April 3, 2023

NewsBiotechnology – on the brink of something big?

If the 19th century was characterised by breakthroughs in chemistry, and the 20th century by big leaps forward in physics, it appears that the 21st century will be all about biology, whereby we will vastly expand our capacities in reengineering biological systems to meet our needs and address pressing global issues. Government ambitions in the space coincide with powerful drivers such as demographics, decarbonisation and deglobalisation to make this a noteworthy portfolio play for long-term investors.

Biotechnology taps into nature’s toolbox, harnessing its cellular and biomolecular processes to develop technologies and products that could improve our lives and the health of our planet. Breakthroughs in mapping the human genome have been credited with “changing the course of science”, comparable perhaps to the impact the silicon chip had on the IT sector. Now, scientists can tailor living organisms to specific tasks – for example, stem cells can be cultured in a lab, converted into the desired cell type and then surgically implanted to replace diseased tissue with healthy tissue.

Technology is a positive disruptor in biotech, with AI, big data and computer science presenting innumerate opportunities. Advances in genomic sequencing, gene editing and synthetic biology, pave the way for nothing short of a revolution in various industries including medicine, agriculture, energy, chemicals and materials, through the creation of new products and processes.

Given its far-reaching potential, the sector is quickly becoming the focus of governments. Noting that “the world is on the cusp of an industrial revolution fueled by biotechnology and biomanufacturing”, President Biden signed an executive order to advance US capabilities in the space, while requesting industries apply biotechnology to address goals such as finding climate change solutions, food and agriculture innovation, supply chain resilience and improving human health. Looking East, Beijing has listed biotechnology as one of 10 key sectors for development under its ‘Made in China 2025’ industrial strategy.

Of course, big biotech ambitions will require significant capital deployment from both the public and private spheres. The “biotech revolution” is something that should be on the radar of long-term investors as tailwinds gather strength. According to BioSpace, the global biotechnology market size is expected to be worth around USD 3.44 trillion by 2030 (from USD 852.88 billion in 2020) and the anticipated CAGR is 17.83% over the same period. In 2022, the largest portion of global biotech revenues were generated in the US, followed by Asia Pacific.

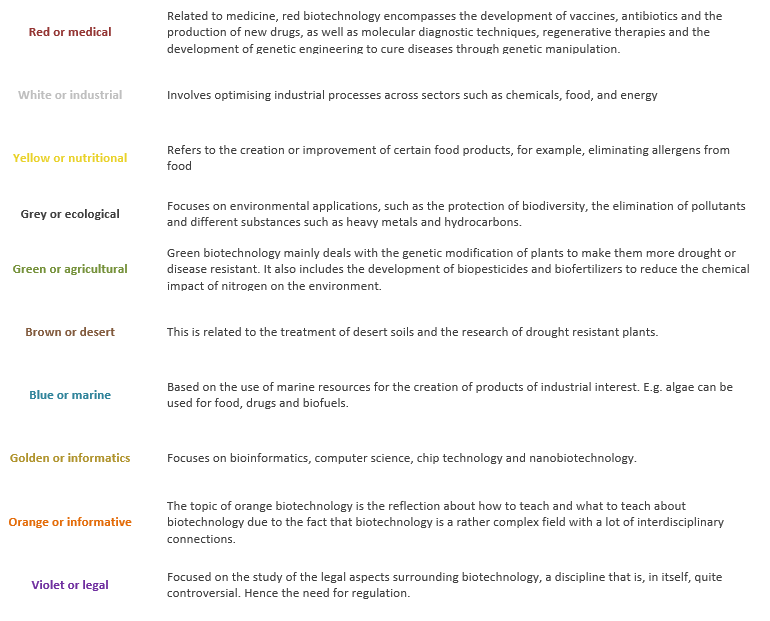

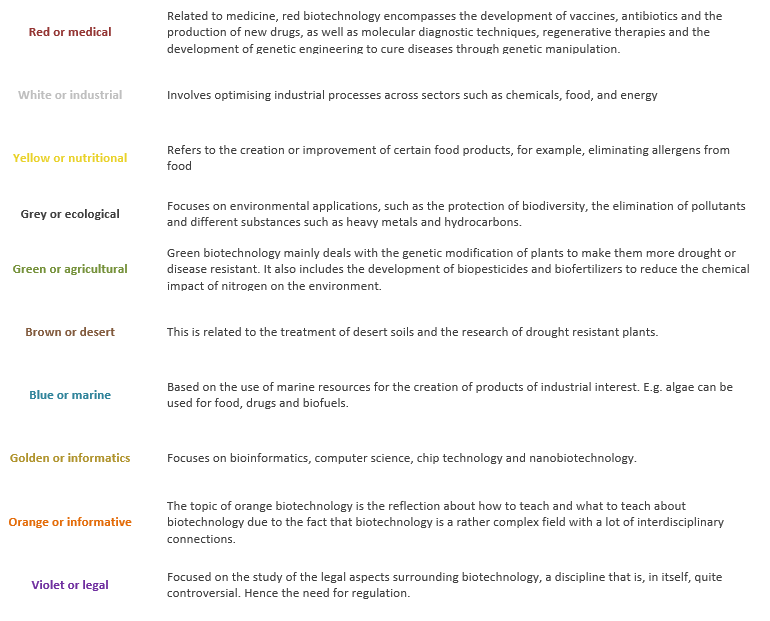

The main method of investing in the biotech sector is through stocks. However, biotechnology is a very heterogenous discipline that can be divided into as many as ten categories – from marine biotechnology to medical, each advancing at a different pace. It can also be volatile as companies within often have to take risks in developing new technologies and products. Because of this, assessing biotech investments requires more nuance than standard financial analysis. Looking at the medical sphere, much depends on whether the company will have positive test results for a potential blockbuster drug, and then whether regulators will approve the drug. Given the complexity of this theme, it therefore makes sense to lean on professional fund managers with adequate scientific and financial training. They will likely be more apt in curating a portfolio of promising names, while ensuring adequate diversification in terms of categories, geographic locations and company size (for example by having a balance between speculative, newly-listed companies in the clinical trial phase and large, well-established biotech large-caps that are less likely to succumb to bad market conditions.)

An alternative option for investors that want to capture the potential of biotech start-ups could be to take the private equity route. By not being publicly-listed, companies can avoid volatility and the public glare as they work to develop their end-products. According to McKinsey, venture capitalists have been largely focused on identifying biotech start-ups with next-generation platform technologies—such as new therapeutic delivery methods and machine-learning-enabled drug discovery. Start-ups with these technologies attracted nearly $35 billion in VC funding from 2019 to 2021, compared with $17 billion for other therapeutics such as immunology.

The 10 biotech categories:

Source: US National Library of Medicine, BIL

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...