Choose Language

Is Crypto Becoming Mainstream? | Part IV – What next?

Welcome to the final post in our four-part crypto series. After a refresher on what cryptocurrencies are, a discussion as to whether cryptos could replace conventional money and a look at cryptos from a portfolio management standpoint, we now tie up, taking a look at what the future could hold for digital currencies.

The promise of technology: a road towards economic efficiency

Blockchain and its underlying distributed ledger technology (DLT) [1] have the potential to fundamentally transform a wide range of industries and markets. These technologies deserve consideration beyond the crazy stories about Bitcoin’s price fluctuations: They are fascinating innovations that could improve efficiency for almost every company in every sector.

Technologically, distributed ledger technology is just a new kind of database, enabling different actors using the system to trust, making it very difficult (if sufficiently decentralized) for minority sets of actors to improperly manipulate the database. It is a baby trust system, its incipient, but it could become the foundational trust system, an automated, objective trust, allowing us to collaborate and coordinate in a much better way than our current foundational architecture permits. It has the potential to squeeze all the delays and the frictions out of our economy with natively digital trust backed into the system, versus the traditional analogue system of money, assets, security, and identity. The technology has a vast amount of potential uses in accounting, financial transactions, identity management, asset ownership, certification,… Creating efficiencies through DLT technology offers a sea change in the way we operate on regulations and laws.

This is going to be the discussion for decades to come. Technology has always been changing the rules of law and business. Smart contracts will be a revolution.

Times Square, New York

Criminality issues: ‘Regulators will make crypto less cryptic’

The most famous example of criminal activities using bitcoins is the “Silk Road”, an online black-market and the first modern darknet market, best known as a platform for selling illegal drugs. The FBI shut down the website in 2013 and seized more than $1 billion worth of bitcoins connected to it.

Cryptocurrencies can be an effective mechanism for money laundering, and regulators are beginning to sharpen their focus. Some exchanges perform extensive due diligence on customers, while others do very little. Financial institutions will be required to better assess and measure the use of crypto currency by their customers, as well as which customers are transacting with cryptocurrency exchanges. Understanding the nature and types of exchanges being utilized by customers will continue to receive more focus. In essence, Know Your Customer’s Customer will expand to Know Your Customer’s Exchange’s Customer.

Under the 5th Anti-Money Laundering Directive (AMLD), fiat-to-crypto exchanges and custodian wallet providers are recognised as “obliged entities” [2]. This means that these crypto businesses must show evidence of compliance with relevant regulations. It follows the adoption of FATF (G7’s Financial Action Task Force) in June 2019, of the U.S. Bank Secrecy Act’s so-called “crypto travel rule” as well the United States’ Financial Crimes Enforcement Network (FinCEN)’s CVC Guidance in May 2019. Other U.S. regulators like the SEC and CFTC have also stepped-up virtual asset policing, which is set to continue with the proposed Crypto-Currency Act of 2020.

The 5th AMLD defines virtual assets and related activities now as follows:

- Cryptocurrency: “A digital representation of value that can be digitally transferred, stored or traded and is accepted by natural or legal persons as a medium of exchange”.

- Virtual Currency Exchange Platforms (VCEPs): “Providers engaged in exchange services between virtual currencies and fiat currencies” – in other words, crypto-fiat currency exchanges.

- Custodian Wallet Providers (CWPs): Providers of “custodian wallets” or crypto wallet services; where they hold the users’ private keys “to hold, store and transfer virtual currencies”.

- Beneficial Owners: “Any natural person(s) who ultimately owns or controls the customer, and/or natural person(s) on whose behalf a transaction or activity is conducted.”

With crypto companies now treated as “obliged entities”, they must adhere to the same AML/CFT (Anti-Money Laundering), KYC (Know Your Customer) and data-sharing requirements as traditional financial institutions, such as monitored transactions, customer due diligence and suspicious activity reporting. These crypto entities must also be registered with each EU member country’s competent authorities, for example, Germany’s BaFin, or the UK’s Financial Conduct Authority (FCA).

Tax evasion and tax fraud are another kind of suspicious practice made possible using cryptocurrencies. The indictment of John McAfee, the antivirus software tycoon, by the US Department of Justice in 2020 for promoting seven initial coin offerings (ICOs) without disclosing that he was paid to do this, will probably become a case study for lawyers and fiscal experts.

The OECD is expected to introduce a common reporting standard for crypto assets in 2021. To combat tax fraud and tax evasion, Europe wants the same data exchange for cryptocurrencies and e-money as for other financial products.

Another potential reason a person or entity may want to move money or assets while avoiding engagement with traditional financial institutions could be to evade financial sanctions. For example, the Venezuelan government has launched a digital currency with the stated intention of using it to evade U.S. sanctions. The governments of Iran and Russia have expressed interest in doing so, as well.

What is also becoming obvious for regulators, is the need to improve consumer protection on crypto assets. According to the UK Financial Conduct Authority (FCA), people investing in cryptocurrencies risk losing all their money, warning the recent skyrocketing movement in prices could be a market bubble likely to burst soon. The regulator is clearly concerned that the big risks already inherent in crypto assets are being compounded by scam activity, as well as unregulated firms targeting consumers with marketing material that highlights the rewards, but not the potential downside, of investing in crypto assets.

Anyone tempted to invest into those virtual assets should make sure that the provider of those assets is registered with competent supervisory authority. In Luxembourg, if the issuing of virtual currencies as such is not subject to authorisation, the service provided by the intermediary – receiving funds from the buyer of Bitcoin to transfer them afterwards to the seller – is covered by the authorisation as a payment institution from the CSSF. The law of 25 March 2020 on the fight against money laundering and terrorist financing (AML/CTF law), introduces new registration and governance requirements for virtual asset service providers.

When US Treasury secretary Janet Yellen said cryptocurrencies, like Bitcoin, have been used to launder the profits of online drug traffickers and to fund terrorism, calling the ‘misuse’ of cryptocurrencies a growing problem, we should clearly understand that scrutiny of regulators is only in its infancy.

Central Bank Digital Currencies

Many central banks are worried that the widespread adoption of these independent cryptocurrencies could weaken their control over the financial system. Financial instability could be the outcome with crypto not having the legal or the regulatory safeguards that central bank money does. This ushers in the idea that central banks could issue their own digital currency.

Over the years, the concept of a virtual, decentralized currency has gained acceptance among regulators and government bodies. Although it isn’t a formally recognized medium of payment or store of value, cryptocurrency has managed to carve out a niche for itself and continues to coexist with the financial system despite being regularly scrutinized and debated.

Central Bank Digital Currencies (CDBCs) are emerging around the world at a rapid rate. Trials are in place, with central and commercial banks working together to understand how this new technology fits within the financial world they already know. The concept has been directly influenced by crypto technology and is already being trialled and tested in various proof of concept models globally.

Negative externalities: massive electricity consumption

According to N. Roubini, the value of Bitcoin should be negative “if a proper carbon tax was applied to its massive polluting energy-hogging production”.

Whether cryptocurrency systems are scalable, meaning their capacity can be increased in a cost-effective way without loss of functionality, is uncertain. At present, the technologies and systems underlying cryptocurrencies do not appear capable of processing the number of transactions that would be required of a widely adopted, global payment system. Furthermore, Bitcoin’s processing speed is still comparatively slow relative to the near-instant transaction speed many electronic payment methods, such as credit and debit cards, achieve. Part of the reason for the relatively slow processing speed of certain cryptocurrency transactions is the large computational resources involved with mining—or validating—transactions. When prices for cryptocurrencies were increasing rapidly, many miners were incentivized to participate in validating transactions, seeking to win the rights to publish the next block and collect any reward or fees attached to that block. This incentive led to an increasing number of miners and to additional investment in faster computers by new and existing miners. The combination of more miners and more energy required to power their computers led to ballooning electricity requirements.

The energy consumption required to run and cool the computers involved in cryptocurrency mining is substantial. In addition to raising questions about whether cryptocurrencies ultimately will be more efficient than existing payment systems, such high energy consumption could result in high negative externalities—wherein the price of a market transaction, such as purchasing electricity, may not fully reflect all societal costs, such as pollution from electricity production.

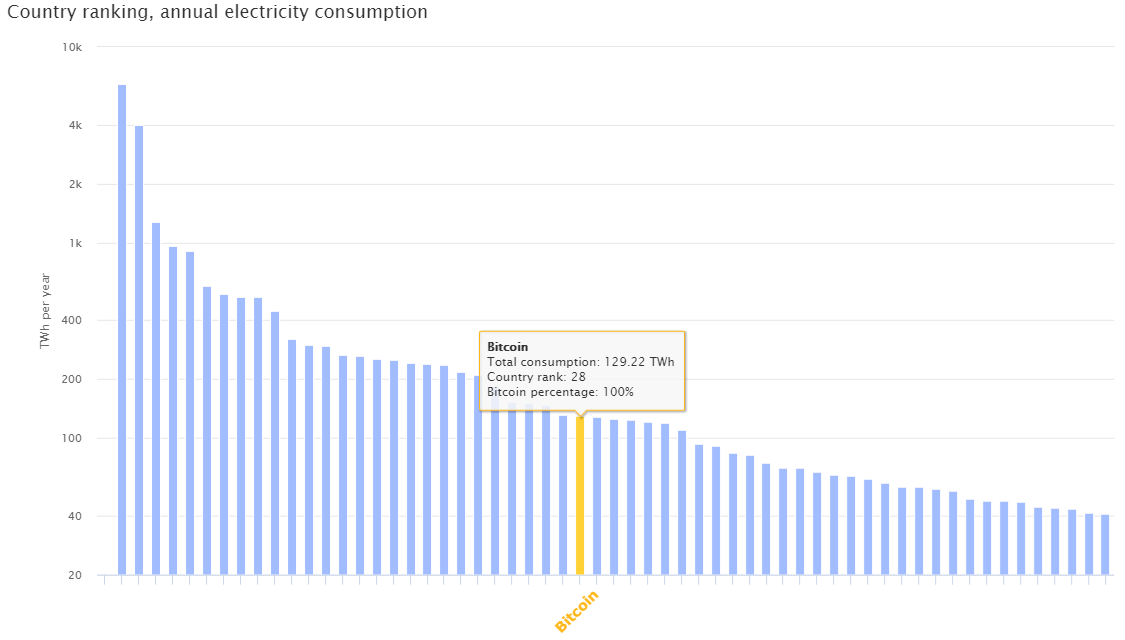

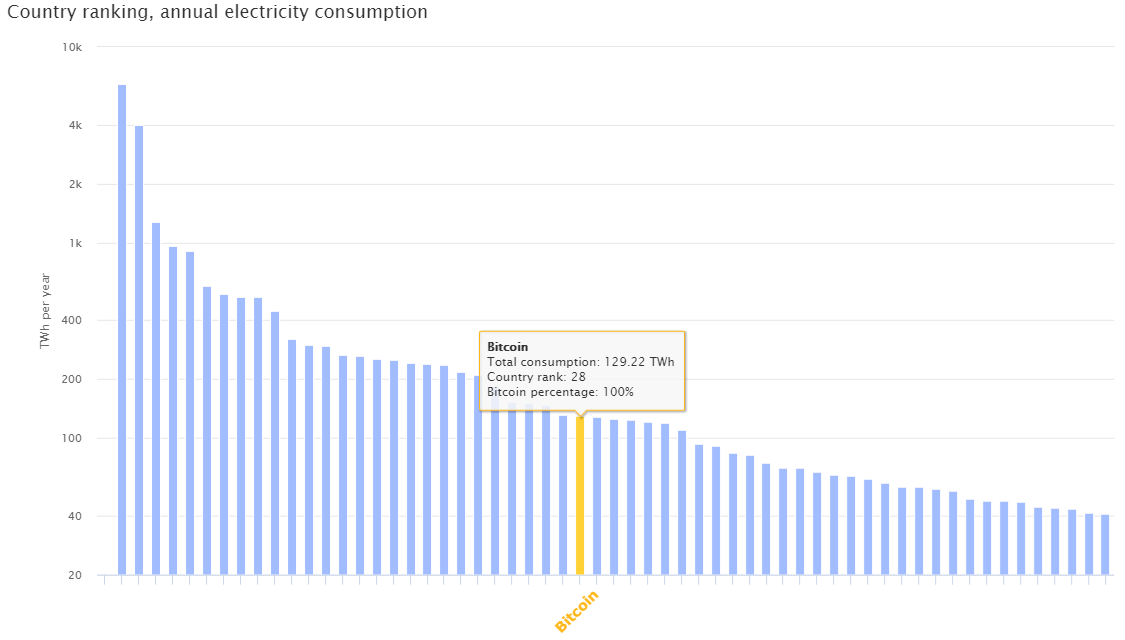

According to the University of Cambridge, If Bitcoin was a country it would be around the 28th highest annual electricity consumer in the world, using more than the entire population of Holland or Argentina.

Graph 4: Bitcoin electricity consumption

Source: Cambridge University

Conclusions

When discussing digital currency, everyone understands that as of today most of our transactions are already digital. Cash via coins and banknotes is now marginal when looking at their proportion versus the total money supply in the system.

We observe evidence that cryptocurrency, once the domain of outsiders, is moving closer towards the mainstream, where major companies, governments, institutional asset managers (hedge funds, asset managers and pension funds),.. are confident enough in its future to either use it or talk it up. Bitcoin’s institutionalisation is at strange odds with its success as black-market money. But the fact is that a growing number of institutional investors seem to be taking Bitcoin seriously. Some of those institutions are adopting the ‘digital version of gold’, in the perspective that we are still in the early days of a price discovery process.

Bitcoin and other cryptocurrencies have all the attributes of bubbles but have been 'the big thing' in the financial industry for more than a decade. As of today, the madness of crowds is in high gear. The gains witnessed recently, in less than a year, are illogical. A probable effect of lockdown is a growing mistrust of governments, creating a perfect storm for Bitcoin - or it could be that people simply have more time on their hands to dabble in this market.

A generation of investors have leapfrogged traditional savings and investments and jumped straight into the deep end by buying cryptocurrencies. Tesla’s recent Bitcoin buy-in shows that a large additional buyer entering the market can boost the cryptocurrency’s price significantly. But an exit by a single important player would likely have a similar impact in the opposite direction. Positive or negative opinions voiced by market makers will have significant effects on bitcoin’s price.

Lacking any obvious fundamental value anchor, Bitcoin is likely to remain a textbook example of excess volatility. This will not change with time. Bitcoin will continue to be an asset without intrinsic value whose market value can be anything or nothing. Only those with healthy risk appetites and a robust capacity to absorb losses should consider investing in it.

The big picture is probably a question of trust. Do you trust the code, or do you trust the issuer?

Footnotes:

- Blockchain and DLT are not the same. A distributed ledger can work without a blockchain. Blockchain is just one form of DLT.

- Currently, “obliged entity” refers to specific financial institutions and businesses, which are:

- Credit institutions

- Financial institutions and money service businesses

- Financial and legal entities: auditors, accountants, tax advisors, notaries, independent legal professionals, trust and company service providers, gambling service providers and individuals who conduct cash transactions exceeding €10,000

- Fiat-to-crypto exchanges and custodian wallet providers

- Art dealers, and real estate agents acting as transaction intermediaries where the combined value is over €10,000

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...