Choose Language

November 28, 2019

BilboardBILBoard November 2019: Economic growth – bottoming or blossoming?

Global economic growth has slowed considerably throughout 2019 on the back of US-China trade tensions, with powerhouses like Germany skirting recession. Recently, with easier central bank policies starting to take effect, we have seen some stabilisation on the macro front and now, opinion is split between two central scenarios for 2020: will the global economy continue flatlining, or is this an inflection point where growth makes a comeback?

Throughout the slowdown, the manufacturing sector has

been the Achilles’ heel, while consumer spending – underpinned by robust labour

markets – has been the saving grace. While the latter remains intact, PMI data suggests

that manufacturing activity has finally found a floor, and has even started to

rebound, predominantly in emerging markets.

In the US, the manufacturing PMI also recently inched up from 51.1 to 51.3 (readings above 50 suggest expansion). It is true that the latest batch of industrial production data disappointed (falling 0.8%), but it is worth noting that the bulk of this was due to disruption in the auto sector amidst the General Motors strike, which saw some 48,000 employees out of the workforce for 40 days. Another positive is the fact that new export orders are back above the 50 level, which helped drive the slight moderation in ISM manufacturing data for October.

In Europe, the

situation looks marginally better than it did a month ago, but we are not yet

out of the woods. Industrial production data offered a little optimism,

expanding for the second month in a row in September, supported by domestic

demand. Further still, despite flirting with recession, business morale in

Germany rose to 95 as measured by the Ifo survey, pointing to Q4 growth of 0.2%

– again driven by domestic demand. However, the problem is that the weakness in

manufacturing may have already bled into the service sector. So while the

eurozone seems to have avoided freefalling growth, the danger to the economy

has not yet been averted, and for the export-oriented economy much hangs on a

US-China trade deal.

In most major economies, financial conditions remain

favourable and inflation is in check, while central banks remain accommodative:

the ECB is firing on all cylinders, whereas the Fed is on a hiatus after three

rate cuts, albeit leaving the door open to further stimulus if warranted. The

People’s Bank of China is also tweaking policy quite actively as it fine-tunes its pro-growth policy. Such

an environment should indeed support further extension of the cycle, especially

with the risks of a full-blown trade war and a no-deal Brexit dimming.

However, if trade talks were to suddenly take a U-turn,

things could quickly turn pear-shaped on the macro front. As it stands, things

seem to be moving in the right direction, with the most recent news coming from

US national security adviser Robert O’Brien, who opined that an initial trade

agreement with China is still possible by year-end.

Equities

We have kept our equity exposure slightly underweight.

Although Q3 earnings surpassed expectations (a short-term market booster),

earnings growth on the whole has been essentially non-existent in both the US

and Europe. Analyst earnings expectations for next year are still quite lofty

and will be difficult to beat should we not see a marked improvement in the

macro landscape. If this materialises, stock markets have the stamina to reach

new highs. But this is quite a big ‘if’ and, in the meantime, investors seem to

have over-extrapolated the stabilisation in PMIs to conclude that PMIs are

headed upwards. This not yet the case, and there is risk that at some point,

attention could turn back to cold, hard fundamentals.

For now, a new gust of risk-on sentiment has blown a

lot of capital from defensives into cyclicals. We prefer to remain sector-neutral,

bearing in mind that sentiment is capricious and can turn at any time.

Furthermore, defensives look better when you drill down into the fundamentals

and top analyst expectations for Q4 earnings.

On a global scale, we prefer growth stocks at a

reasonable price (GARP) and large-caps in order to contain volatility.

Regionally speaking, the US continues to be the place to be, despite being a

bit pricey. We are underweight on Europe (which has suffered the most

collateral damage from the US-China trade war) and emerging markets (analysts

are currently predicting 14% revenue growth in 2020, which is likely to be

revised downwards). Japan is faring well (again thanks to domestic consumption)

and we may reconsider our underweight position early in 2020.

Fixed Income

We have seen a steady climb in rates again, catalysed

by trade optimism and hopes that we have reached a bottom in macro data. Will

this trend continue? Our experts believe that asymmetry is still alive, with there

being a greater probability of higher rates by the end of next year than lower rates.

We are neutral on US Treasuries and underweight on core European government

bonds for the time being. While these instruments may offer little on a

standalone basis, they serve as a cushion against equity market volatility. We

are neutral on duration (benchmark duration is around 7 years), and are reluctant

to reduce this while the white noise of political risk persists.

With most European govies offering negative yields,

European investment grade corporates are still the sweet spot for investors –

especially with ECB buying providing an added buffer against volatility. The

central bank kicked off its CSPP with a bang, buying EUR 2.5bn in the first two

weeks of November – more than expected – and with such support we are happy to

remain overweight on this asset class. In terms of US IG, we are neutral.

Though Fed policy can be seen as credit-friendly, the fundamental picture is

mixed, with gross leverage trending upwards and interest coverage falling.

We are underweight on high yield debt, which is still

expensive on both sides of the Atlantic given the embedded risk. For the small

exposure we do have, we prefer subordinated financials. These have the

potential to continue performing if peripheral European economies continue to

bottom out, while also having lower coupon risk: most banks are operating well above

MDA (maximum distributable amount) levels, which require regulators to

automatically restrict distributions if a bank’s total capital falls below a

predefined level. We are neutral on emerging market debt with a preference for

hard currency sovereigns, which have better liquidity characteristics.

Overall, our global allocation, with a slight underweight on equities, reflects our view of slowing growth but no recession. We prefer to wait and see with regard to increasing risk in our portfolios; after all, economic data is yet to confirm the second coming of growth, and a bottoming out may be as good as it gets.

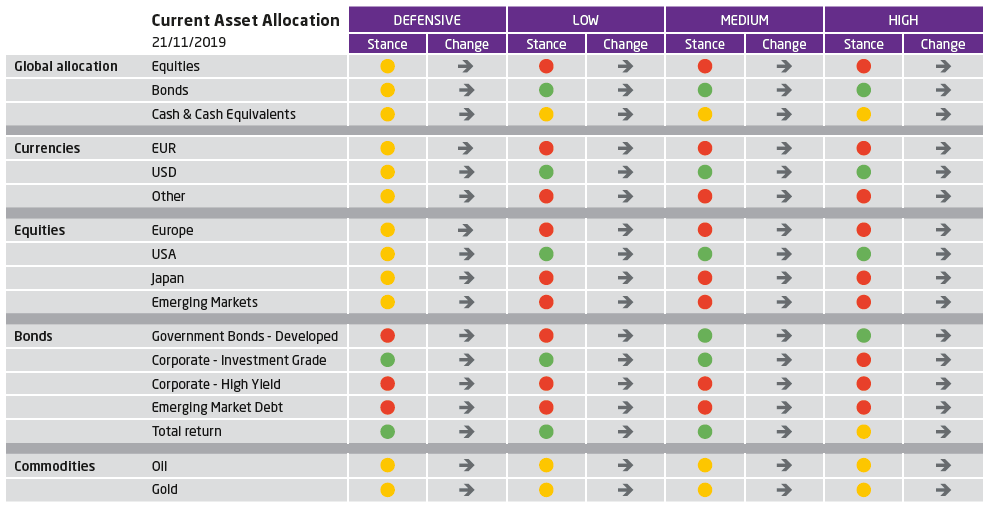

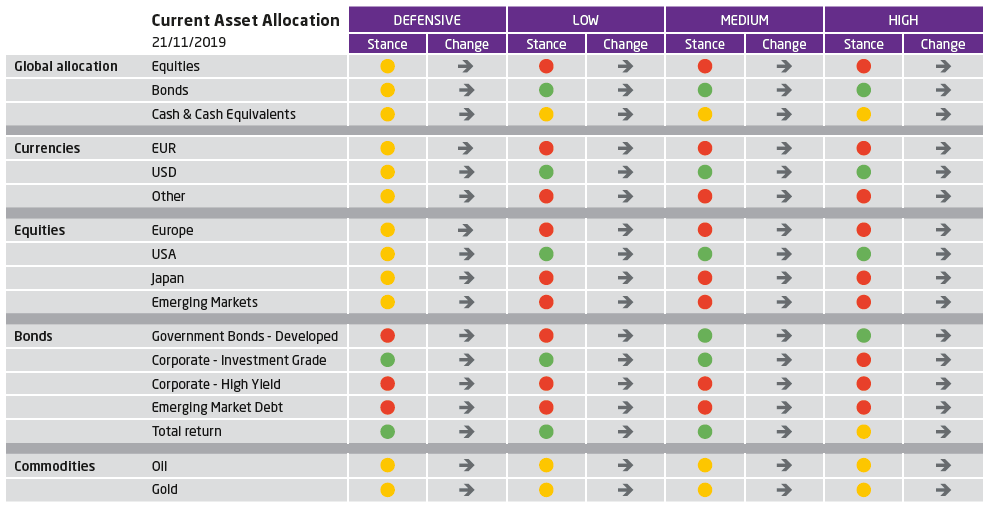

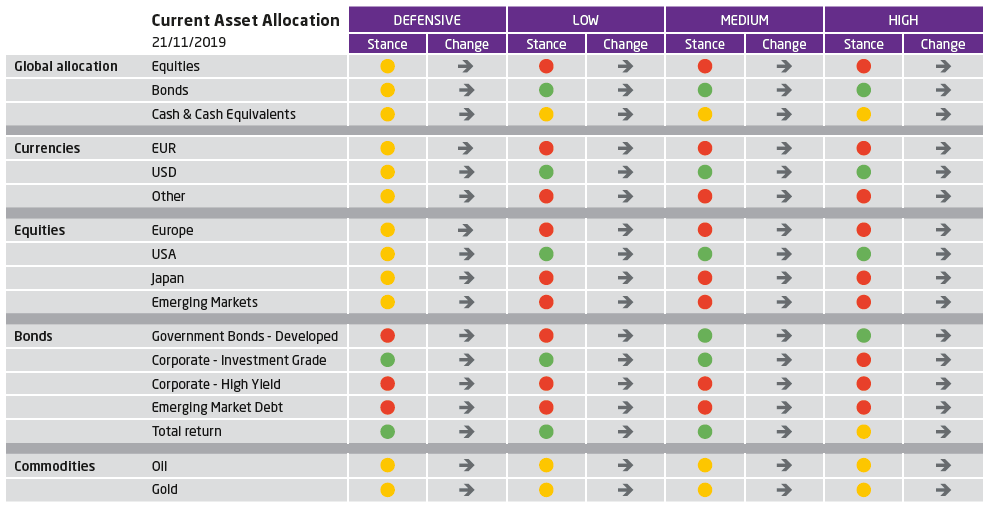

Change: Indicates the change in our exposure since the previous month’s asset allocation committee

More

July 18, 2024

BilboardBILBoard August 2024 – Stocks get tha...

Based on the Committee of 15th July 2024 Over the past few weeks, two important developments have played out for investors. Firstly, US inflation...

July 16, 2024

NewsTourism, a fragile pillar of Europe&#...

Accounting for around 10% of the EU's GDP, tourism is one of the key pillars of the European economy, with a considerable impact on...

July 1, 2024

NewsCan US households continue driving gr...

Consumers are the Atlas holding up the American economy. With the US representing around one-quarter of global output, and with personal consumption accounting for an...

June 21, 2024

BilboardBILBoard – Summer 2024

Despite tight monetary conditions, the global economy held up remarkably well throughout the first half of 2024. From this point on, it appears to be...