March 7, 2024

NewsWeighing the impact of global warming on Europe’s winter economy

It’s peak ski season, but snow sport aficionados are arriving on European slopes to discover that a crucial ingredient is in short supply: snow. In the Alps, the world’s most popular ski destination, regions that depend on ski tourism are in a race against time to future-proof their business models.

The Alps are Europe’s most extensive mountain range and the world’s most popular snow sport destination. Attracting over 40% of global ski tourists each year, its snow sport industry is big business, with an estimated value of 30 billion euros. Local communities tend to be strongly dependent on the income from this spatially concentrated economic sector.

The risk of rising temperatures

Dwindling snowfall, however, means the industry’s future is increasingly uncertain. Temperatures in the Alps have risen by just under 2°C over the past 120 years - almost twice the global average. In some resorts, the effects of this are in plain sight, with skiers greeted by thin ribbons of snow on otherwise brown hillsides. The past twenty years have seen an average snow cover duration of just 215 days in the region – that’s 36 days fewer than the long-term average measured over the past six centuries. [1]

The risk is that warming becomes self-fulfilling: As areas covered with ice and snow (which reflect the sun’s rays) shrink, underlying rock and vegetation absorb the sun’s heat and contribute to even more melting.

As of now, the world is off-piste when it comes to the Paris Agreement’s goal of limiting global warming to well below 2°C above pre-industrial levels. The latest Emissions Gap Report from the UN Environment Programme finds we are on track for a 2.5-2.9°C rise this century.

A study of 2,234 ski resorts in 28 European countries [2] finds that 53% would risk running out of snow with global warming of 2°C. In this scenario, lower elevation resorts would be the most vulnerable. Those at higher elevations might survive but it is likely that they become increasingly unaffordable and exclusive. With warming of 4°C, the number of resorts at risk rises to 98%.

In a sign of the times, last year, the real estate company Savills’ rolled out a Ski Resilience Index. It ranks ski resorts on five factors: season length, altitude, temperature, snowfall and reliability (i.e., “the standard deviation of snowfall”). Resilience (usually found at higher altitudes) is increasingly important to buyers. We do not envisage a collapse in property prices, but a clear premium can be expected for real estate that is, at least for the near-term, immune to the impact of global warming.

Mitigation and adaptation

A lack of snow, decreasing snow depth and waning snow reliability could have a grave economic impact for winter tourism in the Alpine region. Faced with an existential crisis, the region’s ski resorts must pursue a combination of mitigation and adaptation strategies, striking a balance between business continuity and sustainability.

While ski resorts cannot combat global warming alone, mitigation involves doing what they can to minimize their own environmental footprint. For example, banning cars, encouraging public transport, and striving to use renewable energy wherever possible in resorts (for example, in hotels and to power ski lifts). To encourage sustainable travel, some stations now offer an “Alpine express pass” which gives discounts for snow passes, ski guides, and spas to people who travel to their holiday by train. There are, however, calls for a stronger industry-wide sustainability framework.

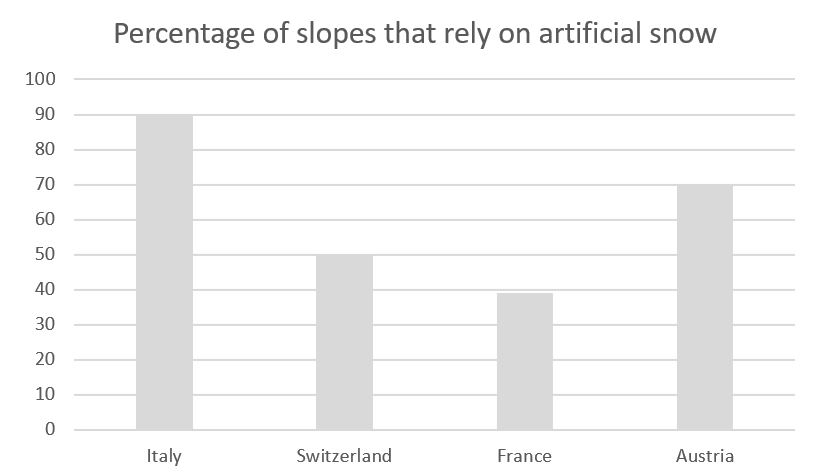

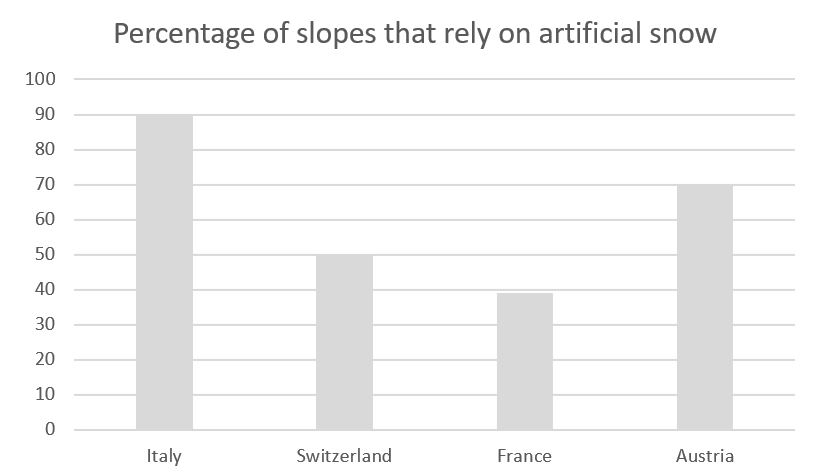

When it comes to adaptation, snowmaking is the most obvious example. This involves deploying artificial snow machines to “top up” areas where snow is too scant to ski upon. As seen in the chart, this method is widely used across Europe.

Source: Italian Green lobby Legambiente, Reuters, BIL

However, it is not a silver bullet. Firstly, it is expensive. Secondly, artificial snow can only be produced when temperatures stay below 1C, as the air has to be cold enough that the expelled water droplets freeze and turn into snow particles. This month, in Italy's Apennine Mountains it was simply too hot for snowmaking to be effective. Thirdly, artificial snow use at scale might detract from mitigation efforts given the amount of energy and water it entails.

In 2022, the Bank of Italy [3] wrote a report on climate change and winter tourism. It acknowledged that snowmaking might not be enough to sustain tourism flows, concluding that while man-made snow can reduce the financial losses from occasional instances of snow-deficient winters, it cannot protect against systemic long-term trends towards warmer winters. This led the bank to call for a more comprehensive approach to adaptation strategies. Resorts will increasingly need to diversify activities and revenues, for example, by promoting four-seasons tourism and investing in weather independent activities such as hiking and biking, as well as educational and health events.

A junction between passion, science, and economics

Recent ski conditions in Europe are a tangible reminder about the impact of climate change on our everyday lives. The ski industry finds itself at a junction where passion, science and economics collide, and if it fails to find a sustainable balance between the three, mountain regions might eventually have to contemplate life and business aprés ski.

To strike that balance, resorts are slaloming between adaptation and mitigation strategies, but some advocate that more formal governance of the industry is required.

References

[1] Carrer et al. (2023) “Recent waning snowpack in the Alps is unprecedented in the last six centuries”, Nature Climate Change, https://www.nature.com/articles/s41558-022-01575-3

[2] François, H. et al. (2023) Climate change exacerbates snow-water-energy challenges for European ski tourism, Nature Climate Change, https://www.nature.com/articles/s41558-023-01759-5

[3] https://www.bancaditalia.it/pubblicazioni/qef/2022-0743/index.html?com.dotmarketing.htmlpage.language=1&dotcache=refresh

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...