Choose Language

May 17, 2021

NewsChina, the innovation hub of the 21st century

Over the last decade, China has distinguished itself as a rising star of global innovation. Shenzhen, the country’s first special economic zone, has emerged as a leading global technology hub on par with Silicon Valley. China has birthed its own FAMG-equivalents, with Tencent and Alibaba now household names in many parts of the world. But it seems that China is only just getting started. The country has great ambitions, ambitions that are enshrined in government policy and which could shift the locus of innovation towards the East.

A marathon, not a sprint

There is a Chinese proverb ( 一口吃不成胖子 ) used to caution against impatience for success. Literally, it translates as wanting “to get fat with only one bite”. In English we would say “learn to walk before you run.” China’s technological prowess has been decades in the making, the result of a marathon, not a sprint. Ever since the founding of the People’s Republic of China in 1949, science and innovation have been viewed as essential elements for growth. Since then, the country has worked astutely to put this policy priority into practice.

Initially, a crucial facet of Beijing’s strategy was the Torch program, an initiative of MOST (the Ministry of Science and Technology), that was approved by the State Council way back in 1988. It was designed to exploit the advantages and potential of China's scientific and technological strength and to create a favourable environment for high-tech industrial development. The program was key in grouping know-how, talent and capital in high-tech zones, including:

- Science and Technology Industrial Parks (STIPs) which cluster government resources and private sector technology talent in close geographic proximities to enable collaboration and innovation in order to develop the commercialization of emerging technologies and research.

- Productivity Promotion Centers which provide consulting and product testing services.

- Technology Business Incubators (TBIs) which support the growth of Chinese start-ups by acting as incubators.

China’s Technology Scene Today

Now, many Chinese companies have advanced to the frontiers of science and technology across many sectors, especially in areas such as high-speed railways, telecommunications, e-commerce and mobile payments.

In relation to the latter, China is moving closer to rolling out the world’s first major sovereign digital currency. It has already begun minting its own digital currency and the People’s Bank of China has distributed more than 100m worth of digital renminbi to citizens. For the Lunar New Year 2021, authorities in several cities gave away tens of millions of renminbi as new year “red packets” that could be downloaded on to a smartphone. Coincidently, the creation of paper money can be traced back to China in the 7th century, during the Tang dynasty.

China is also emerging as global leader in the field of space exploration. The country opened the 2020s by bringing samples back from the moon and sending its first mission to Mars. This year, China launched the first part of a space station. The Tianhe (meaning “harmony of the heavens) module launch was the first of 11 missions that will add two more components and carry supplies and astronauts to the station before it becomes fully operational in 2022.[1] China hopes to end the decade by launching a spacecraft to Jupiter that could include a lander bound for Callisto.[2]

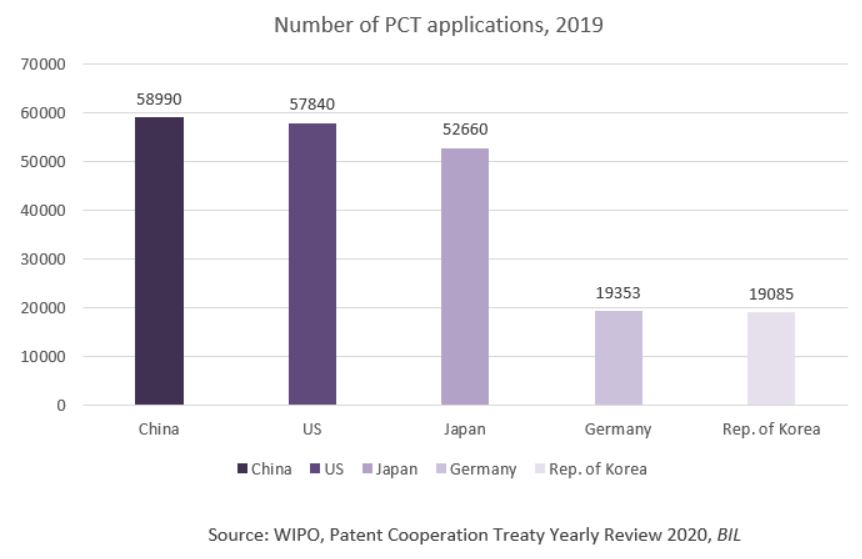

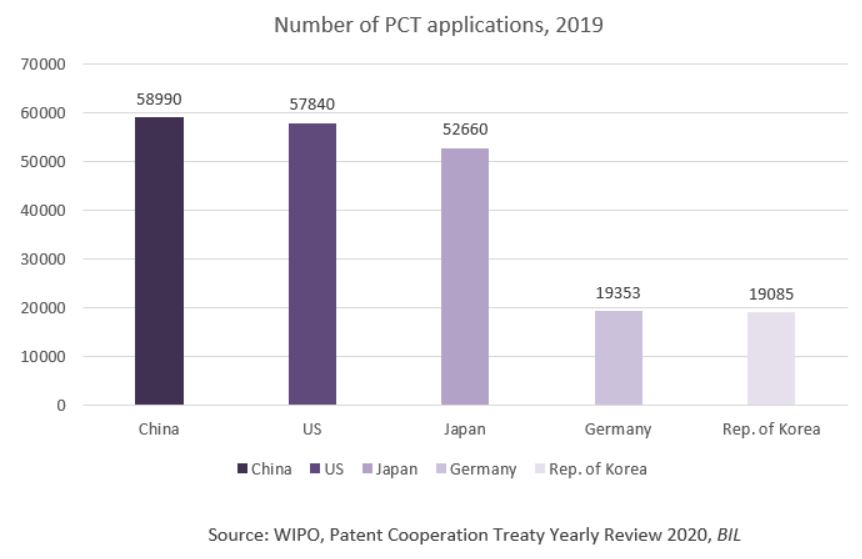

With innovation blossoming, China is now the top source of international patent applications filed with World Intellectual Property Organization (WIPO).

China’s rapid growth to become the top filer of international patent applications via WIPO underlines a long-term shift in the locus of innovation towards the East, with Asia-based applicants now accounting for more than half of all PCT applications - WIPO Director General, Francis Gurry

China filed 58,990 applications in 2019 via the WIPO’s Patent Cooperation Treaty (PCT) System, becoming the biggest user of the PCT System that helps incentivize and spread innovation. Until then, the US had held this position each year since the PCT began operating in 1978.[3]

When looking in more granularity on a cluster-by-cluster basis, it emerges that the Greater Bay Area (Shenzhen-Hong Kong-Guangzhou cluster) filed 72,259 PCT applications in 2019 (6.9% of global PCT applications), while the San Jose-San Francisco cluster (Silicon Valley) filed 39,748 (3.8% of the global filings. [4]

What about semiconductors?

Semiconductors lie at the heart of the modern economy in which China is poised to thrive. These are essentially the “brains” of modern electronics; key enablers behind a vast array of activities, from computing, to healthcare, to communication, to transportation. Current chip shortages are translating into production bottlenecks the world around and countries are now laser-focused on securing their supply chains.

Somewhat ironically, China’s semiconductor industry benefitted from trade tensions with the US. Previously, we saw a lot of Chinese tech companies relying on the US for these essential components. After Trump moved to sever links between US and Chinese firms, through necessity, the latter found alternative sources and doubled down on domestic capabilities.

Looking Ahead

Moving forward, China is set to build on the technological momentum it has already mustered as it accelerates its transformation into a major innovation hub. The latest Five Year Plan, unveiled this year, shows that research and development spending will increase by more than 7% per year between 2021 and 2025. Seven key technological areas it aims to boost were highlighted: next-generation AI, quantum information, brain science, semiconductors, genetic research and biotechnology, clinical medicine and health, and deep space, deep sea and polar exploration [5].

Running in parallel with this is the Made in China 2025 strategy. In a nutshell, this is a blueprint for making China an advanced manufacturing economy, positioning it as a dominant player in the fourth industrial revolution by pursuing home-grown innovation. Made in China 2025 targets ten strategic industries that China wants to become globally competitive in by 2025 and globally dominant in before the close of the century.

It is also worth noting that China’s recent commitment to reach peak CO2 emissions before 2030 and to achieve carbon neutrality before 2060 will be capital and innovation intensive. Already, there is a rich R&D scene around “green-tech” and this is set to proliferate.

As an example, LMC Automotive, a global data firm, estimates China will be making over 8 million electric cars a year by 2028, from 1 million last year. For comparison, Europe is on track to make 5.7 million fully electric cars by then.

As we mentioned in our previous article, China’s Growth Story: Capturing Opportunities, investors are still, on the whole, under-allocated to China relative its size, not to mention its future potential that we have outlined in this piece. China has been explicit about the fact that technology and innovation as the centerpiece of its expansive, near-term growth strategy. As such, perceptions of China as an emerging market are increasingly outdated, as it rapidly moves towards becoming a global technological powerhouse. We believe China’s ongoing, government-led transformation will trigger growth and disruption in a number of industries, bringing attractive and diverse opportunities for investors that are able to deduce where the financial rewards will be greatest.

References

[1] https://www.reuters.com/lifestyle/science/china-launches-key-module-planned-space-station-2021-04-29/

[2] https://www.planetary.org/articles/jupiter-mission-callisto-landing (Callisto is a moon that orbits Jupiter)

[3 & 4] https://www.wipo.int/pressroom/en/articles/2020/article_0005.html

[5] https://www.reuters.com/article/us-china-parliament-technology-idUSKBN2AX055

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...