April 26, 2023

FocusThe Eurozone’s Wage Conundrum

The Eurozone, like many other jurisdictions, has undergone an inflationary shock, resulting in declining real wages. As workers try to recoup lost income, the risk is that consumers will foot the bill and that inflation becomes self-fulfilling…

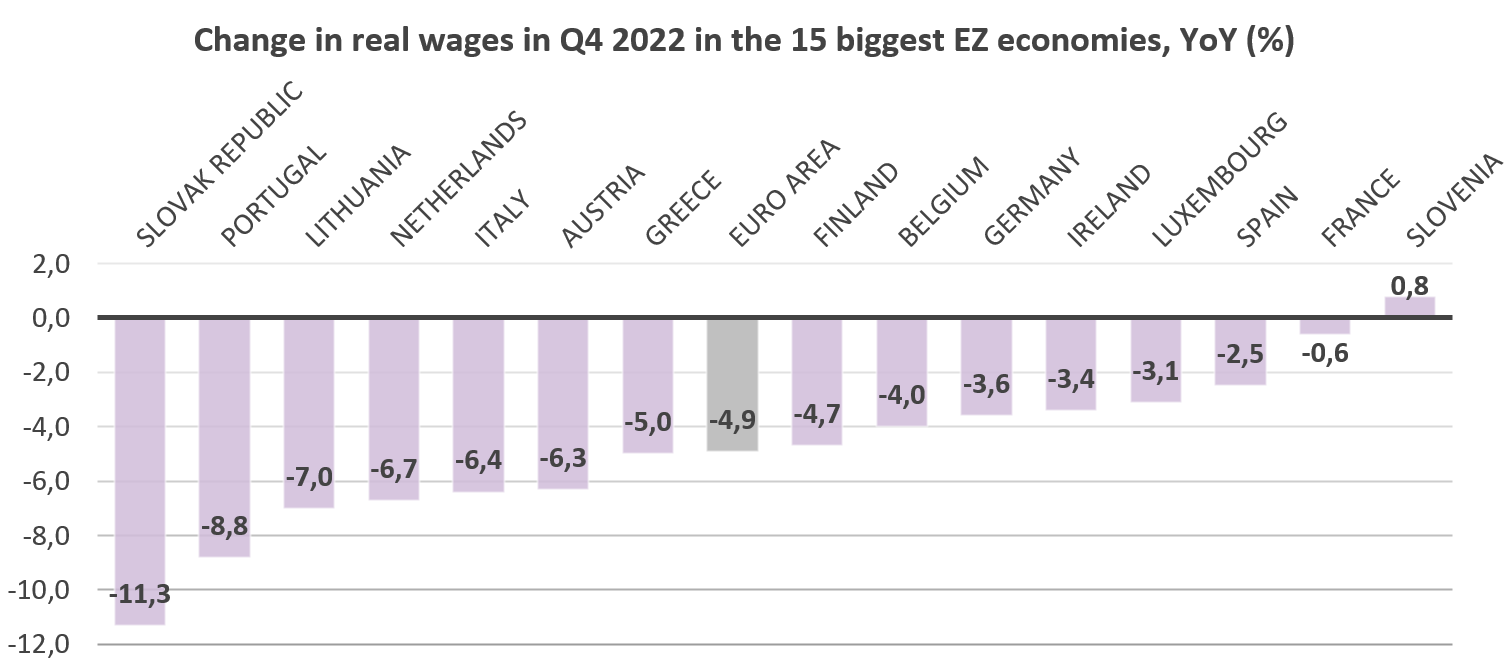

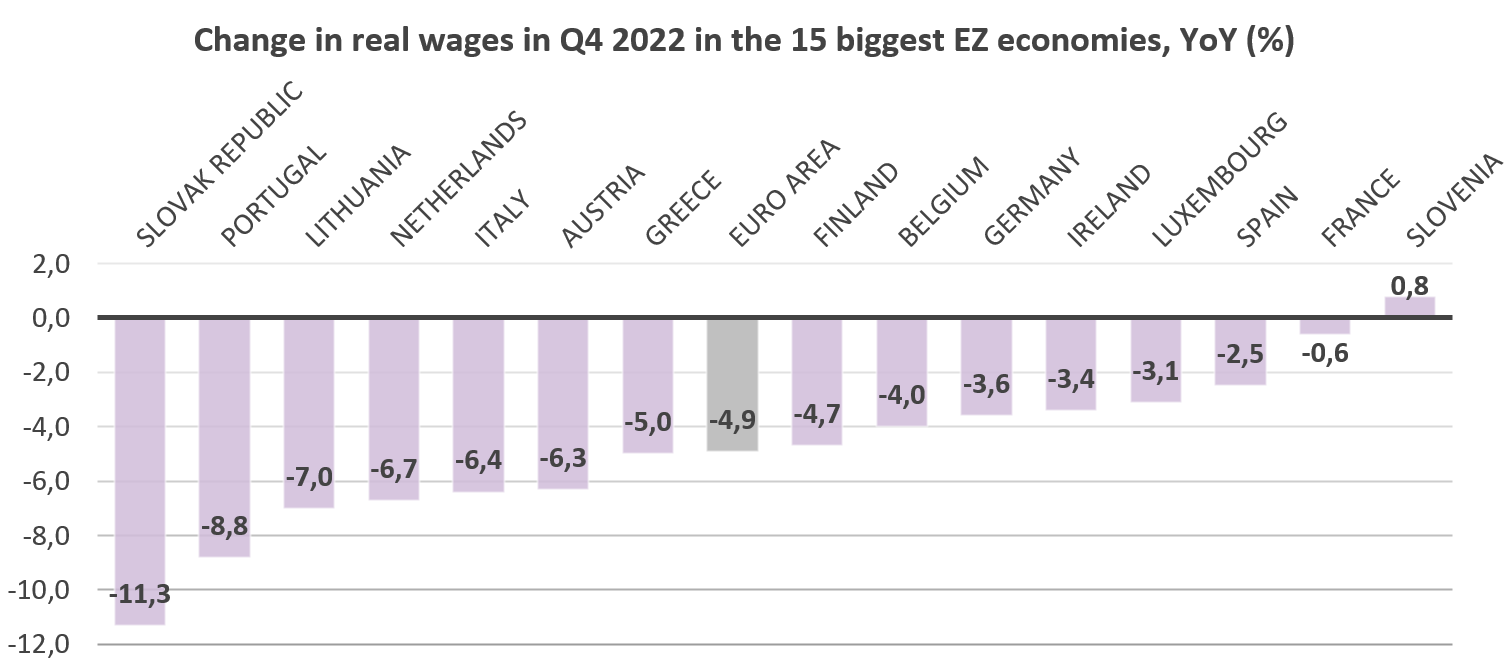

The decline in real income has been felt unevenly across the bloc due to various factors such as heterogeneity in government measures to shelter households from inflation, structural nuances and the differing cyclical positions of countries… In some states, purchasing power has been protected to a greater degree due to wage indexation. Here in Luxembourg, for example, whenever there is a 2.5% change in the CPI, wages are normally automatically adjusted by the same percentage. Similarly, in Belgium, salaries are tied to a so-called health index, which is essentially the CPI excluding certain products such as tobacco, alcohol and fuel. While France ceased indexation to avoid price-wage spirals, the minimum wage remains indexed to inflation, and serves as the foundation for the entire low-wage structure in the country. Real wages in France are amongst the “highest” in the bloc due to generous fiscal measures to protect households from rising costs.

Source: OECD, BIL

For countries that do not have automatic wage indexation, trade unions have played a role in securing higher pay for workers. In Germany, for example, in November last year, employers and unions in the manufacturing sector agreed to increase wages by 8.5% for almost 4 million employees. These measures were complemented by an increase in minimum wage from EUR 9.82 to EUR 12 in 2022, benefiting around six million of the country's 45 million workers. Collective bargaining is still ongoing in Europe’s largest economy, especially in the transport sector.

Because of these various mechanisms, hourly labour costs in the Euro Area surged by a record 5.7% in Q4 2022 from the same period in 2021. Among economic activities, labour cost growth was the highest in construction (6.9%), followed by services (6.2%) and industry (4.4%).

Until now, higher wages have not been enough to offset the increase in the cost of living, however, with the labour market still very tight and a severe energy crisis averted, workers are emboldened to use their bargaining power to recoup lost income – understandably.

However, looking at the bigger picture, this births a real risk of entrenched inflation. While headline inflation is likely to decline sharply this year, driven by falling energy prices, base effects and easing supply bottlenecks, underlying inflation dynamics remain strong. The ECB projects that it will be at least 2025 before inflation falls back to its 2% target. If wages continue to rise unchecked to bridge the gap, progress made in bringing down inflation could be undone. Why? Employers are likely to pass these higher costs on to consumers, and in turn, prices would continue rising, igniting a self-fulfilling feedback loop.

According to the ECB, wage pressures are already fuelling core inflation (which continues to hit new all-time highs, most recently 5.7% YoY). While wage-sensitive items contributed only around 0.5 percentage points to core inflation before the pandemic, that contribution has more than doubled in recent months. This is not so problematic for goods, as wages represent only around 20% of direct input costs for manufacturing firms. Contrarily, wages account for roughly 40% of direct input costs for services providers, and services inflation accounts for almost two-thirds of core inflation!

Cognizant of this, it is easy to understand why central banks are wary about a wage-price spiral taking hold. The key risk, as Lagarde herself has pointed out, is that employers and workers both try to minimise losses to their margins and their paycheques. This risk of such a “tit-for-tat” dynamic is heightened by the fact that labour markets are exceedingly tight with competition for workers high.

As the ECB pursues its “non-negotiable” goal of bringing inflation back down to target, wage growth will therefore be a key determinant of how much tightening is required, and ultimately, of whether the Eurozone faces a hard or a soft landing.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...