Choose Language

July 2, 2021

BILBoardBILBoard July 2021 – A pause in reflation

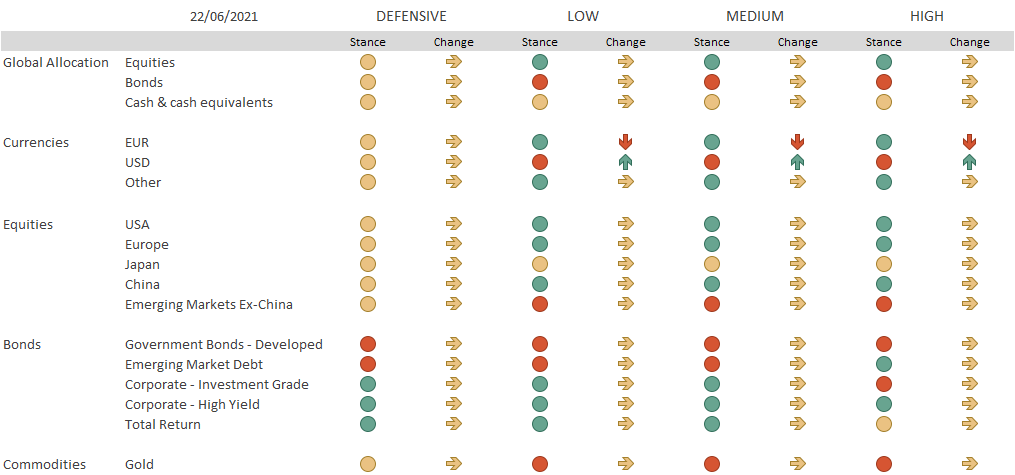

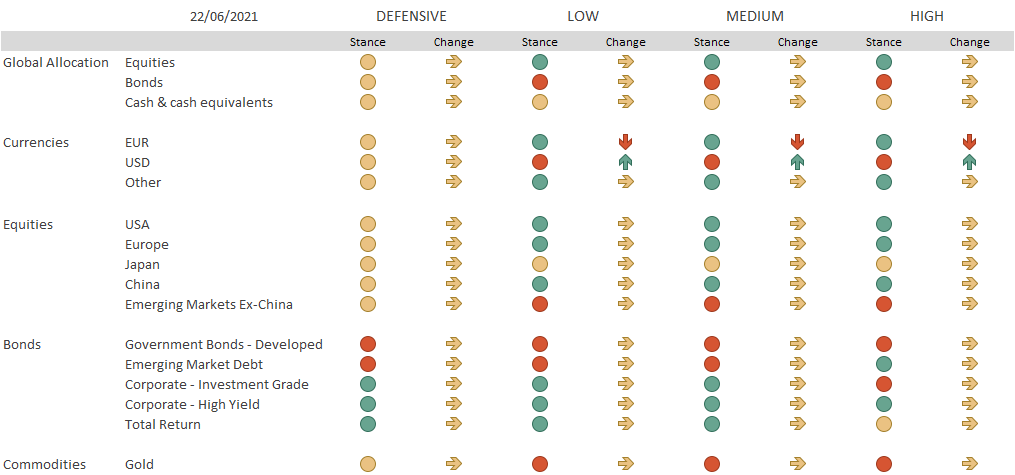

Since our last Asset Allocation Committee, the key event was the June FOMC, at which the Federal Reserve’s communication was decidedly less dovish. Its refreshed dot-plot suggested two rate hikes in 2023 (up from zero) and showed that 7 out of 18 members already expect one in 2021. Given the Fed’s preferred normalisation sequence, this could imply tapering in Q1 2022.

This change of tone caught markets off-guard and we saw a strong repositioning across all asset classes. With the idea that the Fed – contrary to the narrative of the last few months – will not actually allow the US economy to run “too hot for too long”, yields at the long end of the curve tumbled as bond traders unwound their reflationary curve steepening bets. Cyclical and value stocks tied to reopening and reflation themes suffered as growth stocks rebounded.

However, we do not see any change in the fundamental picture and deem the moves as a temporary overreaction. While the prospect of long-term yields shooting up sharply has declined, we still see them drifting up in the US and the rest of the world, in tandem with accelerating growth. For yields to change direction and start moving downwards in a sustained manner, the macro picture would have to change drastically; for example, as a result of a new virus variant, which is not our base case.

Regarding inflation, we believe it could still push higher (especially as rising home rental rates in the US seep into the CPI figure), but believe it will ultimately settle within central banks’ comfort zones – potentially at higher levels than in the last cycle when price pressures were notoriously sticky.

In our investment strategy, we remain positioned for a cyclical upturn, believing that while the reflation trade has faced a setback, it is still intact.

Equities

Supported by growth and stimulus, equities are still our preferred asset class. Some investors are concerned that talk of tapering could derail stocks, but we believe that the market can digest slow and measured adjustments to monetary policy, which, in the end, are necessary to keep overheating fears in check. As we have noted previously, the next leg of the cycle will be about rotation, not direction, meaning that investment returns will largely be dictated by style and sector decisions.

Sector-wise, we like reflation beneficiaries such as financials, who could see plumper net interest margins as long yields grind up, while central banks keep the short end of the curve anchored for now. Dividends and buybacks should also lend support to the sector, while in June the Federal Reserve announced that all 23 banks that took the 2021 stress test passed, with the industry “well above” required capital levels in a hypothetical economic downturn. We also like cyclicals such as consumer discretionary and materials, which are well positioned to benefit from the reopening theme and pent-up demand. At our most recent committee, we upgraded energy from neutral to overweight. Energy is a key beneficiary of the reopening theme (especially as travel resumes), earnings revisions are strong and the sector is supported by higher oil prices, which render more fields profitable. At the same time, we downgraded utilities, a sector that has broadly underperformed, even if we still like the structural long-term potential of green renewables.

At this stage of the cycle, we continue to believe that the value style will prevail, despite coming under pressure as of late.

Regionally, we are overweight the US, China and Europe, seeing strong growth momentum in each, especially Europe where the reopening is just getting started. Given that the Fed is drawing closer to tapering, our short-term outlook for the US dollar is less bearish and we have removed the currency hedging on our US equity overweight.

Fixed Income

The reflationary environment makes us broadly reluctant on fixed income. Expecting higher rates down the road, managing duration will be key. On credits, spread compression leaves us mid-cycle with end-cycle valuations.

We are most active in the investment grade space (both developed and emerging), which still offers some opportunity for excess return, though this will be generated by being highly selective. The sector continues to be supported by central bank buying, economic momentum and strong demand. Given that the Fed is further ahead in contemplating tapering, we have a preference for European Corporates versus the US equivalent.

Further down the quality curve, select pockets of the high-yield bond market in developed regions are still attractive. Inflows are strong as are ratings trends, on both sides of the Atlantic. For the same reasons as with IG, we now give preference to European high-yield corporates. In the US, senior secured loans (SSL) may be preferable to HY, as they carry less duration risk and a lower exposure to rising rates. SSLs are less interesting in Europe where coupons are calculated using the EURIBOR rate as a base (which is still negative).

As the recovery unfolds, Government bond yields are destined to rise, compelling us to carry an underweight on duration and European govies, and virtually no exposure to US Treasuries.

Conclusion

On the back of the vaccine rollout, and winged by expansive fiscal and monetary policies, the global economy expanded more rapidly than expected in the first half of the year. We expect the positive momentum to continue through 2021 and believe that the fundamentals underpinning the reflation trade remain intact. Given the speed of the recovery, investors must be prepared for shifts in cyclical positioning across regions and should brace themselves for potentially higher volatility than we have witnessed recently. While bull market pullbacks are unavoidable, they should not be considered as a reason to stay on the sidelines.

Just as the reflation trade has paused temporarily, we will pause our BILBoard publication for in August, resuming in September. In the meantime, our extensive Midyear Outlook should provide ample reading material. We wish you happy and safe summer holidays.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

October 15, 2024

BILBoardBILBoard November 2024 – Beyond the U...

The race for the US Presidential election on November 5 is heating up, but business activity is essentially frozen given the uncertain outcome and...

October 11, 2024

Weekly InsightsWeekly Investment Insights

Hurricanes caused widespread damage last week. In the US, Florida residents rushed to evacuate ahead of Hurricane Milton, which followed closely on the heels...

October 4, 2024

Weekly InsightsWeekly Investment Insights

Comments from central bankers toyed with both currencies and rate markets over the past week. The Fed Chair Powell said that the US central...

September 30, 2024

Weekly InsightsWeekly Investment Insights

Autumn is in full swing and with the change of season came a turnabout announcement that was noticed in all corners of the market. Beijing’s...