February 23, 2024

BILBoardBILBoard March 2024 – Rate cut bets recede on brighter data

Spring is around the corner. The days are getting a little longer and brighter, while the cherry blossom tree in the BIL grounds is already in bloom. The latest economic data also has a Spring feeling about it.

As the IMF wrote in its latest economic outlook, “the global economy continues to display remarkable resilience, and we are now in the final descent toward a soft landing with inflation declining steadily and growth holding up.” Consensus expectations about the probability of a recession in the next twelve months have receded on both sides of the Atlantic.

It is the US economy that really stands out for its continued strength. Businesses are optimistic about future conditions and manufacturing appears to be catching up with services amid restocking and firm domestic demand. Consumer confidence hit a two-year high in January, largely due to the fact that the sun continues to shine in the labour market: It added 353K jobs in January, almost double market forecasts and well above the 100k per month needed to keep pace with growth in the working population, while the unemployment rate hovers at 3.7%.

The strong data we have seen so far this year gives the Fed much-needed flexibility to wait for more certainty that inflation is on a durable path towards 2%. The headline figure currently sits at 3.1%, but the services component is proving particularly sticky (+5.4% YoY), in part due to rising wage costs that companies are passing onto buyers. The good news is that market expectations for rate cuts have receded without disrupting markets. At the onset of 2024, traders banked on as many as 7 cuts this year; they now envisage only 3 to 4. This better aligns with the Fed’s dot-plot, which shows rates declining by a total of 0.75% through December. At BIL, we think three cuts this year is a fair assumption, beginning in July.

Even in the Eurozone, some mild improvements are visible in the data. With a technical recession avoided, inflation trending down and interest cuts on the horizon, sentiment is improving among institutional investors (as measured by the ZEW), consumers, and businesses. While the PMIs do not indicate an economy that is blossoming, they do indicate one that is bottoming. But not everything is rosy. Tighter financial conditions are still working their way into the real economy, with much of the impact yet to be felt. 30% of fixed rate mortgages in the Eurozone will expire this year, exposing households to higher rates. This might constrain the consumption rebound which was expected to support growth. At the same time, the construction sector remains under intense pressure, with the markets for residential and commercial real estate disrupted by higher rates and the work-from-home trend.

January inflation came in at 2.8% in the bloc, down only slightly from a prior 2.9%. Again, the key culprit is the services sector, where disinflation has stalled, with price growth coming in at 4% for three consecutive months. Linked to this, the ECB has emphasised that it needs to see wage growth slowing. Encouragingly, negotiated wage growth fell from 4.7 to 4.5% in Q4. However, to confirm whether a downtrend is setting in, the ECB needs at least another quarter of data and it won’t have that until its June meeting.

As in the US, markets have tempered their rate cut bets in the Eurozone. They now see a 65% probability of an ECB rate cut in April, down from 1.5 cuts priced in early January. At BIL, we expect the first cut to come in June or July (June would mean pre-empting the Fed but it is possible if data weakens).

In the East, China’s economy remains weak with a recovery largely dependent on government stimulus. Strong consumption during the Lunar New Year holiday should not be misinterpreted as the onset of a recovery in spending, with households exhibiting a tendency to save and spend only on major occasions. At the same time, the potential spill-over risk from US presidential election cannot be underestimated, especially for the stock market. On that same note, Beijing is pursuing stricter regulation enforcement in the financial industry; while this is a necessary improvement for the long-term development of China’s capital markets, it threatens to exacerbate already-gloomy market sentiment.

Investment Strategy

Fixed Income

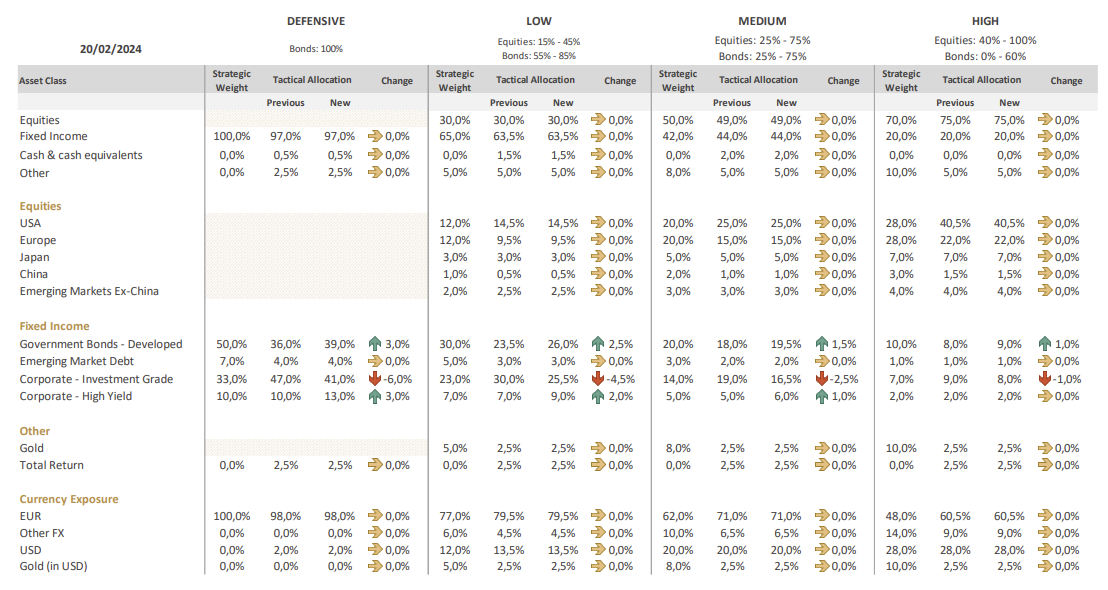

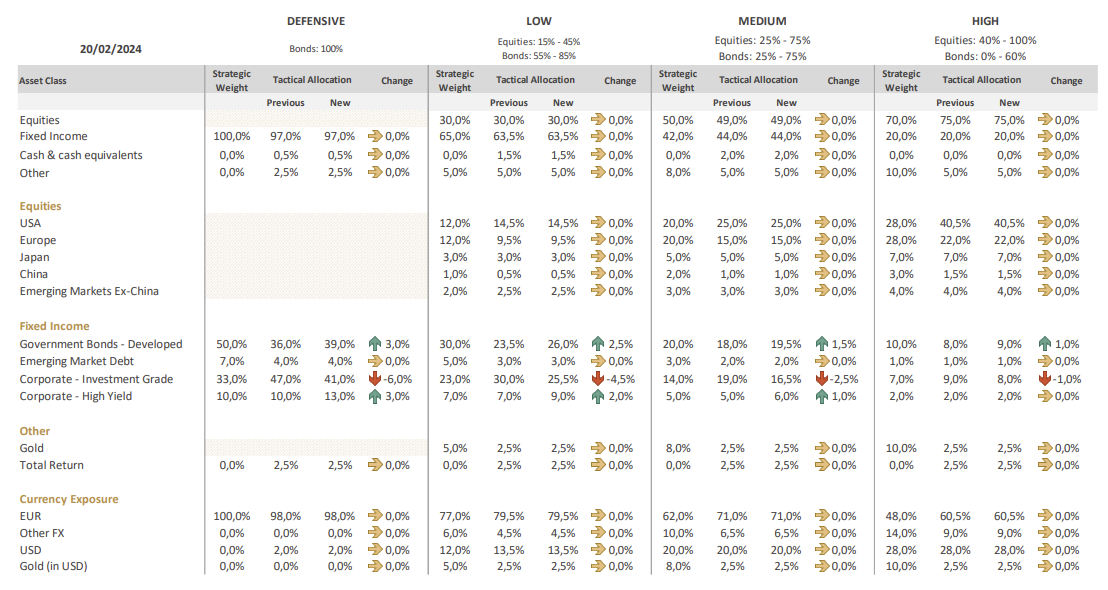

In line with our objective to gradually increase duration, we took advantage of a sell-off to add exposure government bonds. Given that European rates sold off in sympathy with US Treasuries and that the economic outlook in Europe is softer, we prefer adding to European government bonds over US Treasuries. While yields could still move marginally higher, we believe that the bulk of the upwards move has already played out. This allows us to lock in attractive yield levels before the opportunity passes, and to add protection against an economic slowdown. We financed this trade by selling all of our remaining exposure to Floating Rate Notes.

In all profiles except high (where we have more equity exposure), we trimmed our investment grade (IG) bond exposure, in favour of US high yield (HY) which offers attractive carry. High yield bonds have started the year on a positive note on both sides of the Atlantic. However, with maturity walls looming in Europe, we give preference to the US, where this issue is less prevalent. As is the case in the IG market, investors are betting on a soft landing scenario leading to tight spread levels. Momentum for HY remains strong and company guidance does not suggest we are facing a sudden slowdown. Default rates are expected to rise further this year but should remain manageable and well below the levels seen during past crises. Nonetheless, we concentrate on the highest quality bucket of the market. Note that the trades were EUR-hedged. From a longer-term perspective the USD seems overvalued against the euro and we prefer to keep a neutral exposure to the greenback.

Overall, we remain overweight on IG bonds, where technicals are very strong, with demand outstripping supply. We do note that spreads are tight though, so a small widening cannot be ruled out. European IG still trades wide over US IG.

Equities

Broadly, we maintain a neutral stance on equities, with an underweight to Europe and China, and a neutral stance on Emerging Ex-China and Japan.

We maintain our overweight to the US. Amid a 14-week winning streak (the likes of which hasn’t been seen since 1972), US equities are downright expensive. However, slashed earnings estimates create the optimal platform for US companies to beat expectations, especially with growth as strong as it currently is. We also take comfort in the fact that we still have downside protection in place (via options) should volatility arise.

The US offers unique exposure to structural themes such as AI and digitalisation. There is the possibility that we are on the brink of a new AI-driven cycle that drives efficiencies, productivity gains and higher profitability. On the back of the reshoring trend and government stimulus (CHIPs Act, IRA), American firms have been investing heavily in manufacturing capacity, AI and robotics. This already appears to be bearing fruit, with domestic productivity hitting levels unseen since 2009 (excluding the pandemic period).

Sector-wise, we keep our overweight stance on Energy (a geopolitical hedge), Consumer Staples (a defensive play), and US consumer discretionary. IT was kept on overweight with the asterisk that investors who have benefitted from the strong AI-driven rally that kicked off in October 2023, should make sure to rebalance their exposure, in order to monetise some of the gains.

The Utilities sector was downgraded from positive to neutral. The price at which Utilities companies can sell electricity is closely linked to the gas price and, as such, we might see some margin pressure moving forward. Europe entered 2024 with a record gas storage level of 86%: Weak demand has been the biggest driver due to low economic activity, and benign weather (as evidenced by our aforementioned unseasonably pink cherry tree). While rates remain high, the sector’s attractiveness as a dividend play is tarnished.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...