March 1, 2023

BilboardBILBoard March 2023: Strong data and sticky inflation

While the economy is slowing, it is proving more resilient than initially expected. At the same time, inflation remains uncomfortably high, supporting the case for sustained central bank tightening. This has caused a risk-off mood in markets with some participants beginning to consider a stagflation scenario once more.

Until now, market participants were eager to believe that central banks were close to having successfully batted inflation off the field and that a dovish pivot was fast approaching. Incoming data implies otherwise. The personal consumption expenditures (PCE) index – the Fed’s preferred inflation gauge – recently recorded its biggest monthly gain in almost two years. In the euro zone, core inflation reached a fresh all-time high in January and flash readings from Spain and France indicate that prices continued to accelerate in February. In a nutshell, the details show that there is a limit to goods disinflation and that service sector price pressures are going to be more difficult to weed out.

With the labour market refusing to break on both sides of the Atlantic for now (even if faint cracks are visible to the attentive eye), there is a real risk that upward pressure on wages persists (in turn fuelling demand and consumption).

Central banks need to apply just the right amount of pressure to prevent a wage-price spiral, while at the same time trying to avoid overtightening and a so-called “hard landing”. There is ample room for error, especially when considering that previous actions are still percolating through the real economy.

As Claudio Borio, head of economic research at the Bank of International Settlements (often considered the bank of central banks) recently suggested, it could be a stop-and-go process: “There is nothing wrong with central banks slowing the pace of tightening and then adjusting it, possibly having to accelerate it again… The most important thing at this stage is not to declare victory too early.”

Markets had initially priced in a smooth, gentle landing, with central banks simply reaching their terminal rate before embarking on rate cuts towards year-end, allowing the economy to take off once more. Some thought that we might avoid any landing at all. It is becoming increasingly clear that the path back to a level of inflation that the Fed/ECB can live with will be neither quick, painless nor straightforward.

China stands out as a key outlier in the global tightening cycle, where uncertainty around the path of monetary policy is less of a concern for investors. Inflation there is contained and the economy is revving up following the end of zero-Covid policies. Beijing has pledged “unwavering” support for both public and private companies and appears keen to stoke domestic demand with more than CNY 5 billion (USD 720m) earmarked for issuing consumption vouchers and shopping subsidies.

Investment Strategy

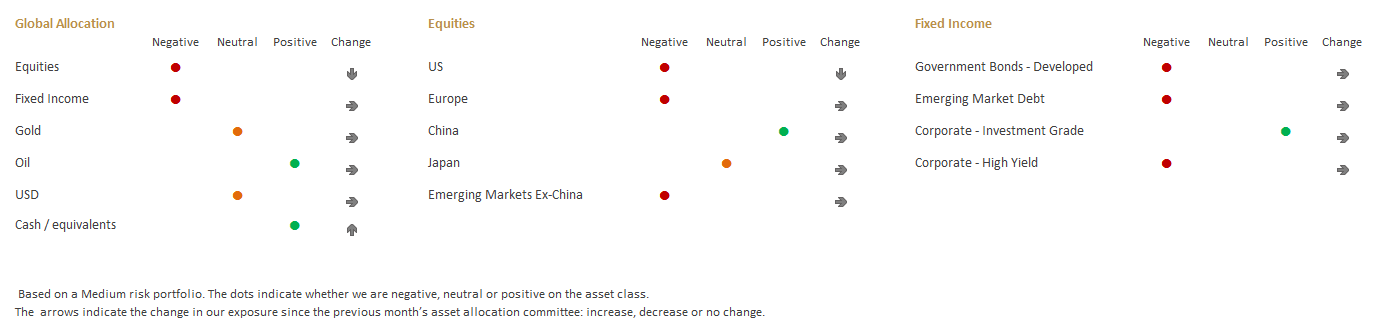

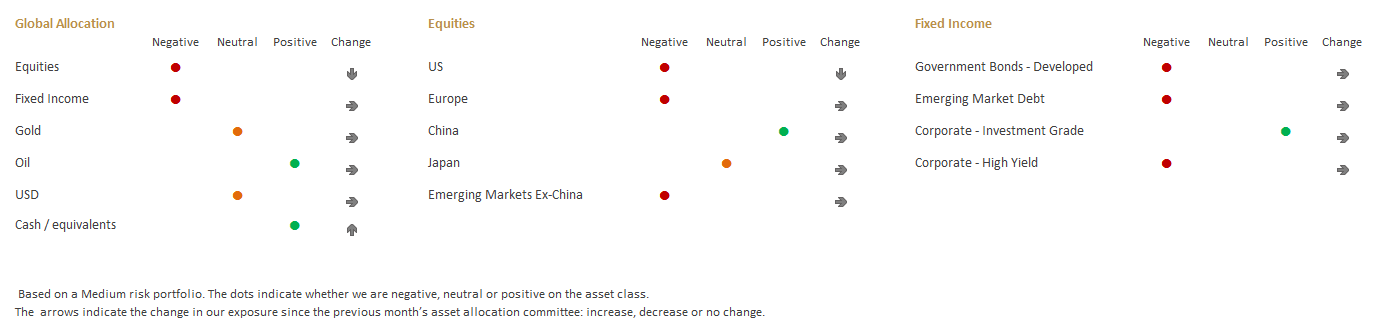

Sticky inflation and the policy implications leave investors in a “sticky wicket” – a common metaphor in the English language, used to describe a difficult circumstance. Sports fans will know that the saying has its origins in cricket and describes a pitch that is rapidly being dried by the sun after rain and is difficult to bat on, as it can cause unpredictable ball movements. The metaphor is particularly fitting as it captures the fact that central bank liquidity is now evaporating, leaving financial markets subject to volatility and unpredictable moves. Given this terrain, we remain underweight on equities and fixed income for the time being.

On the equity side, it is hard to envisage global markets pushing much further ahead until there are clearer signs that the Fed and other central banks can ease off on their tightening campaigns. To this end, we further reduced our underweight to US equities and we now have the same allocation to US and European equities. In defensive profiles, where we have no equity exposure, we instead tempered risk by reducing our overweight to investment grade bonds (locking in gains after a period of spread tightening). The proceeds of both trades were kept in cash equivalents – dry powder for when the investment conditions look more inviting. Where we do have equity exposure, regionally we give preference to China and, style-wise, we advocate a barbell approach between growth and value.

In the bond space, the record-breaking global rally has been stymied by fresh inflation fears and the prospects of “higher-for-longer” monetary policies. Market expectations are becoming more aligned with central bank guidance and, with long-term rates now around our year-end target levels, we discussed whether we should add more duration. Given the current bearish market sentiment, and the fact we topped up on duration at an interim committee on 10 February, we decided to wait, but we are actively monitoring for an entry point to take advantage of higher yields.

We remain overweight on investment grade bonds. After the strong run, spread compression seems to be taking a breather, however, we note that European spreads remain historically wide versus the US. We particularly like Danish mortgage bonds, which offer attractive return perspectives (particularly now on the 5 and 6% series).

Bond fund flows have reversed in recent weeks – particularly at the riskier end of the credit spectrum. We are comfortable with our underweight position on high yield (HY) for now as we don’t believe that valuations fully encapsulate recession risk. Where we do hold this asset class, we give preference to the BB segment as well as CoCo issues (these offer attractive coupons and banks are still well-capitalised and have delivered nice earnings). Note that European HY is slightly better valued, given the longer duration and lower quality of US HY.

Gold closed January up by over 5% before correcting in February as the dollar found renewed strength on prospects of a more hawkish Fed. Longer term, gold remains attractive as a portfolio diversifier and store of value, but we remain neutral noting that continued tightness in the US labour market, as well as stickier core CPI data, could continue to support the dollar, putting pressure on the gold price.

Conclusion

Until recently, things were priced for perfection. Investors were betting that central banks could quickly and efficiently reign in price pressures. It is evermore clear that this won’t be an easy feat. While monetary authorities have repeatedly warned that rates would be high for some time, the market didn’t want to listen. Now, the data is forcing it to realise that central banks are still some way from the metaphorical ninth inning in their fight to tame inflation.

Authors

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...