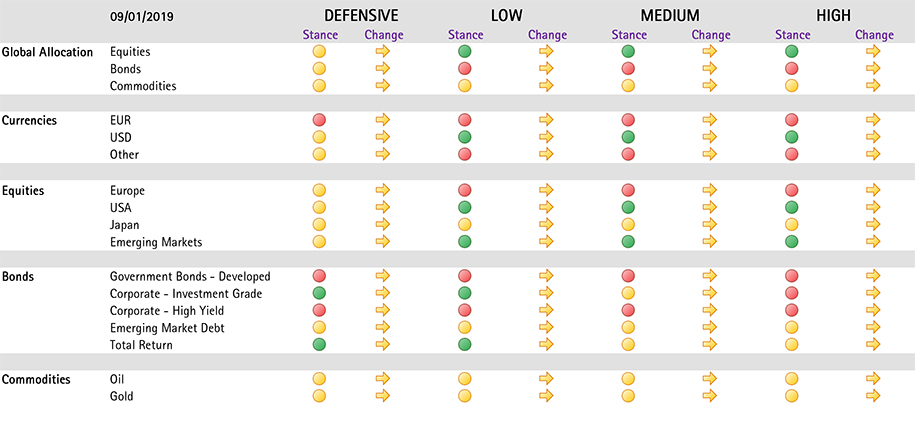

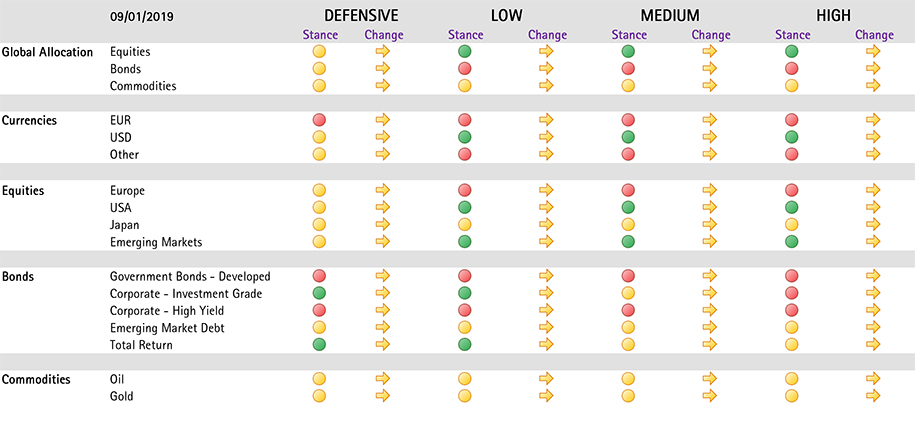

Strategic Asset Allocation

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of January 9th 2019.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...