Choose Language

March 31, 2021

BILBoardBILBoard March/April 2021: Positioning for recovery

Reopening and recovery is the predominant narrative in markets, with investors looking past the here and now to position themselves for a bright post-pandemic future.

Already, things are looking better than expected – the OECD recently upgraded its global growth forecast for 2021 to 5.6% (up 1.4% from previous estimates), while earnings revision trends are positive in all regions.

Better growth prospects have also led to higher bond yields – especially in the US. While higher yields are causing (and could continue to cause) volatility for equities, we do not think it will derail them; firstly because they are rising from extraordinarily low levels, and secondly because their increase is a reflection of an improved economic outlook. In a nutshell: we think yields are rising for good reason.

Monetary policy is expected to remain accommodative for now

The reopening and recovery theme has also caused an uptick in inflation expectations. Inflation usually becomes a problem when central banks decide to fight it by hiking rates to cool an overheating economy. In the US, the Fed seems confident that any increase in inflation will be transitory (breakeven rates also show that the market expects an inflationary burst rather than sustained price increases). At its March FOMC, the Fed reaffirmed its commitment to using its tools to achieve its full employment mandate “for as long as it takes”. Clearly the central bank is focused on fostering sustainable growth, beyond the post-lockdown sugar-rush and, as such, the Fed’s dot plot doesn’t indicate any rate hikes until 2024, even if some Fed board members are considering 2023. The committee also said it would maintain the current pace of its asset purchases ($120bn per month). We view inflation risk as limited for now in the eurozone, as well as in China, where falling pork prices have reduced inflationary pressures.

A continuation of supportive monetary policy, combined with fiscal stimulus and the vaccine rollout, underpins our overweight on risk assets like equities.

Equities

Certain regions, like the US and China, are ahead in terms of the reopening and recovery narrative. In our equity allocation, we give preference to those regions, simply because that is where growth potential is higher and where we see the most opportunities.

In the US, the effects of Joe Biden’s new $1.9 trillion stimulus package are already filtering into the macro data. In March, IHS Markit noted a strong increase in demand, buoying growth of orders for both goods and services to multiyear highs. Indeed, US households (on aggregate) now have higher savings and less debt than before the pandemic and, consequently, there is a lot of dry powder piled up waiting to be spent. Consumer Discretionary is therefore one of our preferred sectors.

Sector-wise, we also like Materials (a sector with strong earnings revisions, supported by higher commodity prices) and Industrials (a key beneficiary of the reopening theme and government stimulus). Finally, we like Utilities. Initially, this defensive play may seem like a bit of a black sheep among the three aforementioned cyclical sectors, but we hold on to it as, within it, we are actively cherry-picking the companies that are poised to benefit from the energy transition (including $400bn earmarked by Biden for spending on clean energy and innovation).

Because the US is ahead in terms of reopening (which is reflected in higher rates and inflation expectations), we have implemented a Value tilt inside of our US equity exposure. Value stocks typically do well when the economy is in an expansionary phase and when corporate profits and interest rates are on an upward trajectory. As of now, Value stocks have clearly cheaper valuations than Growth stocks.

The upward push on interest rates and steepening yield curves would normally represent a positive signal for European equities, due to the higher concentration of Value stocks in the region. Despite a modest increase to our exposure lately, we think it is premature to go overweight. The ambiguity around the reopening timeline in Europe, with some countries still in lockdown, means there is more uncertainty with regard to corporates’ ability to meet earnings expectations. UK equities are now more attractive, given the speed of the vaccination drive.

Fixed Income

Overall, we are negative on fixed income, especially Sovereigns due to a global uptick in rates. In the US, the curve continues to steepen and the overall tone of the Fed leaves bonds with longer maturities at the market’s mercy for increasingly higher rates. This month, we closed all remaining TIPs positions, meaning we no longer have any US Treasuries in our portfolios. The small underweight we hold in govies is concentrated in Europe, where the ECB is front-loading its Pandemic Emergency Purchase Program (PEPP) to cap rising rates. The ECB is also trying (and succeeding) to contain intra-European spreads, making us neutral on core vs. periphery.

We are overweight on investment grade corporate bonds as we believe they should continue to benefit from supportive monetary policy and an improving macro landscape, potentially even overshooting in terms of spread tightening.

We have a small overweight on the high-yield bond segment. Spreads are now at pre-Covid levels, flows are supportive as investors hunt for yield and expected defaults are falling back towards historical averages. Higher oil prices are providing relief for the US energy sector, which represents quite a substantial part of the US high-yield market.

Within our Emerging Market debt allocation, we prefer hard currency corporates, which better withstood the recent sell-off. Corporates are more resilient against a rise in real yields.

Conclusion

All in all, we look to be headed into a period of rebounding growth and ample liquidity, fuelled by an unprecedented symbiosis of fiscal and monetary policy and broad economic re-engagement as vaccines are rolled out. As such, we favour riskier assets, focusing on companies that are set to benefit from the themes of reopening and recovery, primarily in more cyclical sectors.

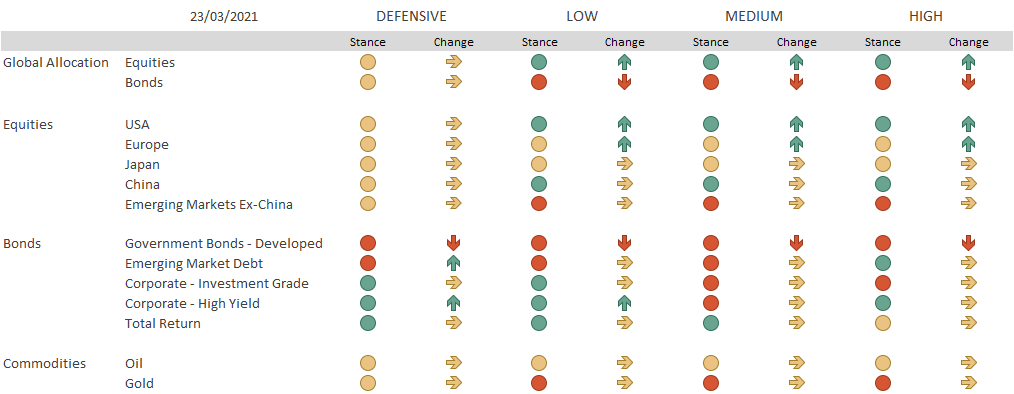

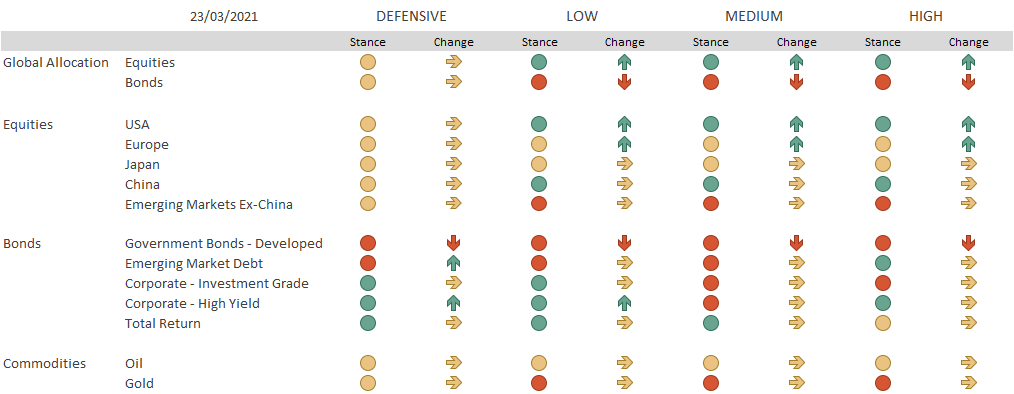

Stance: Indicates whether we are positive, neutral or reluctant on the asset class . Change: Indicates the change in our exposure since the previous month’s asset allocation committee

Disclaimer

All financial data and/or economic information released by this Publication (the “Publication”); (the “Data” or the “Financial data

and/or economic information”), are provided for information purposes only,

without warranty of any kind, including without limitation the warranties of merchantability, fitness for a particular

purpose or warranties and non-infringement of any patent, intellectual property or proprietary rights of any party, and

are not intended for trading purposes. Banque Internationale à Luxembourg SA (the “Bank”) does not guarantee expressly or

impliedly, the sequence, accuracy, adequacy, legality, completeness, reliability, usefulness or timeless of any Data.

All Financial data and/or economic information provided may be delayed or may contain errors or be incomplete.

This disclaimer applies to both isolated and aggregate uses of the Data. All Data is provided on an “as is” basis. None of

the Financial data and/or economic information contained on this Publication constitutes a solicitation, offer, opinion, or

recommendation, a guarantee of results, nor a solicitation by the Bank of an offer to buy or sell any security, products and

services mentioned into it or to make investments. Moreover, none of the Financial data and/or economic information contained on

this Publication provides legal, tax accounting, financial or investment advice or services regarding the profitability or

suitability of any security or investment. This Publication has not been prepared with the aim to take an investor’s particular investment objectives,

financial position or needs into account. It is up to the investor himself to consider whether the Data contained herein this

Publication is appropriate to his needs, financial position and objectives or to seek professional independent advice before making

an investment decision based upon the Data. No investment decision whatsoever may result from solely reading this document. In order

to read and understand the Financial data and/or economic information included in this document, you will need to have knowledge and

experience of financial markets. If this is not the case, please contact your relationship manager. This Publication is prepared by

the Bank and is based on data available to the public and upon information from sources believed to be reliable and accurate, taken from

stock exchanges and third parties. The Bank, including its parent,- subsidiary or affiliate entities, agents, directors, officers,

employees, representatives or suppliers, shall not, directly or indirectly, be liable, in any way, for any: inaccuracies or errors

in or omissions from the Financial data and/or economic information, including but not limited to financial data regardless of the

cause of such or for any investment decision made, action taken, or action not taken of whatever nature in reliance upon any Data

provided herein, nor for any loss or damage, direct or indirect, special or consequential, arising from any use of this Publication

or of its content. This Publication is only valid at the moment of its editing, unless otherwise specified. All Financial data and/or

economic information contained herein can also quickly become out-of- date. All Data is subject to change without notice and may not be

incorporated in any new version of this Publication. The Bank has no obligation to update this Publication upon the availability of new data,

the occurrence of new events and/or other evolutions. Before making an investment decision, the investor must read carefully the terms and

conditions of the documentation relating to the specific products or services. Past performance is no guarantee of future performance.

Products or services described in this Publication may not be available in all countries and may be subject to restrictions in some persons

or in some countries. No part of this Publication may be reproduced, distributed, modified, linked to or used for any public or commercial

purpose without the prior written consent of the Bank. In any case, all Financial data and/or economic information provided on this Publication

are not intended for use by, or distribution to, any person or entity in any jurisdiction or country where such use or distribution would be

contrary to law and/or regulation. If you have obtained this Publication from a source other than the Bank website, be aware that electronic

documentation can be altered subsequent to original distribution.

As economic conditions are subject to change, the information and opinions presented in this outlook are current only as of the date

indicated in the matrix or the publication date. This publication is based on data available to the public and upon information that is

considered as reliable. Even if particular attention has been paid to its content, no guarantee, warranty or representation is given to the

accuracy or completeness thereof. Banque Internationale à Luxembourg cannot be held liable or responsible with respect to the information

expressed herein. This document has been prepared only for information purposes and does not constitute an offer or invitation to make investments.

It is up to investors themselves to consider whether the information contained herein is appropriate to their needs and objectives or to seek advice

before making an investment decision based upon this information. Banque Internationale à Luxembourg accepts no liability whatsoever for any investment

decisions of whatever nature by the user of this publication, which are in any way based on this publication, nor for any loss or damage arising

from any use of this publication or its content. This publication, prepared by Banque Internationale à Luxembourg (BIL), may not be copied or

duplicated in any form whatsoever or redistributed without the prior written consent of BIL 69, route d’Esch ı L-2953 Luxembourg ı

RCS Luxembourg B-6307 ı Tel. +352 4590 6699 ı www.bil.com.

Read more

More

July 1, 2025

BILBoardBILBoard Summer 2025 – Always wear su...

From the brink of a bear market, US stocks have staged a ten-trillion-dollar rally, bringing record highs within reach. Summer is in full swing in...

June 24, 2025

NewsAfter the shipping surge: What’s next...

As the world grappled with the threat of tariffs from the United States, global trade experienced a dramatic yet short-lived boom. Now, as the dust...

June 20, 2025

Weekly InsightsWeekly Investment Insights

Saturday 21 June marks the summer solstice in the Northern Hemisphere. This is the day with the most daylight hours in the year and...

June 16, 2025

Weekly InsightsWeekly Investment Insights

The short week kicked off with a thaw in trade tensions between the US and China as representatives from the world’s two largest economies...