Choose Language

August 1, 2019

FocusThe Future of the Automotive Industry: Part III

The Future of the European Automotive Industry

Trends, challenges, risks and opportunities from an equity market perspective

Interview with Lars Mogeltoft and Arman Arshakyan

In an extensive interview, we spoke to Lars Mogeltoft, Head of Equity, and Arman Arshakyan, Equity Associate, in order to gauge what is happening inside of the European car industry.

The first in the three part series set the scene, detailing the current state of the industry and the key trends shaping the landscape. It also outlined the vital role that this sector plays within the European economy.

The second part delved deeper into the challenges faced by automakers.

And now, in the last of the set, we will tie all of this up and assess what it means for equities.

Part III: Implications for equities

So in the last section, you outlined the various challenges faced by European automakers, and indeed the situation seems to be pretty ominous. What has this meant for their shares?

The Automobiles & Parts Index was the second-worst performer in the Stoxx 600 index in 2018 as the transition to electric vehicles, the move away from diesel, forex and tariffs hit margins, causing earnings to decline from their 2017 peak.

Since the start of 2019, the sector has lagged the broad market, but to a lesser extent than in 2018.

What could act as catalyst for a revival, if any?

Perhaps consolidation as called for by the late Fiat chief executive Sergio Marchionne...

He was quoted as saying: “We have failed collectively as an industry to deliver value commensurate with the level of capital that is being consumed… Consolidation is the only key to remedying the problem in the short term.”

Already we are seeing collaboration in the area of autonomous driving, for example the Argo AI start-up initially sponsored by Ford, has become a 50/50 joint venture (JV) with VW, with Ford gaining access to VW’s electric vehicle platform. This may just be the beginning, because once such operations start to become profitable, M&A is likely to supersede JV activity. The JV is like the engagement, M&A is the marriage once profitability is proven.

However, it is not always straightforward as we saw when the Fiat Chrysler/ Renault merger fell through (largely because of insistence from the French government for the Nissan alliance to continue). This came as a clear reminder that change is complicated for traditional car makers.

But what about the example of VW, who confirmed it would shed its truck division before the summer as part of a broader disposal program of non-core assets?

This should be thought of as a spin-off, with the company doubling down on its core operations.

And what about consolidation in China?

There were about 100 car manufacturers and now Beijing is pushing the idea of ‘quality not quantity’. However, this is more driven by the demand side, with consumers favouring smaller cars and SUVs produced by foreign companies.

Company guidance and consensus estimates for 2019 seem to be heavily back-end loaded, assuming a notable bounce back in sales and production in the second half of the year. Should this worry us?

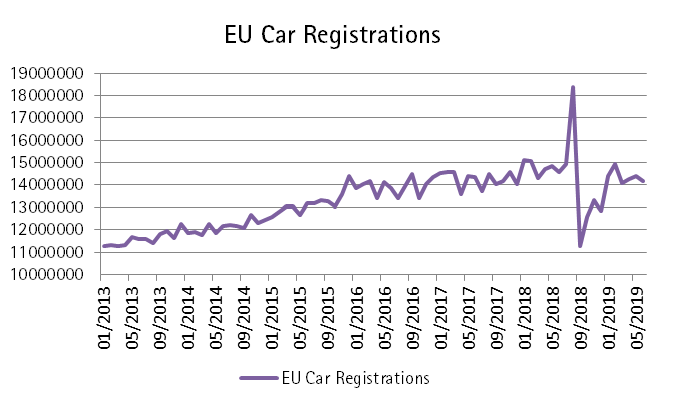

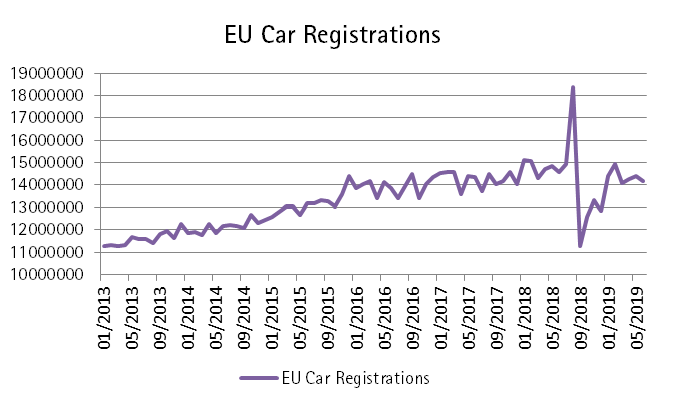

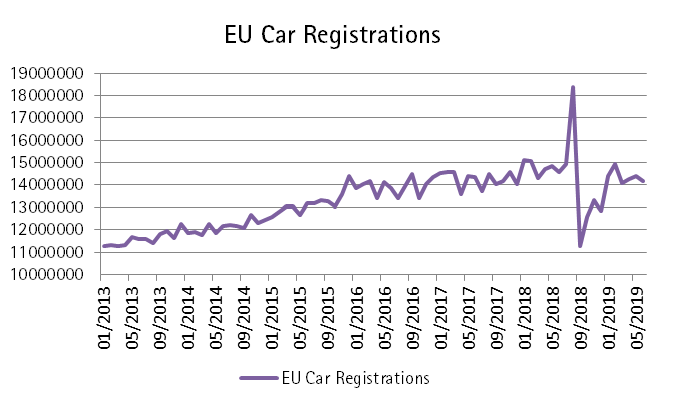

Every time ROE in the car industry is lower than the market average, the stocks under-perform, no matter how cheap they are. It’s important to keep in mind that in August 2018, car registrations in Europe got an artificial boost from the implementation of the new WLTP test that was applicable on all new cars from 1st September 2018. This led most manufacturers to offer pre-WLTP vehicles at huge discounts. This is visible in the incredible sales volumes recorded in August 2018, quickly followed by a sharp reversal the following month and since then, some sort of normalization. Hopes of a notable bounce back in sales have been dashed, but a positive base effect will kick-in from Q4 2019 in Europe. The same is currently true for China, where we will need to stay patient to get a better understanding of registration trends (with current figures skewed by the onset of regulation).

Are car manufacturers cheap?

Car manufactures are trading at a 15 year low (in terms of valuation) against the market, around a 30% discount to the overall market on P/E metrics.

Fundamentally they look in OK shape: They have a high free cash flow yield, their balance sheets are the strongest they have been for 2 decades and they have a relatively high ROE.

However, though they are cheap, there is a lot of risk and their valuation implies that investors are nervous about the current and future profitability. The industry is extremely capital intensive and R&D costs as well as increasing regulation are putting pressure on margins. At the same time, sales volumes are not going up, compelling them to offer incentives. Historically the shining margins of BMW (around 10-12%) are under siege and expected to go down to around 6-8% this year.

As long as relative earnings revisions are lower than those of the broader market, we should not expect any out-performance, no matter how cheap auto firms are. Valuations give some kind of bottom, but the trigger for out-performance will be if relative earnings revisions begin to go up again.

What about part markers?

Auto part makers are worth almost double car manufacturers. This is because they are not subject to the same risks and price pressures. If the economic cycle turns, people may hold off buying cars, but there will always be a demand for things like tyres – they are therefore less exposed to the trade war. Car manufacturers also have to compete with the second-hand car market.

This explains why part makers are more expensive in terms of valuations. We would give preference to them but acknowledge that at some point, the spread in valuations between auto producers and part makers will have to narrow.

So, is the sector cheap or simply too dangerous ?

Over the long term, we still expect growth, despite structural challenges. Keep in mind that the average vehicle age is around 11 years in both Europe and the US. So even mature markets can still offer structural growth

Recent results from BMW (first loss in a decade in its main automotive division) and Daimler (fourth consecutive profit warning in just over a year) are clear illustrations of the challenges facing the industry.

European car registrations fell sharply in June. While the industry group blamed this on ‘fewer working days during the month’, the weak showing adds to the gloom enveloping the sector, with year-to-date demand down 3%. The European industry association already revised its prediction for the full year 2019 and expect to see a 1% drop in vehicle registrations.

Valuations are appealing but a catalyst for being positive the sector is needed. This could take the form of a settlement being reached in the trade dispute, or a confirmation of the anticipated positive base effect in car registrations expected for Q4 2019.

What companies offer a reasonable risk/reward ?

We prefer firms that are primarily exposed to the European market and as such, are less sensitive to tariff risks. We also keep an eye out for companies that are pursuing successful acquisitions, selecting companies strategically, making sure that they fit nicely into their existing operations.

- https://www.acea.be/uploads/publications/ACEA_Pocket_Guide_2018-2019.pdf

- https://home.kpmg/be/en/home/insights/2019/01/the-future-of-the-automobile-industry.html

- http://www.german-times.com/the-automotive-industry-is-facing-major-challenges-around-the-world-german-carmakers-have-more-to-lose-than-most-and-are-thus-investing-a-great-deal-in-securing-its-future/

- https://www.astutesolutions.com/industry-insights/automotive-industry

- https://www.economist.com/leaders/2017/04/06/the-perilous-politics-of-parking

- https://www.candriam.lu/en/professional/market-insights/topics/sri/long-live-our-batteries/

- https://www.scmp.com/news/china/economy/article/2088876/chinas-more-300-million-vehicles-drive-pollution-congestion

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...