June 8, 2023

NewsSell in May and Go Away?

As summer approaches, some market participants might have recently contemplated the old investing adage “sell in May and go away.” This is the notion that investors should cash in their equity investments and take a summer break, re-entering the market around Halloween. In days gone by, some studies implied that stocks performed better between 31 October and May. We ran the numbers on a more recent dataset to see if the theory still holds up…

It is believed that the practice of selling shares in May originated in high society England, around 1700. The full version of the phrase is ‘sell in May and go away, come back on St. Leger’s Day’. This is a reference to the St. Leger Stakes horse race that is held every year mid-September. Back then, investors in London tended to sell their stocks before relocating to their country homes for the summer months where they would not be able to monitor them.

This, in turn, would have caused a market slump and then a subsequent lull in trading. With summer over, investors would return to the city and reopen their positions on the stock market, causing a lurch upwards in prices and a return of liquidity.

Fast-forwarding to the 21st century, summer still usually brings lower liquidity on markets. Long-run studies stretching as far back as 1928 have found that selling in May and coming back in October has not been a bad strategy on the S&P 500: The lowest average and median returns were prevalent in May through October. However, the results are slightly skewed by the fact that some of the worst days for performance in stock market history occurred in October, two of which were during the crash of 1929, and the other was the 1987 Black Monday crash.

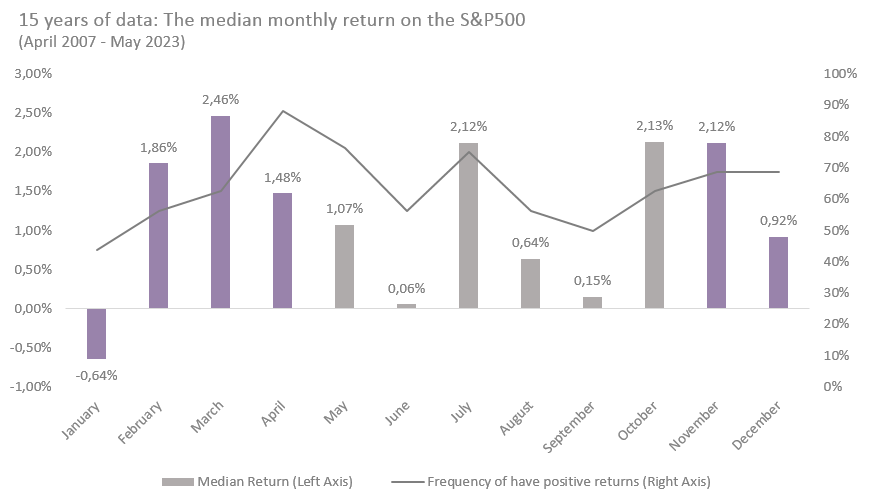

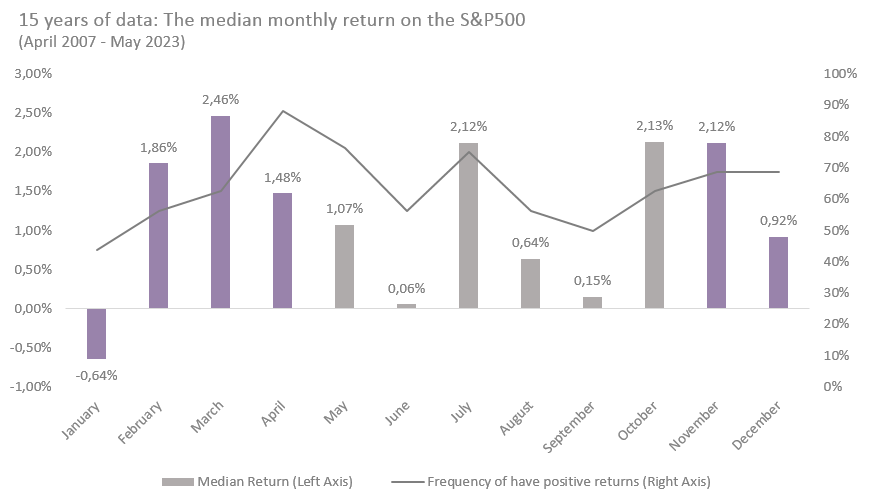

We ran the numbers on a more recent data set – going back fifteen years – to understand if it is still relevant. The results suggest that in modern times, at least on US markets, the adage may be more rhyme than reason.

Source: Bloomberg, BIL

Our findings show that during the period of interest, May – October, median returns were in fact positive, on average.

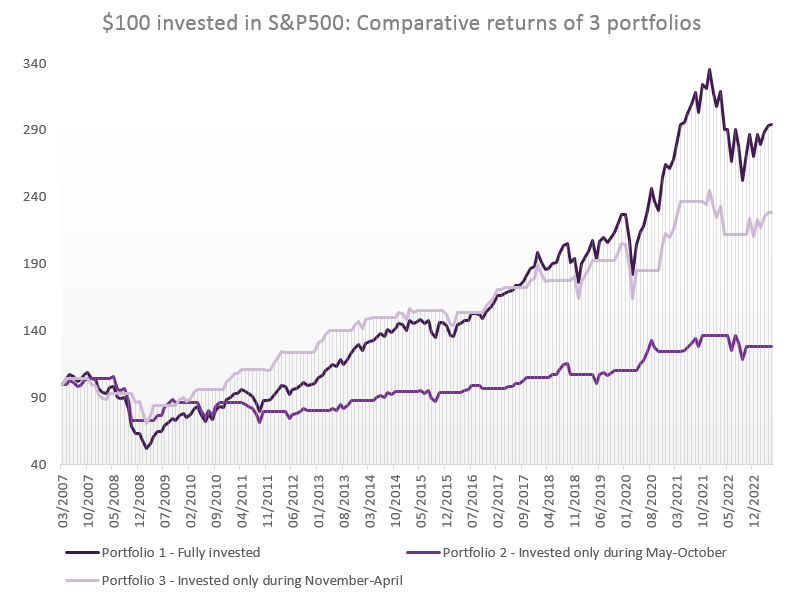

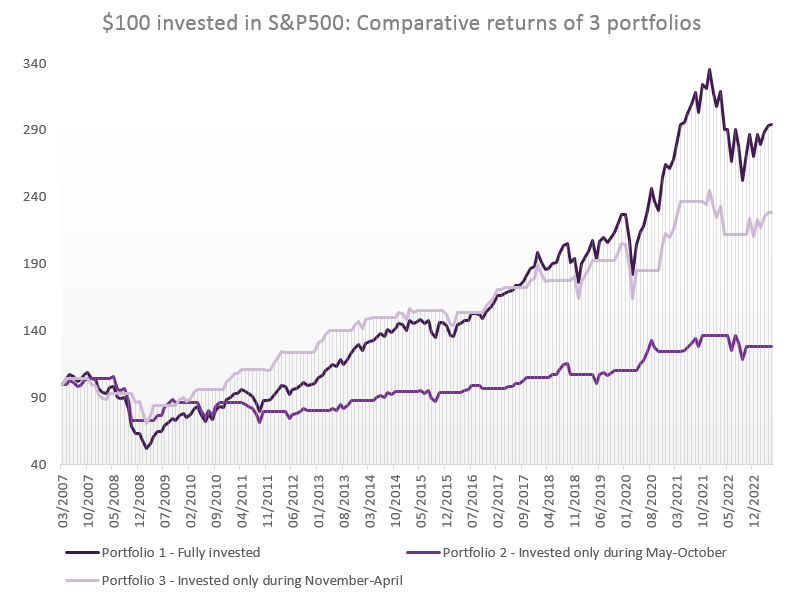

We then built three hypothetical portfolios: one that stayed fully invested ignoring the “sell in May” maxim, a second that invested from May-October each year and a third that invested from November-April each year. Each started out with a sum of $100.

Source: Bloomberg, BIL

Across the fifteen-year timespan, the portfolio that invested during the colder months clearly outperformed the ‘summer portfolio’. However, the portfolio that remained systematically invested throughout the year outperformed. Note that this is without considering the trading costs to exit and re-enter the market.

The risk of using portfolio 3 rather than portfolio 1 is to miss out on moments of market momentum. This was illustrated, for example, during the recovery from the pandemic shock in 2020 and 2021, when the May-October period performed particularly well.

It is notoriously difficult to time the market. Getting out at the right time before prices fall is hard enough, but then on top of that you have to reinvest before missing the recovery for the attempt to really pay off. Any time you switch into cash, you risk being on the sidelines when you could've been earning compound interest or when the market has some of its best days.

Moreover, trying to partake in seasonal effects is like gambling: As the small print on every financial document always says – past returns do not guarantee future performance. There's no assurance that a particular year will closely align with the long-term averages. Each year is unique with its own macro landscape, business cycle, and market environment that differentiates it from the past. Rigidly following calendar trading patterns without considering, for example, the ever-evolving earnings outlook and your unique investing goals and risk constraints, is not a wise strategy.

The summer effect might also be losing relevance in an increasingly digitalized world. Algorithmic trading now accounts for about 60-75% of overall trading volume in US equity markets. Machines don’t go on vacation!

As the movie Wall Street said – money never sleeps. We could also conclude that it doesn’t take summer holidays.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...