August 2, 2023

BILBoardBILBoard August 2023 – Challenging resilience

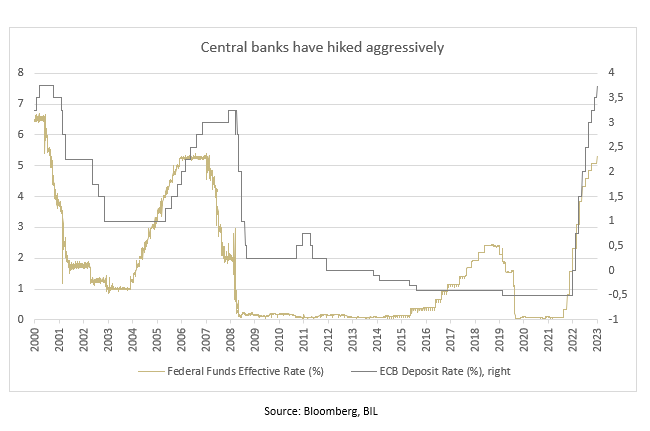

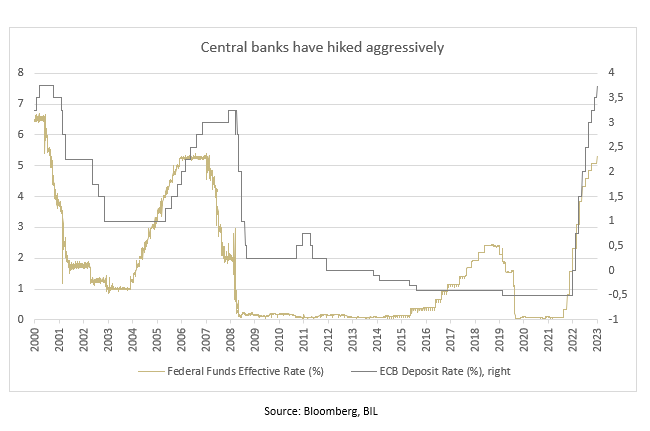

The idea that central banks might be finished hiking rates is gaining prominence. In the US, the Federal Reserve has now hiked rates eleven times, bringing the federal funds rate to a range of 5.25-5.50%, a 22-year high. Closer to home, the European Central Bank has raised interest rates nine times, leaving the deposit rate at 3.75%, which is on par with an all-time high reached in 2001 when the ECB was trying to boost the value of the newly launched single currency.

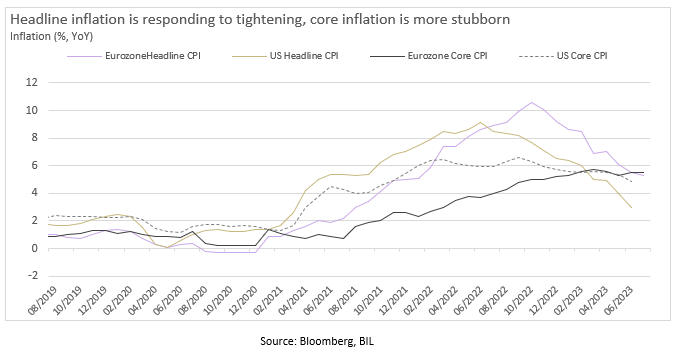

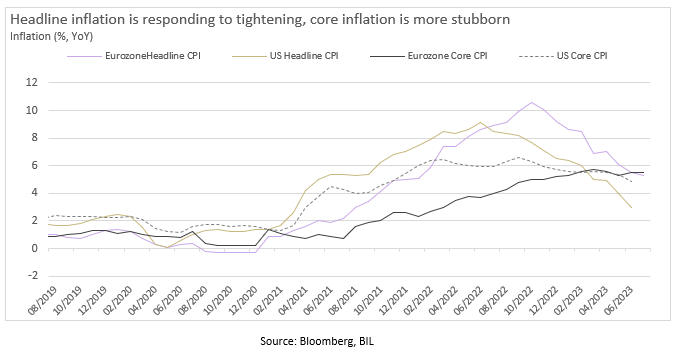

In response, headline inflation continues to fall. Core inflation, on the other hand, has been less susceptible to tightening, with the services sector the main culprit.

In our view, the Fed is probably finished hiking, while one more 25 bp increase from the ECB can’t be ruled out. However, what is more important for investors is the fact that both will probably have to maintain their cruising altitude for some time to be confident that inflation risks are fully contained. No flight plan has been laid out, with Powell and Lagarde both implying that any additional hikes will be based on incoming data.

Until now, economic activity has held up surprisingly well in the face of aggressive monetary tightening – albeit the rule of thumb is that there is a 12-18-month lag between policy enactment and when it shows up in the real economy.

In this sense, it is still early days. The US actually accelerated in Q2, expanding 2.4% on an annualised basis, up from 2% in Q1 and well above consensus expectations of 1.8%. Consumer spending did slow after a surprisingly strong start to the year, but the decline was more than compensated by business investment (thanks in part to the CHIPS Act and the Inflation Reduction Act). Incoming data tallies with our base case for a soft landing (not to be confused with “immaculate disinflation”, rather a mild downturn as consumption weakens and the labour market loosens up). This is opposed to a hard recession with a major spike in unemployment.

The Eurozone also managed to accelerate in Q2, with growth coming in at 0.3% after stagnation in Q1. However, prospects on the continent have darkened since our last BILBoard, with weakness in the beleaguered manufacturing sector threatening to seep into services. Worsening matters for Europe is the fact that China’s re-start appears to have tapered off.

Following lockdowns, domestic demand in China remains lackluster, while external demand conditions are less certain, whether it be for political or economic reasons. At our June Asset Allocation committee, market participants had their hopes pinned on two upcoming events: high-profile meetings between US and Chinese delegates, and the July Politburo meeting, at which an economic stimulus package was expected. Neither of those two events gave investors much to chew on. In terms of fiscal support, the central government seems to be rather reluctant to turn to immediate measures to boost the economy and is instead focusing on providing incentives/administrative support to revamp business activities and address unemployment.

Investment Strategy

Equities

In all, the current context is neatly summarised by the title of the IMF’s latest Economic Outlook, “Near-Term Resilience, Persistent Challenges”. For now, markets are fully focused on the “resilience” part of that equation; all three major US indices closed July in the green, while the S&P 500 recorded a fifth-straight month of gains, marking its best streak since 2021, helped by the fact that companies are beating (very low) EPS expectations and the AI frenzy.

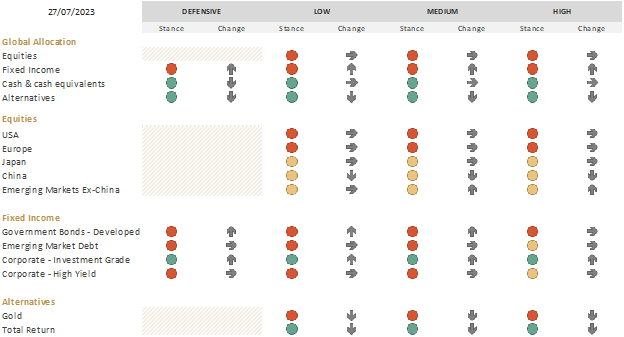

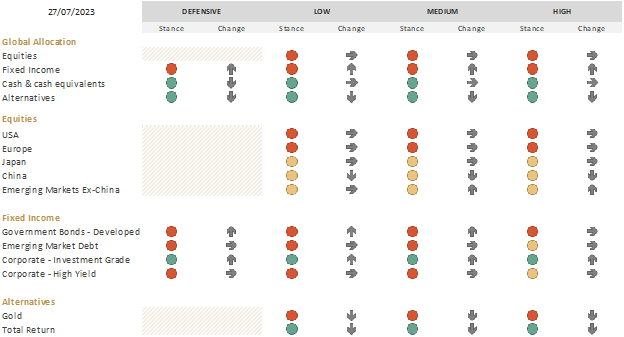

The evolution of the market has meant that our positions have drifted, in that we now have a slightly higher exposure to US equities than before. Given that recent US data offers us some comfort about the very near-term economic outlook, as well as the fact that we don’t want to fight the market, we have decided to maintain the drift effect on our portfolios, resulting in a smaller underweight to US equities than before.

However, we do believe that sooner or later, the “persistent challenges” will garner more attention, as central banks stick to “higher for longer” and the real impact of monetary tightening becomes more apparent. As such, we have used options to hedge 1/3 of our US equity exposure and 1/3 of our European equity exposure until the end of the year. By doing so, we have a degree of protection should we see a market downturn: anecdotal but still worth noting is the fact that over the last 30 years, August and September have been the worst two months for the S&P 500.

With a bumper rescue package in China seemingly off the cards, we took advantage of the recent rally following the announcement of some diluted policy measures, to shift our Chinese equity exposure towards emerging markets more broadly. As a result, we now have a neutral stance on both China and Emerging Markets.

Sector-wise, we made two downgrades. Firstly, IT was moved from positive to neutral. Following the AI rally, valuations for the sector are rich and there could be a pullback as investors come to realise that profitability and productivity gains from AI will take years to materialise, making it more of a strategic play (note the disappointment following Microsoft’s Q2 earnings). We also downgraded Materials from neutral to negative. China is a primary consumer of raw materials and the fact that its post-pandemic recovery is losing steam (manufacturing PMI below 50 for three months running), will no doubt weigh on the sector.

Fixed Income

With the hiking cycle now in its old age in both the US and Europe, our view on duration is becoming more neutral and we continue to add when attractive entry points present themselves.

Higher rates have left yields at attractive levels and we can safely say that TINA’s crown (There Is No Alternative [to equities]) has been stolen by BARBARA (Bonds Are Really Back And Really Attractive).

To capture some of those yields, this month, we focused on building a greater exposure to quality European fixed income (with hedging costs denting the attractiveness of US equivalents). More specifically, we added a mix of European Sovereigns (beyond decent yields, they should also deliver some protection as the “persistent challenges” weighing on the economy grow heavier) and European investment grade (IG) credit (via the broad index and Danish Mortgage Bonds). Fundamentals in the EUR IG space are strong with low leverage and still-high debt coverage ratios, implying that the sector could weather an economic downturn without any major problems.

Those trades were funded by reducing our exposure to gold (as it is non-yielding and expected to move largely sideways throughout the remainder of the year) and total return (believing that we no longer need such strong protection against rate volatility now that the end of the hiking cycle is in sight).

While some might be tempted by alluring yields in the high-yield bond space, our fundamental attitude to the credit market is still based on the long-term thesis that above-target inflation and central bank tightening will ultimately result in spread widening and higher defaults. Thus, we prefer to play it safe at the higher end of the quality curve.

We cannot let near-term resilience blind us to the persistent challenges still faced by the global economy. Central banks may be approaching the end of their hiking campaigns, but the effects are only just beginning to be felt…

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...