July 24, 2023

NewsWhat’s weighing down the German economy and what does it mean for Europe?

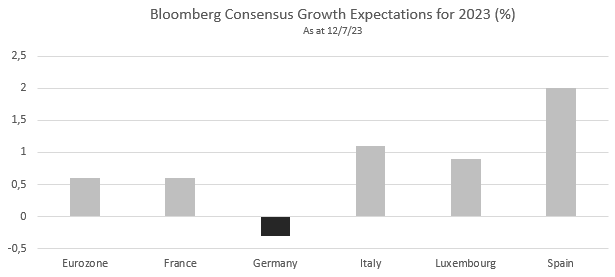

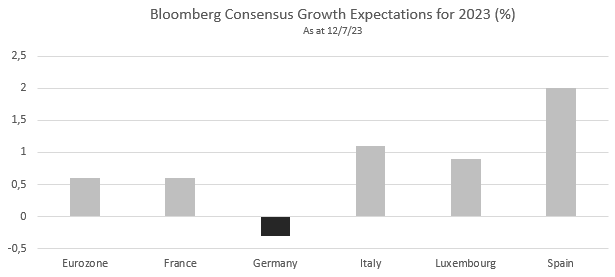

Germany, the fourth largest economy in the world and the leading economic power in the European Union, began 2023 in recession. Given pale full-year growth prospects relative to other countries on the continent, the idea that Germany is once again the “sick man of Europe” is in the airwaves. If this is the case, symptoms will not be contained within its borders…

In the late nineties, The Economist referred to Germany as “the sick man of Europe”. At the time, it was bearing the costs of reunification and grappling with high unemployment and weak domestic demand. After the turn of the Millennium, its economy underwent a rapid transformation. It went from being a laggard to becoming the locomotive that powered European growth. In 2022, it accounted for around one-quarter of the EU’s overall GDP.

The backbone of the German economy is its vast manufacturing sector, accounting for about one-fifth of of gross value-add. In very plain terms, Germany’s business model involved importing cheap raw materials and energy (the latter largely from Russia) and transforming them into world-class products.

Significant global demand for its goods means that around 40% of its GDP is attributable to exports. China has been Germany’s main trading partner for the seven years running, providing raw materials such as rare earth metals (needed for the transition to cleaner energy and transport) and serving as a important export market for German companies. The US is Germany’s second most important trading partner and a key buyer of Germany transportation equipment, machinery, chemicals and plastics. Over the past decade, the deep integration of the German industrial sector in international value chains has meant the country was a clear winner in the context of flourishing globalisation.

What’s weighing down the German economy?

Fast forward to today, Germany faces what is probably its biggest economic challenge since reunification. Slow-burning issues that were already weighing on the economy, such as rising protectionism and Germany’s diminishing competitiveness, have been accelerated by a double-blow of crises.

During the pandemic, Germany was naturally more exposed to global supply chain bottlenecks and before its manufacturing sector had time to fully recover, Russia invaded Ukraine. With an energy dependency ratio of 63% (versus an EU average of 57.5%), Germany was once again disproportionately impacted. Firms operating in the energy-intensive manufacturing sector could no longer rely on a steady flow of cheap gas from Russia and had to turn to volatile global energy markets.

Meanwhile, global trade conditions have soured. Following prolonged pandemic lockdowns, China’s economy is struggling to re-start, and the US is slowing as the Fed hikes rates to combat inflation.

But looking beyond the ups and downs of the economic cycle, the heydays of globalisation might be behind us. Protectionism is on the rise among friend and foes alike. Before the health crisis, the US imposed tariffs on European steel and aluminium, while more recently, the $369Bn Inflation Reduction Act, offers subsidies to companies willing to produce in the US, with emphasis on “Buy American”. In the East, China continues to chip away at Germany’s dominance in certain sectors as Beijing prioritises strategic sectors such as clean energy and transportation. To illustrate, the share of electric cars exported to Germany from China more than tripled in the first quarter of 2023, a worrying sign that its prized auto industry is struggling to keep pace as the combustion engine falls by the wayside. In the political sphere, calls are growing for Germany to reduce its “one-sided” dependency on China.

With its foreign trade model faltering, Germany can’t rely on domestic demand to support growth either. High inflation, rising interest rates and an erosion of real wages are taking their toll on domestic consumption, which fell 1.2% QoQ in Q1.

Then of course, the conversation wouldn’t be complete without mentioning the structural issues that hang over much of the old continent. Germany’s population is ageing. It needs to bring in 400,000 skilled foreign workers a year (far more than it has as of late) to offset this. It also lags behind in terms of digitalisation, with no FAANG equivalents to lead the charge as the fourth industrial revolution gets underway.

In some ways Germany has been a victim of its own success, leaning excessively on a model that has quite quickly become aged. Times are changing fast, and Germany will need to quickly reorient itself.

Germany’s struggles have implications for Europe

The fact that Germany’s business cycle is not synchronised with that of the rest of the Eurozone could be problematic for the ECB as it tries to set the optimal monetary policy stance, raising the risk of a policy misstep. Its economic significance also means that any prolonged downturn will be felt beyond its borders. Germany is the largest consumer market in the European Union with a population of 82.4 million. The list of European Union countries that count Germany as their No.1 trading partner is long. It includes France, Italy, the Netherlands, Belgium, Poland, Slovakia and… Luxembourg.

With 27% of the Grand Duchy’s total foreign trade taking place with Germany, if it does become the “sick man of Europe” once more, Luxembourg will most likely catch a cold.

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...