Choose Language

June 2, 2021

BILBoardBILBoard June 2021 – The R&R Trade

R&R would normally stand for rest and recuperation. However, the economy has already had its downtime and the R&R theme driving markets is quite the opposite: reopening and reflation. Accelerating vaccination campaigns mean a growing number of countries are following in the footsteps of the US and China, and staging an economic reopening – particularly in Europe. At the same time, central banks remain supportive and a bombardment of fiscal policy measures is forthcoming. All this is fanning a reflation trade in markets; one that seeks to capitalise on higher growth and inflation expectations.

As is reflected in the OECD’s recent decision to upgrade its 2021 global growth projection to 5.8% (which would represent the fastest growth since 1973), the macro outlook continues to brighten and we expect strong momentum through the second half of the year – should there be no surprises on the epidemiological front. On top of the vaccine rollout and accommodative monetary policy, the upturn is amplified by government stimulus programmes. In the US, President Biden has put another USD 1.7 trillion infrastructure spending plan on the table, while in Europe, after months of delay, all 27 member states have finally ratified the legal instrument that underpins the EUR 750 billion recovery fund.

Against a backdrop of strong growth and rising commodity prices, the elephant in the room is inflation: US CPI hit 4.2% in April, while Euro Area inflation rose 2% in May. This has led to fear that central banks could tighten monetary policy sooner rather than later, to prevent overheating, thereby cutting off economic expansion.

However, key central bankers – Jerome Powell and Christine Lagarde included – have iterated and reiterated their belief that the inflationary spike will be transitory, making them reluctant to adjust policy. As of now, market-based inflation expectations imply that investors buy into this theory and indeed it makes sense if you consider base effects, bottlenecks and the fact that pent-up demand is being met with limited supply. Moreover, the factors that have anchored inflation in recent decades (globalisation, digitalisation, Amazonisation and others), have not abated.

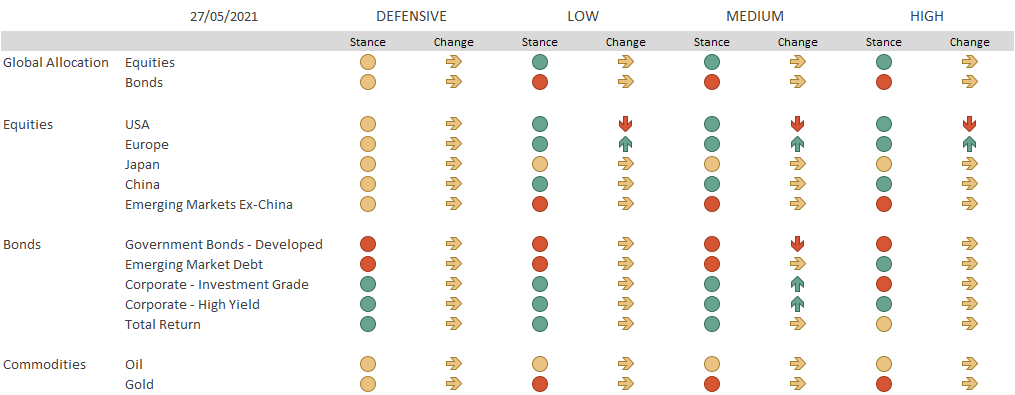

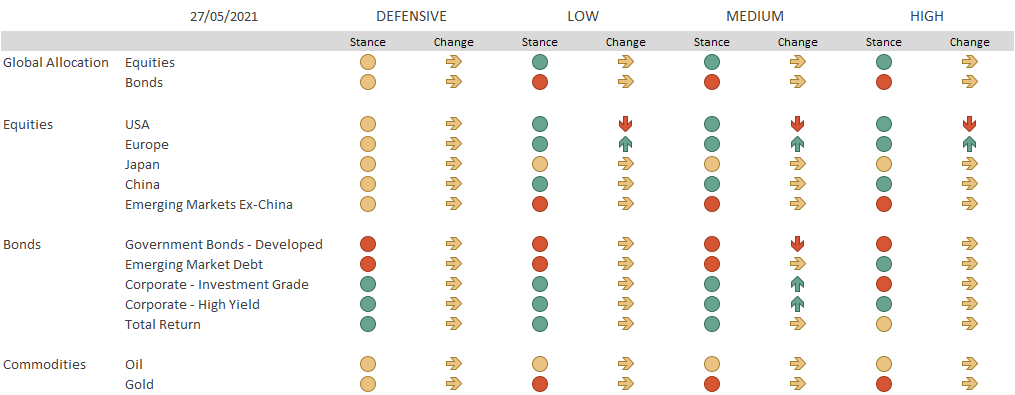

As such, while we do expect inflation to rise further from here, we do not think it will spiral out of control, nor do we believe that central banks will tighten policy in an abrupt way that would derail markets. In light of this, our strategy is overweight equities versus bonds, while being calibrated to take advantage of the R&R trade (which reflects positive economic growth, rising but controlled inflation and a gradual rise in yields).

EQUITIES

We have come to the end of a very positive Q1 earnings season and analyst revisions (relative and absolute) are moving in the right direction in all regions. Nonetheless, markets have traded rangebound with inflation fears tempering gains. From here, while we do believe equities could have further upside – in line with improving macro dynamics – investment returns will largely be dictated by style and sector decisions. In such environments, we have historically seen a rotation from growth and defensive plays to value and cyclicals.

For the past few months, we have carried a value tilt within our US equity exposure; this has been beneficial in light of rising Treasury yields, which have spelled trouble for growth and technology stocks. This month, we rebalanced our regional exposure, bringing our European allocation to overweight. In doing so, we essentially doubled down on our value play, given that Europe has a high concentration of value stocks that typically benefit from rising inflation and interest rate expectations. Additionally, Europe has a lot of catch-up to play given that it is only just beginning to experience its own reopening boom. Further talks about stimulus packages in European countries (e.g. Germany) could be a positive driver, as well as the disbursement of the pan-EU recovery fund in the second half of the year.

To fund this trade, we reduced our US equity exposure (though we remain overweight). We also remain overweight on China, which is an unambiguous global growth driver. The medium-term correction in Chinese equities has levelled off and we are seeing the beginnings of a rebound. The market is supported by strong inflows, while valuations are compelling relative to global peers. Observing that Chinese authorities have made little use of monetary stimulus, especially compared with the West, investors in China will not have to sniff out when tapering might start.

In terms of sectors, we brought industrials down to neutral, while increasing financials to overweight. We have not yet seen a material impact from inflationary pressures on margins but expect this will become more apparent in Q2 earnings results. Moving forward, industrials may lack the pricing power needed to pass on rising costs to consumers, resulting in some margin pressure. Financials, on the other hand, are a key beneficiary of higher inflation and rate expectations. We continue to like cyclicals such as consumer discretionary and materials, which are well-positioned to benefit from the reopening theme and pent-up demand. We are keeping our overweight on utilities, hand-picking stocks that will play a role in the energy transition that governments are pursuing with billions of dollars, euros and yuan.

FIXED INCOME

On the whole, the reflationary environment makes us reluctant about fixed income. Where we do have exposure, we prefer investment grade corporates (in both developed and emerging economies) as well as developed market high-yield bonds. Just as the reopening has signalled a return to tourism in the real world, in search of sunshine, reflation has signalled a return to tourism in the bond world: that is, investors venturing out of their comfort zone in the IG space, into high-yield, in search of yield. These inflows are supportive of the segment, alongside positive rating trends: it is worth noting that in the US HY space, rating upgrades outnumber downgrades by the largest amount seen in a decade (2.04x).

COMMODITIES

On the back of recent price momentum, we felt that it was an opportune moment to take profit on gold. The price of gold recently reached a four-month high topping USD 1,900, erasing yearly losses. We remain more cautious in the medium term with the potential for tapering talk to start popping up more frequently in Q3. We remain neutral on oil. While the reopening narrative and the resumption of travel could push up prices, there is also the prospect of an Iran-US nuclear deal, which could see a flood of supply.

CONCLUSION

As the global economy keeps soldiering on, with steady ammo in the form of fiscal stimulus and accommodative monetary policy, our portfolios are geared towards taking advantage of the R&R trade. This entails an equity overweight, focusing on reopening beneficiaries and typical reflation winners.

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 3, 2025

NewsThe clock is ticking on EU-US trade n...

This article was written on July 1 The July 9 deadline by which US trading partners must have reached a trade deal with the...

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...