Choose Language

March 2, 2021

BILBoardBILBoard February / March – A Smooth Landing?

Let’s rewind to August 2020. Astronauts on the first commercial spacecraft mission, operated by Elon Musk’s SpaceX, returned to Earth successfully, splashing into the Gulf of Mexico after spending two months on the International Space Station. For the rest of us, “staycations” were largely on the cards, with travel still restricted. Global Covid cases had surpassed 20 million and Russia had approved its Sputnik V vaccination, becoming the first country to grant regulatory approval for a jab against the coronavirus. The major central bank collective was running with “whatever it takes” monetary policies, their asset purchase programmes taking “cheap borrowing” to a whole new level. A collapse in real yields had echoed through financial markets, stoking what was coined an “everything rally”, causing key equity indices and gold to hit new highs.

Back to the present, risk assets have moved even higher, now accompanied by commodities (hard and soft). Investors are encouraged by the ongoing economic recovery, continued central bank largesse, more fiscal stimulus and the vaccine rollout. However, promising growth prospects have left investors anxious that the stars are aligned for higher inflation; US 2-year breakeven rates (a gauge of the market’s inflation expectations) recently hit a decade high of 2.6% and yield curves have been steepening around the globe. Investors are cognisant that because longer-term yields determine borrowing rates (mortgages, business credit lines, corporate debt, etc.), if they were to rise too high too quickly, it could be detrimental to the economic recovery, eventually compelling central banks to tighten policy earlier than expected (the market is already starting to price in Fed rate hikes with lift-off in summer 2023). Real yields have also picked up, stoking fears that the “everything rally” could come back down to earth with a bump.

At BIL, this is not our base case. Until now, the rise in nominal yields is largely the result of rising inflation expectations. While there is a danger that inflation expectations can ignite a self-fulfilling feedback loop, there are signs of fatigue in breakeven rates and published inflation has yet to corroborate lofty expectations. Published CPI in the US was lower than anticipated in January at 1.4%, while the relatively high reading in the Eurozone (+0.9%) can be explained by an increase in VAT and carbon prices for German consumers, as well as the timing of winter sales in Italy and France. While breakeven rates do have the potential to go higher, a lot is already priced into the market, limiting upside potential. To quantify this, at the time of the Committee, real rates — the return that bond investors can expect after discounting expected inflation — sat at -0.8% in the US. By the end of the year, a move to around -0.5% (which is still a supportive level for risky assets) is a reasonable expectation.

As such, moving forward we could expect a more orderly rise in real yields, in tandem with improving fundamentals (particularly in the US as Biden’s new stimulus package enters the orbit). If our estimates are correct and the rise plays out in a controlled and steady manner, markets should not be derailed. If the opposite plays out and long-term yields defy the laws of gravity, skipping ahead of the recovery, central banks are there as a safety net. Just as ground control can alter the course of a rocket, central banks can influence the course of the bond market, whether with more hawkish communication or adjustments to their asset purchasing programmes and so on.

In light of our view, we remain overweight risk assets, preferring equities to bonds.

Equities

In the equity space, we hold our regional allocation steady, giving preference to the US and China where macro momentum is the strongest. Europe is hampered by delays in the vaccine rollout and prolonged movement restrictions. Given that we are now riding the upwards leg of the growth cycle, we added more cyclicality to portfolios via our sector preferences. To elaborate, we brought Energy up to a neutral weighting (as a sector benefitting from the economic reopening and rising oil prices), while downgrading defensive sectors such as Consumer Staples and Healthcare. This leaves us with an overweight in the following cyclical sectors: Consumer Discretionary (earnings revision trends are strong while consumer confidence surveys, e-commerce data and corporate commentary suggest consumer demand is resuming at a faster pace than expected), Materials (rising commodity prices are translating into strong earnings growth) and Industrials (a play on rising PMIs and a key beneficiary of large-scale fiscal stimulus). We balance this out with an overweight in Utilities - a defensive sector with promising prospects given the energy transition and the amount of fiscal stimulus being poured into the “greening” of the economy.

Fixed Income

In the fixed income world, we are naturally reluctant on sovereign bonds and duration, given that yields are on an upward trend (prices move inversely to yields). We believe that the bulk of the rise in inflation breakeven rates is behind us, so we see the risk/reward dynamics on inflation-linked bonds as less compelling and have downgraded our view on TIPS to neutral. From a regional perspective, yield differentials between the US and Europe are expected to continue to widen and we closed our Treasury positions earlier in the month.

We remain positive on investment grade corporates. Spreads are showing very low volatility, indeed, the last 3 months represent one of the least volatile quarters on record. In an environment where central banks are expected to continue to be supportive, the macro picture is improving and investors are looking towards a bright post-pandemic future, IG corporates should continue to perform well and could even overshoot in terms of spread tightening.

We are cautious on the high-yield segment of the bond market. High yield indices are at or close to all-time lows from a yield perspective, breaking through the 4% barrier in the US and the 3% barrier in Europe. Assets at the lower end of the quality curve could be vulnerable to rising yields as this represents increased financing costs.

In the emerging market debt space, we continue to prefer investment grade corporates over sovereigns, as their duration profile offers a better buffer against rising real yields.

Other

We are neutral on oil for the time being. While travel restrictions continue to depress global demand, prices are trending upwards as the reopening and recovery theme starts to kick in. Saudi Arabia’s unilateral decision to withhold an additional 1 million barrels per day in February and March adds further support.

Conclusion

In summary: we are riding the upwards leg of the growth cycle and so our investment strategy remains positive on risk assets, with a preference for equities over bonds. Within equities, we have implemented a cyclical tilt through our sector selection, and in our bond solar system, investment grade corporates are the Jupiter while our sovereign allocation would be more comparable to the size of Pluto. Much now depends on the ability of central banks to orchestrate a smooth rise in yields in tandem with the economic recovery. A communication misstep could indeed result in a “Houston, we have a problem” moment on markets and elevated volatility. Our portfolios are to an extent protected by being well-diversified across asset classes and regions. We have maintained our gold allocation in line with the benchmark, which has served well as a diversifier during recent bouts of market volatility.

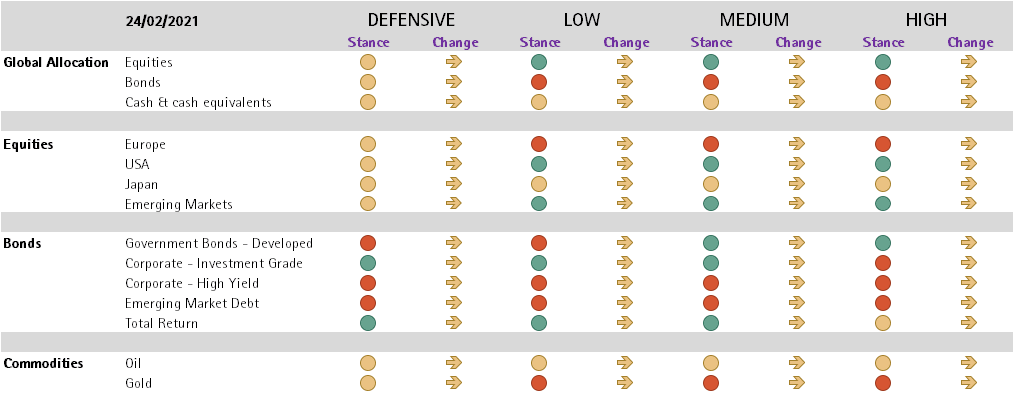

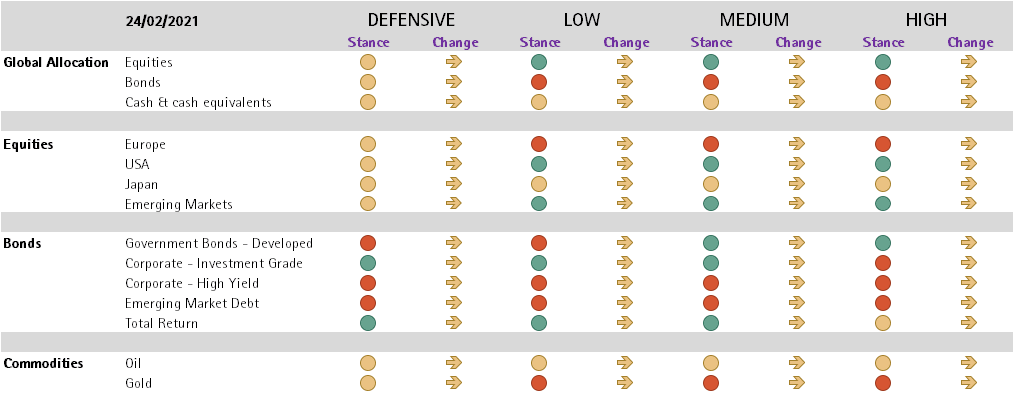

Asset Allocation Matrix

Stance: Indicates whether we are positive, neutral or reluctant on the asset class Change: Indicates the change in our exposure since the previous month’s asset allocation committee

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...