January 23, 2024

BILBoardBILBoard January 2024 – Are we there yet?

Economic overview

- The Fed and the ECB have concluded their hiking cycles.

- The easing cycle is likely to begin with the Fed (but later than March, as markets currently expect).

- The ECB has hinted that rate cuts could come in summer – much depends on incoming data.

- Rate cuts will be accompanied by slower economic growth, meaning fewer companies will be able to deliver on earnings expectations. Quality is key, as is a focus on names benefitting from long-term structural shifts.

In 2023, markets were largely driven by expectations about how soon western central banks would start easing monetary policy. A mini banking crisis, clear progress on inflation, and some weaker-than-expected data prints served to shorten the market’s perceived distance to a much-anticipated rate cutting cycle. However, as with navigation apps on a snowy day, the estimated time of arrival is ever changing, with resilient labour markets, enduring consumption and sticky services inflation all serving to lengthen the expected journey time.

In 2024, as we continue along the road towards eventual rate cuts, the market is like the child in the backseat, asking “are we there yet?” every five minutes and unfastening its seatbelt, ready for arrival. Central banks (the proverbial parents in the driving seats) are advising patience, knowing that speeding would be dangerous – in the 1970s, when policymakers eased too quickly, inflation reaccelerated, and it took years to bring it back under control.

January saw several policy makers trying to reason with the market and push back on hopes that a fast and furious rate cut cycle is just around the corner.

Speaking at Davos, Christine Lagarde conceded that absent another major shock, the ECB has indeed reached peak rates, but she also said that market bets on rate cuts as soon as spring were “not helping” in the fight against inflation. In turn, she added, the ECB must “stay restrictive for as long as necessary” to be sure that inflation is on a sustainable trajectory towards the 2% target. Minutes from the December ECB meeting showed that rate cuts were not discussed, while policymakers are concerned that investor bets on rate cuts as early as March had loosened financial conditions so much that they “could derail the disinflationary process”. Lagarde suggested that the first rate cut is only likely to occur in summer and we believe markets should heed this guidance.

In the US, the Fed also appears to have concluded its hiking cycle, while pencilling in a moderate three rate cuts for 2024. However, the market foresees as many as six rate cuts over the same period, beginning as early as March. In our view, this is overly optimistic and leaves room for disappointment. Such a plunge in rates would imply recession – a scenario that does not square with incoming macro data. The Fed’s Bowman warned that “there is the risk that the recent easing in financial conditions encourages a reacceleration of growth […] or even causing inflation to reaccelerate.”

We believe that central banks will continue to push back on rate cut hopes, while any stronger-than-expected macro releases will also serve as speedbumps (as seen when UK and US inflation came in above expectations), subsequently causing market volatility.

When rate cuts do finally arrive, investors should bear in mind that they will be accompanied by slowing economic growth. 2024 will bring the moment of truth as to whether central banks have managed to control inflation without causing a hard landing for economies – something we will only know after the fact, given the 18-24 month lag with which monetary policy actions show up in the real economy. While the prospect of a soft landing is increasingly conceivable in the US, growth is still expected to be about half of what it was in 2023. In the Eurozone, the economy might have already tipped into a shallow recession, and from here, we expect only very meagre growth at best.

The macroeconomic situation in China remains challenging. The property downturn is well into its third year, deflationary pressures linger, and an ongoing price war in key sectors (EV and new energy technologies) is pressuring company margins. Thus far, government support has failed to stimulate demand, and from here, the trajectory of the economy largely depends on further stimulus.

Global macroeconomic uncertainty is compounded by geopolitical tensions. Shipping disruptions in the Red Sea are affecting supply chains (e.g. Tesla will pause most production at its German plant due to delayed components), and we must closely observe the potential implications for both growth and inflation – especially considering the high volume of petroleum products that flow through this region and Europe’s still-fragile energy situation.

All of the above suggests a challenging terrain for risk assets.

Investment Strategy

- Reduce European equity exposure further, in favour of the US.

- Half Chinese equity exposure, bringing overall stance to underweight.

- Lock in some gains in the investment grade bond space: Allocate proceeds to cash and US high-yield.

- Actively manage duration, monitoring for opportunities to lock in yields.

Equities

For equity investors, earnings delivery will ultimately take over from policy expectations in driving returns, but slowing growth will make it more challenging for companies to deliver. We believe that the US is best poised on this front: on one hand, earnings expectations have receded lately, giving companies a lower hurdle to beat; and on the other hand, it boasts a sturdier macro landscape. Moreover, the region offers unique exposure to structural themes such as artificial intelligence, digitalisation and cloud computing, which we believe will continue to energise markets.

In light of this, we decided to lock in profits on our European equity exposure, in favour of increasing our overweight to the US. Note that the downside we protection we added in December (covering half of our US equity exposure at the time) was maintained – hopefully these are the airbags on the car that we won’t need, but it is good to know that they are there.

In a further adjustment to our equity exposure, we also decided to half our allocation to China, bringing our stance to underweight, given continued macro weakness.

With regard to style, an asymmetric approach is advisable, balancing exposure to aggressive corners of the market (like IT), with more defensive plays, like utilities and staples. Overall, we suggest a bottom-up approach, aimed at identifying quality companies with relative earnings stability.

Fixed income

In the bond space, we spent 2023 gradually building up duration and yield-generating capabilities; this proved beneficial amid December’s rapid repricing. Now, as expectations about the timing and magnitude of rate cuts are buffeted by cross currents of central bank communication, macro data, hope and fear, we believe it is time to actively manage duration and size opportunities to capture and lock in income.

In order to have dry powder on hand to do so, in low and medium risk profiles, we crystallised some gains on our investment grade bond (IG) holdings, moving a portion of the proceeds to cash: cash yields are comparable to those now on offer in the IG space. Note that overall, we remain overweight and constructive on the IG segment, where high supply is being met with strong demand as seen from oversubscribed books. At the same time, corporate balance sheets in this segment appear robust enough to weather a macro slowdown.

The remainder of the proceeds from trimming our IG exposure was used to top up our US high-yield (HY) corporate bond exposure in order to take advantage of the attractive yields on offer. We opted to make this move in the US, again because of the more benign macro landscape, and also because here, maturity walls are less of a concern. While selecting the instruments, we emphasised higher quality US HY (B and BB rated). We are still worried about a tick-up in default rates, particularly in Europe where growth is meagre and where monetary easing is likely to arrive later than in the US.

Conclusion

We are not there yet with regard to the easing cycle, and until we arrive at that destination, volatility is expected as the market adjusts and readjusts its calculations for speed, distance and time. This calls for a cautious approach, but also an opportunistic one, especially in fixed income, where price fluctuations might give investors nice opportunities to lock in attractive yields for the long haul.

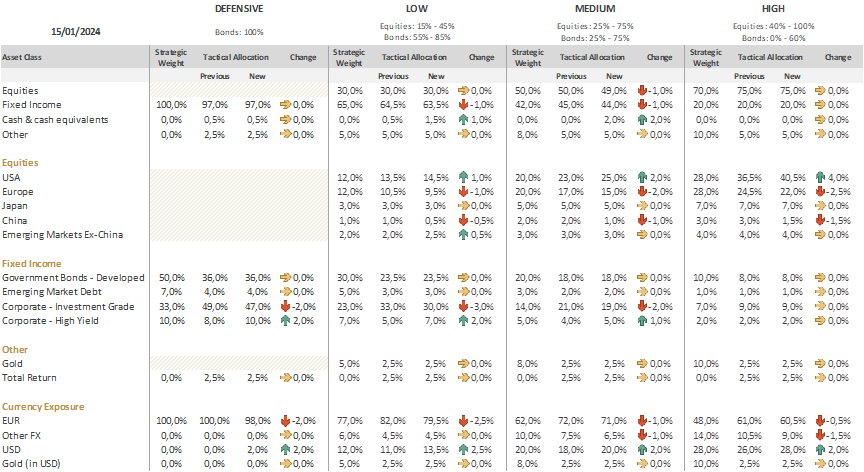

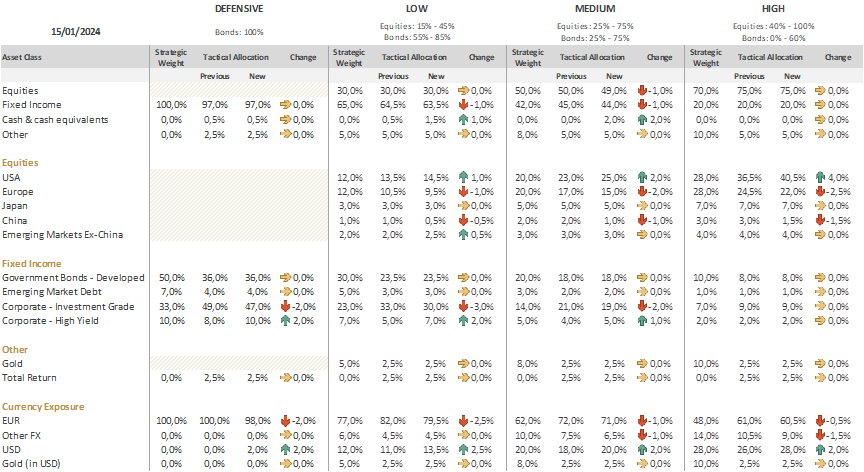

Asset Allocation Matrix

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...